Palladium One is a ‘complete’ energy metal explorer; updated resource estimate expected in Q1

2022.01.12

By giving investors exposure to palladium and nickel, primarily, but also copper, cobalt and platinum, we at AOTH think Palladium One (TSXV:PDM, OTC:NKORF, FSE:7N11) ranks as one of the best energy metal exploration companies.

And at just CAD$0.23 a share, it is also, imo, among the most undervalued.

The excessive demand pressure on these metals as the world transitions from fossil fuels to electrification, is running up against looming supply shortages especially for copper and sulfide nickel. This bodes well not only for the prices of these commodities but, we believe, companies like Palladium One that are exploring for and discovering them.

PDM is extremely well placed to supply the market for electrification metals — nickel, copper and cobalt — along with the longer-term hydrogen economy that will likely employ fuel cells en masse requiring platinum, palladium and nickel.

Palladium One is also fortunate to have a palladium focus at LK in Finland which, if it becomes a mine, can supply the PGE raw materials for gas-powered catalytic converters expected to serve as a bridge between fossil-fueled internal combustion engines and all-electrics. The company has also been getting spectacular results at its Canadian nickel project, Tyko, reporting massive sulfide intersections in multiple holes.

It is obvious to us at AOTH that Palladium One has the decarbonization metals at its two projects to help mitigate the expected supply shortfall and is working hard to develop its nickel-copper rich Tyko deposit and mostly palladium LK property (with copper-nickel kickers) into producing mines.

Palladium

As the transition from internal combustion engines to battery-powered electric vehicles continues, gas-powered cars are gradually displacing more-polluting diesels, equipped with catalytic converters to filter out pollutants like NoX and particulate matter.

This means growing demand for materials that go into autocatalysts, including palladium. A string of annual supply deficits starting in 2018, combined with higher sales of gasoline vs diesel units, culminated in Pd’s historic price pinnacle of $2,830 per ounce in May, 2021.

While prices have since softened, on account of the global chip shortage curbing consumption, and technological advances making it easier to substitute much-cheaper platinum in the converters, a rebound in auto production this year should create upside for palladium, Morgan Stanley said in a 2021 year-end note.

Palladium use in hybrid vehicles, seen as a bridge between gas-powered cars and pure electrics, is a growing source of demand. Hybrids require a greater concentration of precious metals (platinum, palladium, rhodium) than those found on gasoline-only cars.

The world’s continued dependence on oil and gas is reflected in the importance of hybrid vehicles going forward. HIS Markit notes that hybrids are projected to outpace electric cars for years. This is in large part due to car buyers’ preference for the convenience of gasoline fuel, no need to charge the vehicle, and the lower cost of a hybrid compared to an all-electric.

A December report states that global hybrid vehicle market share was worth USD$146 million in 2020 and is expected to grow significantly from 2021-26.

Platinum

We’ve written much about the need for battery metals and their expected shortages in the drive to electrification and decarbonization, and the transition period when palladium will play an increasingly important role in reducing emissions as countries aim to mitigate the effects of global warming.

However there is another solution to the problem of rising temperatures, that has so far received minimal attention in the mass media, and that is hydrogen.

Although hybrids and all-electrics are the modern vehicles of choice for the time being, some believe that lithium-ion batteries are a stop-gap technology that will eventually be replaced by hydrogen fuel cells.

Fuel cells are devices that convert a chemical reaction into electricity with heat and water as by-products. Platinum and ruthenium play a large role in this technology, platinum being the catalyst which converts hydrogen and oxygen to heat, water and electricity. Palladium will likely also play a role in the fuel cell, but it is unknown yet how big.

Platinum prices rose to a six-year high of $1,336.50 an ounce in February, 2021, but have since sagged to around $1,000. Despite an expected platinum deficit in 2020, miners including South Africa’s Tharisa Plc are expecting a rebound on the demand side of the equation.

“Fundamentals of PGMs in the longer term are robust, driven by a healthy outlook for the internal combustion engine (in the short and medium term), investment demand, industrial demand and hydrogen fuel cell production for renewable energy,” the company said in December, in reporting a more than doubling of full-year profit.

Nickel

Nickel sulfide deposits provide ore for “class 1” nickel users which includes battery manufacturers. These companies purchase the nickel product known as nickel sulfate, derived from high-grade nickel sulfide deposits.

However, existing sulfide mines are becoming depleted, and nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting, nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

According to BloombergNEF, demand for class 1 nickel is expected to out-run supply within five years, fueled by rising consumption by EV battery suppliers. Demand for nickel from lithium-ion batteries is expected to surge 16-fold to 1.8 million tons by 2030.

These dynamics have propelled nickel to new heights. A rally last fall, based on a strike at Vale’s Canadian mine, and the expectation that there will be less nickel ores available from top supplier Indonesia, pushed nickel to a 7-year high in October.

On Monday, nickel futures in Shanghai rose to their highest in more than a month, with inventories close to record lows. Spot nickel has gained 23% in the past year.

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically and technically feasible? The pickings are slim.

Decades of under-investment equals few new large-scale greenfield nickel sulfide discoveries. Only one nickel sulfide deposit has been discovered in the past decade and a half, Nova-Bollinger in Western Australia.

The result of such limited nickel exploration is a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions. Any junior resource company with a sulfide nickel project will therefore be extremely attractive to potential acquirers.

Copper

2021 was a great year for the copper price, with the red metal hitting a record-high $4.72 per pound as top consumer China staged an economic rebound, and metal exchange inventories sunk to a 47-year low. Supply disruptions in top producer Chile and Peru, and the Biden administration’s passage of a trillion-dollar infrastructure bill, also helped to support prices.

Of course, the big story for copper, is tight supply.

In 20 years, BloombergNEF says copper miners need to double the amount of global copper production just to meet the demand for a 30% penetration rate of electric vehicles — from the current 20Mt a year to 40Mt. a typical EV uses about four times more of the metal as a regular internal combustion engine (ICE) vehicle. Copper, too, is needed for charging stations and renewable energy, particularly in photovoltaic cells used for solar power, and wind turbines.

Diminishing supply from currently operating mines, combined with the projected increase in demand for copper concentrate over 2021-2030, would result in a 3.85Mt production shortfall in 2025, according to S&P Global estimates.

The refined copper market will also move into a 279,000-tonne deficit by 2025, from a 142,000-tonne surplus in 2020, S&P Global adds.

CRU estimates that over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

S&P Global estimates that new copper discoveries have fallen by 80% since 2010.

As of now, the global copper cupboard is quite bare. To even have a chance at net-zero emissions, at least 19Mt of additional metal must be delivered by 2040, the equivalent of one new Escondida mine (1Mt annual production) every year.

While such a feat is difficult to achieve, finding the right investments in projects leading to copper discoveries would help to close the supply gap.

According to CRU, the copper industry needs to spend upwards of $100 billion to erase what it estimates to be a 4.7Mt deficit by 2030.

Palladium One (TSXV:PDM, OTC:NKORF, FSE:7N11)

Palladium One Mining has been working diligently to advance two projects with mineral deposits applicable to both the battery metals designation familiar to most readers, and future-facing metals like platinum and palladium that will find a market in hydrogen fuel cells.

At Palladium One’s Tyko project in Ontario, its main metals are nickel and copper, while at the LK project in Finland, PDM is exploring for palladium, platinum, nickel, copper and cobalt.

Combined, Tyko and LK offer investors nearly equal exposure to battery metals and precious metals — the latter in the form of platinum and palladium. Note: precious metals refers to palladium, platinum and gold.

LK

In Finland, months of drilling success on Palladium One’s Läntinen Koillismaa (LK) PGE-Cu-Ni property have culminated in a much-increased resource endowment, further confirming the project’s potential to host a large bulk-tonnage deposit.

At the Haukiaho zone there are significant base metals, with two-thirds of the zone’s value in nickel and copper.

The latest resource estimate of 1.2 million ounces palladium equivalent (PdEq) grading 1.15 g/t, comprises only 3 km of strike length; 2 km of strike extent, immediately east of the Haukiaho resource estimate, contains two significant IP chargeability anomalies with sufficient historical drilling to potentially be upgraded to inferred resources with modest additional drilling.

The remaining 12 km of the Haukiaho trend has not been drill tested, though widely spaced historical drilling provides a high level of confidence for potential additional nickel-copper resources to be delineated, says Palladium One.

The Kaukua Zone of LK is mostly a palladium-platinum-gold play, however it may surprise readers to learn there are significant base metal values particularly at Haukiaho, where two-thirds of the zone’s value is in nickel and copper compared to the Kaukua Zone where 66% of the value is in palladium and platinum.

Indeed Haukiaho hosts some of the highest nickel grades on the LK project. At 17 km in length, the Haukiaho trend currently represents the largest continuous patch of blue-sky potential.

As announced in a Sept. 7 news release, results from a 2,000m drill program at the Haukiaho Zone significantly increased existing resources by 32.7 million tonnes grading 1.15 g/t PdEq (palladium equivalent), for 1.21 million ounces of contained PdEq.

This resource update essentially doubles the resource endowment of the entire LK project, which now boasts 11 million tonnes of indicated resources grading 1.60 g/t PdEq (600,000 oz PdEq) and 44 million tonnes of inferred resources grading 1.19 g/t PdEq (1.7 million oz PdEq).

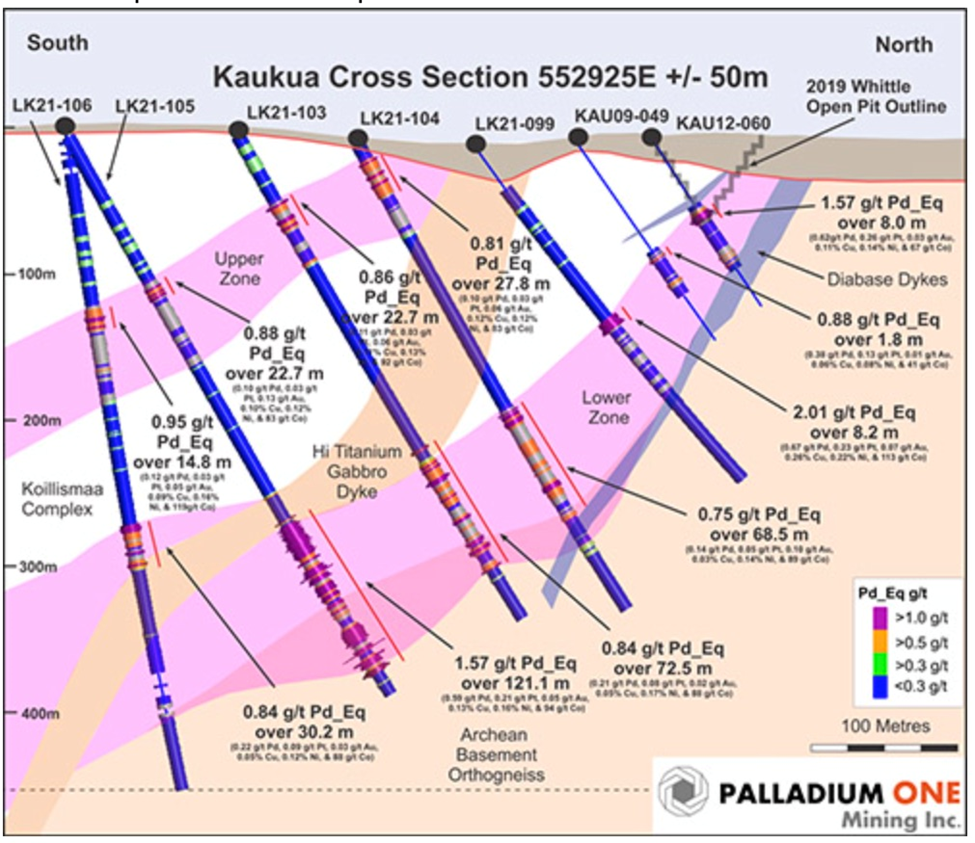

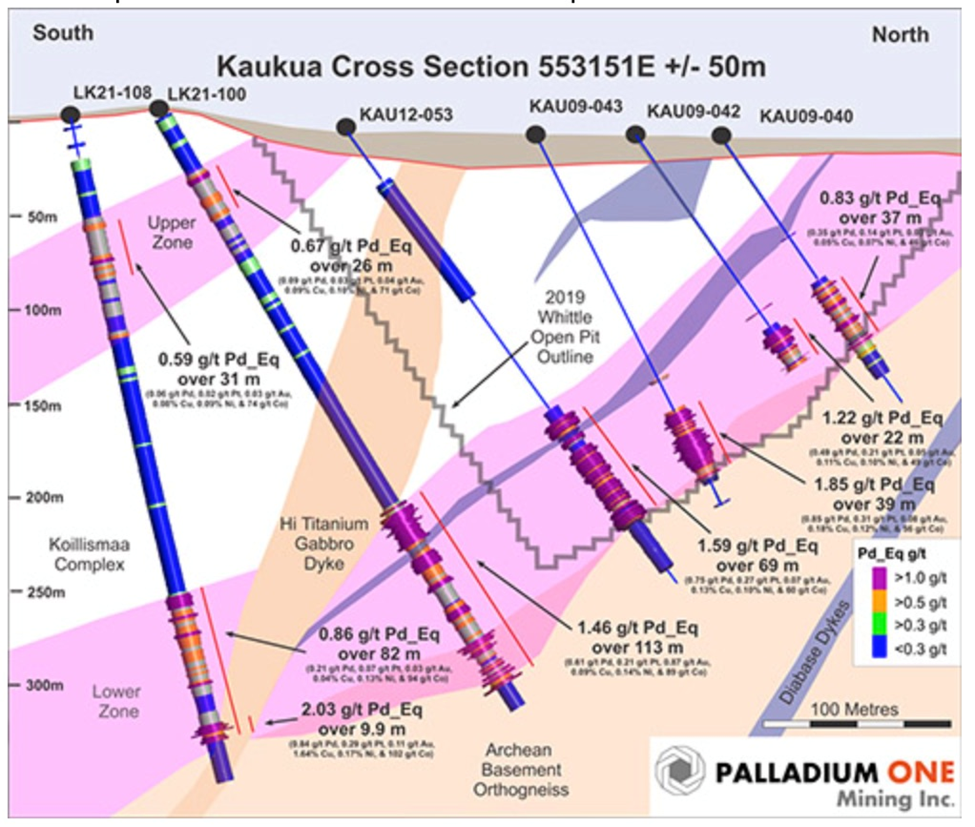

The company recently reported its widest intercept to date, in a hole drilled southwest of the area where the 2019 open-pit resource estimate at Kaukua was compiled.

All three holes spread over 220 meters laterally intersected the down-plunge, high-grade ‘Core Zone’, with hole LK21-05 reporting the best grades.

The hole brought up drill core assaying 2.1 grams per tonne (g/t) palladium equivalent (PdEq) over 33.5 meters, within 1.6 g/t PdEq over 121 meters. Individual samples graded up to 16 g/t PdEq over 0.6m.

The Core Zone of the Kaukua open pit has been extended 250 meters to the southwest, and it remains open at depth.

“We have extended the ‘Core Zone’ of the Kaukua Deposit 250 beyond the current conceptual open-pit and hole LK21-105 is among the thickest intercepts to date within the Kaukua Deposit and adds significant tonnage to our existing resource endowment,” said Derrick Weyrauch, Palladium One’s President and CEO, in the Jan. 11 news release.

These results bolster the company’s belief that it could add a significant amount of open-pit resources to the new NI 43-101 resource estimate expected in the first quarter.

Tyko

Palladium One also continues to outline a high-grade nickel-copper system at its Tyko Ni-Cu-PGE project in Ontario, where a second-phase drill program in 2021 and an announced expansion increases the size of the property by over a fifth.

All 13 holes drilled at the Smoke Lake target intersected magmatic sulfides, with widths ranging from 1 to 15 meters. A second-phase, 2,000m drill program started last April, following up on high-grade hits of 9.9% nickel equivalent (NiEq) over 3.8m. A number of high-grade intersections were reported, all near surface.

Excited as Palladium One is about its nickel results, there are also notable copper and nickel occurrences, in particular the RJ and Tyko zones located about 18 km west of Smoke Lake. Drilling in 2015 returned several intercepts over 1% nickel + copper with a high of about 1.5% Ni + Cu.

The 7,000-hectare mafic-ultramafic Bulldozer intrusion, which has seen virtually no geological mapping nor exploration, also has significant historical copper showings.

Conclusion

Recently cashed up from a $4.35 million financing, Palladium One is ready to continue exploring Tyko and LK, building upon its considerable 2021 news flow, including a brand new resource at Kaukua expected within the first quarter.

PDM has already amassed 11 million tonnes of indicated resources at LK, grading 1.60 g/t PdEq (600,000 oz PdEq) and 44 million tonnes of inferred resources grading 1.19 g/t PdEq (1.7 million oz PdEq).

Tyko’s Smoke Lake continues to advance with the strike of the known mineralization growing to 430 meters. An IP geophysical survey is planned for this winter to continue to chase the mineralization, which includes 5.0% nickel equivalent over 1.4 meters and up to 891 ppm copper and 142 ppm cobalt in soils at the Bulldozer Intrusion. In addition to Smoke Lake, Palladium One believes there are new zones of nickel-copper mineralization yet to be discovered. The project was awarded the 2020 Bernie Schnieders Discovery of the Year by the Northwestern Ontario Prospectors Association.

Between both properties, we see Palladium One and its highly motivated management team as a “complete” energy metals company. To review, Tyko’s main metals are nickel and copper, while at the LK project in Finland, PDM is exploring for palladium, platinum, nickel, copper and cobalt.

All of these metals have a role to play in the new green economy. Palladium One describes itself as focused on discovering environmentally and socially conscious Metals for Green Transportation.

That is certainly true. Copper is a crucial component of electrical vehicle motors, wiring and charging stations. Nickel and cobalt are used in the most popular lithium-ion battery chemistry for electric vehicles, NMC batteries. But electric vehicles won’t replace fossil-fueled powered ones quickly. Gasoline-run cars and trucks with their palladium-containing autocatalysts are needed as a bridge technology, to replace diesels, and will be demanded for many years to come, stoking demand for palladium and challenging miners to supply enough of the mineral.

Hybrids are another, more advanced bridge technology. Despite the increased penetration of EVs, hybrids are projected to outpace electric cars for years. They require a greater concentration of precious metals (platinum, palladium, rhodium) than those found on gasoline-only cars.

Platinum and possibly palladium will play a large role in hydrogen fuel cell technology, platinum being the catalyst that converts hydrogen and oxygen to electricity.

Platinum group metals don’t get the same kind of love from investors as gold and silver do, despite being worth considerably more per ounce.

Perhaps it would help to convert the resource at LK into terms that most resource investors will understand. Being conservative by using the 2019 NI 43-101-compliant, open pit-constrained resource estimate at Kaukua (the company has said that drilling at Haukiaho last year doubled the resource at LK), Kitco’s ‘Rocks in the Box’ tool calculates an insitu value of $96.31 per tonne in the indicated category, and $79.26/t inferred.

At Haukiaho, where an NI 43-101 resource was announced last year, plugging the values into Rocks in the Box spits out a $69.84 insitu value, or around 1.2 g/t gold.

That means the $100 rock at Kaukua equates to a 1.7 gram per tonne gold deposit, and the $70 rock at Haukiaho is similar to a 1.2 g/t gold deposit— both of which, in our view, would work quite well for an open-pit operation.

I’m expecting the updated resource estimate at Kaukua to wake-up the market. Stay tuned.

Palladium One Mining

TSXV:PDM, OTC:NKORF, FSE:7N11

Cdn$0.23, 2022.01.11

Shares Outstanding 248m

Market cap Cdn$60.2m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Palladium One Mining (TSXV:PDM). PDM is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.