RooGold, backed by renowned geologist Dr. Quinton Hennigh, is a player to watch in Australia’s gold mining space

2021.12.31

Australia has long been known as a mining powerhouse, home to world-class geologists, accessible projects and excellent infrastructure.

Australia’s mining history traces back to the 1840s, with its first discovery of silver and then copper in Southern Australia. Gold was later found in 1851 near Bathurst, New South Wales, and was followed up by more discoveries in Victoria.

The series of gold rushes that ensued helped to spur the development of inland towns, communications, transport and foreign trade, boosting Australia’s development heading into the 20th Century.

Today, mining has become a significant contributor to the Australian economy, accounting for about 7% of Australia’s GDP and more than half of its total exports.

Gold in Australia

A treasured commodity since ancient times, gold holds a special place in Australia’s mining industry.

Consistently ranked as one of the world’s top 3 gold producers, Australia has, by a wide margin, the largest mine reserves in the world, with nearly 10,000 tonnes of gold or 20% of the global total.

Significant gold endowments can be found throughout the country. Western Australia currently leads all states in gold production, and is home to about a dozen of the world’s biggest mines, including Boddington, Superpit, Gwalia and Granny Smith.

However, seeing that the Yilgarn Craton of Western Australia, which hosts 4% of the world’s economically recoverable gold reserves, is almost completely staked and devoid of search space, exploration focus has gradually shifted towards the southeastern states.

New South Wales, being the second-largest producing state, and where the first Australian gold was found, has become a focal point of Australia’s mining industry. The state’s gold endowment is said to exceed 100 million ounces, plus about 1 billion ounces of silver.

NSW is already home to some of the biggest gold deposits in the world including Newcrest Mining’s Cadia Valley, which has the largest facility of its type in the country.

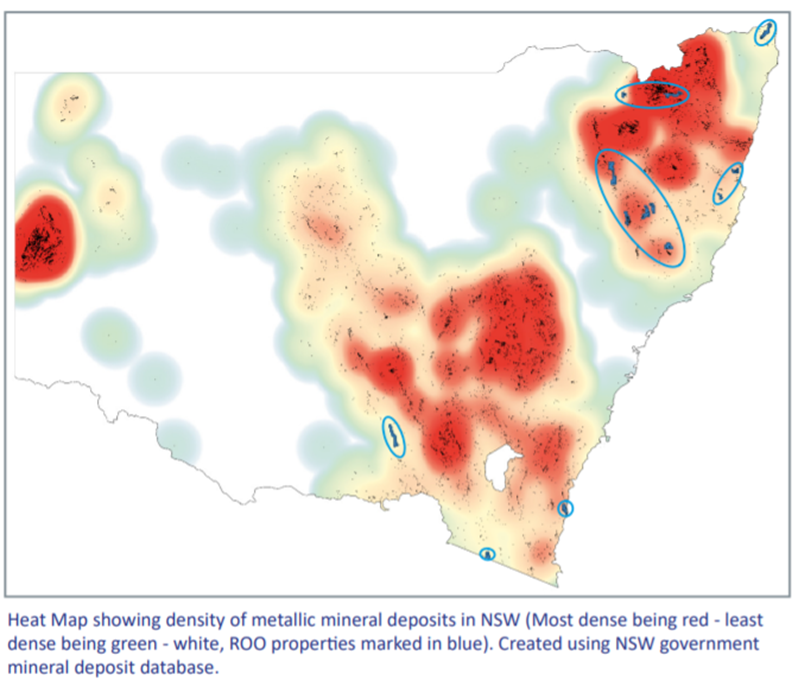

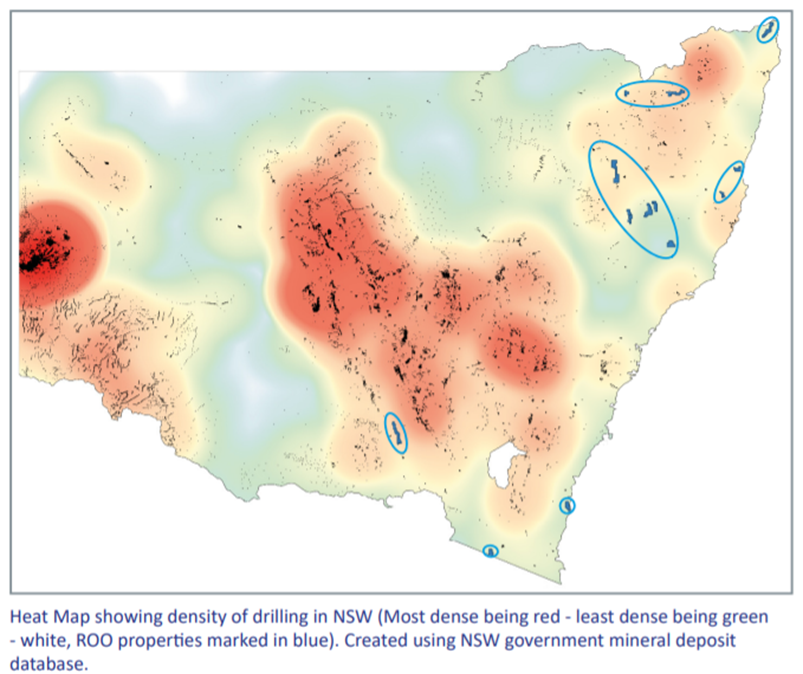

As compared to other states, NSW is prolifically mineralized with multiple metallogenic belts that are largely unexplored outside of the main camps. Past exploration mostly centered on the Cadia-McPillamys camp, North Parks trend, the Conwall-Giginburg trend and Broken Hill.

The Lachlan Fold Belt and New England Orogen terrane cover approximately 50% of NSW. They encompass multiple metallogenic belts and deposit types, including the high-value orogenic, intrusion-related, low sulphidation epithermal and VMS deposit types.

The New England Orogen is considered to be a significant mineral province that forms the basement throughout the northeast of NSW. The presence of alluvial gold fields and showings, the large number of historic underground mines and the variety of tectonic terranes all indicate that the terrane is highly prospective for gold and silver discoveries.

Major deposits in the past include gold bonanzas at Mount Morgan (> 7moz) and Gympie (> 3moz) (Queensland) and Hillgrove (New South Wales). Significant gold resources have been recently discovered at Gympie, Cracow, Tooloom and Mount Rawdon.

The Lachlan Orogen, which spans New South Wales, Victoria and eastern Tasmania, comprises a series of prolifically mineralized accretionary terranes hosting a variety of deposit types. In NSW, these include porphyry and related skarn Cu-Au, epigenetic and hydrothermal Au and Pb-Zn-Cu, and orogenic Au.

By Australian mining standards, a large part of NSW’s metallogenic belts remains relatively unexplored to this day. Highly prospective ground, most with very high-grade historic showings, remains available for further exploration.

RooGold Inc.

Until recently, the significant number of high-value, strategically located licences have attracted a new wave of up-and-coming gold miners, including Canadian junior venture RooGold Inc. (CSE:ROO) (OTC PINK:JNCCF) (Frankfurt:5VHA).

Coming off a series of property transactions this year and a recent name change (formerly JNC Resources), ROO is uniquely positioned to be a dominant player in New South Wales through a growth strategy focused on the consolidation and exploration of highly mineralized precious metals properties in this prolific region of Australia.

To build its portfolio, the company has adhered to the following criteria:

- Properties with limited historic exploration.

- Deposit types controlled by regional structures and contacts.

- Targets underpinned and outlined by historic mining activity.

- High-grade precious metal mineralization.

Through its acquisition of Southern Precious Metals Ltd., RooGold Ltd. and Aussie Precious Metals Corp. properties, RooGold now commands a portfolio of 13 gold and silver concessions that spans a total area of 1,380 sqkm, and is home to 137 historic mines and prospects.

Mineralization across all these properties is associated with significant, largely untested regional structures or contacts, on which gold and silver endowment is underpinned by historic mining activity, thus providing excellent discovery potential.

Below is a summary of ROO’s properties located in the world-class mining region of NSW:

Gold Projects

ROO currently has nine gold properties covering a total of 1,091 km² and 106 historic gold mines and prospects, all located within the highly mineralized but relatively underexplored New England Orogenic Terrane and prolifically mineralized Lachlan Orogenic Belt.

The mineralization is mostly of an orogenic type associated with large-scale structures, making for large attractive targets and lesser intrusion-related types. There is also potential for listwanite-hosted gold mineralization of the Bralorne and Motherlode type along the Peel-Manning suture zone.

- Trilby — A 35 km strike length of the Peel-Manning Fault zone and hosts numerous quartz veins with visible gold. The Peel-Manning Fault Zone is a crustal suture zone with ophiolites and abundant gold alluvial deposits, indicating potential for listwanite-hosted gold deposits.

- Lorne — 28 historic gold mines and prospects, including the historic Golden Star mine. It also covers up to 500 m of underground workings at the historical Marquis of Lorne mine, which had reported grades of up to 15 g/t Au. The project area spans 12 strike kilometers of the significantly mineralized regional Peel-Manning fault system.

- Malebo — 5 historic gold mines and prospects. Historic rock-chip grab sampling of the Malebo mine returned assays up to 71 g/t Au. Mineralization is of a low-sulphide orogenic quartz type associated with the regional Narriah Fault, potentially analogous in geology and structure with the Mt Adrah deposit 50 km to the east.

- Eastdowns — 10 historic gold mines and prospects. Historical records from small-scale production cite grades of up to 384 g/t Au. Mineralization is associated with a sedimentary-intrusive contact zone with a target zone that is several hundred meters wide and over 1 km long.

- Bluebell — 9 historic gold mines and prospects immediately north of the Victorian border. Mineralization is a sulphide-poor orogenic type. Small-scale historical production had reported assays of up to 87 g/t Au.

- Solomons — 11 historic silver/gold mines and prospects with reported production grades of up to 132 g/t Au and 1,648 g/t Ag. Mineralization is probably associated with numerous low sulphidation epithermal veins related to regional northeast-southwest oriented structure.

- Dingo — 17 historic gold mines and prospects including the Golden Star mine. Mineralization is of a low-sulphide orogenic quartz type associated with regional structures, analogous to the West African and Abitibi-type styles of mineralization.

- Goldstar — 6 historic silver/gold mines and prospects. Much of the property is unexplored. Mineralization is of a low-sulphide orogenic quartz type associated with regional structures, also analogous to the West African and Abitibi-type styles.

- Gold Belt — 20 historic gold mines and prospects across the significantly gold-endowed Peel-Manning fault. Two parallel gold-controlling regional fault systems have been identified on the property, forming two significant gold-mineralized corridors with a total strike length of over 7 km. Potential exists for listwanite-hosted gold deposits of the Bralorne and Motherlode types.

Of these 9 gold concessions, the three located on the Peel Manning Fault System (Trilby, Lorne and Gold Belt) are considered to be priorities.

Together, they form the company’s Peel Manning property, a district-scale land position totalling 422 km² that includes 48 historic gold mines and prospects with average historical production grade of up to 83 g/t Au.

The Peel-Manning Fault system is a crustal scale structure that is strongly gold mineralized along its 350 km strike length. The system hosts ocean floor mafic and ulltramafic rocks present as listwanite (quartz-carbonate) altered serpentinites.

Listwanite associated gold deposits are considered to be highly attractive exploration targets. Multi-million ounce deposits such as the Californian Motherlode deposit, Bralorne (British Columbia) and numerous large high-grade gold systems throughout the shield area of Saudi Arabia are hosted in listwanites.

Newmont has recently staked a 1,200 km² land package covering 125 km strike length of a parallel structure, 30 km to the east of the Peel Manning Fault Zone.

The gold mining giant, recognizing that these regional structures are fundamental to mineral deposit formation and thus highly prospective, mainly staked areas under shallow surface cover, lacking historic production on and anomalism due to other licences already being taken.

ROO’s Peel Manning property covers over 30 km of untested strike of highly prospective gold-endowed Peel Manning structure, encompassing two significant undrilled gold trends measuring over a 7 km strike length.

The historic Marquis of Lorne mine, which includes a non-compliant historic reserve of 50 koz Au, is hosted on the property.

Silver Projects

In addition, ROO has four silver properties covering a total of 289 km² and 31 historic gold-silver mines and prospects, also located within the prolifically mineralized but relatively underexplored New England Orogenic Terrane.

All properties remain largely underexplored since their discovery in the early 1900s. Little to no historic drilling and almost no exploration. Several styles of mineralization are present, including intrusion-related vein stockwork targets and low sulphidation epithermal types.

- Castle Rag — 11 historic silver/gold mines and prospects, including the historic Castle Rag silver mine with small-scale production at grades of up to 1,200 g/t Ag. The project is characterized by intrusion-related mineralization with multiphase quartz-tourmaline stockworks and polymetallic Au/Ag rich veins.

- Arthurs Seat — 3 historic silver mines and prospects, including the historic Murray and Co mine, which has returned chip samples grades of >1,200 g/t Ag. The project is also characterized by intrusion-related mineralization with multiphase quartz-tourmaline stockworks and polymetallic Au/Ag rich veins.

- Goodwins Reef — 11 historic silver/gold mines and prospects with sample assays of up to 18,000 g/t Ag. Mineralization is associated with numerous low sulphidation epithermal veins that are between 0.5-4.6 m wide and up to 1500 m in strike.

- Silver Creek — 6 historic silver/gold mines and prospects, including the historic Silver Mine Creek mine with workings across a 1,000 m x 400 m zone, where chip samples assayed 777 g/t Ag and 6.2 g/t Au, and 1,617 g/t Ag and 35.7 g/t Au.

Castle Rag, the largest of the four silver projects, currently hosts two high-priority targets: Castle Rag Group and the Eastern granite/rhyolite contact.

The Castle Rag target is formed from 27 mineral occurrences, 7 of which are silver-base metal intrusion-related vein deposits within the Castle Rag concession. The Castle Rag mine operated between 1888 and 1929, producing an estimated 4,000 tonnes at average grades of 1,200 g/t Ag and >20% Pb.

The Eastern target is formed by a gold, silver and molybdenum mineralized grisened granite/rhyolite contact that is over >5 km long. Limited past surface exploration had grades of up to 612 g/t Ag, 5.5 % Pb, 3.35 g/t Au and >1.5 % Mo.

The property remains significantly under-explored, with only three holes drilled for 159 m in 1985.

Exploration Plan

ROO’s initial exploration focus will be on the high-priority Peel-Manning gold and Castle Rag silver properties.

The remaining properties will be evaluated and developed according to a five-stage exploration plan, as described below:

- Historic data compilation and modernization — Compile and digitize historic datasets and mine records into a comprehensive GIS database, translating and modelling historic deposits and mines into 3D where appropriate.

- Remote data acquisition and target generation — Acquisition of high-resolution satellite, DTM and geophysical datasets for select properties to better define historic prospects, assist geological and structural mapping, extend potential deposit footprints and identify new prospective anomalies.

- Field-based target delineation and development — Extensive geological mapping is planned, focused on delineating and developing historic mines, prospects and areas of interest outlined from desk-based work. Surface and UG rock chip sampling will be used to confirm historic assay results and test mineralized exposure, deposit extensions and new targets identified by stages 1 and 2.

- Drill planning — Targets will be assessed and ranked for drilling suitability based on risk-reward scale. Targets will be modelled in 3D to optimize drill targeting beneath high-grade ore zones identified from UG and surface sampling.

- Execution of targeted drill programs alongside ongoing project development — Targeted RC drill programs will be completed across the highest priority targets highlighted by all previous exploration activities.

The initial exploration plan would require a total expenditure of C$2.5 million, with a large chunk of that (C$2 million) going towards RC drilling and ongoing project review/development. The remaining C$500,000 will be allocated to the first four stages.

To fund its exploration activities, RooGold successfully secured in October a first tranche financing of C$2.63 million. The net proceeds will be used for Phase 1 exploration of its Australian properties.

The company is also looking to spend at least another C$1.6 million during Phase 2 exploration, which could bring the financing total up to C$5 million.

World-Class Technical Team

The ROO technical team collectively brings almost 150 years of global experience, having worked in over 75 countries, on most deposit types and commodities, and at all stages of a project’s life.

The board members and senior management/advisors all have significant and demonstrated public market experience, with a proven track record of adding shareholder value. A notable figure on its advisory board is Dr. Quinton Hennigh, who for over 25 years has led exploration teams for Homestake Mining Company, Newcrest Mining and Newmont.

Dr. Hennigh is currently founder, chairman and president of Novo Resources; founder and director of Irving Resources; and director of New Found Gold. He also holds the position of geological and technical director at Crescat Capital LLC, an award-winning global macro asset management firm based in Denver, Colorado.

Crescat recently became a strategic shareholder in the company and will provide expertise regarding RooGold’s exploration and development strategy, along with other geological and technical matters, with the support of Dr. Hennigh.

Crescat’s mission is to grow and protect wealth over the long term by deploying tactical investment themes based on proprietary value-driven equity and macro models. Its investment goal is industry-leading absolute and risk-adjusted returns over complete business cycles with low correlation to common benchmarks.

Another familiar name on the ROO advisory board is Dr. Chris Wilson, the world-class geologist behind Ivanhoe Mines’ Mongolian operations for 10 years, who was responsible for an exploration portfolio of 127 licensees covering over 11 million hectares.

Dr. Hennigh, a high-profile geologist himself, knows the Australian mining scene inside and out. His biggest success was also in Australia, in the Victoria region, when billionaire junior mining financier Eric Sprott flew him in to analyze the New Market land package.

And the rest was history. Dr. Hennigh’s due diligence and strong endorsement resulted in Sprott’s Kirkland Lake acquiring the asset, and on the strength of the high-grade Swan-Zone discovery at Fosterville, KL went from under $2 to a high of $76/share.

Sprott still credits Dr. Hennigh to this day for KL’s success, especially because the other principals of KL were hesitant on going ahead with the transaction.

The fact that Dr. Hennigh and Crescat are also early backers in ROO and the NSW land package, with Quinton being a director of New Found Gold, a current high flier in the space, bodes well for ROO’s future prospects.

Conclusion

Gold prices have recently rebounded above the key $1,800/oz level as the momentum of fear continues to build on inflation, covid, geo-political tension and socio-economic pressures.

At AOTH we are convinced that the commodity bull market will naturally find its way towards precious metals, and after seeing how the inflation pressure keeps on mounting and the central banks are being more reactive than proactive, we hold an even stronger conviction than before.

While it’s rare for industry leaders to agree on one thing, most are in accord with the idea that prices are going higher, not only this year but even the next.

In such periods we at AOTH have always sought haven in gold and silver bullion, we also buy shares of precious metal focused junior companies to best leverage a rising gold price.

Following a busy few months which saw Roogold establish a strategic position in the world-class mining state of NSW, the newly rebranded gold junior will use that as its foundation heading into 2022 with a clearly designed exploration plan.

RooGold Inc.

(CSE: ROO) (OTC PINK: JNCCF) (Frankfurt: 5VHA)

Cdn$0.25, 2021.12.30

Shares Outstanding 69.7m

Market cap Cdn$17.4

ROO website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of RooGold Inc. (CSE: ROO). ROO is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.