$2.85 trillion in new US spending bolsters bull market in electrification & decarbonization metals

2021.11.15

The road to upgrading America’s infrastructure is long and costly.

A report published by the American Society of Civil Engineers (ASCE) in March validated the nation’s success in improving its infrastructure, while justifying the need for additional government spending.

The “Report Card for America’s Infrastructure”, published every four years since 1998, gave US infrastructure an average grade of “C-” — up from a “D+” in 2017 — marking the first time in two decades that a “C” range grade was given.

While it appears that US infrastructure programs are on the right track, a lot more work still needs to be done to address crumbling roads, bridges, water/ wastewater systems and the like, says the ASCE, labelling overall infrastructure in “mediocre condition.”

According to the engineering society, the US is paying just about half of its infrastructure bill, and its total investment gap has widened over the past decade. The country is now facing a $2.59 trillion shortfall in infrastructure needs over the next 10 years that will require a massive jump in investment, the ASCE says.

Addressing these needs is the focus of two major pieces of legislation the Biden administration has been aiming to get agreement on, in the House of Representatives and the Senate. The Democrats hold razor-thin majorities in both Houses of Congress, and Biden’s original spending plans have been scaled back considerably to ease passage.

The $1.1 trillion infrastructure bill (exactly half of the original $2.25 trillion proposal) will deliver $550 billion of new federal investments in America’s infrastructure over five years. It touches everything from highways and ports to the nation’s broadband, water and energy systems.

Build Back Better is a $1.75 trillion spending package, the result of months of negotiations between Democratic Party moderates, progressives and the White House. President Biden’s second signature piece of legislation after his infrastructure bill revises key climate change proposals, keeps funding for universal daycare and removes earlier plans to provide paid family and medical leave.

An AOTH analysis found that both pieces of legislation will be bullish for mined commodities, in particular those metals needed to support our electrification and decarbonization investment thesis.

The modernization and electrification of our global transportation system will require a change hitherto unprecedented in the history of civilization. Not even the shift from horse and buggy to the crank-start Ford Model T can compete with what it will take to electrify the billion-plus cars on the planet’s roads, and eventually do away with noxious tailpipe emissions that are poisoning the air we breathe.

The fossil-fuel-based transportation system needs to be electrified, and the switch must be made from oil, gas and coal-powered power plants to those which run on solar, wind, hydro and thorium-produced nuclear energy. If we have any hope of cleaning up the planet, before the point of no return, a massive decarbonization needs to take place.

According to a 2021 report from Wood Mackenzie, mining companies will need to spend $1.7 trillion over the next 15 years, to supply enough lithium, graphite, cobalt, copper and nickel for the shift to a low-carbon world.

The commodities consultancy says meeting new emissions targets being set by countries like Canada, the US, Britain, China and Japan, will mean large-scale deployment of electric vehicles, renewable power and electrical transmission, all of which will require copious metal content.

The challenge for mining companies will be finding enough metal to meet the demand.

Infrastructure bill

In the United States, the seeds of that demand are planted in the hundreds of billions of new spending outlined in the Build Back Better framework and in Biden’s “bipartisan” infrastructure bill. The legislation is bipartisan in the sense that it was by passed by the Senate’s unwieldy mix of Democrats and Republicans; it is expected to be voted on by the House, where Democrats outnumber GOP representatives 220 to 212, before the end of the month.

The bill calls for investing $40B for bridge repair, replacement and rehabilitation — the largest investment in bridges since the construction of the interstate highway system; $39B to modernize public transit; $66B for passenger and freight rail; and $12B in partnership grants for intercity rail service including high-speed rail.

Vehicle electrification is a major part of the legislation’s focus. It would provide $7.5B for low-emissions buses and ferries, and aims to deliver thousand of electric school buses to districts across the country. Another $7.5B would go towards building a nationwide network of plug-in EV chargers.

This past August, Biden signed an executive order requiring that half of all US new vehicle sales be electric by 2030.

$65 billion is earmarked for rebuilding the electrical grid including thousands of new miles of power lines and expanding renewable energy, according to the White House.

Biden’s proposed beefing up of the electric vehicle sector with subsidies, adding 500,000 new charging stations and converting half a million school buses to zero emissions, would require nearly 2 million tonnes of copper over the next 10 years, or 200,000 tonnes a year, states a 2021 report from Australia and New Zealand Banking Group (ANZ), via Kitco.

That is equivalent to adding 10% to US copper demand of 1.9 million tonnes, or 1% to global demand. Aluminum and nickel also are expected to benefit from EV sales.

“The real kicker will be the $7.5 billion investment in electronic vehicle (EV) infrastructure. Overall we see growth in copper demand hitting double digits over the next year or two,” ANZ wrote in the report.

“Construction has traditionally been the biggest contributor to demand for most metals,” the report emphasized. “Therefore, this spending package should boost demand for copper and zinc, in particular.”

ANZ points to wiring and cabling in new home construction as an example of higher expected copper usage.

“Building and construction use 22–23% of U.S. copper demand, which is nearly 800kt of copper,” the report specified. “Construction of two million houses would generate nearly 320kt of copper demand over eight years, 40kt per year in a very optimistic scenario.”

A piece by Reuters metals columnist Andy Home touches on how the legislation targets critical minerals supply. While more money for upgrading highways, railways and power grid systems will mean higher demand for steel, copper and aluminum, Home notes that $6 billion has been set aside for battery materials processing and manufacturing projects. Another $150 million is for a rare earths demonstration plant.

The bill also allocates $100 million a year for the next four year in grants for developing, processing and recycling critical minerals.

Build Back Better bill

From an initial social spending package of $3.5 trillion, panned by Republicans for containing a wish-list of “progressive” priorities, Biden’s Build Back Better legislation is now $1.75 trillion and has as its centerpiece over $550 billion to tackle climate change and the transition to clean energy.

SP Global notes The biggest chunk of the climate and clean energy investment — $320 billion — would provide for 10-year expanded tax credits for “utility-scale and residential clean energy, transmission and storage, clean passenger and commercial vehicles, and clean energy manufacturing,” according to a three-page summary from the White House…

Another $110 billion would support investments and incentives for clean energy technology, manufacturing and supply chains, including for “solar, batteries, and advanced materials while boosting the competitiveness of existing industries, like steel, cement, and aluminum.”

The bill leaves out Biden’s proposal to spend $400 billion to bolster caregiving for aging and disabled Americans – the second largest measure in the American Jobs Plan.

The remaining $20 billion would support clean energy procurement by the federal government, including through incentives for the government to purchase “long-duration storage, small modular reactors, and clean construction materials.”

Ball-parking the metal content expected to result from this hodge-podge of government-speak is no small feat, however a 2020 World Bank report entitled ‘The Mineral Intensity of the Clean Energy Transition’, estimated that production of minerals underpinning the clean energy shift, such as the battery metals graphite, lithium and cobalt, would have to increase by nearly 500% by 2050 to meet global demand for renewable energy technology.

The need for mainstay materials like steel and copper for construction and wiring or zinc for galvanization is apparent, along with lithium needed for grid-scale renewable energy storage and silver required for solar.

According to Bloomberg NEF estimates, solar panels with the power capacity of 1 gigawatt of electricity will need about 18.5 tons of silver, 3,380 tons of polysilicon and 10,252 tons of aluminum.

Copper is also a key component of photovoltaic cells. A solar power plant contains approximately 5.5 tons of copper per megawatt of power generation. A single 660-kW turbine is estimated to contain some 800 pounds of copper.

Insecure metals supply

At AOTH we’ve been covering the topic of US critical minerals insecurity in the face of China’s mining and processing dominance, for over a decade.

In a recent interview with Cris Sheridan of Financial Sense, I discussed the long-term investment case for the three most critical inputs in the race to electrify and decarbonize: copper, lithium and graphite.

Obviously you can’t make a lithium-ion battery without lithium but did you know it’s also impossible to build one without graphite? Are you aware that the rush to electrify and make the green-power transition won’t happen without copper, needed in EV motors & charging stations, transmission lines, and renewable energy, which is five times more copper-intensive than conventional energy sources?

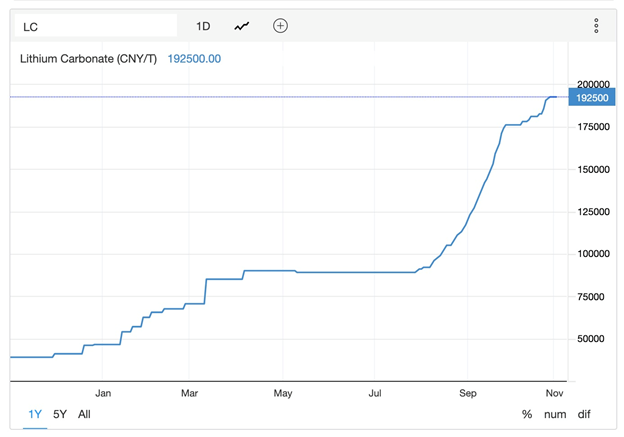

China controls most of the world’s lithium processing and makes over 60% of the world’s lithium-ion batteries. The prices of lithium carbonate and hydroxide, both used in the li-ion battery cathode, have soared this year on break-neck demand.

Rio Tinto has said even if they had another 60 lithium mines, that wouldn’t fill the supply-demand gap, with EV sales expected to hit 55% of total vehicle sales as early as 2030. That represents 65 million units, and 3 million tonnes of lithium in just eight years, compared to the 400,000 tonnes of lithium per year mined currently.

Even if you combine all existing operations with future projects, that’s only 1Mt of future lithium, compared to the 3Mt we need by 2030. With all that is going on in the US — Biden’s clean energy agenda; America now the world’s second largest EV manufacturer behind China; new battery plants being built including Tesla’s second gigafactory in Texas; billions worth of EV investments coming from major carmakers like Ford, GM, VW and Mercedes, battery-makers such as Korea’s SK Innovation; and 11 electric vehicle start-ups such as Rivian — we would expect there to be a lot of lithium needed to satisfy a burgeoning domestic mine to battery to EV supply chain.

In fact there is only one US lithium mine, Albemarle’s Silver Peak in Nevada, outputting a tiny 5,000 tonnes of lithium carbonate per year, according to the US Geological Survey.

Bloomberg NEF shows just over five times more lithium is needed in 2030 compared to current levels. In the absence of new North American lithium supply, this lithium will come from China, which as I stated, processes the majority of the world’s lithium and makes nearly two-thirds of all lithium batteries.

Furthermore, it is ridiculous to think that the US can rely on China for delivering a steady and reliable supply of lithium (and other critical minerals it has locked up), given an increasingly belligerent China, in trade, politics and militarily.

Graphite is the only material that can be used in the lithium battery anode, there are no substitutes. The mineral was just added to the US Defense Stockpile Acquisitions List so the US should soon start to stockpile graphite after decades of ignoring, once again, its complete dependence on China. In fact it’s easier to get lithium in America than graphite.

Most graphite is mined in China and North America produces just 10,000 tonnes from two mines in Canada. There is currently no US graphite production. This means that to build a lithium-ion battery anode, means sourcing graphite from China, as they are by far the largest miner and currently the only country that processes the battery-grade material.

Graphite used in li-ion batteries is projected to gobble up well over 1.6Mt of flake graphite per year. This is a scary number considering that in 2020 graphite mined for all uses, including lump graphite for pencils, graphite used in nuclear reactors, etc., was only 1.1Mt. So we’re talking 1.6Mt just for batteries. The USGS believes that large hydrogen fuel cell applications being developed, like a central fueling station designed for a fleet of hydrogen-powered buses, could devour as much graphite as all the other uses! A recent White House report on critical supply chains showed that graphite demand for clean energy applications will require 25 times more graphite than was produced worldwide in 2020. Where is the United States going to find all the graphite?

Nothing happens regarding electrification and decarbonization without copper, an essential ingredient in EVs, charging stations and “smart” grids. Aluminum is not a viable substitute.

Copper demand is outstripping supply — we simply do not have enough copper coming into the market to meet demand, which is creating a huge structural supply deficit, not to mention higher copper prices. The price of spot copper earlier this year hit a record $4.71/lb; it’s up 26.9% year to date.

In 20 years, Bloomberg NEF says copper miners need to double the amount of global copper production, just to meet the demand for a 30% penetration rate of electric vehicles — from the current 20Mt a year to 40Mt.

Copper consumption by green energy sectors globally is expected to jump five-fold in the 10 years to 2030, data from consultancy CRU Group shows.

Yet an adequate amount of new copper supply is not only lagging; it doesn’t even exist.

Without new capital investments, CRU predicts global copper mined production will drop from the current 20 million tonnes to below 12Mt by 2034, leading to a serious supply shortfall. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines to take their place.

80% of new production is coming from just five mines, and of these five, none is greater than 200,000 tonnes, initially. Also, the majority of production is locked up in offtake agreements with Asian buyers, namely China, South Korea and Japan, meaning it will not be available to the global market and therefore shouldn’t, in my opinion, be counted as new copper supply.

Remember, Bloomberg NEF says we will need 40Mt by 2040. Let’s be conservative and say we only require an additional 10Mt. New copper from the five new mines including 1Mt from Kamoa-Kakula in the DRC, and others that ideally could add 1-2Mt, will take us from 20Mt currently, to around 22.2Mt. A boost, no doubt, but still a far cry from the 30Mt required.

And it gets worse. It takes 10 to 20 years to develop a copper mine and in the US, probably no new copper mines will ever get approved. The Biden administration is moving to ban mining in the Boundary Waters area of Minnesota, is trying to permanently protect Bristol Bay, effectively killing the huge Pebble copper-gold project in Alaska, and the Democrat-controlled Congress wants to impose an 8% gross royalty on existing mines and 4% on new ones. A House committee is also attempting to block Rio Tinto from building its Resolution copper mine in Arizona.

There are other factors impinging on the means to supply more copper. Resource nationalism is grabbing hold of governments in the main copper-producing nations of Chile, Peru, the DRC and Zambia. Examples include higher royalties and the banning of raw ore exports, with producers expected to beneficiate the ore in-country instead of shipping it off-shore.

The low-hanging fruit has been picked and mining companies/ explorers are having to go further afield. This typically means riskier, more remote jurisdictions, lower-grade deposits where the metallurgy is more complicated i.e. more expensive, and places where there is little to no mining infrastructure, often meaning hundreds of millions in capital expenditures are required.

Conclusion

In sum, we have the perfect storm for copper brewing, and it’s not going to blow away anytime soon.

Lithium like copper has enjoyed a hell of a run this year based on robust demand as vehicle electrification surges around the world and consumers continue to demand e-everything, from smart phones to power tools. An additional use of lithium-ion that came to my attention in talking to Chris Sheridan, involves lawn machinery like mowers and leaf blowers. California Gov. Gavin Newsom recently signed a bill to ban the sale of gas-powered equipment using small off-road engines by 2024 — the first state to do so. The new models would be run on lithium batteries.

Regarding electrification, there is talk of new technology, including other battery chemistries besides the dominant nickel-manganese-cobalt (NMC) combination, and other battery types like zinc-air and solid state, however the reality is that lithium-ion is the first mover in this space and the technology is not going away.

Consider: Toyota just announced it is going to spend $3.4 billion on US automotive batteries through 2030, including building a new battery plant by 2025. Would the world’s largest automaker make this kind of investment if it thought that current battery technology was on its way out? Clearly not.

The infrastructure including millions of charging stations is in place and growing, there are US$ billions worth of lithium-ion battery plants in the works not only in the US but in Europe and China. Lithium and graphite are both must-haves to build a lithium-ion battery, there are no substitutes. In my book this makes them long-term investable commodities. Graphite is lesser known to investors than copper and lithium but this only adds to its allure. Lithium is like the first mover in an area play, and graphite is similar to the next company on trend, the one you would want to invest in because that is the direction the money flows. Of course, not every graphite deposit will do. It must be large flake, spherical graphite, the kind used in the battery anode. To interest a major, the deposit should also be scalable and reasonably low-cost.

The best leverage to a rising commodity price is a quality junior resource company. Despite carrying a certain amount of risk, these investments can also deliver handsome rewards to patient and shrewd shareholders, which is why I continue to own shares in companies that are hunting for The Big Three Commodities of Electrification and Decarbonization.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.