ZincX Resources: Developing the world’s next zinc mine

2021.02.18

According to the US Geological Survey, zinc is mined in over 50 countries, but the vast majority of global supply comes from China, followed by Australia and Peru. Most of the world’s largest zinc mines are found in Latin America and Australia, although the US hosts the biggest, Teck Resources’ Red Dog, Alaska operation.

Zinc orebodies are formed in various tectonic environments and at different temperatures and pressures, which cause significant variability in their properties. Of the eight main orebody classifications, sedimentary exhalative (sedex) Zn-Pb-Ag deposits are the most prevalent, and are critical sources of the global zinc supply.

According to the International Zinc Association (IZA), sedex deposits are typically found in sedimentary rocks, particularly shales, with mineralization that can sometimes exceed 100 million tonnes and grades of 10-20% Zn. Many of these can be traced to the mountainous ranges forming the northern portion of the American Cordillera. The prime example is Teck’s Red Dog deposit, the world’s largest by reserves, situated in the Brooks Range of northwest Alaska.

Further to the south, there is an abundance of sedex Zn-Pb-Ag deposits in British Columbia, Canada, found mainly in Proterozoic to Paleozoic deep-water basin strata of the Purcell anticlinorium, Kechika trough, Kootenay terrane and metamorphic complexes. The 2015 British Columbia Geological Survey identified as many as 4,510 zinc occurrences within the province, of which 589 have zinc as the primary commodity.

ZincX Resources Corp. (TSXV:ZNX, US:ZNCXF)

The report singled out Akie, an advanced exploration project with indicated resources owned by Vancouver’s ZincX Resources, a junior explorer focused on sedimentary exhalative (sedex) Zn-Pb-Ag deposits.

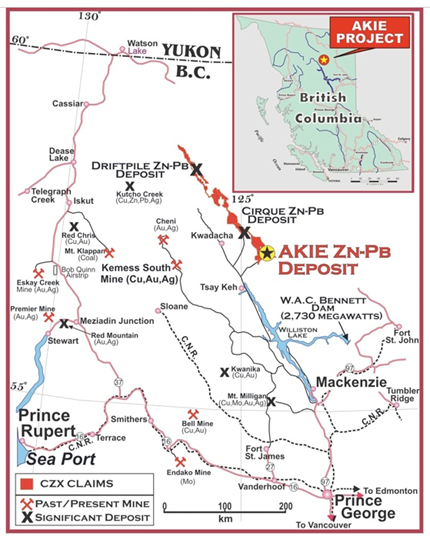

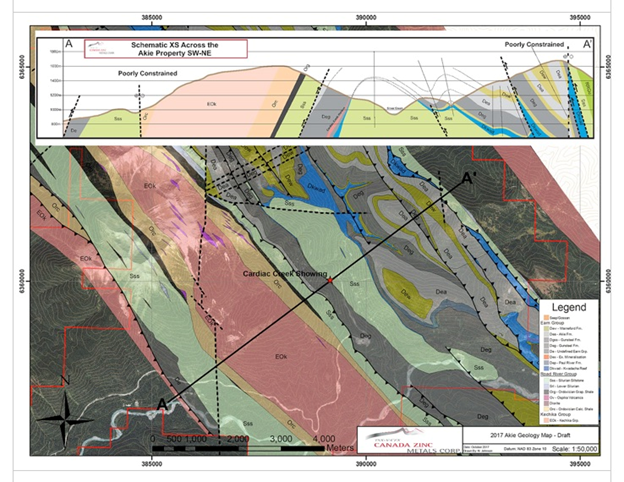

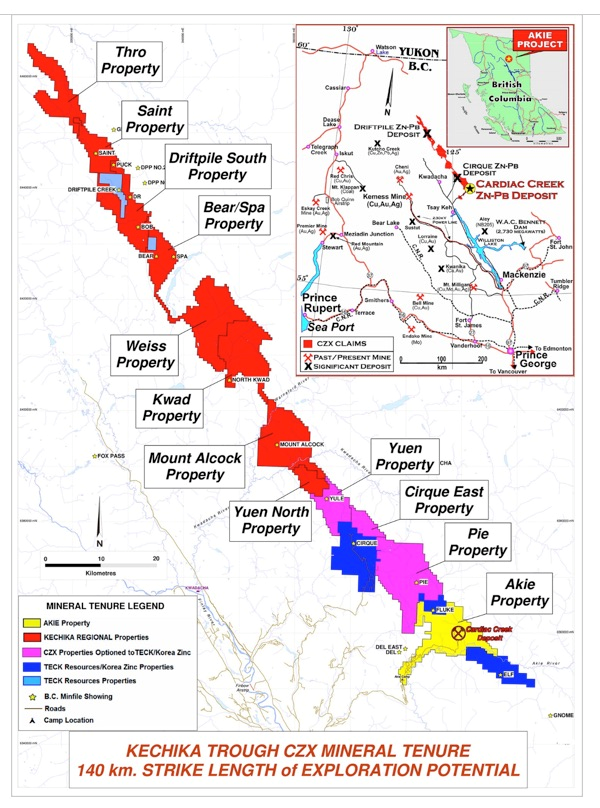

ZincX’s Akie property consists of 46 mineral claims covering an area of approximately 116 km2. It is located in northeastern British Columbia within the geological district known as the Kechika Trough, which is highly prospective for zinc, lead and silver. The Cirque deposit, held jointly by Teck Resources (50%) and Korea Zinc Co. Ltd. (50%), is also found in the district.

Since acquiring the Akie project more than 15 years ago, ZincX has conducted numerous exploration programs and completed a substantial amount of drilling on the property’s primary asset: Cardiac Creek — a large sediment-hosted stratabound sedex Zn-Pb-Ag deposit.

To date, over 150 holes have been drilled, totaling more than 64,000 meters. These drill campaigns have defined a significant body of mineralization.

The deposit contains an estimated 22.7 million tonnes (Mt) of indicated resources averaging 8.32% Zn (4.16 billion pounds), 1.61% Pb (804 million lb) and 14.1 g/t Ag (10.3 million oz), as well as 7.5Mt of inferred resources averaging 7.04% Zn (1.17 billion lb), 1.24% Pb (205 million lb) and 12 g/t A/g (2.9 million oz) – making it one of the largest undeveloped zinc projects in the world.

A 2018 preliminary economic assessment (PEA) for Cardiac Creek envisions a 4,000 tonnes per day (tpd) underground mine capable of producing 178 million pounds of zinc and 20 million pounds of lead annually over an 18-year mine life.

Earlier this month, ZincX announced that planning is underway for a 2,000-meter summer drill program, which will provide new drill core samples for advanced metallurgical testing, with a focus on enhancing the recoveries and boosting concentrate grades for zinc and lead.

Industry interest

As the dominant landholder in the Kechika District, ZincX has quietly been gaining the attention of the industry’s big players.

The 2021 drill program at Akie is being funded by Tongling Non-Ferrous Metals Group Co. Ltd., a Chinese state-owned enterprise and one of the largest smelting companies in China. Tongling first invested in the company back in 2009 and is now its largest shareholder.

Tongling is known in the mineral resource industry for having deep pockets, having bought out TSX-listed Corriente Resources for $680 million, and later led the consortium that put the $1.4 billion Mirador copper project in Ecuador into production.

Tongling’s latest investment in ZincX saw Tongling convert the exploration proceeds into shares priced at an eye-popping 400% premium (based on the share price at the time the transaction was negotiated).

And with the exploration upside of the Akie project, it might only be a matter of time before the likes of Teck Resources and Korea Zinc come calling, too.

In fact, in September 2013, Teck and Korea Zinc joined forces and optioned three contiguous Kechika propertiesfrom ZincX (then known as Canada Zinc Metals Corp.), while also acquiring a small stake in the company at double the existing share price (the projects optioned by Teck-Korea Zinc are referred to as the Pie, Cirque East, and Yuen properties, shown on map below).

Peer comparisons

In 2018, a similar zinc project located in the Patagonia Mountains of Arizona switched hands following a billion-dollar M&A deal, which saw Australia’s South32 Ltd. agree to buy out the remaining 83% stake in TSX-listed Arizona Mining Inc. at a hefty 50% premium.

Arizona Mining’s prized asset was the Hermosa project, which contains Taylor, a high-grade zinc-lead silver sulfide deposit, and Clark, a zinc-manganese-silver manto oxide deposit. “This is one of the most exciting base metals projects in the mining industry,” South32 said at the time.

ZincX’s Cardiac Creek deposit stacks up exceptionally well against Taylor. Both are sedex deposits with published NI 43-101 resources, so a comparison is justifiable.

A 2017 preliminary economic assessment for Taylor outlines a 19-year underground mine, reaching production capacity of 10,000 tpd in 2023, compared to 4,000 tpd @ 18 years for Cardiac Creek.

However in terms of zinc and silver grades, Cardiac Creek trumps the Taylor deposit. Based on market prices (as of Feb. 16, 2021), metals in the ground at Cardiac Creek are valued at $280.79 a tonne, while those at Taylor come to only $232.65/t.

For another good comparison, consider Fireweed Zinc’s (TSXV:FWZ) MacMillan Pass. The project comprises four zinc-lead-silver deposits — Tom, Jason, the Boundary Zone and the End Zone. A 2018 mineral resource estimate combines the Tom and Jason deposits for an indicated category total of 11.21Mt @ 6.59% zinc, 2.47% lead and 21.33 g/t silver, containing 1.63 billion pounds Zn, 0.61 billion lb Pb, and 7.69Moz Ag.

ZincX’s Cardiac Creek indicated resource is about twice as big, and is higher grade, boasting 22.7Mt (indicated) @ 8.32% zinc, 1.61% lead and 14.1 g/t silver, with contained metal consisting of 4.16 billion pounds Zn, 0.80 million lb Pb, and 10.3Moz silver.

A PEA done on MacMillian Pass in 2018, the same year as ZincX’s preliminary economic assessment, envisions an 18-year mine with an average 4,900 tpd — around the same throughput and mine life as Cardiac Creek.

And then there’s Rokmaster Resources (TSXV:RKR), whose Revel Ridge project in southeastern British Columbia reached the PEA stage earlier this year. The updated mineral resource estimate reports 5.27Mt measured and indicated tonnes in three zones. The resource is harder to compare to Cardiac Creek because it contains gold, but we notice the zinc grades at Revel Ridge are lower, @ 6.36% averaged across the three zones, versus 8.32% at Cardiac Creek.

The PEA envisions an underground mine located 35 kilometers north of Revelstoke, BC, with a processing plant capable of 2,300 tpd for the mine’s 12-year lifespan.

Zinc market update

Despite zinc’s low profile among resource investors, it is the fourth most mined metal. While zinc’s primary use is to stop steel from rusting, other applications are shoring up demand. Adding zinc to fertilizer increases soil productivity, and there is research being conducted to develop a nickel-zinc battery for use in electric vehicles. Zinc, of course, is already used in alkaline batteries.

Zinc is also used heavily in infrastructure build-outs. This includes desperately needed bridges, public buildings, power stations, dams etc. in the US, much of the developing world, and China’s Belt and Road Initiative which along with needing millions of tonnes of copper, is going to require a lot of galvanized steel containing zinc.

According to the US Geological Survey, in 2020 the top zinc-producing countries were China, Australia and Peru. Total mine production was 12 million tonnes. From 250 million tonnes of global reserves, Australia has the most zinc at 68Mt, second is China at 44Mt, with Mexico and Russia tied for third place at 22Mt. About 1.9 billion tonnes of zinc resources have been identified throughout the world.

Over the years, some very large zinc mines have been depleted and shut down, with not enough new mine supply to take their place. MMG’s shuttered Century mine for example used to supply 4% of the world’s zinc. Between the closure of the Lisheen mine in Ireland, Century, and Glencore’s Brunswick and Perseverance mines in Canada, over a million tonnes was ripped from global zinc production.

The closed mines represent an estimated 10 to 15% of the zinc market. On the flip side, there have been few discoveries or big zinc projects planned, setting the zinc market up for a supply shortage.

The pandemic initially crimped zinc demand, but a combination of constrained supply and strong demand from China squeezed the market from an expected surplus to a pronounced deficit in 2020; this was reflected in higher prices.

For the first 10 months of the year, the International Lead and Zinc Study Group (ILZSG) registered a refined zinc deficit of 480,000 tonnes — a complete turnaround from the 620,000-tonne surplus the group predicted for 2020, and another hefty 463,000-tonne surplus for 2021.

The main factors behind the deficit were the closure of Vedanta’s 250,000 tons per annum Gamsberg mine in South Africa (since re-opened) following a serious accident; the collapse in Chinese smelter charges to two-year lows (under $100/ton) as operators competed for concentrates said to be in short supply; and China zinc buying (zinc fell into the Chinese stimulus narrative — higher steel demand meant lots more zinc needed to make galvanized construction beams, bars and appliances), although a Reuters article notes that China has had no need to soak up the world’s excess supply of zinc, as it did for copper and aluminum. Net imports of of 332,000 tons in the first nine months of the year were 24% lower than 2019 and the lowest January to September tally since 2015.

Zinc and its sister metal lead, have also been hit hard by quarantines affecting output in key supplier countries, such as Peru, Bolivia and Mexico.

From last March’s low of $0.83/lb, zinc prices climbed to $1.29 in December, making zinc bulls happy as the calendar flipped to 2021.

We aren’t the only ones thinking that zinc is in for a good year. The ILZSG predicts a rebound in refined zinc output this year to 13.15 million tons, and a rise in demand to 13.52Mt, suggesting the market will remain in deficit.

In December the Northern Miner quoted Carlos Sanchez, the CPM Group’s director of commodities and asset management, who forecast zinc to trade at $2,628 per tonne ($1.19/lb) in 2021, up 17% from the average price in 2020. In 2022, the galvanizing metal should rise 8.7% from 2021 prices, to $2,857/t, or $1.29/lb.

After a brief lull in the zinc market at the end of January of this year, the zinc bulls already seem to be back in charge. For the week ending Feb. 12, zinc soared 7%, rising the most among the LME’s base metals complex, bettering copper, lead aluminum and tin. Supporting the weekly price rise were outflows of 6,100 tonnes from LME zinc warehouses.

Demand for zinc is expected to pick up after the end of the Chinese New Year, and as far as we can tell at AOTH, it can only grow stronger.

Like copper, zinc is an important metal for civil infrastructure renewal. The International Zinc Association explains that “Galvanaized steel is one of the strongest construction materials in existence and has been used for centuries in the building of bridges, buildings and other structures.”

US President Biden is already planning what we think will be a major infrastructure spending package, aimed at the country’s crumbling freeways, bridges, airports and water systems.

Last week, Biden reportedly met with four senators from both sides of the aisle, to discuss a potential infrastructure program, warning that if the US does not address the problem, China is “going to eat our lunch.”

The President was prompted to call the meeting following a telephone call with Chinese President Xi Jinping, during which the two discussed the urgent need for investments in rail, roads and labor. Biden clearly believes the issue is bipartisan, stating, “I’ve been around long enough … that it used to be that infrastructure wasn’t a Democrat or a Republican issue. There are not many Republican or Democratic roads and bridges,” The Hill quoted him saying in the Oval Office.

As a presidential candidate, Biden promised over a trillion dollars for infrastructure, including a $50 billion investment in repairs to roads and bridges and $10 billion for transit construction. We think it’s highly unlikely that Biden will settle for less than the $2 trillion Trump floated on an infrastructure bill during his term, that never made it past the White House. Biden’s plan could be double that.

Remember, Biden is a tax and spend Democrat firmly in the pocket of the party’s progressive left, which doesn’t care about debts and deficits because it follows the twisted logic of Modern Monetary Theory (MMT).

Beyond the United States, there is China’s Belt and Road Initiative (BRI), consisting of a vast network of railways, pipelines, highways and ports that extends west through the former Soviet republics and south to Pakistan, India and southeast Asia. BRI requires millions more tonnes of zinc, along with other key infrastructure metals such as copper, nickel and aluminum.

In Europe, the EU wants to spend its way out of the pandemic, leading with a “green recovery” pledge worth 550 billion euros. Among the projects that could benefit from the funds, are low-carbon steel production in Sweden (steelmaking represents about half of zinc consumption) and an EV battery factory in Poland.

The bullish case for zinc, then, is clearly bolstered by the green and blacktop infrastructure projects that haven’t even begun to be rolled out.

While China has always been the world’s biggest producer of the metal, Fitch Solutions sees mine production stagnating there over the coming years on declining ore grades and environmental concerns, thereby supporting higher prices.

Conclusion

With a project that has the perfect combination of size, grade, location and further exploration upside, ZincX Resources is a company that warrants special attention.

At a current market capitalization of under $30 million, ZincX appears to be a low-risk, high-reward opportunity for any mining company looking to unlock the zinc space.

Late last year, analysts at Goldman Sachs predicted that we’re on the cusp of another bull market for commodities, also referred to as a “supercycle”. With almost every country looking to spend more money on infrastructure projects, demand for base metals will be relentless, with prices expected to eclipse multi-year highs.

This is good news for the established miners, many of which have already experienced double-digit gains on the commodity price rally during the second half of 2020. But junior miners too will stand to benefit, as their projects will only grow in value.

ZincX Resources Corp.

TSX.V:ZNX US:ZNCXF

Cdn$0.17, 2021.02.16

Shares Outstanding 170.3m

Market cap Cdn$28.9m

ZNX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of ZincX (TSX.V:ZNX). ZNX is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.