World’s running short on nickel supply for battery use

2022.02.12

The nickel market is currently experiencing its biggest squeeze in recent memory.

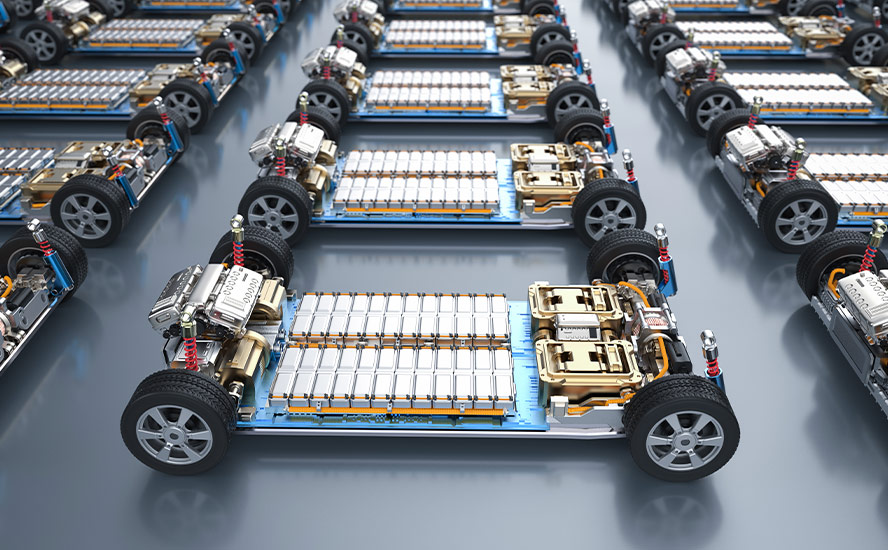

Aggressive pledges to fight climate change have precipitated a buying spree of metals that are key to the clean energy transition. Nickel, a key ingredient in EV batteries, is undoubtedly near the top of every shopping list.

Inventories of the metal have been dwindling across the world, given the relentless demand from the EV sector, and it appears some are even willing to pay “whatever it takes” to snap up the battery mineral before others can.

This week, the cash three-month spread on nickel notched a new record. Contracts for immediate delivery traded at a premium of $570/t to those in three months, the highest such premium since the historic squeeze of 2007.

Similar happened in January, but for near-dated contracts. Cash contracts on the LME reached a $90/t premium on Jan. 18 to those expiring a day later, the highest since 2010 and nearing levels seen in 2007. This prompted the bourse to step up its monitoring measures, the third time it had to do so in 12 months.

The latest nickel squeeze, though, has much bigger implications, seeing the market is now pricing in tighter nickel supplies for longer periods amid strong demand from battery manufacturers.

For instance, the spread between February and March contracts has more than doubled in the past week; so has the spread between March and April contracts.

Since April 2021, LME stock has declined by nearly two-thirds, from approximately 261,000 tonnes to roughly 88,100 tonnes in January 2022.

All this reveals that the world may quickly run out of available nickel for clean energy applications, especially with the break-neck speed at which demand is moving.

A report by UBS indicates that a deficit in nickel will come into play as soon as this year. By the end of the decade, UBS forecasts a large deficit of 2.2 million tonnes for the battery metal.

A more conservative estimate from Rystad Energy shows that demand for high-grade nickel used in EV batteries will outstrip supply by 2024. By then, global demand will climb to 3.4Mt, compared to 2.5Mt this year, while supply will grow to 3.2Mt.

The gap will then widen quickly to a deficit of 0.56Mt by 2026, driven by surging demand from the battery sector.

While EV battery is not the dominant end-user for nickel, that being stainless steel, EV’s share of nickel demand has been growing at a faster rate and is expected to trend up.

Wood Mackenzie analyst Andrew Mitchell estimates that of the 2.8 million tonnes demanded last year, 69% was used to make stainless steel and 11% to make batteries, up from 71% and 7% respectively in 2020. Mitchell expects batteries’ share of demand to rise to 13% in 2022.

According to Rystad’s latest report, nickel demand from the stainless steel industry is expected to grow at about 5% per year, while the market for batteries is poised to explode. “In an unconstrained supply scenario, batteries could require more than 1Mt of nickel metal by 2030, quadrupling from the current demand of 0.25Mt,” the energy research firm said.

An explosive demand has also propelled nickel prices to levels last seen over a decade ago. In late January, nickel reached $24,435/t, representing the highest since August 2011.

Analysts believe that high prices could become the norm for many years as long as the supply shortage problem remains unsolved.

Commodities such as nickel may stay high for decades, according to BlackRock’s Evy Hambro, as mining companies struggle to keep up with the demand created from the switch to a “greener world”.

In a Bloomberg interview, the firm’s global head of thematic and sector-based investing said: “What we’re likely to see is strong demand that will keep prices at very very good levels for the producers for many years into the future, and that could be decades.”

These views were shared by Goldman Sachs Group, which also pointed to a commodity supercycle that has the potential to last for at least a decade.

The bullish market forces that are swirling in preparation for what many are calling the next commodities supercycle are excellent news for companies on the hunt for raw minerals to feed the energy revolution.

Nickel Sulfide Opportunity in Quebec

As one of the few junior miners racing towards the next nickel discovery in Canada, Renforth Resources Inc. (CSE: RFR) (OTCQB: RFHRF) (FSE: 9RR) has the right metals at the right time, embodied in its Surimeau polymetallic project in Quebec.

The 260 square-kilometer property hosts several target areas for gold and industrial metals (nickel, copper, zinc, cobalt, silver) located south of the Cadillac Break, a major regional gold structure.

Exploration focus is currently placed on the sulfide nickel rich VMS targets, in particular the Victoria West prospect, which has been the site of drilling by the company for over a year (see map below).

The Victoria target was last explored in the 1990s by LAC Minerals looking for gold, though it was later determined by LAC and previous operators that nickel, zinc and copper, plus a few more minerals, were also present. This finding was later validated by Renforth’s initial fieldwork.

According to Renforth, information gleaned from drilling and trenching the Victoria West target, along with surface sampling, creates an area of interest that includes about 5 km of strike on the western end of a 20 km magnetic anomaly.

The company interprets this anomaly to be a nickel-bearing ultramafic sequence unit, which occurs alongside and is intermingled with VMS-style copper-zinc mineralization.

Renforth considers this rare style of mineralization to be an “Outokumpu-like” occurrence, referring to a district in eastern Finland known for several unconventional sulfide deposits with economic grades of copper, zinc, nickel, cobalt, silver and gold.

About 50 million tonnes of ore averaging 2.8% copper, 1% zinc and 0.2% cobalt, along with traces of nickel and gold, were mined from three deposits between 1913-1988.

Geologists believe that Outokompu’s unconventional deposit type originated through deposition of copper-rich ore on the seafloor around 1,950 Ma. Some 40 Ma later, disseminated nickel sulfides formed through chemical interaction between massifs (blocks of rock) and adjacent black schists.

As for how closely Renforth’s Surimeau deposit resembles the size and qualities of the Outokumpu district, it is still early to say. However, the scale of the Finnish district is certainly impressive (up to 50Mt of ore has been mined in Finland), and we also know that Outokumpu is enriched with palladium, a high-value metal currently worth more than an ounce of gold.

Moreover, the Finnish deposit contains a confluence of elements that yields a large suite of base metals. If Renforth can delineate a similar mix, there is a good chance they can be mined as a single unit like at Outokumpu, and processed into separate concentrates.

Quebec’s Dumont sulfide nickel deposit is another interesting analog to Surimeau. Described in a corporate presentation as “a shovel-ready sustainable nickel project,” Dumont is considered one of the only large-scale nickel deposits not currently owned by a major mining company.It has 2.8Mt of nickel in proven and probable reserves, and 110,000 tonnes of cobalt.

A feasibility study suggests Dumont has the potential to become a top 5 nickel producer globally, producing an average 39,000 tonnes of the EV battery metal per annum for 30 years.

The fact that Surimeau compares well to both the Outukompu camp in Finland and the Dumont polymetallic deposit, which shares similar geology, is encouraging.

Drilling completed by Renforth to date has only reassured the presence of a large polymetallic camp richly endowed with nickel, copper, cobalt and zinc, along with some PGEs (platinum group elements).

Exploration Progress at Surimeau

As mentioned, Renforth’s exploration has mainly focused on the Victoria West prospect and other nickel sulfide targets.

First drilling occurred in October 2020, with 2.5 short holes completed.

This was followed by 15 holes for 3,456m in spring 2021, drilling off 2.2 km of strike within the approximately 5-km-long Victoria West target. Another four holes totaling about 1,000m were drilled last summer; these holes all delivered visible sulfides in the core.

Assays for the 21 holes drilled at Victoria West were announced in November, with each hole hitting mineralization as expected, and the four deeper holes demonstrating an increase in grade.

Highlights of the 2020-2021 drilling included:

- A 111.05m mineralized interval starting at 57m down hole, averaging 0.17% nickel and 139.58 ppm cobalt. A highest-grade 40-meter sub-interval assayed 0.22% nickel and 168.98 ppm cobalt.

- A 107.2m interval starting at 130.5m down hole, averaging 0.15% nickel and 112.64 ppm cobalt, within which the highest-grade sub-interval of 14.4m assayed 0.22% nickel and 196.4 ppm cobalt.

- A 119.7m interval starting at 81.3m down hole, averaging 0.13% nickel and 90.49 ppm cobalt. A highest-grade 0.55m sub-interval assayed 0.95% copper, 0.17% nickel and 217 ppm cobalt.

Since then, seven new holes (1,203m) have been completed within an approximate 275m strike length. The recently concluded stripping of this area encountered more copper and zinc on surface than was seen in the drilling.

According to Renforth, this is thought to be due to the presence of the ultramafic nickel/cobalt body and the magmatic copper/zinc body, consistent with the company’s Outokumpu-style model that suggests two different mineralized bodies juxtaposed in one location due to the circumstances of the mineralizing event.

In January, Renforth published the results of channel sampling across the 275m of stripped surface area at Victoria West. According to the company, these channel samples demonstrate elevated nickel, copper, cobalt and zinc values, the highlight being where the two mineralization types (nickel-cobalt and copper-zinc) mix.

Channel 49 featured a 12.9m section with assays of 0.121% nickel and 0.013% cobalt. Included within this section were 0.224% nickel over 1m, and 5.5m of 0.43% copper and 1.63% zinc. The latter intersection included a best-grade 0.8m of 2.05% copper.

In addition to the channels cut, there were several grab samples taken. Highlights included 0.163% nickel and 0.012% cobalt, along with 0.496% copper and 0.09% zinc.

Renforth says these sampling results demonstrate that its discovery of a polymetallic (nickel/cobalt and copper/zinc) mineralized system at Victoria West, stretching over >5km, is in fact “a surface system hiding in plain sight.”

The company adds that the Surimeau property is located approximately 70 km from Glencore’s Horne Smelter in Rouyn-Noranda, Canada’s only copper smelter, which also engages in recycling of strategic and precious metals, shipping anode to their Montreal refinery, also Canada’s own copper/nickel refinery.

So, should Renforth be able to develop Victoria West into a minable asset, then the processing solution could just be sitting within an hour of its doorstep. Just how long until we reach that stage remains to be seen, but the company is aggressively pursuing the answers to that question.

Conclusion

While still at an early stage, Renforth considers the extent of its findings to date, plus other known targets and unexplored prospective ground, warrant further exploration.

Remember: Victoria West is only one of six polymetallic target areas on the Surimeau property historically documented as hosting mineralization. It is located at the western end of a 20-km-long magnetic anomaly that hosts proven mineralization at either end, with the Colonie target at its eastern end.

The fourth and latest to be prospected is the Huston area, located at the western end, about 18 km from Victoria West. This area is almost entirely unexplored with the exception of a limited drill program by Hecla in the 1980s, which focused on gold.

Results of last summer’s prospecting from the southwestern part of the area gave the first ever documented nickel occurrence at Huston, with one grab sample returning 1.9% nickel, 1.38% copper, 1,170 ppm cobalt and 4 g/t silver.

Management considers this sample, which was taken from strongly foliated diorite, a coarse-grained intrusive igneous rock, to be a new discovery that will be revisited.

The company also plans to investigate the 14 km of magnetic anomaly between Victoria West and Colonie to determine the continuation of the ultramafic mineralization.

Could Surimeau be part of a polymetallic camp within the Val d’Or-Rouyn-Noranda region of Quebec? Well, the nearby Dumont deposit appears to have a similar style of mineralization containing nickel and cobalt.

At the moment, Renforth has a >5 km of a mineralized system, starting on surface, endowed with grades of nickel, copper, cobalt and zinc, along with some PGEs, which in the words of CEO Nicole Brewster, “collectively are giving the company of a total contained metal value which may exceed the cost to mine.”

A potential mine of this scale could be huge, considering the urgent need around the globe for battery metals.

Bank of America forecasts that, given the current rate of EV penetration, as much as 690,000 tonnes of nickel will be needed by 2025 to build car batteries; that is nearly the entire mined nickel supply of top producer Indonesia.

For what it’s worth, the mineralization system at Surimeau may play a crucial role in filling the nickel supply gap. Stay tuned.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.065; 2022.02.10

Shares Outstanding 262.3m

Market cap Cdn$18.3m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.