Why the lithium bears are wrong

2018.11.01

Economics has been called “the dismal science” for its conclusions which often suggest miserable outcomes for humanity. The saying was born in the 19th century by Scottish writer and philosopher Thomas Carlyle, who was referring to economist Thomas Malthus. Malthus famously calculated that humanity was trapped in a world where population growth would outstrip resources and lead to widespread misery including starvation – a condition known as “The Malthusian dilemma.”

Economics is dismal for another reason: it often fails to make accurate predictions.

We see this in the monthly US employment figures which are usually wrong, and in the copper supply projections trotted out by commodities analysts. Every year these analysts dutifully tally up the predicted market supply tonnage based on output targets from the major producers, and almost every year they turn out to be wrong. Why? Because these so-called experts failed to account for the gaps in output that occur due to strikes, extreme weather, bans on concentrate shipments, or any other reason why a mine closes temporarily due to “force majeure”.

Now the same thing is happening with lithium, with two recent reports coming up with predictions of a slide in lithium prices due to a glut of new supply overwhelmingly the tiny (by mining’s standards) lithium market. What is puzzling is that both of these reports either gloss over or fail to adequately break down the demand side of the lithium market – something we at Ahead of the Herd did some time ago in a separate article. The conclusion we came to was that lithium demand is skyrocketing, and will continue to do so in coming years, due to the irreversible trend of moving from internal combustion engine-powered vehicles to electric vehicles. The trend is particularly evident in Asia. China is the largest EV market by volume, while Japan is number three behind the US. India is also aggressively ramping up EV targets. Of course we’ve seen the demand scenario play out through lithium prices, which have doubled in the last two years and are current trading at around $23,000 a tonne for battery-grade lithium carbonate. Still, the lithium bears are coming out from hibernation, and lithium stocks have been taking it on the chin. This article will show why they’re wrong.

The lithium bears

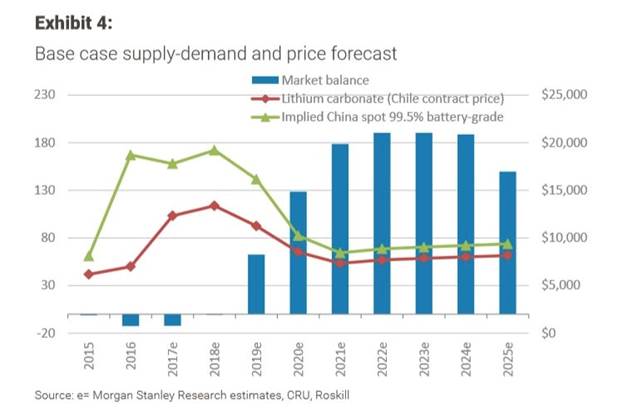

In February investment bank Morgan Stanley was first out of the gate with a damning report on lithium; its research team concluded that an avalanche of lithium was in the works and would put the roughly 200,000 tonnes per year lithium market into surplus. The glut would mean a fall to around US$13,000 a ton in 2018, before halving to $7,000 by 2021.

“A host of lithium projects and expansion plans – including increased production by low-cost Chile brine operator SQM – threatens to add 500 kilo-tonnes per annum to global lithium raw material supply by 2025, swamping forecast demand growth,” Morgan Stanley said.

The main reason for Morgan Stanley’s argument for oversupply was the recent government approval in Chile for mine expansions which would “open up the floodgates” to new lithium product. That is referring to a deal struck in January between Chilean development agency Corfu and SQM, Chile’s largest lithium producer, over lithium royalties in the Salar to Atacama, one of the largest and highest-grade lithium deposits in the world. The deal frees SQM to boost its production quota in exchange for higher royalty rates equivalent to those paid by competitor Albemarle. It also permits SQM to work with state copper miner Codelco to start developing the Maricunga lithium deposit – the second largest lithium-bearing salt brine deposit in Chile. In all the agreement allows SQM to produce up to 216,000 tonnes of lithium carbonate a year from the Salar de Atacama. Lithium supply could also increase due to the election of a new president in Chile, Sebastian Pinera, whose National Renewal Party is open to revisiting a law prohibiting lithium production above 80,000 tonnes.

The bank put out a base-case supply-demand and price forecast leading up to 2025, indicating that lithium prices in China and Chile would trend below the market-equilibrium price for the next seven years. Curiously though, the report skewed heavily towards supply with little to no mention of demand.

Morgan Stanley also noted that brine production in Chile has been constrained due to high amounts of magnesium, an impurity in the metallurgical process, but “this is evolving” said the bank, without an explanation how.

Other criticisms levelled at the report:

- It makes no mention of the fact that the new royalty rates on SQM are prohibitive and may impede production.

- The report says new production from brines in Chile and Argentina will be low-cost (under $5,000 a ton), suggesting a pulling away of demand from supply. In fact the lithium market is tight, even with new supplies coming online. According to the USGS lithium supply in 2017 was 236,000 tonnes while demand was 228,000 tonnes. Demand forecasts are expected to increase by 2025 according to the three major producers, Albemarle, SQM and FMC, who will be pressured to produce enough to meet demand.

- The report states that “A bottleneck in conversion capability will keep a lid on realised carbonate production from hard rock mines in the near term – but this is expanding too.” Presumably referring to the ability of a miner to convert raw lithium into battery-grade lithium carbonate – this statement is never explained, leaving the reader to wonder how hard rock lithium miners are bettering their metallurgy. Lithium is extremely difficult to process from pegamites and there is currently only one mine doing it – Greenbushes in Australia. Read the next section for more on this.

The next lithium bear to wake up was commodities researcher Wood Mackenzie, which forecast a rout in lithium and cobalt – both key ingredients in EV batteries. While Woodmac at least didn’t lowball demand growth – expecting it to grow from 233 kilo-tonnes lithium carbonate equivalent (LCE) in 2017 to 330kt in 2020 and 405kt in 2022 – it too forecast an imminent tsunami of lithium supply. Quoting from the report:

… the supply response is under way. Yet it will take some time for this new capacity to materialise as battery-grade chemicals. As such, we expect relatively high price levels to be maintained over 2018. However, for 2019 and beyond, supply will start to outpace demand more aggressively and price levels will decline in turn. – Wood Mackenzie

The London-based firm thus predicts prices will average $13,000 per tonne this year, slip to $9,000 by 2019, and keep dropping to $6,500 in 2022.

Not so easy to make lithium

What the bears seem to have in common is the belief that a rush of new lithium supply will soon hit the market, but what the analysts don’t realize, or maybe for their own reasons neglect to mention, is that a lot of these mines will fail to deliver.

There are two primary means of extracting lithium: from brines in evaporated salt lakes known as salars, and hard rock mining, where the lithium is mined from granite pegamite orebodies containing spodumene, apatite, lepidolite, tourmaline and amblygonite.

Many junior exploration companies chasing lithium projects are not cognizant of the economic and technical challenges – no brine mining projects and even fewer hard rock projects have been put into production for the last two decades and when done so it’s been by the major lithium producers in just four countries – Chile, Argentina, China and Australia. This exposes something in the industry no one talks about – a lack of skilled personnel to get involved with mineralogy/metallurgy and the engineering side of production.

A major factor affecting capital costs for lithium brines is the net evaporation rate – this determines the area of the evaporation ponds necessary to increase the grade of the plant feed. These evaporation ponds can be a major capital cost. Potassium, boron, potash and other minerals are often harvested from early ponds, while later ponds have higher concentrations of lithium. The lithium-pregnant solution is then pumped to an extraction plant where impurities like boron and magnesium are removed.

Hard rock lithium miners have large problems facing them when competing with brine economics – firstly most have large capital costs for start up and secondly their production cost is roughly twice what it is for the brine exploitation process.

Lithium products derived from brine operations can be used directly in end-markets, but hard-rock lithium concentrates need to be further refined before they can be used in value-added applications like lithium-ion batteries.

Extracting lithium from spodumene requires a whole range of hydrometallurgical processes. The ore is first crushed and heated in a kiln to create a spodumene concentrate, which is then cooled and milled into a fine powder. It is then mixed with sulfuric acid and roasted again, before waste is separated from the concentrated liquor, and magnesium and calcium are precipitated out. Finally soda ash and lithium carbonate is crystallized, heated, filtered, and dried, creating 99% lithium carbonate.

Lithium carbonate is turned into metal in an electrolytic cell using lithium chloride.

Demand “going through the roof”

We’ve been been crunching the supply and demand numbers for almost a decade – at least since President Obama put aside nearly $2 billion in 2009 to support research on hybrid and electric vehicles and their battery components. What we know is this:

Asia and particularly China are looking to lock up lithium supply, and are years ahead of North America in terms of EV penetration and battery supply chains. Last year China sold about 700,000 electric cars, 200,000 more than 2016. Government subsidies to EVs have been reduced by 20%. The Middle Kingdom sees EVs as the key to unlocking the pollution dilemma that has plagued its car-choked cities. China represents over a quarter of the global EV market, and will own 40% by 2040 according to the International Energy Agency (IEA).

The country has signed lithium offtake agreements with mines in Australia, Canada and Africa, and despite Tianqui Lithium – which owns 51% of Talison’s Greenbushes mine in Australia, the largest hard rock lithium mine in the world – being recently denied a 32% ownership stake in SQM, China isn’t giving up. Other Asian companies, such as Japan’s Panasonic and Korean conglomerate Samsung, are also looking to ink deals in the lithium triangle of Chile, Argentina and Bolivia.

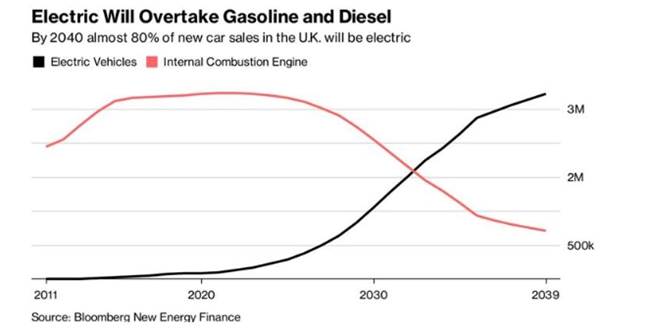

China and India are both going to 100% electric vehicles. Every major car manufacturer has electric models. Volvo has even promised to phase out internal combustion engines (ICE) from 2019.

France has promised to end the sale of gasoline and diesel vehicles by 2040; the UK quickly followed suit. Almost a third of cars sold in Norway in 2016 were electric and Germany could outpace its neighbors as Volkswagen aims to become a leader in both EVs and automated vehicles.

EVs surpassed 2 million units in 2016 and Bloomberg New Energy Financepredicts they will make up an astounding 54% of new car sales by 2040.

In 2016, Chinese carmakers sold 28.03 million cars. If China follows through on its promise to go 100% electric that’s a minimum 28.03 million lithium-ion battery packs for EV’s per year.

Add in the UK’s2.7 million car sales in 2016and France’s2 million car sales in 2016.

That’s 32.73 million electric vehicles all requiring lithium-ion battery packs, without counting electric buses (a big deal in China, and going to be in India as well) or annual growth rates in auto sales.

One Tesla car battery uses 45 kg or 100 pounds of lithium carbonate.

Despite recent issues with its Model 3, Tesla aims to produce 6,000 cars a week, or 312,000 a year. It plan to ramp that up to 1,000,000 cars by 2020. New models would include the Model Y SUV, a pick-up truck, and a semi-truck, all electric. A recent news report states the problem with the Model 3, and the obstacle to putting more cars on the road, is a bottleneck in battery production.

A million electric cars produced in North America means 45,454,000 kg/ 100,000,000 pounds or 45,454 tonnes /50,000 tons of lithium carbonate equivalent (LCE) has to be mined just for Tesla’s North American electric vehicle production – and Tesla has promised to source North American lithium. Elon Musk, Tesla’s CEO, also has plans to build four more Gigafactories other than the one currently being built in Nevada. And it’s not just about the US. China is also building lithium-ion megafactories, and by 2020 these are expected to grow global production capacity by six times.

Think about those global 32,730,000 lithium battery packs.

If each used the same amount of lithiumcarbonate as Tesla’s electric vehicles, that’s 1.487 billion kilograms/ 3.273 billion pounds or 1,487,727 tonnes /1,636,500 tons of new lithium carbonate demand.

Current annual production of lithium carbonate equivalent (LCE), for all purposes, stands at about 230,000 metric tonnes.

SQM recently predicted that demand will increase from between 600,000 and 800,000 tonnes of LCE over the next 10 years. To meet the need, SQM plans to double capacity from current annual production of 48,000 tonnes to 100,000 by 2019.

The industry agrees that Morgan Stanley is out to lunch on its forecasts.

“I am firmly of the view that everyone, including Morgan Stanley, is grossly underestimating how quickly the market is moving on the demand side,” Ken Brinsden, chief executive of Australian lithium miner Pilbara Minerals, said at a mining conference in Florida in February.

“Lithium is coming of age in a big way. It’s the core ingredient to 99 percent of electric vehicles and as a result, demand is going through the roof,” Simon Moores, managing director at Benchmark Mineral Intelligence, a UK-based battery metals consultancy, told CNBC.

Another key point is that analysts tend to lump all potential lithium production together, including producers, near-term producers, brines, hard rock mines, and lithium sucked from oilfield brines. The forecasts vastly underestimate the difficulty in extracting lithium from spent oilfields, for example. Some of these wells are up to four kilometers deep, the brine needs to be pumped and trucked to a storage site, then the lithium has to be separated from all the other impurities which could include uranium, thorium, magnesium and potash. It’s neither an easy nor a cheap process and no company has yet been able to do it on a commercial scale.

Canaccord bullish

One consultancy must have had a re-think about the near future of the lithium market. Addressing questions from investors, who likely read the negative reports from Morgan Stanley and Woodmac, Canaccord said in its “Morning Coffee” bulletin that mine production does not necessarily equal LCE supply. In fact mined conversion capacity for 2017 (the amount of lithium actually converted to lithium carbonate or lithium equivalent), 111 kilo-tonnes, was about half their mined LCE estimate of 215kt. Over the next seven years, Canaccord states that more lithium is likely to be mined than can be converted into lithium, thus creating a supply chain bottleneck. This scenario would keep upward pressure on prices. It also expects new lithium to come from higher-cost hard rock mines – likely due to the recently announced expansion at Greenbushes. The mine is set to double in size by next year.

As for demand, Canaccord is bullish, ball-parking 920,000 tonnes of LCE demand by 2025. If that came true, it would be almost five times the current global production. It even admits that figure could be conservative, “with upside risks driven by the increasing potential for demand from LiB-based Energy Storage Systems and larger Electric Vehicle battery sizes (see charts).”

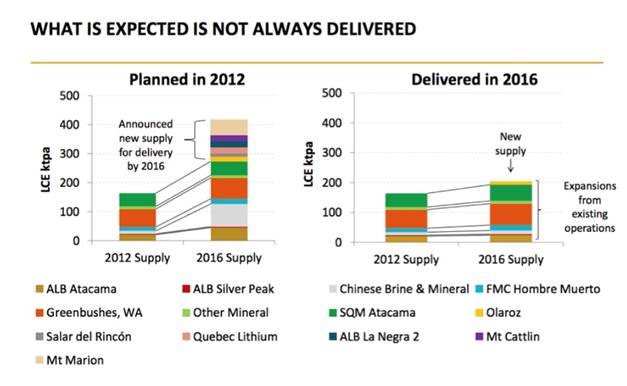

What is expected is not always delivered

MINING.com riffed on the Canaccord story by noting that both the Morgan Stanley and Canaccord reports referenced a year-old graph from an investor slide presentation from Orocobre, which mines lithium in Argentina. Take a look at the left part of the slide showing that in 2012, major lithium mines planned to produce an extra 200,000 tonnes of new supply by 2016. But when 2016 rolled around, under 50,000 new tonnes came online, despite “expansions from existing operations” (see right part of the slide).

This slide is fascinating for a couple of reasons. One, it proves, like the title, that “What is Expected is Not Always Delivered.” In other words, the major lithium miners despite their best efforts to double production in four years, were unable to do so. Why not? It can’t have been due to prices, which, as seen in the chart below, started heading higher in 2015. As far as we know there weren’t any government policies restricting demand in the producer countries during this period so the only explanation must have been technical challenges in getting the lithium to market.

The second reason we love this chart is because it shows definitively how vulnerable the United States is to foreign imports of lithium carbonate especially considering Tesla’s often-stated goal that it plans to source the lithium for its EV batteries from North American mines. The country currently imports most of the lithium that it consumes – with import reliance today pegged at greater than 70%.

On the left of the chart notice the red square denoting Albemarle’s Silver Peak mine – the only producing lithium mine in the United States. We know that Silver Peak has the capacity to produce 6,000 tonnes of LCE per year. They delivered it in 2012 but what happened in 2016? The mine is missing from the right side of the chart, meaning that Silver Peak, located about 200 miles from Tesla’s Gigafactory, failed to produce any new supply to the market. Why not?

If Silver Peak can’t deliver any additional lithium in four years, how can it possibly be expected to supply Tesla’s lithium needs, which as we calculated above, would be 50,000 tonnes of LCE by 2020 if a million Teslas come out of its factory? Let alone four more gigafactories and lithium needed for electric batteries in the Chevy Bolt – the second-best selling EV in the US last year behind Tesla.EV sales in the US, by the way, were up 25% last year compared to 2016, making it the best year ever – giving more ammo to the demand argument.

According to Benchmark Intelligence, Tesla’s Gigafactory also needs about 24,000 tonnes of lithium hydroxide annually, out of a global market of around 50,000 tonnes. Like lithium carbonate, lithium hydroxide is a key raw material for EV battery cathodes.

Given the dearth of current US production, Tesla is looking to Chile to source its lithium, and is reportedly in talks with SQM about possibly building a processing plant. The reason is simple. North American lithium mines are currently too small, not far enough developed, and do not produce a unified product that can easily feed into a supply stream. Tesla would have to go to dozens of different mines for its lithium carbonate and lithium hydroxide. Such a fragmented supply line just isn’t practical.

Lithium in the US

If we want a lithium-ion battery industry and electric vehicles built in North America we need lithium security of supply. No longer can we rely on the good graces of other countries, namely Australia, China, Chile and Argentina, where 90% of the lithium is produced.

We need to develop an energy metals industry in North America – from mine to battery.

Lithium stocks – the producers and the near-term producers – are expensive. There are few bargains to be found among the more developed plays. Fortunately, for investors and our planet’s health, the move towards electrifying the global transportation system is fully underway and appears unstoppable.

And that means earlier-stage, lithium-focused resource plays are going to receive major investor attention.

The old adage, to find a mine, look around a mine, applies here. As mentioned Albemarle’s Silver Peak mine is the only producing lithium mine in the US, but there are other properties around Silver Peak that could become the next big producer and be the solution Tesla has been looking for.

Currently Tesla has an agreement with Pure Energy Minerals to supply lithium hydroxide. Pure Energy’s lithium brine project is located in Clayton Valley adjacent to the Silver Peak mine. It has an inferred resource of 218,000 tonnes of LCE according to an NI 43-101 report filed in August, 2017.

Pure Energy has calculated in a preliminary economic assessment annual production of 10,300 tonnes lithium hydroxide or 9,100 tonnes lithium carbonate equivalent (LCE). Let’s revisit those Tesla LCE requirements. At a million vehicles a year Tesla needs 45,000 tonnes of LCE, meaning Pure Energy can supply just 20% of that.

Where else could Tesla, and Chevy, and any other North American EV maker, source its lithium from in the US? Tesla reportedly wants to reduce its battery costs by 30% in order to make its vehicles more affordable to the average car consumer, and the same is true for other car companies. Getting lithium from the US or Canada, rather than importing it from Australia, South America or China, would reduce shipping costs and provide a ready supply of battery-quality lithium to Tesla and other EV manufacturers. Tesla and Panasonic are making batteries and battery packs at the Tesla Gigafactory, but the lithium produced at Silver Peak is sold to Asian companies, which make cathodes used in lithium-ion batteries. Why not cut out the Asian middlemen and produce everything required for the batteries, right here in North America?

According to the USGS, the United States can only claim about 203,000 tonnes of LCE reserves compared to 75 million tonnes of reserves found throughout the world. That’s about the same amount of lithium currently being produced. But the States has much more lithium than that in the ground. US lithium resources (which include reserves plus lithium that can’t yet be economically mined) currently stand at about 36 million tonnes of LCE, versus 217 million tonnes globally. That leaves a lot of lithium in the US, still to be converted from resources to reserves through exploration drilling.

Cypress Development Corp

Fortunately there is a solution to the problem faced by Tesla regarding its current inability to source US lithium for its Gigafactory, which could also go a long way towards developing an electric vehicle battery industry in the US, while also significantly diminishing the currently 70+% dependence on foreign lithium imports.

Three years ago Cypress Development Corp (TSX.V:CYP) began prospecting in the Clayton Valley, home to Albemarle’s Silver Peak mine.

Cypress wasted no time in acquiring two land packages: the 1,520-acre Glory Project totaling 76 placer/lode claims located in Esmeralda County, and the 2,700-acre (35 association placer claims) Dean Project.

Drilling was conducted in 2017-18 and the company is currently waiting on its maiden 43-101 compliant resource report expected near the end of April. All eyes are on that maiden resource because it is expected to be BIG. Retail and institutional investors are starting to pay attention. The stock has risen nearly 60% over the last month.

Recently Lithium X Energy (TSX.V:LIX) put out a news release updating investors on the takeover announced by the lithium explorer in December, by Chinese company Nextview New Energy Lion Hong Kong Ltd.

Lithium X’s Sal de Los Angeles project in Argentina has an NI 43-101 resource of 1.04 million tonnes lithium carbonate equivalent (LCE) in the indicated category and 1.01MT inferred, for a total LCE resource of 2.05 million I&I tonnes.

This news from Lithium X is extremely interesting, because we now know how much a larger company will pay for a lithium brine exploration property in Argentina with a battery-grade lithium resource. That number is fairly easy to calculate: take the buyout value of $265 million and divide it by the NI 43-101 Indicated and Inferred resource of 2 million tonnes lithium carbonate equivalent or LCE, and you get Cdn$132.50 a tonne. In other words, a tonne of LCE, in the ‘ground’ in today’s hot lithium market is worth 132.5 loonies.

Cypress is coming out with a 43-101 compliant resource report which will also have metallurgical tests and lithium recovery results. Let’s look at some of my numbers.

CYP’s Clayton Valley Lithium Project in Nevada is, well there’s no other way to describe it other than eye-poppingly massive. My personal (and please remember these are my personal calculations, they are not from Cypress, are not 43-101 compliant and are not to be relied on for an investment decision), back-of-the-napkin resource calculation is 3,500 meters length X 2,000 meters width X 70 meters thick X 1.75 specific gravity (density) = 857,500,000 tonnes of lithium enriched claystone (approx. 4,500,000 tonnes of LCE).

I get into more conservative, and ulta conservative numbers here, but the results are still pretty impressive.

FMC, Albemarle, SQM and China’s Tianqi Lithium Corporation together, according to Wood Mackenzie consultant James Whiteside, accounted for 78% of the world’s lithium carbonate equivalent last year.

SQM, the largest global LCE producer, plans to expand its lithium carbonate capacity in Chile to 63,000 tonnes in 2018.

Australia’s Orocobre planns to produce 17,500 tonnes a year of lithium carbonate at its Olaroz facility in Argentina.

If there are 4,500,000 tons of LCE on CYP’s Dean and Glory claims it would take SQM 71 years to mine it at 63,000 tons per annum, 2mt of LCE would take 31.7 years. Massive potential indeed.

Let’s return to that $132 a tonne buyout value ascribed to Lithium X. Nextview paid that for a brine-based lithium deposit in Argentina. Cypress has a non-hectorite claystone starting at surface deposit in Nevada, USA. No tariffs, no trade war worries, next to the only producing lithium mine in the US and in the home state of Tesla’s Gigafactory.

Conclusion

Those with a surface knowledge of the lithium industry are being scared off by analysts who are writing reports showing that the lithium market is on the peak of a downturn due to an overabundance of the white metal. But more in-depth analysis shows that the supply-demand balance skews heavily towards the demand side which is still extremely bullish. Lithium supply forecasts must be weighed carefully, because most lithium mines will never make it into production due to the difficult technical challenges involved.

The electric vehicle is upon us and it’s not going away. While gas-powered cars will be around for some time, along with our oil-driven economy, the future is definitely going electric, and in some cases, autonomous – not only passenger vehicles but buses, municipal vehicles and semi-trucks. They will all require lithium-ion batteries in various combinations. Where will they get the lithium from? The “Big Four” – Chile, Argentina, Australia and China, is the easiest answer – but North America can also be in the mix if it chooses to.

Where should we look to find more US lithium? How about right next to the only producing lithium mine in the United States – Albemarle’s Silver Peak.

Cypress Development Corp is developing a huge lithium deposit. We’ll find out just how big within a very short time. Or the project could be bought out by Albemarle, which as we have shown, in four years was not able to add any new US based supply to the market. It seems to me that Albemarle could use a monster deposit such as Cypress has – making it an ideal takeout target.

Consider this: Pure Energy, which like Cypress is in the Clayton Valley next to Silver Peak, has 218,000 tonnes inferred LCE. According to my numbers, and again these are from my calculations not Cypress, at an ultra-conservative estimate of 2 million tonnes LCE, that’s close to 10 times as much lithium in the ground. Remember that Lithium X buyout figure of $134 per tonne? Multiplying that by 2 million tonnes gives a value of $268 million. The stock is currently trading at 38.5 cents, at a market cap of $21 million, meaning that, imo, CYP is obscenely undervalued. But let’s wait and see till the maiden resource comes out.

When was the last time you saw a junior resource company that might. make such a huge impact on the world’s largest lithium (or any metal), miner’s bottom line? These kind of opportunities just don’t come along very often. I have Cypress Development Corp, and what could be the biggest junior mining story of the year on my radar screen. Do you?

If not, perhaps you should.

Richard (Rick) Mills

Just read, or participate in if you wish, our free Investors forums.

Ahead of the Herd is now on Twitter.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Cypress Development Corp. TSX.V – CYP

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.