Why solar and wind can’t save us

2020.12.24

Recently, British Petroleum (BP) went public in declaring that “peak oil demand” was reached in 2019. According to the oil major’s 2020 outlook, global oil demand will not regain levels reached last year, and that demand could soon fall rapidly, due to stronger climate action by countries, by at least 10% over the next 10 years, and up to 50% by 2040.

Demand for the fossil fuel has doubled over the past 50 years, reaching around 100 million barrels of oil per day (bopd) in 2019.

While earlier editions of BP’s outlook stated that global demand would continue rising steadily, peaking in the mid-2030s, the latest version sees the decline as much more dramatic, with peak demand already reached in 2019, and either slowing down or plateauing over the next three decades.

The magnitude of the fall in demand depends on the degree to which global carbon emissions are addressed/ cut by governments and industry.

The largest reductions in oil demand are modeled by BP’s “rapid” and “net-zero” scenarios. Here, global carbon dioxide emissions plummet by more than 95% by 2050, compared to their 2018 levels. This is accomplished by significantly lower usage of fossil fuels, ie., coal, oil and natural gas. According to the International Energy Agency (IEA), last year total energy-related CO2 emissions fell by 3.2%, with the power sector, which accounts for 34% of energy-related emissions across advanced economies, leading the decline.

But the need for electricity hasn’t decreased; if fossil fuels in future account for a lower percentage of the global energy mix, the loss will have to be made up, from non-carbon sources.

Under net zero, BP predicts solar and wind power will see explosive growth over the next 15 years, with demand reaching around 2,000 million tonnes of oil equivalent (Mtoe) in 2035, quadruple the 500Mtoe used in 2019.

By 2040, use of renewables more than doubles again, to an amount equivalent to the current total from coal and natural gas combined.

In contrast, coal sees the most dramatic decline, with demand for the dirtiest of fossil fuels dropping by a third by 2030 and around 90% by 2050.

Natural gas is also looking at a major reduction in usage. BP’s 2020 outlook shows demand for NG peaking in 2025 under net-zero, then falling to 36% below 2019 levels by 2050. The “rapid” scenario has NG demand peaking in 2035, returning to 2019 levels by mid-century.

(At AOTH, we have already written the real story of fracked gas. The US ‘Sultans of Shale’ have had it good for a long time, but the party in the Permian and other US oil shale basins is coming to an end. Not right away, but at most, the fast-depleting shale oil fields which produce via hydraulic fracturing and horizontal directional drilling, are likely to last another five to seven years. In October, Reuters reported that output from seven major shale formations is expected to decline by about 68,000 bopd, to 7.6 million bopd.

This is because shale oil wells are gushers in their first year, then deplete rapidly. Shale companies are therefore money losers because they have to keep ploughing more money into production just to keep output flat, a phenomenon known as “The Red Queen Syndrome.” Shale wells typically bleed off 70 to 90% in their first three years, and drop by 20 to 40% a year without new drilling. According to consultancy Wood Mackenzie, Permian production could peak in 2021 versus the more optimistic 2025.)

Let’s stop for a moment to explain what BP is saying here. Economists will quibble over when peak oil demand is reached, and how much market share fossil fuels will lose to non-carbon sources. The up-shot, according to BP, is that oil, coal and natural gas are dead in 20 years. Coal will die before oil, which will run out prior to the end of natural gas, seen by many as a transition fuel to renewable energy sources.

If we accept that the end of fossil fuels is nigh, the next question is, what will replace them? For BP, the answer is clearly renewables. Here is an excerpt from the 2020 outlook, quoted by Carbon Brief: In the net-zero scenario, renewables supply some 130EJ in 2030, more than four times their output in 2019 and similar to current supplies from gas. By 2040, renewables more than double again to reach 296EJ, equivalent to the current total from coal and gas combined.

Still a carbon economy

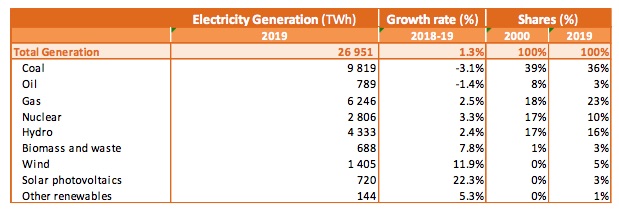

Wow. Really? The table below from the IEA’s ‘Global Energy Review 2019’ shows global electricity generation in 2019 dominated by fossil fuels, with coal and gas representing 59% of the total 26,951 terrawatt hours (TWh) generated. Solar and wind accounted for just over 2,000 TWh.

Source: IEA, ‘Global Energy Review 2019’

So BP is telling us that in 20 years, these renewables energy systems, which are not suitable as base-load power because their plants cannot run continuously (they can only make electricity when the sun shines or the wind blows) are going to jump from 2,000 TWh, to 16,000 TWh, an 8-fold increase?

We get further into the math below, but for now, we want to focus on 2019. A closer look at the IEA report shows a global economy that continues to run on oil and gas, and to a surprising extent, coal.

In sum, the report states that, while renewable energy is certainly gaining market share, it remains a relatively low 12% of total electricity generation (just 12% including solar, wind, biomass & waste), which is still dominated by coal and natural gas.

For example, while demand slipped 1.7% in 2019, coal continues to represent the largest source of electricity generation in the world, with a share of 36%. It’s also true, however, that 2019 was the first year in which low-carbon generation, ie., renewables, hydro and nuclear, produced more electricity than coal. Generation from coal-fired plants in advanced economies dropped nearly 15% last year, due primarily to utilities switching from coal to cheaper and cleaner natural gas. The only region where coal demand increased significantly was Southeast Asia, where coal use grew over 10%.

Source: IEA, ‘Global Energy Review 2019’

Yet despite moves in various countries to decarbonize, oil continues to be in high demand. Last year oil requirements in China rose by 680,000 barrels per day, the highest growth rate since 2015. There was also strong Chinese demand for transportation fuels, ie., gasoil/ diesel and gasoline.

After two years of strong gains, natural gas consumption growth cooled in 2019 to 1.8%, or 70 billion cubic meters. However, NG demand was second only to growth in demand for renewables, thereby pushing its share of the global energy mix to a historic high of 23%, the IEA report states. The two main growth markets for NG were the United States and China, which accounted for more than two-thirds of the increase in global natural gas consumption.

The reason for pulling some of these stats from the IEA report, is to show how resilient the fossil fuel sector is. Combined, they cast a penumbra of doubt on the light of positive messaging regarding the renewable energy growth story.

We decided to go a couple of steps further, in determining whether it is even possible, as the BP report suggests, for renewable energy to replace fossil fuels in 20 years. That’s step one in the calculations below. The next step is to find out what that would mean in terms of materials consumption. How many solar plants, how many wind farms, would have to be built to replace the 80% of global energy currently demanded by fossil fuels? How much metal would go into them?

Wind and solar: a pipe dream

From the blue table above, notice that world energy demand in 2019 was 14,385 million tonnes of oil equivalent (Mtoe). Stripping out fossil fuels leaves a hole of 11,594 Mtoe. To fill it with renewables would require an additional 11,594 Mtoe, of biomass & waste, hydro and other renewables, on top of renewables’ existing 2,061 Mtoe, for an increase of 462%!

Mtoe is a clunky measurement to work with. Convert 11,594 Mtoe to gigawatt hours (GWh) by multiplying by 11,630 (1 Mtoe = 11,630 GWh) = 134,838,220 GWh. This is the amount of electricity generated by fossil fuels in 2019. If we get rid of all fossil fuels – oil, NG and coal – in 20 years, we need to generate an additional 134,838,220 GWh of renewable energy.

1 gigawatt hour (GWh) = 1,000.00 megawatt hours (MWh).

A large solar farm would be 500 megawatts (MW), keeping in mind that the biggest solar farm in the US, the Topaz/ Desert Sunlight, is 550 MW, the biggest in the world is 1,547 MW; most solar farms in the US are much smaller, less than 5 MW).

Let’s say it is able to operate half the time, or 182 days. 500 MW x 24 = 12,000 MWh x 182 = 2,184,000 MWh. 134,838,220,000 MWh divided by 2,184,000 = 61,739 500 MW solar farms.

What does this mean for materials? We know from a previous article, that a 500-MW solar conversion plant would cover 25 to 50 square miles with 17,500 tons of aluminum, a million tons of concrete, 3,750 tons of copper, 300,000 tons of steel, 37,500 tons of glass, and 750 tons of other metals such as chromium and titanium — 500 times the material needed to construct a nuclear plant of the same capacity.

According to a 2018 paper by the International Association for Energy Economics (IAEE), the type of solar PV technology will dictate which metals are used:

Crystalline silicon (c-Si) – Ag, Ni, Al, Cu and Fe

Amorphous silicon (a-Si) – Ni, Cr, Ge, Mo, Al, Cu and Fe

Cadmium Telluride (CdTe) – Ni, Cr, Mo, Cd, Al, Te, Cu and Fe

Copper indium gallium selenide (CIGS) – Ni, Cr, Mo, Al, Cu, In, Fe, Ga and Se

The author identifies eight types of orebodies that supply the elemental needs of PV technologies: gold, nickel, chromium, molybdenum, zinc, copper, aluminum and iron ore.

The amount of aluminum and copper needed to build that many solar farms is off the charts:

17,500 tons aluminum x 61,739 (500 MW) solar farms = 1,080,432,500t @ 64 million tonnes (MT) global production (2019 USGS) = 1,080,432,500 tonnes aluminum required or 16x global production

7,500 tons copper x 61,739 (500 MW) solar farms = 463,042,500t @ 20Mt global production (2019 USGS) = 463,042,500 tonnes copper required or 23x global production

But it’s not only the amount of materials, but the land, that would have to accommodate the more than 61,000 new solar farms. A study by Denholm and Margolis calculated the per capita solar footprint per person, based on the assumption that electricity needs in each state are met by solar power alone. According to the authors, via a blog by Dr. Werner Antweiler, who teaches at the UBC Sauder School of Business, the number range from about 100 square meters per person in California, to 300 square meters in Wyoming. Using current populations, that accounts for 3,951 square kilometers in California, and 173.6 square kilometers in Wyoming. Using an average of 200 square meters per capita, extrapolated to the population of the whole country, of 328.2 million, gives a figure of 65,640 square kilometers of land required for solar energy — a size roughly equal to the size of Nevada. Not taken into consideration is the amount of land needed to fit renewable energy storage batteries.

Is wind power any more feasible? The 10 largest wind farms in the world range from 630 megawatts to 20 gigawatts. Taking a 500 MW wind farm, to facilitate a comparison between solar and wind, the Manhattan Institute estimates that replacing the output from a single 100 MW natural gas-fired turbine, would require at least 20 wind turbines, each about the size of the Washington Monument, occupying 10 square miles (25 square kilometers) of land. Upsizing that to 500 MW would thus require 100 wind turbines, on 125 square km. That’s just for one one wind farm equivalent in size to a natural gas or solar plant.

How many wind farms would be required to produce 134,838,220 GWh of electricity, the amount needed to replace fossil fuels? A 2-MW wind turbine with a 25% capacity factor (the actual output over a period of time as a proportion of a wind turbine’s capacity), due to intermittency, can produce 4,380 MWh in a year. Upsizing this to 500 MW = 1,095,000 MWh. 134,838,220,000 MWh divided by 1,095,000 MWh = 123,139 wind farms @ 500 MW each.

Back to land considerations, according to Dr. Antweiler’s research, to replace about 20% of Canada’s power generation that is still from combustible fuel sources, the country would need four times as many wind farms as today. Finding space for that many, a total of 46,800 MW of nameplate capacity, would require 26,676 square kilometers. This is the size of five Prince Edward Islands, or around half of Nova Scotia. Remember this is just to replace 20% of Canada’s electricity still generated from fossil fuels. Consider that in the United States, around 63% of its power still comes from coal, oil or natural gas. According to the Energy Information Administration, replacing the 966 TWh generated from coal in 2019, would require 344.6 GW of wind farm capacity, spread over 200,000 square kilometers! (about the size of Nebraska)

How about materials? According to a report from the National Renewable Energy Laboratory, wind turbines are predominantly made of steel, fiberglass, resin or plastic (11-16%), iron or cast iron (5- 17%), copper (1%), and aluminum (0-2%). This isn’t counting the electrical system, which uses copper and rare earths such as dysprosium and neodymium.

A single 2-MW wind turbine weighing 1,688 tons, comprises 1,300 tons of concrete, 295 tons of steel, 48 tons iron ore, 24 tons fiberglass, 4 tons each of copper and neodymium, and .065 tons of dysprosium. (Guezuraga 2012; USGS 2011).

The Manhattan Institute estimates that building a 100-MW wind farm would require 30,000 tons of iron ore and 50,000 tons of concrete, along with 900 tons of non-recyclable plastics for the large blades. The organization says that for solar hardware, the tonnage in cement, steel and glass is 150% greater than for wind, to get the same energy output.

According to The Institute for Sustainable Futures at the University of Technology Sydney, Australia analyzed 14 metals essential to building clean tech machines, concluding that the supply of elements such as nickel, dysprosium, and tellurium will need to increase 200%–600%.

Materials required to build solar PV, hydro, wind, geothermal and natural gas machinery. Source: Manhattan Institute

Conclusion

If BP is correct in its outlook that in two decades, renewables are going to supply the equivalent amount of electricity currently generated by coal and gas combined, we have a problem, Houston. First of all, just replacing the current amount of energy demanded by coal and natural gas, let alone the inevitably higher figure in 2040, with solar and wind (about 11,500 Mboe, from the blue table above), would be nothing short of miraculous. Our research shows that it would mean over 60,000 solar farms and more than 120,000 wind farms. In all it’s about a 450% increase in renewables.

Of course, solar and wind farms can’t be located just anywhere. They need to be in the right locations, where the winds are strong and frequent, areas that get a lot of sunshine, and close enough to power lines to be economical. Consider: putting up enough wind farms in the US just to replace coal, in an area the size of Nebraska (or half the size of Nova Scotia, here in Canada), is bound to come into conflict with towns and cities, where residents’ commitment to renewable energy vs fossil fuels will surely be tested.

We already know that we don’t have enough copper for more than a 30% market penetration by electrical vehicles. Building renewable energy capacity is over and above supplying the ever-growing marketplace for EVs. How are we going to get enough solar and wind to produce a minimum of 134,838,220 GWh (that’s for 2019, it could be double by 2040), if we are to replace fossil fuels in 20 years?

And even if we could, how are we going to find the raw materials? For solar power we are talking about finding 16 times the current annual production of aluminum, and 23 times the current global output of copper. Up to six times the current production levels of nickel, dysprosium and tellurium are expected to be required for building clean-tech machinery. Good luck!

We need a new fuel source to supply the energy required by the coming electrification of the global transportation system, and for transforming the world energy nexus from fossil fuels to non-carbon sources. In our next article, we’ll tell you what that fuel is.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.