Why a Dow Peak Will Boost Silver

By Hubert Moolman

During the Great Depression, both silver (1931) and the Dow (1932) reached a significant low. Both have rallied significantly since then. However, the structure of the rallies was very different.

To date, the Dow has significantly outperformed silver since those lows. The Dow increased 988-fold from the low to the all-time high, whereas silver has only increased 179-fold from the low to the all-time high.

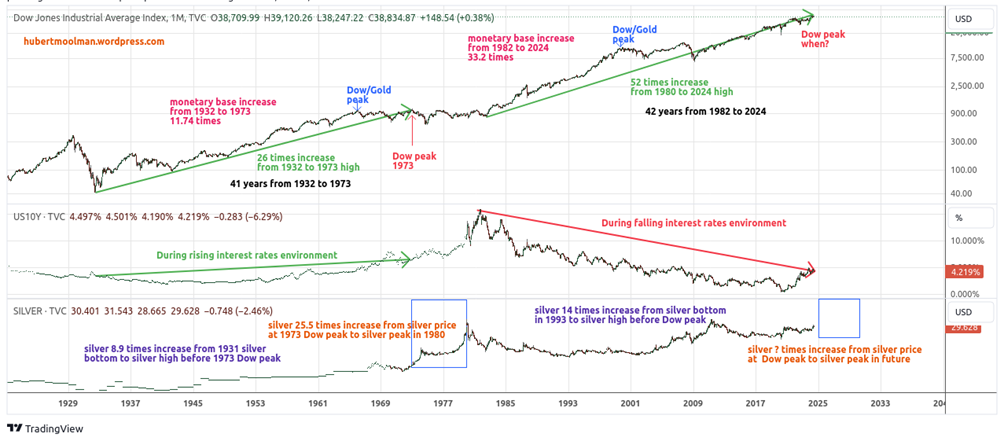

Here is a long-term comparison of the Dow, interest rates, and silver:

The period from circa 1931 to now can be divided into an era of rising interest rates (1931–1982) and falling interest rates (1982–2024). During that period of rising interest rates, the Dow increased 26 times from the low to the high in 1973, while during the falling interest rate period, it increased 52 times from the low in 1982 to its 2024 all-time high.

Falling interest rates and a greater monetary base increase (11.74 times vs. 33.2 times) were evidently better conditions for the Dow. On the other hand, though, silver has a different relationship with interest rates.

During the period from 1931 to the Dow peak in 1973, silver only increased 8.9 times. This does not compare well to the Dow’s 26-fold growth during the same period. However, after the Dow’s peak in 1973, silver rose much faster. In fact, silver increased about 25.5 times from the silver price at the 1973 Dow peak to the silver high in 1980. This resulted in an overall 178.57-fold increase from the bottom (1931) to the top in 1980.

This means that ultimately, during that cycle, silver significantly outperformed the Dow (178.57 vs. 26).

During the period from 1982 to 2024 (the falling interest rate period), silver increased about 14-fold from the low (1993) to the high (2011). Again, this does not compare well to the Dow’s 52-fold growth during the same period. Will silver again rise much faster after the Dow peak is in? If this is the case, then a confirmation of a Dow peak (similar to 1973) is a much awaited signal for Silver bulls

If silver again outperforms the Dow to the extent it did during the early cycle (1931–1988), then we could see some crazy high silver prices (just do the calculations for yourself).

A chart I posted previously also points out the significance of the next Dow peak for future silver prices:

Warm regards,

Hubert Moolman

And that, knowing the time, that now it is high time to awake out of sleep: for now is our salvation nearer than when we believed.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.