Who got copper?

June 15, 2021

China’s Belt and Road Initiative (BRI), first proposed by President Xi Jinping in 2013, is a “belt” of overland corridors and a “road” of shipping lanes. The grand design consists of a vast network of railways, pipelines, highways and ports that would extend west through the mountainous former Soviet republics and south to Pakistan, India and southeast Asia.

So far over 100 countries have either signed onto BRI. According to a Refinitiv database, more than 2,600 projects at a cost of $3.7 trillion were linked to BRI, as of mid-2020.

The Belt and Road Initiative is seen by proponents as an economic driver of proportions never seen before in human history. It would not only allow Asia to relieve its “infrastructure bottleneck” ie. an $800 billion annual shortfall on infrastructure spending but bring less-developed neighboring nations into the modern world by providing a growing market of 1.3 billion Chinese consumers.

Opponents argue that is naive and the real intent of BRI is to carve new Chinese spheres of influence in Asia that will replace the United States, in-debt poor nations to China for decades, and restore China to its former imperial glory.

It is the latter view that is driving some of the world’s richest nations besides China, to develop an alternative to Belt and Road that incorporates Western values and investment.

This past Saturday, the G7 comprised of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States, agreed during a meeting in southwestern England, to counter China’s BRI with an infrastructure plan of their own.

B3W vs BRI

The Build Back Better World (B3W), initiative is “a values-driven, high-standard, and transparent infrastructure partnership led by major democracies to help narrow the $40+ trillion infrastructure need in the developing world,” according to a June 12 statement from the White House.

Through B3W, the United States and its allies would mobilize

private-sector capital in areas such as climate, health and health security, digital technology and gender equality.

A statement by a senior official in the Biden administration, quoted in a news article, suggests the bold infrastructure plan is a rebuke against China’s growing assertiveness and economic/ military rise over the past 40 years:

“This is not just about confronting or taking on China. But until now we haven’t offered a positive alternative that reflects our values, our standards and our way of doing business.”

China is already the world’s largest consumer of commodities. Why does it need to build a belt and road? There are a few reasons. The first as mentioned is to build infrastructure such as railways, roads and bridges. China would also construct 50 “special economic zones” modeled after the Shenzhen Special Economic Zone, first launched in 1980 under economic reformer, President Deng Xiaoping.

BRI would allow China to expand the use of the Chinese currency, the yuan, as the global influence of the US dollar as the world’s reserve currency wanes.

According to the Council on Foreign Relations, BRI is also a central tenet of Xi Jinping’s pushback against Obama’s “pivot to Asia” (contain China by extending US ties to southeast Asia), and distancing himself from his predecessors who followed Deng’s philosophy “bide your strength, bide your time.”

For Xi, the waiting is over: the time for imperialist expansion is now.

An Asia geopolitical expert says that, while the BRI satisfies a number of economic goals for China, including expanding its supply chains, accessing overseas labor, and preventing massive layoffs when companies run out of infrastructure to build, the over-riding goal is regional influence.

Richard Javad Heydarian, author of ‘Asia’s New Battlefield: The USA, China, and the Struggle for the Western Pacific’, writes:

“Above all, however, it allows China to lock in precious mineral resources and transform nations across the Eurasian land mass and Indian Ocean into long-term debtors. A leading credit rating agency recently warned that the OBOR is “driven primarily by China’s efforts to extend its global influence”, where “genuine infrastructure needs and commercial logic might be secondary to political motivations.”

The result is what one observer aptly described as “debt-trap diplomacy”, since some nations end up piling up unsustainable debts to China…

Although it is not yet clear how B3W would work, or how much capital would be allocated to it, the White House communique said the government will “work with Congress to augment our development finance toolkit with the hope that, together with the private sector, other U.S. stakeholders, and G7 partners, B3W will collectively catalyze hundreds of billions of dollars of infrastructure investment for low- and middle-income countries in the coming years.”

Not coincidentally, the G7 leaders followed up the B3W announcement with an agreement to collectively continue fiscal stimulus programs rolled out to deal with the covid-19 pandemic.

“There was broad consensus across the table on continued support for fiscal expansion at this stage,” an un-named source told Reuters, adding that Biden, British Prime Minister Boris Johnson and Italy’s Mario Draghi expressed particular support.

Drain on copper

2,600 projects costing $3.7 trillion are linked to BRI, as of mid-2020. Think about how much metal that would entail — in particular, copper, necessary for construction wiring, plumbing and telecommunications, along with renewable energy, 5G and vehicle electrification.

Research commissioned by the International Copper Association, quoted by Mining Technology, found that Belt and Road projects in over 60 Eurasian countries will push the demand for copper to 6.5 million tonnes by 2027, a 22% increase over 2017 levels.

That much copper equates to nearly a third of the 20Mt of copper produced in 2020 — new copper supply that would need to be either mined from existing operations or discovered.

The research, jointly presented by the International Copper Association and the International Wrought Copper Council, in a 2018 workshop entitled, ‘Copper: The Building Block of the Energy Transition’, also says that, during the first five years of the Belt and Road Initiative, 1.25Mt of copper was used to build a network of power generation and grids, highways and railroads — about 5% of world supply.

BHP, which operates the world’s largest copper mine, Escondida in Chile, reportedly estimated in 2018 that BRI is already seven times larger than the Marshall Plan, undertaken by the United States to rebuild Europe following World War II.

The firm told Reuters the initiative could boost copper demand by 1.6Mt, roughly 7% of annual demand at the time.

That’s for Belt and Road. Now consider: the United States and its G7 buddies want to match what the Chinese are spending on infrastructure with a similar plan of their own, ie., trillions in infrastructure spending in developing countries, to counter China’s growing influence. If the International Copper Association is right, and BRI demands 6.5Mt of additional copper supply by 2027, and G7 countries get their act together and begin rolling out big infrastructure projects through their new B3W initiative, we can probably count on another 6.5Mt. That would mean finding, in the next six years, an extra 13Mt, on top of current mine production of 20Mt.

This, in addition to what these countries are promising to spend in their own countries, to kickstart economies that have been battered by the pandemic. Plus the huge amount of copper that is going to be required for electrification/ decarbonization.

In 20 years, BloombergNEF says copper miners need to double the amount of global copper production (20Mt), just to meet the demand for a 30% penetration rate of electric vehicles. That means an extra million tonnes a year, over and above what we mine now, every year for the next 20 years! The world’s copper miners need to discover the equivalent of two Kamoas, (referring to the Kamoa-Kakula mine in the DRC that just entered production) at 500,000t, each and every year, while maintaining current production of 20Mt.

The continued move towards electric vehicles is a huge copper driver. In EVs, copper is a major component used in the electric motor, batteries, inverters, wiring and in charging stations. An average electric vehicle contains about 4X as much copper as regular vehicles. Electrification includes not only cars, but trucks, trains, delivery vans, construction equipment and two-wheeled vehicles like e-bikes and scooters.

The latest use for copper is in renewable energy, particularly in photovoltaic cells used for solar power, and wind turbines. The base metal is also a key component of the global 5G buildout. Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment.

In the United States, President Joe Biden has centered his $2.3 trillion American Jobs Plan around shoring up America’s crumbling infrastructure, while investing in clean energy. (the plan has recently been scaled back to $1.7 trillion to appease Senate Republicans)

Biden wants to get more electric vehicles on the road, pledging to slash greenhouse gas emissions by nearly half over the next decade.

As part of its aggressive climate change goals, the US is looking at a $174 billion spending over the next eight years in an attempt to “win the EV market.” This includes building more charging stations and more incentives for consumers (ie. “point of sale” rebates) over that time span.

According to the US Department of Energy, there are about 100,000 public charging outlets nationwide today, but the goal is to increase that to 500,000 by 2030.

How much copper is all of this going to use? We don’t know but you can see from everything discussed so far, that demand for copper is going to go absolutely bonkers. Yet we have a problem, Houston. As demand rapidly expands, the world’s copper supply is tightening, amid long-term structural supply issues including lower ore grades, existing mine depletion and a lack of new discoveries, that are only going to make matters worse (or better, if you’re a copper miner/ explorer).

A report by Roskill forecasts total copper consumption will exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization, and electricity demand. Total world mine production in 2020 was only 20Mt.

The demand pressure about to be exerted on copper producers in the coming years all but guarantees a market imbalance, resulting in copper becoming scarcer, and dearer, with each ambitious green initiative rolled out by governments, whose backs are against the wall due to negative fall-out from global warming.

A recent report by resource investment house Goehring & Rozencwajg Associates found stagnating supply is a key factor pushing “copper prices far higher than anyone expected.”

According to the Wall Street firm,, the number of new world-class discoveries coming online this decade “will decline substantially and depletion problems at existing mines will accelerate.”

Also, geological constraints surrounding copper porphyry deposits, a subject few analysts and investors understand, will contribute to the problems, the report said.

By 2015, the industry’s head grade was already 30% lower than in 2001, and the capital cost per tonne of annual production had surged four-fold during that time — both classic signs of depletion.

According to the Goehring & Rozencwajg model, the industry is “approaching the lower limits of cut-off grades,” and brownfield expansions are no longer a viable solution.

“If this is correct, then we are rapidly approaching the point where reserves cannot be grown at all,” the report concluded.

It also shines a light on the importance of making new discoveries in establishing a sustainable copper supply chain. Over the past 10 years, greenfield additions to copper reserves have slowed dramatically, with tonnage from new discoveries falling by 80% since 2010.

Trouble in copper land

To this we can add the most recent trouble to visit the copper market, ie., resource nationalism in South America and the Democratic Republic of Congo (DRC) surrently the focal points of global copper mining.

With the copper price soaring on tight supply and heavy demand, as the world’s biggest economies revive following a year of coronavirus-related restrictions, the temptation for producer nations to cash in on more valuable copper reserves to pay for social programs is proving hard to resist.

Chile and Peru, the number one and two producers, are both seeking to raise the royalty tax on copper miners, while in the DRC, Africa’s top copper-mining country, the government has just slapped a ban on the export of copper and cobalt concentrates — an action almost identical to what has happened in Indonesia with nickel.

Adding to these events, potential strikes at BHP’s Spence and Escondida mines in Chile are seemingly always fueling concerns about copper supply.

In Chile, presidential hopeful Daniel Jadue, who leads in polls ahead of the November election, wants to align mining rules with Peru, Argentina and Bolivia, so they don’t compete for investments, he said last week in an interview.

The Communist Party President would also renegotiate with foreign companies to take stakes in their assets, in what Bloomberg describes as the industry’s biggest disruption since U.S.-owned mines were nationalized to form Codelco in the 1970s.

The South American nation is fast becoming a liability for copper miners.

Triggered by the worst social unrest in a generation, anchored in rampant inequality, the country reportedly has just elected an assembly that will place responsibility for writing a new constitution in the hands of the left wing.

The reforms could give more power to indigenous communities and expand water rights, including a potential ban on mining in areas where there are glaciers, along with increased state ownership of water desalinated by mining companies.

There is also proposed legislation that, if approved by the Chilean Senate, would impose a royalty as high as 75% on sales of copper, if copper is above $4 like currently.

In a May note, Goldman Sachs said the new law could put at risk 1 million tonnes of annual copper supply representing about 4% of global output.

The future looks equally grim for miners in neighboring Peru, where left-wing candidate Pedro Castillo appears all but certain to become the country’s next president, following a too-close to-call June 6 election.

Among his campaign promises, Castillo has vowed to take up to 70% of mining companies’ profits, and introduce new royalties on mineral sales.

The copper-mining country, second only to Chile in terms of output, has 46 mining projects representing a potential investment of $56 billion in the pipeline.

With so much at risk, it seems insane for Peru, and Chile, to be moving in an anti-mining direction, especially considering that foreign mining companies could pull their investments from South America, meaning a substantial loss in revenue to government coffers.

It also begs the question, at the risk of repeating myself, what is going to happen to copper supply, amid all of this resource nationalism? Will copper miners ramp up output even though doing so could mean a bigger chunk of profits goes to the state? Remember, if Chile’s law passes, mining companies will hand 75% of their profits to the government, as long as copper stays above $4 a pound, as most analyst expect it to.

Who needs that?

With resource nationalism putting a vice-like grip on the copper mining industry not only in Chile and Peru but in the top two African copper producers, the DRC and Zambia, it may beehove miners to go elsewhere.

One jurisdiction they should take a look at, a place where governments have not been influenced by leftists intent on grabbing a larger slice of the resource pie, is Colombia, where Max Resource Corp. (TSXV:MXR, OTC: MXROF, FSE:M1D2) is developing a huge copper deposit in the northeast of the country.

Max Resource Corp.

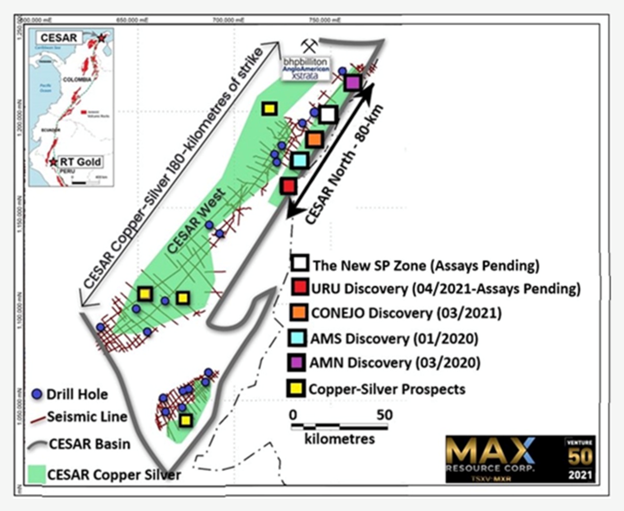

Vancouver-based Max continues to make significant progress at its flagship CESAR project, situated along the world-famous Andean Copper Belt.

In May, the company reported more promising assay results from the copper-silver property, increasing the area of the newly discovered CONEJO zone at the CESAR North target by a substantial 500% — six times its previous size!

The high-grade CONEJO discovery spans 1.6 km by 0.6 km, is open in all directions, and lies along the CESAR North Kupferschiefer-type sedimentary exhalative (sedex) copper-silver mineralization in the region.

The discovery is considered to be a new type of copper mineralization related to the sediment copper-silver system, but hosted in an igneous (volcanic) unit, which enhances the company’s steadfast belief in CESAR as a district-scale project with several pulses of mineralization.

The latest set of assays expanded the CONEJO zone to an area covering 3.2 km by 1.6 km. It remains open in all directions, lying along the mid-portion of the 80 km-long CESAR North copper-silver belt.

Meanwhile at another new discovery, the URU zone located 30 km to the south, the mineralization is “very similar” to that of CONEJO, CEO Brett Matich said. According to a June 10 news release, 15 rock channel samples over widths of 10 meters along a 4-kilometer-long strike, returned greater than 1% copper, with highlight values of 5.7% and 14 g/t Ag (silver).

Over the past 18 months, the Max team has significantly extended the CESAR North target area, consisting of multiple new discoveries spanning over 80 km of strike, demonstrating a district-scale sediment-hosted copper-silver system.

The most recent discovery, called the SP zone, was announced in late April. Following the aforementioned CONEJO and URU discoveries, and the AMS and AMN discovery zones of 2020, SP became the fifth copper zone discovered along the continuous copper belt at CESAR North.

Along with pointing out the potential of five potential copper deposits along an 80-km strike, German website goldinvest.de makes some interesting observations about CESAR in a recent post.

The first is concerning the grades. The site points out “we are talking about high grade copper with peak values of >5.0 percent copper near surface!”, while tempering its enthusiasm by noting Max is still in the early stages of exploration.

Second, there is the observation that the URU zone is located within magmatic host rocks that cut through the sedimentary mineralization. “Thus, one does not appear to be dealing with a classic copper shale,” goldinvest.de writes, referring to the “Kupferschiefer” (copper shale, in German) group of rich copper-silver deposits covering Germany and Poland.

Third and most important, imo, is the site’s conclusion, “that the 200-km CESAR basin in northeastern Colombia has many of the characteristics of a world class copper destination.”

While such a statement might be considered vague, goldinvest.de backs it up with some solid arguments:

- Unlike most copper explorers these days, the focus of Max is not on low-grade porphyry deposits at depth, but predominantly sedimentary deposits that outcrop near surface. The copper grades of this type of deposit are significantly higher than those of porphyry deposits due to their natural pre-concentration. Instead of extending to depth, these deposits extend laterally along their depositional layers. Finally, they are former marine sediments.

- The recent discovery in URU now seems to prove that secondary copper mineralization of volcanic origin is present in addition to these copper shales. It will be interesting to see what else is to come.

- To be sure, Max is still far from a resource estimate, which perhaps explains the lack of interest in the market. But it is also clear that discoveries of this magnitude are not common. To put this in perspective: It’s about as if the entire European copper shale basin has just been rediscovered. We are keeping our fingers crossed for Max Resources as it continues its work. There could be something really big here. The big mining companies that are already in the country are likely to follow Max Resource’s work very closely.

To the above I would add another very important point concerning the land base that Max has acquired in Colombia and Peru, where the company is developing its RT gold project.

In both countries, Max has the support of the local communities that own the land, this is a necessary requirement for exploration and moving mining projects forward. Community buy-in, the support of the local landowners in Colombia and Peru paves a smooth road for access and exploration activities.

So ‘Who got copper?’

Max Resource Corp.

TSXV:MXR, OTC:MXROF, FSE:M1D1

Cdn$0.29, 2021.06.14

Shares Outstanding 90.6m

Market cap Cdn$26.2m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV:MXR). MXR is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.