Where are North America’s battery anode plants being built? – Richard Mills

2023.08.27

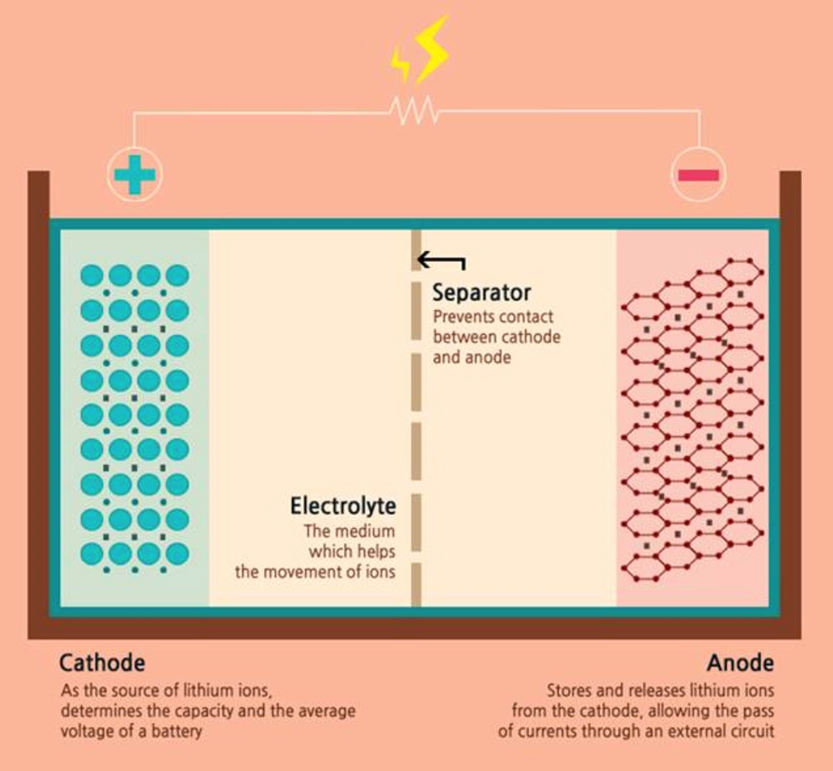

The electrification of the global transportation system doesn’t happen without graphite. That’s because the lithium-ion batteries in electric vehicles are composed of an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

The cathode is where metals like lithium, nickel, manganese and cobalt are used. Depending on the battery chemistry, there are different options available to battery makers. Not so for graphite, a material for which there are no substitutes.

Due to its natural strength and stiffness, graphite is an excellent conductor of heat and electricity. It is also stable over a wide range of temperatures.

Graphite is thus found in a wide range of consumer devices, including smartphones, laptops, tablets and other wireless devices, earbuds and headsets. Besides being integral to electric car batteries, graphite is found in e-bikes and scooters.

Graphite has the largest component in batteries by weight, constituting 45% or more of the battery cell. Nearly four times more graphite feedstock is consumed in each cell than lithium and nine times more than cobalt.

Needless to say, graphite is indispensable to the EV supply chain.

BloombergNEF expects graphite demand to quadruple by 2030 on the back of an EV battery boom transforming the transportation sector.

The IEA goes 10 years further out, predicting that growth in graphite demand could see an 8- to 25-fold increase between 2020 and 2040, trailing only lithium in terms of demand growth upside.

Given that demand for graphite is accelerating at a rate never seen before, and the EV industry is gradually shifting towards natural graphite, the impending supply crunch could get serious.

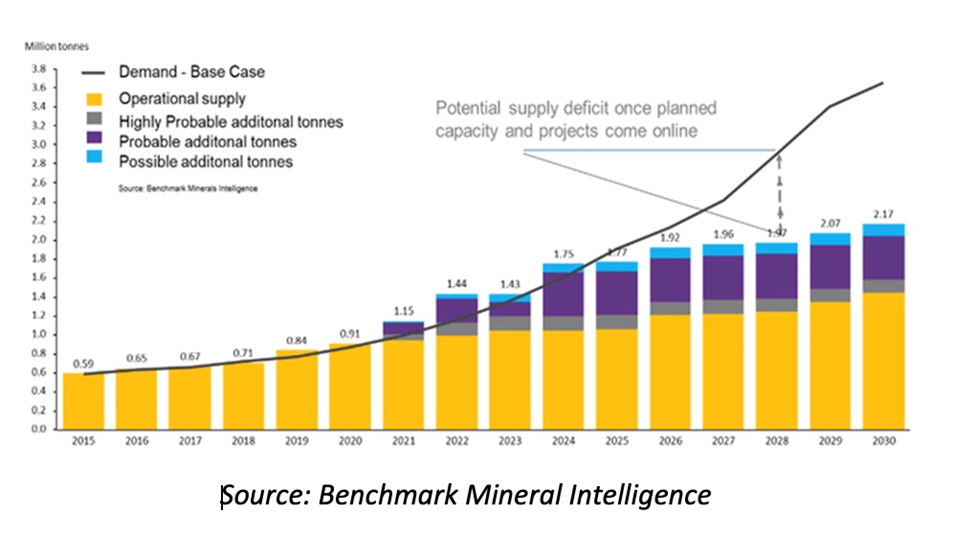

Analysis by Benchmark Mineral Intelligence projects that natural graphite will have the largest supply shortfalls of all battery materials by 2030 — even more than that of lithium — with demand outstripping expected supplies by about 1.2 million tonnes.

And this is just counting EV battery use only; the mining industry still needs to supply other end-users. The automotive and steel industries remain the largest consumers of graphite today, with demand across both rising at 5% per annum.

BMI previously stated that flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. For reference, the amount of mined graphite for all uses in 2022 was just 1.3 million tonnes.

The lithium price reporting agency has said as many as 97 average-sized graphite mines need to come online by 2035 to meet global demand.

$100 billion in US battery plants

In an article this week, Tech Crunch states there are currently about 30 battery factories in the United States either planned, under construction or operational. Among the automakers that have made EV battery plant announcements are BMW, Ford, GM, Honda, Hyundai, Mercedes-Benz, Rivian, Stellantis, Tesla, Toyota, Volkswagen and Volvo.

The impetus to plan and build new EV battery plants has been helped significantly by the Biden administration’s Inflation Reduction Act, signed into law one year ago.

The IRA requires that 60% of the value of the electric vehicle’s battery components must be produced or assembled in North America, for the buyer to qualify for half of a $7,500 tax credit. To get the remaining half, 50% of the value of critical minerals must be sourced from the United States, or a country it has a trade agreement with.

Biden’s goal is for half of all new vehicle sales in the US to be electric or hybrid by 2030.

Tech Crunch notes that, while China has long controlled the supply and manufacture of lithium-ion batteries, The country’s grip on that supply chain began to loosen after automakers, hesitant to repeat the chip shortage crisis that hampered manufacturing during the pandemic, began promising to build EVs and batteries closer to home in 2021.

The publication states that automakers and battery manufacturers have collectively invested and promised to invest nearly $100 billion in building domestic cell and module manufacturing. This works out to an annual capacity of over 1,200 gigawatt-hours by 2030.

Among battery manufacturers with plans for the US:

- Japan’s AESC will have three facilities by 2030, including the existing Tennessee operation and two new plants that have already broken ground in Kentucky and South Carolina;

- Panasonic plans to build the world’s largest EV battery plant, a $4 billion facility in Kansas — adding to its Sparks, Nevada plant that operates inside Tesla’s gigafactory. Panasonic has also said it would build at least two new factories for the production of Tesla 4680 battery cells in North America by 2030;

- Gotion Inc. will build cathodes and anodes at a battery factory in Michigan, for which it has secured $175 million in state funds;

- South Korea’s LG Energy Solution has joint ventures to build battery plants with General Motors, Hyundai, Honda and Stellantis;

- Korean battery manufacturer SK On has joint ventures with Ford and Hyundai, while its US subsidiary, SK Battery America, has invested $2.6 billion in two manufacturing plants in Jackson County, Georgia;

- Our Next Energy announced plans to build a gigafactory in Michigan focused on lithium-iron-phosphate (LFP) batteries;

- Redwood Materials has said its battery materials campus in South Carolina will recycle, refine and remanufacture cathode and anode materials such as nickel, cobalt, lithium and copper.

Canadian battery hub

Electric automakers who promise to build battery plants in Canada are expecting similar incentives to those offered under the IRA.

Construction of a lithium-ion battery plant in Windsor, Ontario, a joint venture (called NextStar Energy) between Stellantis NV and LG Energy Solution Ltd., was halted in May after Stellantis said the federal government had not met its financial commitments.

In July the governments of Canada and Ontario said they would provide up to $15 billion in performance incentives provided the companies meet certain conditions, allowing construction to resume. The facility is slated for completion in 2024, and according to CBC News, it will have six production lines and make enough batteries for a million cars a year.

A similar deal was arranged with Volkswagen, which would receive at least $13 billion in performance incentives at the battery plant it is looking to build in St. Thomas, ON.

A third arrangement was announced between the Ontario and Canadian governments and Umicore, a global metals refiner, to build a new battery materials facility in the province’s Loyalty township. The Belgium-based multinational would transform metals such as nickel, cobalt and lithium into cathode active materials (CAM). The $1.5 billion facility is expected to come online in 2025.

According to CBC News, GM, Honda and Stellantis, which makes Jeep and Chrysler vehicles, have also promised to spend billions of dollars to build battery and electric vehicle manufacturing facilities in Ontario.

A battery materials plant is also coming to Quebec. Last week, a consortium of Ford and South Korean companies said they would build a CAD$1.2 billion plant to produce EV battery materials in Becancour, QC.

The group comprising Ford, EcoProBM and SK On would produce 45,000 tonnes of CAM per year for electrified Ford cars and trucks, using nickel-cobalt-manganese (NMC) chemistry.

Finally, according to Reuters, GM and South Korea’s POSCO Future M have said they would increase production capacity at a chemical battery materials facility whose construction was announced last year. Germany’s BASF is also building a battery materials factory in Quebec.

Anode plants

Last October, Anovion Battery Materials announced it was getting a $117 million grant under the Bipartisan Infrastructure Law, to build a 35,000 tonnes-per-year synthetic graphite manufacturing facility — an expansion of its existing plant near Niagara Falls, New York, which opened in early 2021.

The second anode manufacturing facility in the United States opened in Chattanooga, Tennessee in November 2021. NOVONIX’s ‘Riverside Recharged’ is a $20 million retrofit of a former nuclear turbine manufacturing plant. The company aims to produce 40,000 tonnes of synthetic graphite by 2025.

In terms of natural graphite, the major project expected to be the recipient of $2.8 billion in federal grants announced last fall, is an expansion of Syrah Resources’ active anode material (AAM) facility in Vidalia, Louisiana. Feedstock for the plant would come from Syrah’s Balama graphite mine in Mozambique.

African sources of graphite, uranium tainted by conflict

Applied Materials, Inc. was awarded $100 million to set up an advanced prelithiation and lithium anode manufacturing facility. The proposed plant will support industrial-scale production of advanced lithiated anodes for multiple battery call makers and automobile manufacturers. Nameplate production capacity would exceed 5 gigawatt-hours (GWh).

Group 14 Technologies will receive $100 million for making a silicon-carbon composite to displace graphite in lithium-ion battery anodes. Called SCC55, the composite is made of amorphous silicon within a porous carbon scaffold. The company plans to build two 2,000-tonnes-per-year commercial manufacturing modules in Washington State.

Sila Nanotechnologies will get $100 million to support a 600,000 square-foot facility, also in Washington, expected to start producing Sila’s proprietary silicon anode material in the second half of 2024.

According to Sila, via Charged magazine, “the Moses Lake site has the potential for further expansion and investment by 15X to reach production volumes to power 150 GWh of cells when used as a full graphite replacement or 750 GWh as a partial replacement — enough to power 2 to 10 million electric vehicles per year.” The company has partnerships with BMW and Mercedes-Benz, Bloomberg reports.

Note: Group 14 and Sila’s technologies are next-gen and have yet to be manufactured on a commercial scale. Both are using silicon and/or carbon in the anode, in place of graphite. Power & Beyond says the main obstacle to commercialization is the fact that silicon’s large volume change and high reactivity can cause the battery to break.

The most recent development is an announcement by Epsilon Advanced Materials for the construction of a 50,000 tpy graphite manufacturing facility in the US. The India-based company plans to invest USD$650 million in the plant, which would make synthetic anode materials customized to specified battery chemistries.

Natural vs synthetic

Given that several of the above plants are proposing to make anodes from synthetic versus natural graphite, it’s important to know the difference.

Natural graphite is mined whereas synthetic or artificial graphite is produced by heating petroleum coke feedstock in a special furnace. Because synthetic graphite must be baked at 3,000 degrees Celsius, this method is costly and very energy-intensive. Battery Power Online states the graphite anode is responsible for 50% of the CO2 emissions from battery production, and that synthetic graphite is often processed with coal power in Mongolia.

Last year, Fastmarkets wrote that Producing spherical graphite out of natural mined flake material requires less energy than the Acheson furnace process employed in synthetic graphitization.

The latter is obviously reflected in a significant cost savings for natural graphite, which is priced around half that of synthetic.

Moreover, natural flake graphite exhibits a much higher crystalline structure than synthetic, and is therefore more electrically and thermally conductive. According to Canada Carbon, natural graphite’s ability to be exfoliated and then pressed into sheets make it the preferred structure for heat sinks, fuel cells and gaskets.

While the current graphite mix in China is about 80% synthetic and 20% natural (most anode technologies employ a blend of both), the surging costs related to graphitization of synthetic have Chinese battery manufacturers considering a shift to using more natural graphite.

Conclusion

With all that is going on, it’s easy to lose sight of the big picture.

If Biden’s targeted one-half of new light-duty vehicles being battery-electric and plug-in by 2030 is fulfilled, it would require roughly 8 million new EV batteries a year.

Have we got the metals, and in particular, the graphite?

An average plug-in EV has 70 kg of graphite. Every 1 million EVs requires 70,000,000 kg (70,000 metric tons) of natural graphite.

70,000 tonnes X 8 (million EVs) = 560,000 tonnes (617,294 tons)

In 2022 the US imported 82,000 tons of natural graphite, of which about 77% was flake and high-purity (i.e. battery-grade), 22% amorphous, and 1% lump and chip graphite.

77% of 82,000 tons = 63,140 tons

Getting from 63,140 to 617,294 tons would require a nearly 10-fold increase in the amount of graphite the United States either imports or produces domestically. There are currently no producing US graphite mines and all of the country’s graphite processing is still done overseas.

In its 2022 natural graphite survey, the US Geological Survey says at full capacity, US lithium-ion battery manufacturing plants are expected to require 1.2 million tons per year of spherical purified graphite. From this total, 40-60% is estimated to come from synthetic graphite.

Import ban on goods made with Chinese slave labor extended to electric car batteries

Conservatively, let’s say the rest, 40%, is natural graphite. To supply this 480,000 tons would require importation or production of 7 times the amount of battery-grade graphite the US imported in 2022. Not exactly Security of Supply is it?

I pose a simple question: Where are we going to find the graphite?

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.