West to East gold migration – Richard Mills

2022.10.13

Gold bounced around wildly on Tuesday, Oct. 11, the day following the Canadian Thanksgiving holiday. October has seen major volatility in the gold market, with prices swinging about $63, from $1,725 an ounce on Oct. 5, to $1,662 on Oct. 11, then back up to $1,683, the same day.

At time of writing the precious metal was down $3 from Monday’s close in New York of $1,669 an ounce. Although gold has managed to stay above recent two-year lows, commodity analysts at Heraeus Precious Metals warned investors the gold market could continue to struggle through year-end as higher interest rates support the US dollar.

“The longer the Fed continues on its current path, the longer that a strong dollar will depress the gold price,” the analysts wrote in a report. Also weighing on gold is the fact that the markets keep pushing out any “Fed pivot”, referring to a shift from monetary tightening to easing as a result of poor US economic performance and/or the widely anticipated recession.

According to Kitco News, the markets don’t see a pivot until the end of 2023, while the CME FedWatch Tool expects another 75-basis-point increase in interest rates next month. If that happens it will be the sixth-straight rate hike this year.

“The Fed is far behind the curve in combating inflation that is still well above its 2% target rate,” reads the report. “In addition, the supply-side element of the current inflation crisis cannot be solved with rate hikes, meaning that demand-side inflation may need to be more firmly suppressed. The Fed must be willing to endure a significant contraction in manufacturing if it wants to bring down inflation to target levels. This is something it last had to do in the early 1980s.”

2% inflation target blinding the Fed to economic reality

But it’s not all gloom and doom for the gold price. Three new trends point to light at the end of a tunnel: investors bailing on US Treasuries; a shift in gold-buying from Western markets to Eastern/Asian; and the fact that we appear to be at a point in the “gold cycle” just before gold turns upward.

Treasuries shunned

Bond market and gold market observers keep a close eye on US Treasury yields, particular the yield on the benchmark 10-year note. This is because the 10-year serves as a proxy for other financial products, such as mortgage rates, and it also signals investor confidence. When there is low confidence in the economy, people want safe investments, and US Treasuries are considered among the safest.

Demand for Treasuries bids up their prices and yields fall. Conversely, when confidence returns, investors dump their bonds, thinking they do not need to play it safe. This causes bond prices to sink and yields to climb.

Although Treasuries were popular during the coronavirus crisis, with high demand pushing nominal yields into negative territory, as bond prices soared, Bloomberg reported on Oct. 10 that the biggest players in the $23.2 trillion US Treasury market are in retreat:

From Japanese pensions and life insurers to foreign governments and US commercial banks, where once they were lining up to get their hands on US government debt, most have now stepped away. And then of course there’s the Federal Reserve, which a few weeks ago upped the pace that it plans to offload Treasuries from its balance sheet to $60 billion a month.

The latter refers to the Fed’s “quantitative tightening” program whereby the central bank sells government bonds and mortgage-backed securities to lighten its nearly $9 trillion balance sheet. The opposite occurs during quantitative easing, or QE, when the Federal Reserve prints money then buys up bonds and securities to inject liquidity into the financial system and drive down interest rates.

Central bank buying represents the largest reduction in demand for US Treasuries. According to Fed estimates, the balance sheet could fall to $5.9T by mid-2025, should Fed officials stick to current roll-off plans.

Bloomberg notes that the high US dollar is having a negative impact on foreign US Treasury holdings, giving the example of Japan:

As the Fed has continued to boost rates to tame inflation in excess of 8%, Japan in September intervened to support its currency for the first time since 1998, raising speculation the country may need to actually start selling its hoard of Treasuries to further prop up the yen.

And it’s not just Japan. Countries around the world have been running down their foreign-exchange reserves to defend their currencies against the surging dollar in recent months.

In fact, emerging-market central banks have trimmed their stockpiles by $300 billion this year, International Monetary Fund data show.

That means limited demand at best from a group of price-insensitive investors that traditionally put about 60% or more of their reserves into US dollar investments.

Commercial banks are also bailing on T-bills, with demand from them dissipating as Fed tightening drains reserves out of the financial system.

A JPMorgan strategist was quoted saying that banks during the second quarter purchased the least amount of Treasuries since the final three months of 2020:

“The drop in bank demand has been stunning,” he noted. “As deposit growth has slowed sharply, this has reduced bank demand for Treasuries, particularly as the duration of their assets have extended sharply this year.”

Asian buyers sop up gold

China and India have long been among the world’s top buyers of physical gold (and silver). The latest numbers from the World Gold Council show the United States as by far the top gold holder, followed by Germany, Italy, France, Russia, China, Switzerland, Japan and India.

Countries in Asia tend to stock up on gold when prices fall (duh), while Western countries (foolishly imo) flee the market. Indeed Asians’ greater confidence in gold as an investment, rather than as a commodity to be bought and sold like any other, can be seen in a trend that has been repeated for decades:

When Western investors retreat and prices drop, Asian gold-buying picks up and and precious metals flow east, helping to prop up prices during times of weakness. Then, when gold rallies again, Western investors buy it (too expensively – Rick) from Asian banks and bullion dealers, and physical gold returns to banks vaults held in New York, London and Zurich.

According to data from the CME Group and London Bullion Market Association, more than 527 tons of gold bullion has moved from vaults in New York and London — the two biggest Western gold markets — since the end of April.

In August Chinese gold imports hit a four-year high, with net imports via Hong Kong at 68.2 tonnes, compared with 48.7 in July.

Bloomberg via USAGold reports Rising rates that make gold less attractive as an investment mean that large volumes of metal are being drawn out of vaults in financial centers like New York and heading east to meet demand in Shanghai’s gold market or Istanbul’s Grand Bazaar.

In fact, it can’t move fast enough. [The amount of gold heading east is not enough to meet demand].

Logistical issues combined with quirks of the market are making it difficult for traders to get enough bullion where it’s wanted. As a result, gold and silver are selling at unusually large premiums over the global benchmark price in some Asian markets.

On Sept. 22, the gold benchmark price in Shanghai reportedly hit a premium of more than $43 an ounce over its London equivalent, the highest since 2019 according to data from the World Gold Council.

A Bloomberg chart from the above link, shows Asia has net-imported gold from the West since April. China brought in the most at 160 tons followed by India’s 80 tons, Turkey’s 62, Thailand’s 38 and Saudi Arabia’s 20. By contrast, 136 tons flowed out of the United States, followed by Australia (34), Canada (33), South Africa (32) and the UK (15).

Meanwhile, central banks continue to buy gold at a steady clip.

The World Gold Council said central banks added 20 tons to their net gold holdings in August, making it the fifth straight month of additions. So far this year, these banks have added over 300 tons of gold bullion, with Turkey the biggest buyer in August with 8.9t. The Middle Eastern country is under US sanctions for acquiring Russian missile defence systems, and is among a bloc of countries that are pursuing de-dollarization. Earlier this summer it was reported that Turkey is working with Russia on a proposal to pay for energy imports with currencies other than the US dollar.

How much longer can the dollar trade last?

Gold cycle about to turn

Over the past few decades there have been three gold cycles: 2001-07, 2008-11 and 2018-20. These cycles revolve around bear markets in stocks and/ or recessions. Gold usually outperforms assets such as stocks, commodities and currencies during a downturn, along with strong outperformance from gold-mining stocks. The metal loses its appeal when the economy begins to expand, commodity prices other than gold rebound, and the Fed starts raising interest rates.

The turning point is when the Fed switches from a tight monetary policy to a loose one. Despite gold’s lackluster performance year to date, falling 8% as of time of writing, it has actually outperformed the stock market and is just beginning to outperform commodities. (gold has fallen 8% year to date whereas the CRB Commodity Index has dropped 22%)

We are likely in the early stages of a global recession, which is typically defined as two straight quarters of negative growth. (GDP growth in the US shrank 1.6% in Q1 and 0.9% in Q2).

Further weakness in the stock market and the economy clearly increase the odds of a shift in Fed policy from rate hikes to rate cuts.

One commentator notes that gold’s biggest moves come during those shifts, as well as moves in the stock prices of gold miners. He also observes that the difference between today’s gold cycle and those of the 1970s, is that we have yet to experience a full-blown recession and rising unemployment. But as in most scenarios, a recession and lower lows in the stock market will be the catalyst for the coming gold cycle.

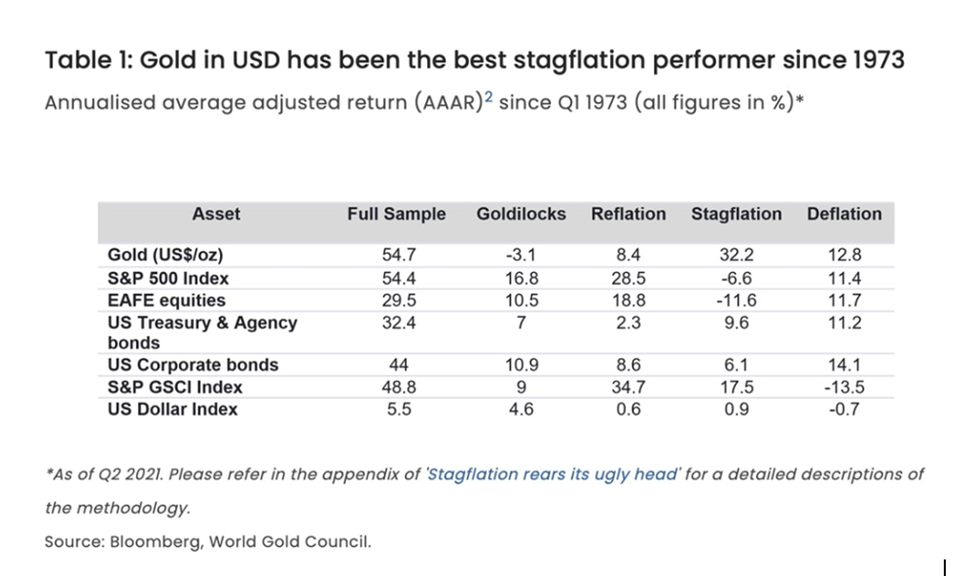

In a previous article we proved that gold outperforms other asset classes during times of economic stagnation and higher prices (stagflation).

The Great Stagflation 2.0 and gold

The table below shows that, of the four business cycle phases since 1973, stagflation is the most supportive of gold, and the worst for stocks, whose investors get squeezed by rising costs and falling revenues. Gold returned 32.2% during stagflation compared to 9.6% for US Treasury bonds and -11.6% for equities (as of Q2, 2021).

Simply put, goes does well in stagflationary environments because it benefits from the elevated risk environment, high inflation and falling real interest rates (interest rate minus inflation). Although nominal interest rates have been climbing since March, real rates remain negative because inflation is so high (3.25% – 8.3% = -5.05%).

Historical charts prove that practically every time yields fall below the rate of inflation, i.e. they turn negative, gold goes up.

Conclusion

According to Peter Schiff, gold has sold off based on the notion that the Federal Reserve will win the war against inflation, by continuing to hike interest rates. The problem with this approach is the humongous US national debt, currently sitting at $31.1 trillion. In a recent interview with Fox Business’s Charles Payne, he reminds us that a year ago, Treasury Secretary Janet Yellen said there’s no need to worry about inflation because interest rates were so low:

When Yellen made that comment, the yield on a 1-year T-bill was about .25%. Now it’s 4%. Says Schiff:

“You’ve got a 16-fold increase in the cost of funding that debt. And remember, that debt keeps having to be rolled over. The government has very short financing on this national debt. So, it’s already a problem. And it’s going to become a much bigger problem. It’s one of the reasons the Fed is going to chicken out in the fight against inflation. Because the US government would be forced to default on that debt if it actually let interest rates rise high enough to bring inflation down to 2%.”

The central banks are going to try to keep fighting inflation through tightening monetary policy (increasing interest rates), but they don’t recognize, or don’t care, that there is a tectonic shift going on, that is flipping all we have known for 30 years on its head. It’s the on-shoring and friend-shoring that we wrote about, the deglobalization, the shortage of labor, goods and raw materials. There’s also unstable geopolitics, the rising costs of climate change, increasing trade protectionism, and last but certainly not least, the incessant money-printing.

“The post-pandemic economy’s high inflationary pressures are being powered in part by secular trends and forces, many of which are operating on the supply side. While there are also transitory factors – such as supply-chain disruptions and bottlenecks, and China’s zero-COVID policy – these presumably will abate at some point. But the secular trends are likely to lead to a new equilibrium in many economies and global financial markets.

Geopolitical tensions are an especially important aspect of this process. Governments are now advocating “friend-shoring” through policies (such as tariffs, subsidies, or outright bans) aimed at shifting their countries’ trading patterns toward strategic allies and other, more reliable partners. This is partly a response to potential disruptions associated with the growing use of trade and finance to gain leverage in international relations or conflicts.

While one can debate the security benefits of these policies, they are clearly inflationary, as they explicitly shift supply chains away from the lowest-cost sources. Indeed, an even more extreme version of friend-shoring is onshoring, the costs of which are so high that policies encouraging it can be justified only in sectors exhibiting extreme economic and national-security vulnerabilities.” Secular Inflation, Michael Spence

From the start of pandemic-related government spending in the spring of 2020, to today, the US government has printed over $6 trillion. During that period, the US money supply increased by 41%, with the Fed’s actions amounting to the biggest monetary explosion that has occurred in the 227 years since the founding of the United States. Read more

Central banks can’t print or buy their way out of this this inflation, and the quicker they realize this and back off, the better off we’ll be. In the meantime, investors imo should take a close look at gold and silver as a safe place to park their money during these turbulent times.

It’s been a terrible year for stocks, bonds and now, commodities. (The CRB Index gained 123 points from Dec. 1, 2021 to June 9, 2022, when it began losing ground. Since then, CRB has plunged 16.5%, from 353 on June 9 to 303, currently).

Gold has slipped too, but not as much — just 8%, YTD. In fact gold is proving to be a resilient asset despite five straight interest rate hikes this year. Central banks and Asian buyers are taking advantage of lower prices and are stocking up on the precious metal. In previous financial crises, Treasuries were the go-to option for many foreign governments, banks and investors. Not this time. The biggest players in the $23.2 trillion US Treasury market are in retreat. How much longer before this trend impacts the US dollar, which arguably is way overvalued?

(The dollar is the strongest it’s been in a generation, with safe haven demand, inflation, higher interest rates, and worries overgrowth being cited as factors.)

I have no problem admitting that the dollar trade is the only trade right now, with the US Federal Reserve and other central banks intent on raising interest rates. The question on my mind, though, is when the trade flips to gold (and commodities).

Is the Fed really going to keep raising interest rates like the Volcker Fed did in 1981, until it crashes the economy and causes a recession?

Very likely, the latest inflation numbers came out today, 13th October. The overall CPI is up 8.2% yoy. Core inflation is the highest since 1982. A 75 point rate in November is now certainly the minimum with traders now calling for an 18% chance of a 100 basis point increase.

When, and not until, the Fed pivots to lowering interest rates, gold, silver and commodity prices will turn sharply higher.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.