Water — the next US-Canada trade irritant – Richard Mills

2023-01-01

US eyes Canadian water

The fact that the United States is more vulnerable to droughts than Canada, due in part to geography, and also because of misuse, ie., over-drawing from aquifers and reservoirs, has Uncle Sam looking to Ottawa to solve its freshwater dilemma.

It’s not only a matter of public health, but economics. For example, California, whose nearly 40 million population is greater than Canada’s, is North America’s biggest supplier of fruits, nuts and vegetables. Not being able to properly irrigate its 43 million acres used for agriculture, is motivation alone, to begin looking elsewhere for a reliable source of H2O.

In fact, Canadians may be surprised to learn that plans have been on the books since the 1950s to divert a large amount of water from Canada, state-side.

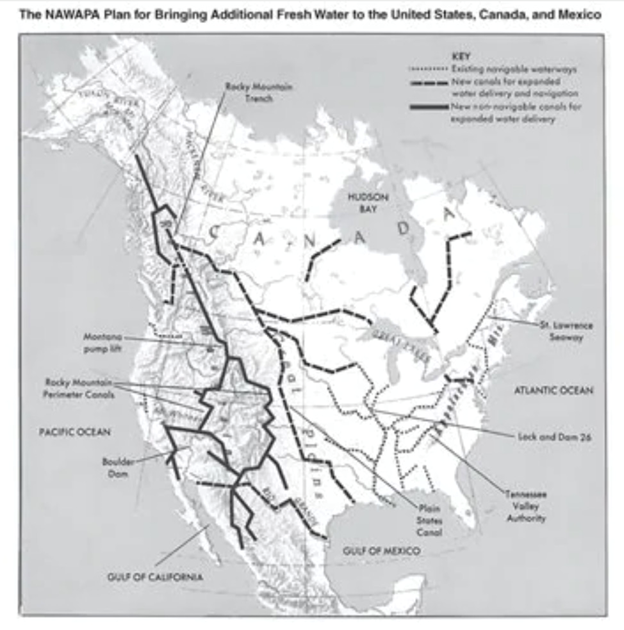

The North American Water and Power Alliance (NAWAPA) proposed to use nuclear explosions to blast canals and channel water from the north-flowing Yukon, Liard, and Peace rivers, southward to water-deprived US agricultural regions and cities. A 2015 column posted on Radio Canada International notes that NAWAPA is still very much alive, with detailed proposals and analysis made in 2010 and 2012.

Another scheme, called the Grand Canal, would dam the top of James Bay, turning it into a huge reservoir, and cut a massive trench through northern Ontario that would bring fresh water to the Great Lakes, from where Americans could siphon however much water they need for farms, towns and cities impacted by climate change.

Abhorrent as these ideas seem, some Canadian politicians have advocated selling Canadian water down the river.

Former Prime Minister Brian Mulroney introduced a bill that would have allowed exports by tanker and small-scale land diversion. Ex-NDP leader Thomas Mulcair wanted to explore the concept of bulk water exports while he was Quebec’s environment minister.

The Montreal Economic Institute reportedly argued that water exports would be a huge boon to heavily indebted Quebec, pointing out the province could earn as much as $65 billion annually by exporting around 10% of its fresh water supply.

Of course a large amount of Canadian water was shipped out of the country by Swiss consumer products giant Nestle, which sucked up vast amounts of groundwater for its bottling plant in Ontario, before selling its Canadian water business last year.

Columnist Lloyd Alter, in his piece ‘Canada has water. The US wants it’, claims that 3,200 cubic feet per second is pumped from Lake Michigan and sent south through the Chicago River and into the Mississippi, through deals made between Canadian and US industries.

The federal government’s Bill C-383 bans inter-basin transfers into international rivers but the legislation does not cover non-boundary waters or water resources in the north, states the Council of Canadians. A further loophole in the act, is it narrows the definition of water removal to 50,000 liters or more, and exempts water used to make beverages.

With friends like these…

Canadian politicians should be wary of any overtures the United States makes toward us for our water, not only because we may need all we can get, as drought conditions migrate north, but given how poorly our southern neighbour and supposed friend has treated us lately.

Consider how former President Trump decided the first country he would visit after inauguration in January 2017 was Saudi Arabia. Most incoming US presidents prioritize a visit with Canada, arguably its greatest ally, friend, and neighbor. The snub was not easily forgotten.

In 2018 Canada was surprisingly included among countries subject to US tariffs on aluminum and steel. Claiming they were being imposed for reasons of “national security” (what Trump really meant was security of supply), the duties were dropped a year later, but threats of more tariffs returned in 2020. The US was about to impose a second 10% levy on Canadian aluminum imports when the Americans announced they had reached a deal.

Then there was the fight over NAFTA. In renegotiating the trilateral agreement between Canada, the US and Mexico, Trump railed against Canadian dairy farmers, calling tariffs on milk, cheese and butter from the United States “a disgrace”; threatened to slap a 25% duty on Canadian-made cars; and at one point during the negotiations lashed out at Prime Minister Trudeau, calling him “meek, mild and dishonest.”

After Trump lost the election to Joe Biden many in Canada hoped the tense relationship between the two countries would morph into something more cordial, but Biden was quick to throw sand in the face of that notion. On his first day in office, Biden announced the Keystone XL pipeline expansion project would be scrapped.

The executive order to scuttle the 1,897-kilometer pipeline, with capacity to carry 830,000 barrels of Alberta oilsands crude to Nebraska and on to Gulf Coast refineries, fulfilled a campaign promise by Biden, and showed that the US didn’t really need Canadian oil.

Indeed, the country’s reliance on shale oil, resulting in a 230% surge in crude production, or an extra 6.9 million barrels a day, combined with other pipelines that have come to the fore, including the Trans Mountain Pipeline which heads west from Alberta to BC and connects with a pipeline to Washington State, and Enbridge Line 3, also beginning in Alberta and crossing Minnesota into Wisconsin, made sure of that.

Still, the fact that Biden wasn’t even willing to discuss the project, which had already started construction, left a bad taste in the mouth of Canadians hoping for a better trading relationship, and especially infuriated Alberta Premier Jason Kenney, who called the cancelation “a gut punch”.

In 2019 the Financial Post reported on another protectionist measure, a “little-known tariff” that is costing Canadian oil companies about $60 million a year. While only amounting to about 10.5 cents per barrel, traders say it makes a big difference at the margins, especially since oil prices have fallen and Canadian oil prices have remained persistently low.

It’s interesting how the United States, whether it’s a Republican or a Democratic administration, plays hard ball with Canadian trade interests — whether it be oil, softwood lumber, dairy or autos — but when Washington wants something, it comes across like a back-slapping uncle at a Thanksgiving feast.

Case in point: the US making nice with Canada over critical minerals. It took a trade war with China for the country to realize how easily it can be held ransom over rare earths, cobalt, graphite, manganese or any other of the 35 minerals the US Geological Survey considers critical to US economic and national security.

Realizing that Canada supplies 13 of these minerals, and is America’s leading supplier of indium, potash, aluminum and tellurium, its second-largest supplier of tungsten, manganese and niobium, and ships roughly a quarter of US uranium supply, suddenly all previous acrimony was forgotten amid the new threat posed (mostly) by China’s monopoly over much of the world’s critical minerals supply chain.

In January 2020, the two nations agreed to a Joint Action Plan on Critical Minerals Collaboration aimed at improving critical mineral security.

That was followed in 2021 with an agreement between Biden and Trudeau to build a US-Canada electric vehicle supply chain.

Both countries are also, as Reuters states, members of the Energy Resource Governance Initiative, a pact to share mining experience and resources.

Our point is not that there’s anything wrong with this type of collaboration. At AOTH, we have been pushing for more top-down action on critical minerals insecurity of supply for years.

The fact that closer collaboration appears to be more than lip service — note for example, that recently the US Commerce Department had a closed-door meeting with miners and battery manufacturers to discuss Canadian production of EV materials, and that three US mining companies have already invested in Canada — is heartening news. Great for the mining industries of both countries.

What gets me, though, is how bad Canadian politicians are at negotiating. Here we finally have a resource that should give us significant leverage in dealing with our largest trading partner, ie., critical metals. In return for offering our minerals and our mining expertise, what are we asking for in return? I’ve yet to discover anything in print.

Our best friend and ally’s reaction? To increasingly view Canada as a kind of “51st State” for mineral supply purposes (quoting here from Reuters).

Excuse me? A 51st State? What happened to Canadian sovereignty over mineral resources? Where’s the contrition in treating little brother Canada like a punching bag over our oil? Our lumber? Our dairy products?

If we can’t even stand up for ourselves over mining, an area of national expertise since well before the United States asked for our help, what hope do we have in maintaining Canadian sovereignty over fresh water?

It’s about time our politicians grew a backbone. Access to our resources should only be granted at a fair price, and only after our needs are taken care of first.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.