Walking dead US dollar – Richard Mills

2022.10.19

For more than a year, the US dollar has been gaining strength relative to other currencies, including the euro, yen, yuan and Canadian dollar. On Sept. 1 the US Dollar Index (DXY) hit a 20-year high, and as the chart below shows, the index has been risen steadily all year.

Rising interest rates have put upward pressure on the dollar, as foreign investors pour capital into the country. The dollar has also done well because the US economy is perceived to be stronger than Europe’s, which is suffering from an energy crisis. On Aug. 22 the euro fell to a two-decade low of 0.9903 against the dollar.

The New York Times stated in July that the dollar is the strongest it’s been in a generation, citing safe haven demand, inflation, higher interest rates and worries over growth as factors.

Treasuries shunned

Bond market and gold market observers keep a close eye on US Treasury yields, particular the yield on the benchmark 10-year note. This is because the 10-year serves as a proxy for other financial products, such as mortgage rates, and it also signals investor confidence. When there is low confidence in the economy, people want safe investments, and US Treasuries are considered among the safest.

Demand for Treasuries bids up their prices and yields fall. When confidence returns, investors dump their bonds, thinking they do not need to play it safe. This causes bond prices to sink and yields to climb.

Although Treasuries were popular during the coronavirus crisis, with high demand pushing nominal yields into negative territory, as bond prices soared, Bloomberg reported on Oct. 10 that the biggest players in the $23.2 trillion US Treasury market are in retreat:

From Japanese pensions and life insurers to foreign governments and US commercial banks, where once they were lining up to get their hands on US government debt, most have now stepped away. And then of course there’s the Federal Reserve, which a few weeks ago upped the pace that it plans to offload [sell] Treasuries from its balance sheet to $60 billion a month.

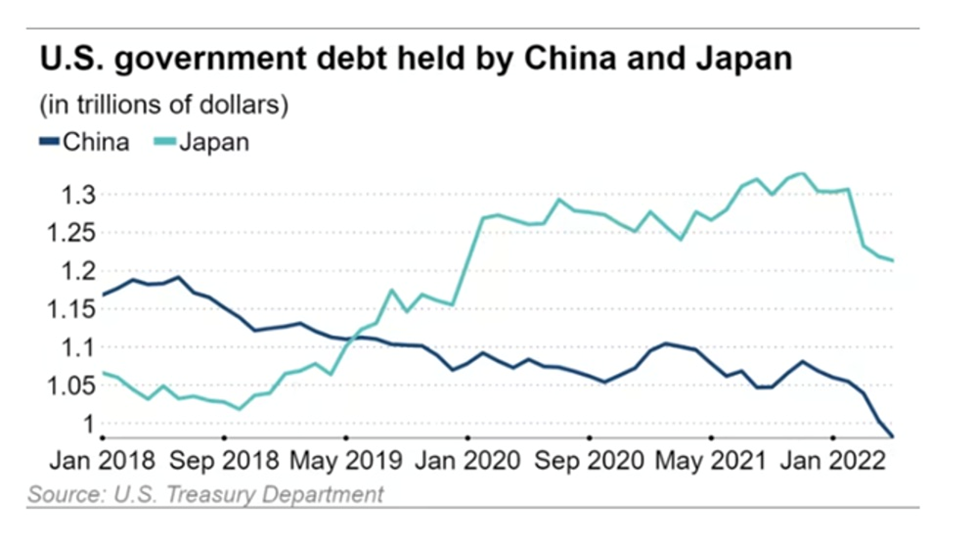

Bloomberg notes that the high US dollar is having a negative impact on foreign US Treasury holdings, giving the example of Japan:

As the Fed has continued to boost rates to tame inflation in excess of 8%, Japan in September intervened to support its currency for the first time since 1998, raising speculation the country may need to actually start selling its hoard of Treasuries to further prop up the yen.

And it’s not just Japan. Countries around the world have been running down their foreign-exchange reserves to defend their currencies against the surging dollar in recent months.

In fact, emerging-market central banks have trimmed their stockpiles by $300 billion this year, International Monetary Fund data show.

That means limited demand at best from a group of price-insensitive investors that traditionally put about 60% or more of their reserves into US dollar investments.

Commercial banks are also bailing on T-bills, with demand from them dissipating as Fed tightening drains reserves out of the financial system.

A JPMorgan strategist was quoted saying that banks during the second quarter purchased the least amount of Treasuries since the final three months of 2020:

“The drop in bank demand has been stunning,” he noted. “As deposit growth has slowed sharply, this has reduced bank demand for Treasuries, particularly as the duration of their assets have extended sharply this year.”

Even Treasury Secretary Janet Yellen is fretting about a lack of adequate liquidity in Treasuries. Yellen notes that the supply of Treasury debt has climbed by about $7 trillion since the end of 2019, but large financial institutions haven’t stepped up as purchasers. The former Fed Chair was also quoted saying that the Federal Reserve now has a standing repurchase facility to provide a liquidity backstop to the Treasuries market; that “can be helpful.”

This meshes with a September article in Sprott Money, which predicts the Fed will buy “everything” when the proverbial shit hits the fan, and this will trigger the collapse of the dollar. In asking who is going to purchase all of the ballooning deficits and debt resulting from the influx of government spending to help consumers and businesses deal with inflation, author David Brady’s answer is central banks.

Brady notes that interest rate hikes are a way for central banks to reduce inflation, but printing money to pay for relief programs means more currency chasing fewer goods and services, i.e., inflation.

How will the government fund even bigger deficits? Issue more treasury debt. Again, who is going to buy the debt? Central banks, led by the Fed. The Fed will have to pivot sooner rather than later or the whole house of cards collapses. While the dollar will likely continue to rise against the sliding euro and yen, its days are numbered also. It may be the last to fall, but when it does, it will be brutal, imho.

Simply put, fiscal spending must be funded with more debt issuance, and the only major players left remaining to buy that debt is the central banks.

Emerging market distress

A Bloomberg article from last week states that rising interest rates are evoking fears of the mid-1990s IMF debt crisis.

Developing-world economies that borrowed heavily in dollars when interest rates were low, are according to the article now facing a huge surge in refinancing costs. The narrative is as follows:

In 1997 several Asian currencies collapsed and were forced into default. Foreign debt-to-GDP ratios rose from 100% to 167% in the four large ASEAN economies in 1993-96, then shot up beyond 180% during the worst of the crisis. The first country to default was Thailand; the crisis then spread to Indonesia and South Korea, both of which sought financial assistance from the International Monetary Fund.

As a result of the IMF crisis, for a time developing-world economies eschewed foreign debt, but over the past few years many such economies were lured by low interest rates into issuing debt in hard currencies, usually dollars or euros. According to Bloomberg data, in 2020 dollar and euro borrowing by EM sovereigns and corporate borrowers hit a record USD$747 billion. Bulgaria and Turkey are among countries with over half their debt in foreign currencies.

Now, sovereign dollar bonds from a third of countries within the Bloomberg EM Sovereign Debt Dollar Index, are trading with a spread of 1,000 basis points of more over US Treasuries — a generally considered metric of distress. For example, investors in Mongolia are demanding a premium of about 1,200 basis points over Treasuries, to holds its March 2024 dollar bond. This is around five times the level recorded a year ago.

A wave of defaults across developing nations would have major implications for the global economy, just as Asian debt contagion in 1997 spread to Russia and Latin America.

So long as the dollar is at a high level, this risk grows. Surging import costs from a strong dollar caused Mongolia’s hard currency reserves to shrink and debt has reportedly grown to almost 100% of GDP.

Meanwhile, 15 of 23 emerging-market currencies tracked by Bloomberg are down more than 10% this year, heaping pressure on governments at a time when energy bills are also rising. Developing-nation governments need to pay back or roll over about $350 billion in dollar- and euro-denominated bonds by the end of 2024, according to data compiled by Bloomberg.

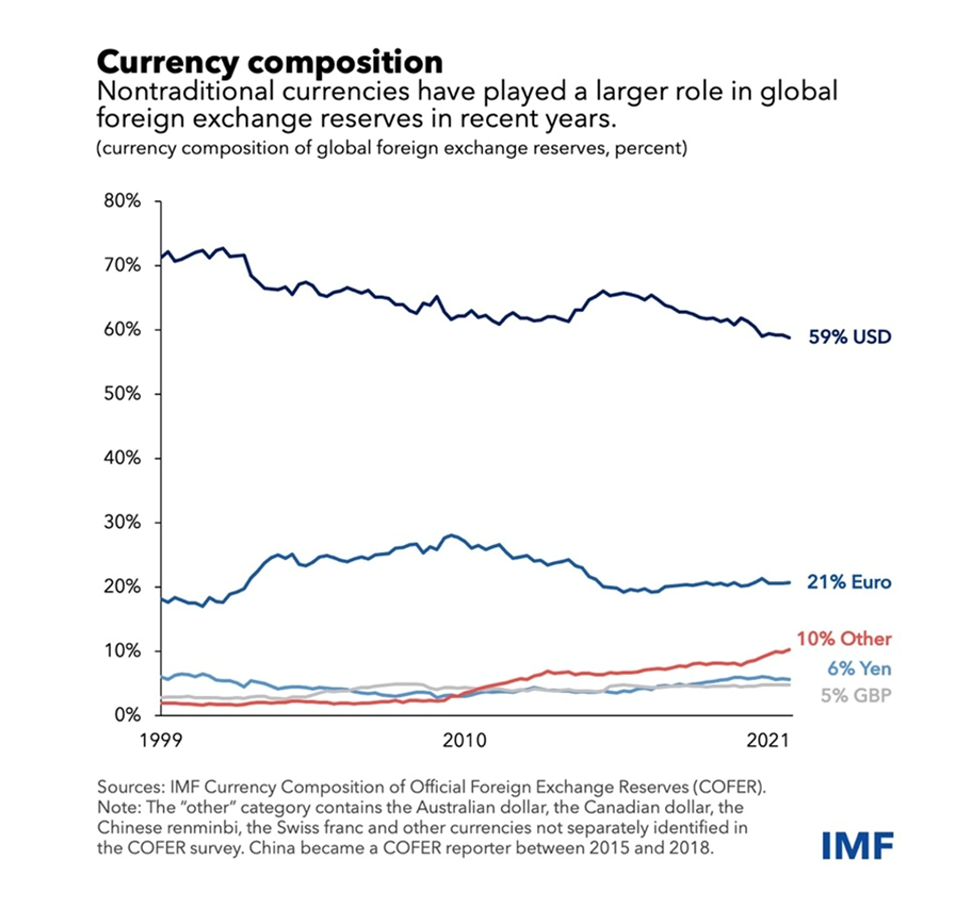

De-dollarization

In the 1960s, French politician Valéry d’Estaing complained that the United States enjoyed an “exorbitant privilege” due to the dollar’s status as the world’s reserve currency. His point was well taken.

The US dollar is the most important unit of account for international trade, the main medium of exchange for settling international transactions, and the store of value for central banks.

Because of the dollar’s position, the US can borrow money cheaply, American companies can conveniently transact business using their own currency, and when there is geopolitical tension, central banks and investors buy US Treasuries, keeping the dollar high and the United States insulated from the conflict. A government that borrows in a foreign currency can go bankrupt; not so when it borrows from abroad in its own currency i.e. through foreign purchases of US Treasury bills.

Lately though, “de-dollarization” is being pursued by countries with agendas at odds with the US, including Russia, China, Saudi Arabia and Iran.

As the target of US economic sanctions (for annexing Crimea, interfering in its election, and now, invading Ukraine), Russia sees diversification from the dollar and into gold and other currencies, as a way of skirting trade restrictions.

For the first five months of this year, China’s Treasury holdings fell below $1 trillion, a 12-year low, with concerns about the risk of Russia-style sanctions possibly accelerating a long-term financial decoupling driven by political tensions, according to Nikkei Asia. The country sold US government debt for a seventh straight month in June, signaling that Beijing is trying to defend the yuan against the dollar, added Markets Insider.

A few years ago China came up with a new crude oil futures contract, priced in yuan and convertible into gold. The Shanghai-based contract allows oil exporters like Russia and Iran to dodge US sanctions against them by trading oil in yuan rather than US dollars.

Russia and China have both made moves to de-dollarize and set up new platforms for banking transactions outside of SWIFT that skirt US sanctions. The two nations share the same strategy of diversifying their foreign exchange reserves, encouraging more transactions in their own currencies, and reforming the global currency system through the IMF.

In 2014 after Russia annexed Crimea, there were calls to cut Russia off from SWIFT. In response the Kremlin developed its own financial communications platform, SPFS. In December 2021, SPFS had 38 participants from nine countries. As of March, the system had 399 users. Russia is currently negotiating with China to join SPFS.

China has also developed an alternative to SWIFT, in 2015 launching the Cross-Border Interbank Payment System (CPS) to help internationalize the yuan.

Vladimir Putin’s invasion of Ukraine has resulted in the West’s attempt to isolate Russia through economic sanctions. But the plan has backfired. Not only have the sanctions failed to stop Russian aggression, the high energy prices resulting from the war, have boosted the rouble. More importantly, the sanctions are pushing Russia closer to China, American’s main economic, political and military adversary.

As Foreign Affairs puts it, “Deteriorating U.S.-Chinese relations incentivize Beijing to join with Moscow in building a credible global financial system that excludes the United States.”

Without taking action to reverse this trend, Washington will see its global standing weaken.

Since 2018, the Bank of Russia has substantially reduced the share of dollars in its foreign exchange reserves, through purchases of gold, euros and yuan. As of March, 2022, Russia was the fourth largest holder of gold bullion, behind the US at no. 1, Germany, Italy and France. The country’s gold holdings have tripled since the first Russo-Ukraine war in 2014, and are estimated at around 20% of the BoR’s total reserves.

China and Russia have drastically reduced dollar usage in conducting trade. In 2015 about 90% of transactions used the dollar. After the trade war between the US and China broke out, the figure by 2019 had dropped to 51%. And that was before the war in Ukraine.

Bilateral currency swaps between Russia’s and China’s central banks helped Russia to bypass US sanctions in 2014. A three-year currency swap worth $24.5 billion, enabled each country to access the other’s currency without having to buy it on the foreign exchange market.

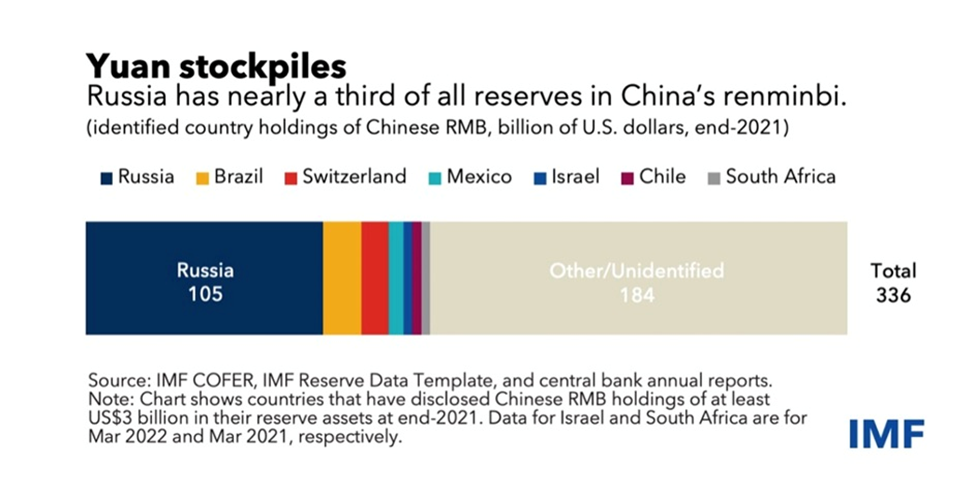

The Bank of Russia in early 2019 purchased $44 billion worth of Chinese yuan, tripling its share of Russia’s foreign exchange reserves from 5 to 15%. Russia’s yuan holdings are about 10 times the global average; it currently has nearly a third of all reserves in China’s renminbi/ yuan.

Major Russian energy companies including Gazprom and Rosneft have stopped using the US dollar, with the euro now the primary vehicle of trade between Russia and China. At the end of 2020 more than 83% of Russian exports to China were settled in euros.

Governments vs central banks

A strong dollar is good for America, but it’s not so great for the rest of the world, as the section on emerging markets showed. Nor is a soaring buck advantageous for US exporters, who expect the dollar to remain competitive (lower) against other currency holders, who must purchase dollars to buy American goods. Allow the dollar to appreciate too much, and US exports become over-priced, hurting US manufacturers.

It’s interesting that Donald Trump, the former US president, was for a low US dollar to help exports and manufacturers, whereas President Biden is happy with a strong dollar even though there are significant disadvantages for holders of other currencies.

The 15% climb in the greenback this year has raised the cost of their dollar-denominated imports and triggered inflation, as the value of their currencies relative to the dollar plunged, prompting their own central bank tightening cycles. The latter is hindering economic growth. A week ago the IMF downgraded its 2023 growth outlook for the world economy to 2.7%, down from the 2.9% they had estimated in July.

In an article describing how Biden has brushed off the effects of a strong dollar, Bloomberg notes that the strong dollar continues to weigh on the global economy, particularly poorer nations that rely on food imports. The destructive combination of the soaring greenback, high interest rates, and elevated commodity prices is eroding their power to pay for goods typically priced in the dollar and compounding a worsening global food crisis, among others.

“I’m not concerned about the strength of the dollar, I’m concerned about the rest of the world. Our economy is strong as hell,” Biden bragged to reporters on Saturday.

Paradoxically though, while central banks around the world try to defeat inflation by hiking interest rates, thereby crimping demand for goods & services, governments are adding to it with prodigious new spending. Remember, economies with fiat currencies rely on money-printing, and borrowing, to pay for their expenses.

The United States leads the way in this fiscal free-for-all, followed by Europe. The Biden administration’s $5.8 trillion federal budget will add nearly $15 trillion in new debt over the next decade, with annual budget deficits of at least a trillion per year.

Globally, governments are being forced to spend more to deal with an energy and food crisis that is squeezing consumers’ pocketbooks, and they will almost certainly be called upon again, if the world economy enters a recession as it is expected to within the next year.

The problem is, this policy of government largesse runs counter to central banks, who are raising interest rates to quell demand for goods and services, and thereby slow inflation.

It’s a tug of war between monetary authorities, who see inflation as something needing to be stamped out through higher rates, and governments, who are expected help out citizens with cost-of-living increases, by spending more or taxing less.

A great example of this dynamic, is what happened in Britain when new UK Prime Minister Liz Truss tried to ram a tax cut through for the wealthy, to appease the right-wingers in her party.

Going against the advice of the former finance minister under Boris Johnson, Rishi Sunak, who in a post-Brexit world (rightly, it turns out) argued thought that slashing taxes, cutting regulations and rolling back the state would crush the pound and panic markets, Truss and her finance minister, Kwasi Kwarteng, did the opposite.

Using the economic logic of the Laffer Curve, that tax reductions will eventually drive up growth rates and pay for themselves, Truss-Kwarteng tried to simultaneously cut taxes and subsidize energy bills. At the same time, the Bank of England was scrambling to control inflation with higher interest rates.

Truss’s unfunded proposals triggered a gilt-market rout. For five days, not a single gilt, the UK equivalent of a Treasury note, was sold!

As The Globe and Mail newspaper put it in last weekend’s edition, The Truss-Kwarteng strategy seemed to be that with enough time, if they could just get enough people to share their belief, optimism would return to the economy.

But in their “just-trust-us” boosterism, they neglected those strangers on whose kindness they’d come to rely. Bond investors took one look at the budget and said ‘no’. Preferring the established orthodoxy, they snapped shut their chequebooks.

The incident serves as a warning to other governments, that ignoring its bond holders can backfire.

One of the risks of central banks and governments working at cross-purposes, is that public spending can fuel the price pressures that monetary authorities are trying to contain. Also, central bankers when they raise rates add to budget costs, because governments must pay more to borrow.

New research by Bloomberg Economics, quoted in a recent article, suggests that several major economies are on an “unsustainable debt trajectory” unless they make painful budget cuts. For the Group of Seven nations, the study found that interest payments on public debt are on track to reach 3.6% of public output by 2030, more than double the pre-pandemic level.

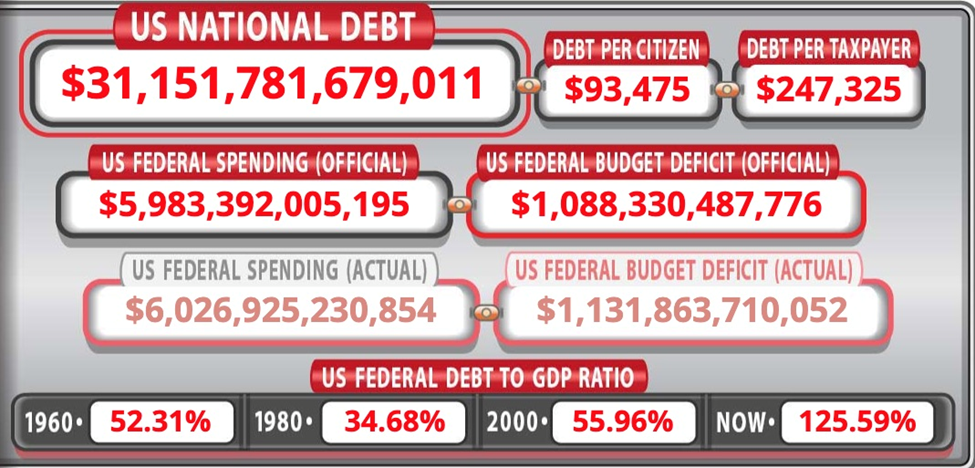

The United States is heavily indebted, having run the world’s biggest budget deficit during the pandemic.

“That bond-market hissy fit [in the UK] could be coming to a US theater near you,” Bloomberg quotes Peter Boockvar, chief investment officer at Bleakley Financial Group. “At the same time that the biggest buyers of Treasuries — including the Fed — are retreating, US debts are exploding higher. And the budget deficit is about to do the same, as tax receipts are at major risk if economic growth continues to slow.”

Gorging on debt

According to the FRED chart below, the US debt to GDP ratio in the ‘70s was around 35%. Today it is three and a half times higher, at 125%.

This severely limits how much and how quickly the Fed can raise interest rates, due to the amount of interest that the federal government will be forced to pay on its debt.

The national debt has grown substantially under the watch of Presidents Obama, Trump and Biden. When Trump was handed the keys to the White House in January 2017, the national debt stood at nearly $20 trillion. When he left, in Q1 2021, it was at $28.1T.

Each interest rate rise means the federal government must spend more on interest. That increase is reflected in the annual budget deficit, which keeps getting added to the national debt, now standing at a gob-smacking $31.1 trillion.

We are talking about interest costs approaching a trillion dollars per year, about a quarter of the $4 trillion in revenues the federal government takes in annually. That’s insane.

Higher debt servicing costs take away from other spending that that will have to be cut, as the government tries to keep its annual budget deficit under control.

Consider: a year ago, Treasury Secretary Janet Yellen said there’s no need to worry about inflation because interest rates were so low. When Yellen made that comment, the yield on a 1-year T-bill was 0.25%. Now it’s 4%, 16 times higher. The federal funds rate, the interest rate established by the Federal Reserve, is now north of 3%, following five rate increases this year. The FFR is likely to climb at least 0.75% each when the Fed meets again in November and December, with a 100-basis-point increase (+1%) not unexpected.

Thus, by the end of the year we could be looking at a benchmark interest rate of 4.5%, which is 18X higher than before the Fed started its tightening cycle in March. That also equates to an 18X increase in interest payments on the debt. Now imagine you’re a developing country, and you’ve issued debt in US dollars to help pay for higher spending to combat inflation. Not only do you have to pay a much higher rate of interest to bond holders when the bonds mature, but the US dollar keeps rising, meaning it takes more units of your currency to purchase the same amount of dollars. Eventually that becomes unsustainable.

Conclusion

Only six months into the Fed tightening cycle, we’ve got developing countries defending their own currencies against the surging US dollar, trying to support them by selling Treasuries and dumping the dollar. (Japan, the second-larger holder of Treasuries behind China, has intervened to support its currency for the first time since 1998, raising speculation the country may need to start selling its hoard of Treasuries to further prop up the yen).

As mentioned at the top, for more than a year now, the US dollar has been gaining strength relative to other currencies, including the euro, yen, yuan and Canadian dollar. A strong US dollar carries both advantages and disadvantages. It’s good for America’s standing in the world, and it also holds down domestic inflation by lowering the cost of imported goods. Every dollar buys more goods & services as it rises.

However, a high dollar is bad for US exporters. When American companies sell their products to other countries, the latter’s purchasing power is weakened by the strong dollar. The result is lower demand for US exports.

Conversely, the dollar as the world’s reserve currency can only go so low because it will always be in high demand for countries to purchase commodities priced in US dollars, and US Treasuries. It should not be allowed to fall too much, because that would risk the dollar losing its “exorbitant privilege”.

Because the dollar is the world’s currency, the US can borrow more cheaply than it could otherwise, US companies can conveniently do cross-border business using their own currency, and when there is geopolitical tension, investors buy US Treasuries, keeping the dollar high. A government that borrows in a foreign currency can go bankrupt; not so when it borrows from abroad in its own currency i.e. through foreign purchases of US Treasury bills. The US can spend as much as it likes, by keeping on issuing Treasuries that are bought continuously by foreign governments. No other country can do this.

The cost of having this privileged status is the country that has it, must run a trade deficit with the rest of the world. It can’t have the strongest currency, and also keep the currency low in order to increase exports. This is explained in a previous AOTH article titled ‘The Triffin Dilemma Will Create a 3G World’. Here is an excerpt:

When a national currency also serves as an international reserve currency conflicts between a country’s national monetary policy and its global monetary policy will arise.

By “agreeing” to have its currency used as a reserve currency, a country pins its hands behind its back. In order to keep the global economy chugging along, it may have to inject large amounts of currency into circulation, driving up inflation at home. The more popular the reserve currency is relative to other currencies, the higher its exchange rate and the less competitive domestic exporting industries become. This causes a trade deficit for the currency-issuing country, but makes the world happy. If the reserve currency country instead decides to focus on domestic monetary policy by not issuing more currency then the world is unhappy.

Becoming a reserve currency presents countries with a paradox. They want the “interest-free” loan generated by selling currency to foreign governments, and the ability to raise capital quickly, because of high demand for reserve currency-denominated bonds. At the same time they want to be able to use capital and monetary policy to ensure that domestic industries are competitive in the world market, and to make sure that the domestic economy is healthy and not running large trade deficits.

Unfortunately, both of these ideas – cheap sources of capital and positive trade balances – can’t really happen at the same time.”

In trying to force Russia to end the war in Ukraine, sanctions were imposed by the United States and its allies. For the most part they haven’t worked. Higher energy prices have benefited Russia and its currency, the rouble. President Biden was supposed to be the great conciliator, but in acting aggressively against Russia, not just with sanctions but by helping Ukraine with weapons and economic aid, he has caused global division and hurt US dollar hegemony, and by extension, US global influence. A large percentage of the world’s population, some reports are as high as 85%, is ruled by governments who no longer wish to buy all their needed commodities with US dollars. They include Russia, China, India, Saudi Arabia and Iran.

I personally believe we are rushing headlong into a US dollar crisis of epic proportions. In fact within the next five years, the buck could lose its status as the world’s reserve currency.

Why? Because the US can’t “have its cake and eat it too”. It can’t continue to have a strong dollar while the rest of the world suffers the ill effects. This is the Triffin Dilemma.

President Biden doesn’t appear to understand what is happening, when he says “I’m not concerned about the strength of the dollar, I’m concerned about the rest of the world. Our economy is strong as hell.” It’s not the developing countries’ fault that they are being wracked by inflation. It’s the US’s fault for allowing the dollar to run so high — again, the dollar is the reserve currency and they are forced to conduct transactions in dollars, and to borrow in dollars. The higher the dollar goes, the worse it is for their currencies, and localized inflation.

It seems to me, the only way to avoid a global recession resulting from low growth and high inflation (i.e. stagflation) is to lower the value of the US dollar.

Yet the signals coming from the Fed indicate that this is the last thing it wants to do.

The central banks are going to try to keep fighting inflation through tightening monetary policy (increasing interest rates), but they don’t recognize, or don’t care, that there is a tectonic shift going on, that is flipping all we have known for 30 years on its head. It’s the on-shoring and friend-shoring that we wrote about, the de-globalization, the shortage of labor, goods and raw materials. There’s also unstable geopolitics, the rising costs of climate change, increasing trade protectionism, and last but certainly not least, the incessant money-printing.

The objective of raising interest rates is to cool demand. However, the Fed can raise rates as high as they want, the problem is they are not going to magically increase the supply of a number of commodities, food and manufactured goods we are running short of.

A big part of the current inflationary cycle, the worst since the early 1980s, is “supply-side” inflation. This has nothing to do with killing demand, and everything to do with increasingly supply. The Fed can’t control supply-side inflation, and they know it.

So, is the Fed really going to keep raising interest rates like the Volcker Fed did in 1981, until it crashes the economy and causes a recession?

Very likely. The latest inflation numbers came on Oct. 13. The overall CPI is up 8.2% yoy. Core inflation is the highest since 1982. A 75-point rate hike in November is now certainly the minimum. with traders now calling for an 18% chance of a 100-basis-point increase.

Catherine Austin Fitts is publisher of The Solari Report, and the former assistant secretary of housing under the Bush (Senior) administration. In a recent interview, Fitts argues the Fed will defend the dollar, no matter what crashes. An excerpt from the video interview follows:

Most of the benefits in the dollar system come from the benefits of having the reserve currency and being able to swap money you print out of thin air for real labor and real commodities worldwide. That’s an enormous benefit, and they are going to protect that benefit. If they don’t protect that benefit, they run the risk of everybody moving out of the channel. This is what the Chinese and Russians are trying to do. They are trying to move out of the dollar channel and trying to create economic resiliency and trade outside the channel. What the Fed is trying to do and the dollar syndicate is trying to do is protect that channel. . . . It’s global government reengineering. It’s 100% power politics, and it’s a war.”

In short, the Fed will defend the dollar and the world reserve currency status no matter how hard the stock market crashes, no matter how much the economy crashes, no matter how much the bond market crashes and no matter how much the housing market crashes.

Things are starting to look eerily similar to the late 1970s. We are getting close to when former Fed Chair Arthur Burns lost control of the economy and Paul Volcker was brought in to clean up his mess. Inflation was running at 10.5% and it was undermining economic stability. Determined to slay inflation once and for all, Volcker in October 1979 pushed the Fed to adopt new procedures to control the growth of the money supply, which he argued was important for bringing down inflation. While this was considered a victory for “monetarism”, Volcker also continued a rate-hike cycle that pushed the federal funds rate to a recession-inducing 22%, a milestone for which he is today widely condemned.

Arguably the Jay Powell Fed will not be able to bring inflation down to its 2% target without increasing the FFR significantly — probably into the double digits. How high can rates go, and how strong can the dollar get, before the rest of the world “cries uncle”?

Will Powell make the same mistake as Volcker, running the economy into the ground with rate hikes? It seems likely, given the importance the Fed has placed not only on taming inflation, but maintaining the dollar system.

Mark Twain is reputed to have said, “History does not repeat itself but it rhymes.”

To be sure, the United States will not easily give up the dollar’s role as both the reserve currency and as the monetary unit in which trade payments are settled. Wars have been fought over less and I expect that any serious threats to USD hegemony will be seriously resisted.

However, I also believe the US dollar is due for a reckoning.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.