Victory Resources plans for drilling at Loner property in Nevada

2021.01.21

Precious metals are coming off a victorious year that saw gold and silver prices jump by 25% and 48%, as demand for safe haven assets skyrocketed due to the global pandemic.

Analysts are predicting that these metals could shine even brighter in 2021, with the same economic uncertainties associated with Covid-19 and repercussions of further stimulus measures carrying over in the coming months.

Not only does this mean further gains for gold and silver investors, mining companies would also see their project economics strengthen as a result of higher commodity prices, making this a good opportunity to hold and acquire more assets.

The same goes for up-and-coming miners. The key is to identify regions that have historically produced the most gold and silver, along with infrastructure and regulations that are conducive to mining operations.

One junior miner that is actively investigating multiple precious metals opportunities around the globe is Victory Resources Corp. (CSE: VR) (FWB: VR61) (OTC: VRCFF), which has assembled a portfolio of projects in some of the most popular gold mining jurisdictions here in North America.

First Pass Drilling at Loner

Consistently ranked among the best gold mining regions in the world, the US state of Nevada offers a low-risk, high-reward opportunity for mining upstarts.

Recently, Victory Resources began the process of exploring its Loner property in Nevada, filing a “notice of operations” towards permitting for a 500 m short-hole drill program that is scheduled to begin in early 2021, permit dependent.

Located about 35 km south of Winnemucca in the southern Sonoma Range, the Loner property currently consists of 16 federal lode claims covering historic workings and exposed low-sulphidation gold mineralization.

Recent exploration in the area includes the Goldbanks project, an epithermal gold project about 12 miles to the south, and the Coronado VMS project, which has been exploring for copper on a property about 6 miles to the southeast. The Loner project area is prospective for both these styles of mineralization.

The property was optioned by Victory in December 2020 from fellow Canadian miner Silver Range Resources (TSXV: SNG). Under their option agreement, Victory would acquire 80% of the project over a four-year period by making payments totalling $400,000 and completing 1,200 m of drilling on the property.

In the first pass drilling program, Victory intends to confirm intersections of gold-bearing quartz vein that correlates with historical underground mining and mapped surficial gold occurrences. The company anticipates that this will demonstrate broader mineralization across the width and depth of the occurrence, which remains open in all directions.

To date, bedrock grab sampling by Silver Range has returned grades of up to 16.6 g/t Au, while chip sampling in old workings has returned up to 25.7 g/t Au over 1.83 m. Prospecting during 2020 also identified additional workings on the expanded claim block, returning grab samples up to 10.6 g/t Au.

Based on analysis of surveys conducted in fall 2020, Silver Range said the strong gold and arsenic soil geochemical anomalies found on the property are coincident with the exposed mineralization and historic workings.

This indicates that the drill program may define the anomalies more extensively through-out the target area, according to David Deering, VP exploration and a director of Victory Resources.

Deering added that the first pass drilling work will evaluate the “best and most productive way” to continue bringing the project forward over the coming year.

Phase 1 Drilling at Mal-Wen

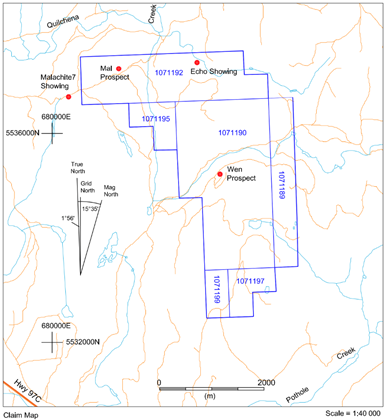

North of the border, Victory has also acquired three exploration projects that are diversified across different provinces. One of those is the Mal-Wen property, located about 30 km southeast of Merritt in south-central British Columbia.

The Mal-Wen property is made up of four contiguous claims covering a total area of 1,954.5 hectares, all 100% owned by Victory. It forms part of a larger copper-gold porphyry district that is known to host some of the best deposits in Western Canada.

The exploration target is an alkalic porphyry of the same age and type (intermediate to mafic volcanic country rocks belonging to the Triassic Nicola Formation) as the New Afton and Copper Mountain deposits. The Mal-Wen property occurs within Nicola Group rocks along the same trend as these deposits.

For reference, the New Afton deposit contains about 1 million ounces of gold and 802 million pounds of copper in reserves, while Copper Mountain has over 10.7 million ounces of gold and 2.3 million pounds of copper.

The specific geologic setting is especially similar to that of the Primer prospects 20 km to the south, where Nicola Group rocks are intruded by smaller alkalic intrusive bodies and dikes, rather than a large alkalic stock. The Rabbit North project, which has seen substantial exploration success recently and is 14 km southeast of New Afton, is another example of this type of system.

According to Victory, these alkalic porphyry deposits make attractive exploration projects for a number of reasons:

- They can form large copper deposits amenable to open-pit mining.

- They are often enriched in gold relative to calc-alkalic porphyry deposits.

- They are also often lower in sulphides, which lessens concerns around acid rock drainage.

In fall 2020, the company began the first phase of its work program at Mal-Wen, with the goal of advancing towards drilling as soon as permitting is completed. While there are current drill targets on the property, magnetic and IP surveys have never been done over the ground between the two main showings (i.e. the Mal and the Wen prospects).

Phase 1 drilling is intended to better define existing targets and locate new targets.

Exploration at Hammond Reef South

Also in fall 2020, Victory kicked off the first phase of exploration at its Hammond Reef South property in Ontario.

The project is located about 3 km south of Agnico Eagle’s Hammond Reef deposit, which contains an open-pit measured and indicated mineral resource of 208 million tonnes grading 0.67 g/t Au (containing 4.5 million ounces of gold).

The property area is underlain by the Archean Marmion Lake batholith, which is situated in the Wabigoon subprovince of the Superior Province of the Canadian Shield. The Marmion Lake batholith is dominantly felsic intrusive rocks varying from granite to tonalite.

North-northeast trending faults splay off the east-west trending Quetico Fault and mark the western boundary of the batholith. Where they crosscut the Marmion Batholith the faults become diffuse and disseminated as braided anastomosing zones of alteration with associated vein stockwork systems.

This diffuse zone of alteration and mineralization is up to 6 km wide and hosts the Hammond Reef gold deposit. Gold mineralization occurs in quartz veins and stockworks within zones of sericite alteration.

Victory believes that the Hammond Reef South property is immediately adjacent to this zone and may contain extensions of the Hammond Reef zone or parallel structures. Agnico has staked a large area that completely surrounds the property, suggesting they consider the area to be prospective.

Current exploration at Hammond Reef South focuses on prospecting and mapping of anomalous trends previously identified by Osisko Mining Inc. From 2009 to 2012, exploration carried out by Osisko returned significant mineralization just north of the property boundary. Anomalous samples from this local returned grades ranging from 0.18 to 4.75 g/t Au.

Lac Simard Property

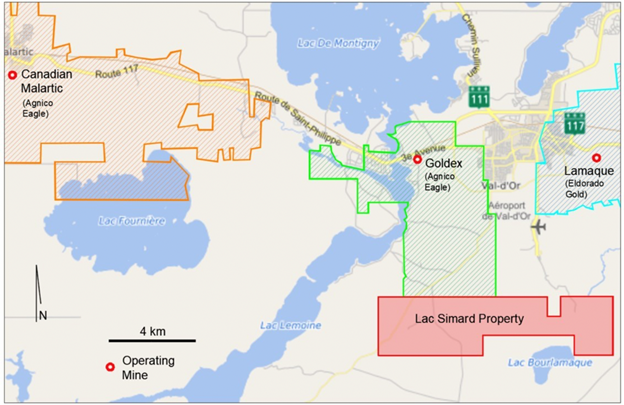

The most recent addition to Victory’s portfolio is the Lac Simard property in Quebec, which was acquired in September 2020 from Archie Capital Inc., an arm’s-length party. Located about 5 km south of Val-d’Or, Lac Simard consists of 46 contiguous mining titles with a total area of 2,560 hectares.

There are three operating gold mines within 20 km of the property including Agnico’s Goldex and Canadian Malartic mines and Eldorado Gold’s Lamaque mine (see map below). All three are considered to be orogenic gold deposits and occur along the Larder Lake – Cadillac Fault System.

The Goldex deposit, situated 6 km north of the property, has proven and probable mineral reserves of 1.1 million ounces of gold (21 million tonnes grading 1.61 g/t Au).

Lamaque, also 6 km to the north, is an underground gold mine that declared commercial production in spring 2019. It is expected to mine and process over 615,000 tonnes of ore at an average grade of 7 g/t Au.

About 20 km to the northwest is the Canadian Malartic, Canada’s largest operating open pit gold mine. Its gold reserves as of 2019 were 2.39 million ounces.

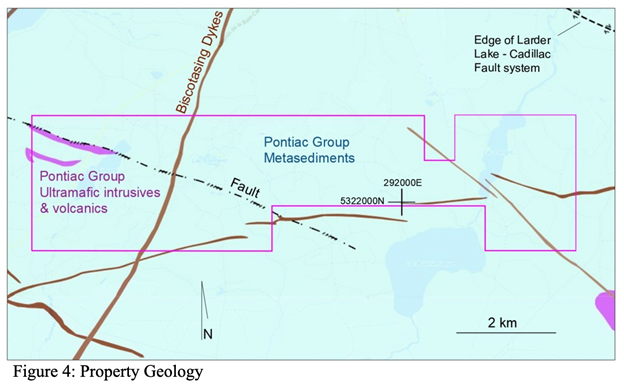

The Lac Simard property is largely underlain by metasediments of the Neoarchean Pontiac Group, with arrow ultramafic intrusives and/or volcanics occurring at the west end of the property.

Conclusion

As with every mining project, location is the key determinant of success.

Having gained a foothold in each of North America’s top gold mining districts, Victory Resources is well positioned and diversified to take advantage of the favorable market conditions for precious metals.

Not to mention, its projects are found within the vicinity of several million-ounce deposits, which strengthens the company’s prospects for growth.

Victory Resources Corp. (CSE: VR)

(FWB: VR61) (OTC: VRCFF),

Cdn$0.075, 2020.01.15

Shares Outstanding 19,322,104m

Market cap Cdn$1.44m

Victory Resources Corp. website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Victory Resources Corp Victory Resources Corp. (CSE: VR) (FWB: VR61) (OTC: VRCFF). VR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.