Victory Resources names new CEO as it expands exploration focus to battery metals

2021.04.02

As Victory Resources Corp. (CSE: VR) (FWB: VR61) (OTC: VRCFF) continues to scale up mining operations on multiple properties across North America, the company has made a significant management change to reflect its broadening exploration focus that now includes battery metals, appointing industry veteran Mark Ireton as new President and CEO.

“We are thrilled to welcome Mark to the Victory team. His experience, both in the mining and finance fields, is exactly the match Victory requires to grow its exploration capabilities and, very importantly, to operate at the highest levels of efficiency and purpose,” stated former president David Lane, who will remain with the company as a director.

Previously, Mark Ireton served as President and CEO of Canadian lithium miner Noram Ventures Inc. (TSXV: NRM), where he oversaw the exploration and advancement of that company’s primary asset, a clay lithium property with similar attributes to Victory’s newly acquired Smokey Lithium project, and in the same vicinity.

“Timing in the resource sector is everything and I am excited to join the Victory team, with a focus toward maximizing the value from a very promising portfolio of properties from gold to lithium,” Ireton stated in the March 29 news release.

“Victory’s exploration and work programs are progressing rapidly at a time when we see unprecedented demand for lithium and a continued appreciation in the value of metals across the board,” he added.

In recent months, Victory has added multiple properties to its portfolio, most recently announcing the Smokey Lithium and Black Diablo properties, all of which are in the world-class mining state of Nevada.

Smokey Lithium Property

Taking its exploration focus beyond precious metals, Victory announced earlier this month its acquisition of the Smokey Lithium project located in Esmeralda County, Nevada, located within the Big Smokey Valley.

Esmeralda County is considered a prolific region for lithium clay deposits with large proven tonnage and acceptable grades in excess of 900 ppm.

The Smokey Lithium property is located approximately 20 miles north of the Clayton Valley project held by Cypress Development Corp. (TSXV: CYP), and 20 miles west of American Lithium’s (TSXV: LI) flagship Tonopah lithium project, which has measured and indicated resources of 5.37 Mt of lithium carbonate equivalent. The Zeus lithium deposit being developed by Noram is also in the vicinity.

Victory’s property lies adjacent and contiguous to Jindalee Resources (ASX: JRL). Outcropping clay on the Au stralian miner’s property has demonstrated lithium grades as high as 930 ppm and perhaps trending northwest onto this property.

The entire project comprises 350 claims covering 7,000 acres with excellent access and relatively flat ground. The property is easily accessible, located just off a main highway and 2-track dirt road.

As consideration for the mineral claims, Victory will pay $178,500 cash and issue 1.5 million common shares to the vendor. The company would also need to pay $1 million in cash or common shares upon completion of a positive feasibility study on Smokey Lithium.

Subsequent to available acreage, Victory holds an exclusive option to acquire an additional 350 claims in the project area surrounding the claims in Esmeralda County, for a total of 7,000 additional acres. Upon exercise of this option, Victory will issue an additional 1.5 million shares and pay $200 per claim.

The property is subject to a net smelter royalty of 2% on revenues derived from the sale of lithium and other ores extracted from the property. Victory can buy back one-half of the royalty (1%) at any time for $1 million cash.

Geological Program

Shortly after its acquisition, Victory announced it has conducted a geological program on the Smokey Lithium property. This includes a two-day reconnaissance sampling program to provide a preliminary assessment of its geology, collect samples from select areas of interest and assess the company’s access to the claims.

Mudstones were observed on the property similar to those found on the adjacent Jindalee property, which have returned assays up to 930 ppm Li. Twenty grab and chip samples were collected from two areas underlain by mudstone, though most of the property remains unevaluated.

The company is now in the process of putting together an aggressive program to explore for a new discovery in this lithium-rich part of Nevada.

Lithium Market Rebound

Victory’s latest foray into lithium mining comes at just the right time.

There has been a resurgence in the global lithium market as governments aim for more stringent environmental targets, driving up interests in electric vehicles.

As a vital ingredient in EV batteries, lithium has seen its demand rebound from a sluggish two-year window between 2018-2020. In turn, the EV battery boom has sent lithium prices on an upward trajectory once again.

In China, arguably the world’s biggest EV market, the price of battery-grade lithium carbonate increased by 68% in the first two months of 2021 on the back of high battery demand, according to Benchmark Mineral Intelligence, a leading data provider for the Li-ion battery supply chain.

Through February, the Benchmark Lithium Price Index rose by 32% after plunging by nearly 60% from an all-time high in May 2018.

However, this may only be the beginning of a year-long lithium price rally across major EV markets.

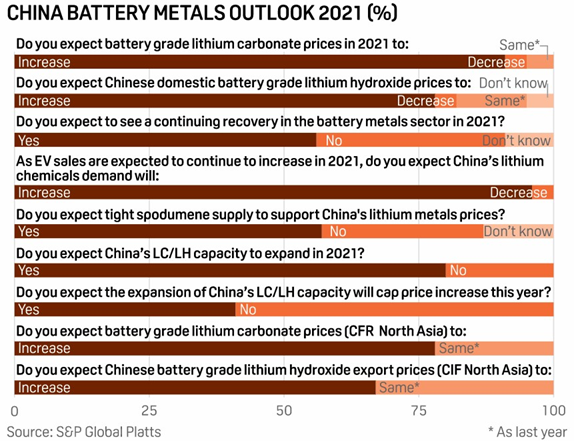

A recent study by S&P Global Platts shows that China’s demand for both battery-grade lithium carbonate and hydroxide is expected to increase in 2021 on even stronger EV sales. To complete the outlook report, Platts spoke to a group of 23 lithium metal producers, consumers, and analysts.

Some 96% of respondents expect China’s demand for lithium to rise further this year due to stimulus measures that will likely boost demand for EVs. More than half believe there will be a big recovery in the battery metals sector this year.

The survey respondents noted that with few new projects in the pipeline this year, the world’s spodumene supply could struggle to keep up with demand, ensuring prices are well supported.

On the demand side, Platts refers to figures from the China Association of Automobile Manufacturers, which predicts that domestic EV sales will hit 1.8 million units in 2021, up 40% from a year earlier. The stronger outlook is based on a recovering economy and policies to boost vehicle consumption.

Accordingly, most participants see domestic lithium carbonate prices reaching 80,000 RMB/mt ($12,371/mt) this year, an increase of more than 20% from early January.

In the long run, future refined lithium supply will remain tight with a period of sustained supply deficit in the mid-2020s, according to Roskill’s latest lithium outlook report.

In a recent interview with The Northern Miner, David Merriman, an expert on EV and battery materials at Roskill, says he believes the global demand for lithium carbonate equivalent (LCE) is expected to exceed one million tonnes in 2026.

Towards the end of the decade, the lithium market will move into a growing deficit of several hundred thousand tonnes of LCE, Merriman forecasts, adding that this will “require significant amounts of lithium supply brought online to meet demand growth.”

Black Diablo Project

In the same week as the lithium project acquisition, Victory also announced the staking of 16 mining claims in Nevada to complement its interests in the Loner gold property. The claims, together known as the Black Diablo property, are located south of Winnemucca, about 4 miles east-northeast of the Loner property.

At Black Diablo, Victory is exploring for VMS (volcanogenic massive sulphide) copper deposits in the same belt of rocks as Nevada Sunrise Gold Corp.’s Coronada project immediately to the south. The historic Big Mike copper mine, which produced approximately 25 million pounds of copper in 100,000 tonnes of ore grading 10.5% Cu, can be found on the Coronada property, about 10 miles south of the Black Diablo property.

According to Victory, the proximity of Black Diablo to the Loner property allows for cost-effective evaluation of the newly staked claims while crews are in the area.

The Black Diablo property hosts the Black Diablo manganese oxide mine. Regarding manganese oxide deposits, the USGS notes that (in the Winnemucca, Nevada area) “permissive and favorable tracts coincide with those of the Cyprus massive sulphide deposits.”

VMS deposits in ophiolite complexes are usually attributed to the Cyprus type. They are associated with arc-related volcanism, hosted by submarine mafic-volcanic rocks and their altered equivalents, typically in brecciated rocks commonly associated with pillow lavas, which have good buffering capacity. The deposits are characterized by copper or copper-zinc ores that are enriched in nickel, cobalt, and in places, manganese, and arsenic.

The Mineral Resource Data System entry for the Black Diablo deposit reports a sample containing 10,000 ppm Cu. As this is an anomalously high amount of copper for a manganese oxide deposit, it may indicate the area is particularly prospective for Cyprus-style VMS deposits such as the Big Mike.

Conclusion

Mining, like real estate, is all about location and timing.

Victory Resources has pretty much nailed the first part, having assembled an exciting portfolio of projects in Nevada, one of the best mining jurisdictions in North America, if not the world.

Not only has Victory made significant progress over the past few weeks in expanding its Nevada footprint, but the company has also taken a big step in its exploration efforts, having initiated a 500-metre drill program on the Loner property earlier in the month.

Timing-wise, Victory’s entry into lithium exploration just as the market for EV battery materials is beginning to heat up represents another significant milestone for the junior miner. The global EV revolution is not slowing down anytime soon, and for lithium miners, that spells opportunity.

And now, under the leadership of Mark Ireton, an experienced mining executive who oversaw the success of a similar project, and all cashed up from a recent financing, the company looks all set to capitalize on that opportunity.

Victory Resources Corp.

(CSE:VR, FWB: VR61, OTC:VRCFF)

Cdn$0.105, 2021.04.01

Shares Outstanding 68.8m

Market cap Cdn$6.5m

Victory Resources Corp. website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Victory Resources (CSE:VR). Victory is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.