US sanctions against Russia accelerating de-dollarization

2022.06.18

The dollar is the most important unit of account for international trade, the main medium of exchange for settling international transactions, and the store of value for central banks.

Lately though, “de-dollarization” is being pursued by countries with agendas at odds with the US, including Russia, China, Saudi Arabia and Iran.

As the target of US economic sanctions (for annexing Crimea, interfering in its election, and now, invading Ukraine), Russia sees diversification from the dollar and into gold and other currencies, as a way of skirting trade restrictions.

In 2021, China trimmed its holdings of US Treasuries for four straight months, in what analysts called a move to prevent potential adverse impact from escalating China-US tensions.

China really started to move away from the dollar in 2014. China agreed with Brazil on a $29 billion currency swap, to promote the Chinese yuan as a reserve currency. The Chinese and Russian central banks signed an agreement on yuan-rouble swaps to double trade between the two countries. The $150 billion deal is a way for Russia to move away from US dollar-dominated settlements.

A few years ago China came up with a new crude oil futures contract, priced in yuan and convertible into gold. The Shanghai-based contract allows oil exporters like Russia and Iran to dodge US sanctions against them by trading oil in yuan rather than US dollars.

More evidence of Chinese and Russian de-dollarization concerns the SWIFT system of international banking transactions.

In 2014 after Russia annexed Crimea, there were calls to cut Russia off from SWIFT. In response the Kremlin developed its own financial communications platform, SPFS. In December 2021, SPFS had 38 participants from nine countries. As of March, the system had 399 users. Russia is currently negotiating with China to join SPFS.

China has also developed an alternative to SWIFT, in 2015 launching the Cross-Border Interbank Payment System (CPS) to help internationalize the yuan.

Vladimir Putin’s invasion of Ukraine has resulted in the West’s (the US and its allies) attempt to isolate Russia through economic sanctions. But the plan has backfired. Not only have the sanctions failed to stop Russian aggression, the high energy prices resulting from the war, have boosted the rouble so that it is now the best-performing currency against the dollar. Russia’s energy exports may have declined due to Western sanctions but their value has increased. As buyers of Russian oil and gas lessen, others are stepping into the breach, including India. More importantly, the sanctions are pushing Russia closer to China, American’s main economic, political and military adversary.

At AOTH we agree with an opinion piece published in The Hill and authored by Brahma Channelly, the author of nine books, including the award-winning ‘Water: Asia’s New Battleground’, who writes:

The efficacy of U.S. sanctions has been eroding with the relative decline of American power, and a growing body of evidence suggests that such measures have often proved counterproductive to America’s own economic and geopolitical interests.

The U.S. has virtually ejected Russia from the Western-led financial order at a time when economic power is moving east. Expelling the world’s 11th-largest economy from an order that the U.S. seeks to uphold could intensify the search for a viable alternative system that isn’t dominated by the West.

What is more certain is that the new U.S.-led hybrid war against Russia, centered on unparalleled sanctions, will help deepen the undeclared Beijing-Moscow axis against Washington and make China the big winner financially and geopolitically, thereby aiding its expansion of economic and military power.

Russia

There is little doubt that Biden’s flexing of economic muscle will only embolden Russia and other US rivals, namely China, to deprive the United States of the very power that makes sanctions so devastating —US dollar strength. Russia and China have both made moves to de-dollarize and set up new platforms for banking transactions outside of SWIFT that skirt US sanctions. The two nations share the same strategy of diversifying their foreign exchange reserves, encouraging more transactions in their own currencies, and reforming the global currency system through the IMF. As Foreign Affairs puts it, “Deteriorating U.S.-Chinese relations incentivize Beijing to join with Moscow in building a credible global financial system that excludes the United States.”

Without taking action to reverse this trend, Washington will see its global standing weaken.

Since 2018, the Bank of Russia has substantially reduced the share of dollars in its foreign exchange reserves, through purchases of gold, euros and yuan. As of March, 2022, Russia was the fourth largest holder of gold bullion, behind the US at no. 1, Germany, Italy and France. The country’s gold holdings have tripled since the first Russo-Ukraine war in 2014, and are estimated at around 20% of the BoR’s total reserves.

Foreign Affairs reports that between March and May 2018, the Bank of Russia cuts its holdings of US Treasury securities from $96.1 billion to $14.9 billion. In early 2019 the bank more than halved its US dollar assets by selling $101 billion. After the Biden administration imposed new sanctions on Moscow, Russia decided to completely remove dollar assets from its $186 billion sovereign wealth fund.

Apparently Russia is also preparing to launch a state-backed cryptocurrency that can get around the dollar, with Russian entities able to trade with anybody willing to accept the digital rouble without first converting it into dollars. Once set up, Russian banks would have access to international liquidity and be less vulnerable to sanctions.

Rouble benefiting

Normally a country facing economic sanctions would see its currency take a nose-dive. Not so for Russia.

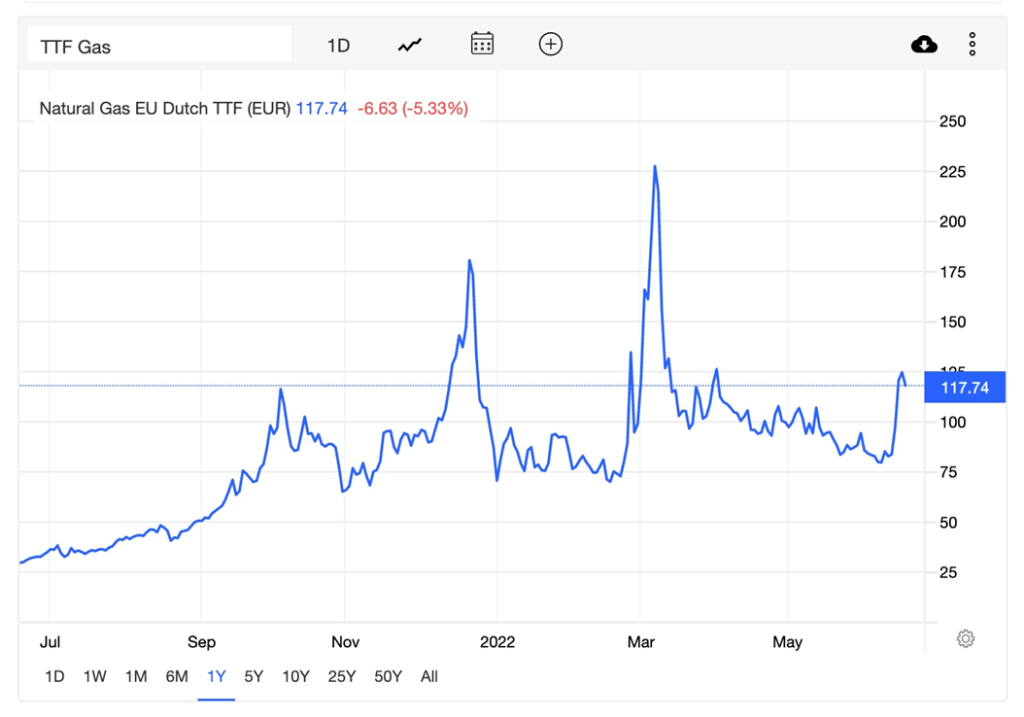

The main reason, of course, is energy prices. Russia is a major oil producer and supplies 40% of Europe’s natural gas. After Russia invaded Ukraine in February, already elevated oil and gas prices pushed even higher. The war may have horrified onlookers, but it hasn’t stopped purchases of Russian oil, gas, wheat, fertilizer, and minerals such as nickel and palladium.

According to CBS News, the country is pulling in nearly $20 billion a month from energy exports, and many foreign buyers are complying with Russia’s demand to pay for oil and gas in roubles, which is propping up the currency despite punishing sanctions.

Another lesser-known tactic was fixing the price of 5,000 roubles to a gram of gold. The quasi-gold standard forces traders to go to the Bank of Russia to convert gold into roubles to pay for oil, natural gas and Russia’s other significant exports. The steady demand for roubles is keeping the currency strong.

China

China and Russia have drastically reduced dollar usage in conducting trade. In 2015 about 90% of transactions used the dollar. After the trade war between the US and China broke out, the figure by 2019 had dropped to 51%. And that was before the war in Ukraine.

Bilateral currency swaps between Russia’s and China’s central banks helped Russia to bypass US sanctions in 2014. A three-year currency swap worth $24.5 billion, enabled each country to access the other’s currency without having to buy it on the foreign exchange market.

The Bank of Russia in early 2019 purchased $44 billion worth of Chinese yuan, tripling its share of Russia’s foreign exchange reserves from 5 to 15%. Russia’s yuan holdings are about 10 times the global average.

Major Russian energy companies including Gazprom and Rosneft have stopped using the US dollar, with the euro now the primary vehicle of trade between Russia and China. At the end of 2020 more than 83% of Russian exports to China were settled in euros.

Some believe the new US-Russia “cold war” that has been brought on by the war in Ukraine, will mostly benefit China, and help to minimize the financial damage to it from an attack on Taiwan. We agree.

According to the above-cited op-ed in The Hill,

The West’s heavy economic penalties on Moscow, including unplugging key Russian banks from the international SWIFT payments system, are set to turn China into Russia’s banker, enabling it to reap vast profits. In structural terms too, Russia’s sanctions pain will be China’s gain: To help insulate itself from similar Western sanctions if it were to invade Taiwan, Beijing is seeking to boost the payments and reserve role of the yuan and the international use of its competitor to the SWIFT network — the Cross-Border Interbank Payment System, or CIPS. The West’s Russia sanctions are likely to provide a fillip to both efforts.

Furthermore, the sanctions have opened the path for China to build an energy safety net through greater land-based imports so that it can withstand a potential U.S.-led energy embargo or blockade in the event of a Chinese invasion of Taiwan. The re-imposition of sanctions on the Nord Stream 2 gas pipeline is welcome news for Beijing, which is seeking to further boost energy imports from Russia after concluding new oil and gas deals worth a whopping $117.5 billion during Russian President Vladimir Putin’s Beijing visit last month…

The outrage over Russia’s invasion of Ukraine should not obscure one key fact: China, with about a 10 times larger population and economy than Russia, poses the biggest challenge to America. Whereas Russia’s strategic priorities and ambitions are concentrated in its neighborhood, China is working to supplant the U.S. as the dominant global power.

The greatest beneficiary of US sanctions against Russia is China, the country that will pay the biggest price is, ironically, the United States.

India

We’ve always known that Russia and China have been gunning for the US, but it’s a little more surprising to see India courting trade with Russia in the wake of an attack on its neighbor.

As many countries took the high road and shunned Russia, India used the opportunity of cheaper energy prices to stock up on Russian crude. The country is the world’s third-largest oil consumer and over 80% of it is imported. According to tanker traffic in May quoted by the BBC, Russian oil imports are now the second-largest source for India behind Iraq.

The country is also reportedly considering a transaction system based on local currencies, where Indian exporters to Russia get paid in roubles instead of dollars or euros. The plan is to boost shipments by an additional $2 billion, by taking the place of countries that used to supply Russia with products before sanctions were imposed.

Middle East

Countries in the Middle East are also taking up the slack of Russia’s former trading partners. This week Business Standard reported that Iran’s state-run shipping company started its first transfer of Russian goods to India, using a new trade corridor that transits the Islamic Republic.

In 2019 Iran and Russia connected their financial messaging systems, thus bypassing SWIFT, while Russia and Turkey have discussed using the rouble and the Turkish lira in cross-border trade.

In a move that would surely anger the United States — the “petro-dollar” was born out of a deal between the Americans and the Saudis that would see the Kingdom sell oil in dollars in return for US protection — Saudi Arabia is reportedly in active talks with Beijing to price some of its oil sales in yuan. According to the Wall Street Journal, The Saudis are angry over the U.S.’s lack of support for their intervention in the Yemen civil war, and over the Biden administration’s attempt to strike a deal with Iran over its nuclear program. Saudi officials have said they were shocked by the precipitous U.S. withdrawal from Afghanistan last year.

Iran could soon start selling its oil and gas in rial instead of the dollar, dealing another blow to USD hegemony.

Conclusion

In trying to force Russia to end the war in Ukraine, sanctions have been imposed by the United States and its allies. For the most part they haven’t worked. Higher energy prices have benefited Russia and its currency, the rouble. President Biden was supposed to be the great conciliator, but in acting aggressively against Russia, not just with sanctions but by helping Ukraine with weapons and economic aid (roughly $54 billion has been approved by Congress so far), he has caused global division and hurt US dollar hegemony, and by extension, US global influence. A large percentage of the world’s population, some reports are as high as 85%, is ruled by governments who no longer wish to buy all their needed commodities with US dollars. They include Russia, China, India, Saudi Arabia and Iran.

Among the countries most benefiting from the war is China. The sanctions are pushing Russia closer to its Communist ally, and America’s main economic, political and military adversary. China and Russia have drastically reduced dollar usage, preferring instead to conduct trade in euros, roubles and yuan.

Despite pressure from Washington not to increase their oil purchases from Russia, China, India and other Asian nations have become an increasingly vital source of revenue for Moscow. A recent report from the Finland-based Centre for Research on Energy and Clean Air, said Russia earned $97.4 billion in revenues from fossil fuel exports in the first 100 days of the Ukraine invasion.

Economic power had begun shifting to the East even before the war in Ukraine, with China taking steps to make itself independent of the US, for example through its Belt and Road Initiative, and purchases of overseas mineral deposits such as copper, lithium and cobalt. China is watching closely to see how the US handles the war in Ukraine. The sanctions have opened up a path for China to receive more energy shipments from Russia, that could help it survive a US-led energy embargo if China invades Taiwan.

Instead of sanctions ruining the Russian economy and forcing a retreat from Ukraine, they have blown back in the United States’ face, with high energy prices fueling inflation that could easily lead to a global recession, through Fed and other central bank tightening. Remember too, the Biden administration has not removed Trump’s tariffs on Chinese goods, keeping the prices of many US imports elevated.

When you put it all together — near double-digit inflation, interest rates ratcheting higher, plummeting US stock markets, the increasing likelihood of a recession, and less demand for US dollars — America’s enemies couldn’t have asked for a better scenario.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.