US CBD sector moving closer to legalization

2021.01.21

Cannabidiol (CBD) is a non-psychoactive chemical found in marijuana and hemp plants. The substance is in marijuana joints, but in such low quantities that its presence is overwhelmed by THC and the other 100-odd compounds that make up a batch of pot.

The pot and hemp plant extract comes in the form of oils, oral sprays, creams, pills, or edibles like gummies and lollipops, and is marketed as a sleep aid, or for relieving stress and pain.

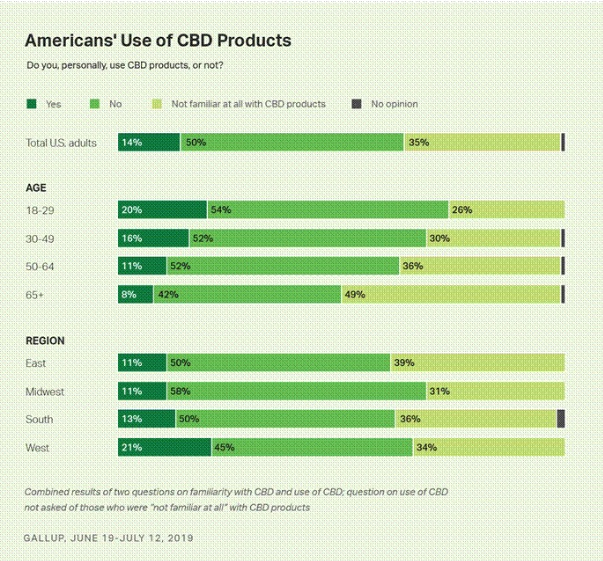

Prior to 2018, many Americans were still unfamiliar with CBD and the potential health benefits it entails.

This all changed with the passing of the 2018 Farm Bill, which made the growing and purchase of hemp plants legal in the US. Despite not completely legalizing CBD, the new bill made it much easier for industrial hemp growers to produce CBD.

Market interest and demand skyrocketed soon after, as more and more people began to recognize and embrace the compound’s therapeutic properties. A 2019 survey by Gallup shows that one in seven Americans consume CBD in some shape or form.

Now, CBD products have become one of the most popular ingredients in the wellness and edibles space.

Market growth

The CBD market is the perfect example of an industry undergoing exponential growth.

In 2019, the global market size for CBD was estimated at around $2.2 billion, more than 10 times its 2015 value of $200 million. This represents a CAGR of more than 46%.

This type of growth will likely continue in the coming years as the social stigma surrounding CBD continues to evaporate.

Industry analysts at Brightfield Group predict that the CBD market’s value will exceed $22 billion per annum as early as 2022.

These figures are slight increases from the forecast made by New York-based investment bank Cowen & Co, which conservatively estimated that the market could pull in $15 billion by 2025.

While there are varying figures projected for the CBD market value going forward, the one common factor is that there is a prevalent “green rush” in the US and around the world.

In the US alone, the collective market for CBD sales is projected to surpass $20 billion by 2024, according to BDS Analytics and Arcview Market Research.

The blue wave

The path to an improved US CBD market landscape appears to have been cleared by the so-called “blue wave” that materialized in the Nov. 3 US election, and the two recently decided Senate races in Georgia.

With the Democrats now controlling the House of Representatives, the Senate and the White House, industry participants are optimistic that federal regulations surrounding cannabis usage will be eased.

Investopedia notes that President-elect Joe Biden has said he wants marijuana decriminalized and the criminal records of those convicted of pot possession expunged. His Vice President, Kamala Harris, is also on board, having co-sponsored a bill to decriminalize pot. Harris also favors throwing out convictions for those caught with marijuana and has called for a path toward decriminalization and legalization.

A vote to decriminalize marijuana federally but let states decide their own cannabis policy was passed last month by the Democrat-controlled House.

Policy reform

Until the law is passed by the Senate, though (tie votes in the new Senate will be decided by Vice President Harris), cannabis laws in the United States will continue to be a patchwork.

Despite marijuana being illegal under federal law as a Schedule 1 drug, 15 states have legalized it for adults, and 34 allow its usage for medicinal purposes. From 11 at the beginning of November, four more states voted to legalize cannabis in the Nov. 3 election: New Jersey, Arizona, South Dakota and Montana. Canada officially legalized the controversial weed in 2018.

According to CBD Origin, a common misconception about the 2018 Farm Bill, is it legalized both hemp- and marijuana-derived CBD. This is untrue. Based on DEA guidelines, CBD is still a Schedule 1 substance and illegal. However, if the CBD is extracted from hemp, it will be removed from Schedule 1 under the following conditions:

- The hemp must contain less than 0.3% THC

- The hemp must adhere to the shared state-federal regulations

- The hemp must be grown by a properly licensed grower

The 2018 Farm Bill also removed restrictions on the sale, transportation, and possession of hemp-derived CBD products and allowed for the transportation of hemp-derived CBD products across state lines, as long as the products follow the above-defined regulations.

In 2019, the Department of Agriculture published the Interim Final Rule, designed to establish the Domestic Hemp Production Program. The IFR is expected to lay the foundation for testing and licensing protocols regarding hemp-derived cannabis products.

Marijuana-derived CBD is more complicated, because it comes from a plant that, federally, is illegal. Thus in states such as California and Colorado, where cannabis is 100% legal, so is CBD. Others allow marijuana-derived CBD usage under certain conditions, such as an underlying medical condition, while some states prohibit it outright.

If marijuana is legalized in the United States under federal law, as a consumable, CBD would come under the rubric of the FDA and other food/beverage regulatory agencies.

The current law does not allow foods to contain CBD, nor is it legal to advertise CBD-infused health and wellness products. However, the FDA has indicated that may change. In a December 2018 press release, the food and drug regulator said, “Although such products are generally prohibited to be introduced in interstate commerce, the FDA has the authority to issue a regulation allowing the use of a pharmaceutical ingredient in a food or dietary supplement. We are taking new steps to evaluate whether we should pursue such a process.”

According to Mackie Research analyst Greg McLeish, who reviewed the state of the industry in a 2020 update to clients, industry players in the US CBD market can also take heart from two events last year indicating that CBD is getting closer to full legalization. As quoted by Cantech letter,

McLeish points to legislation introduced on January 14, 2020, by Rep. Collin Peterson, Chair of the House Agriculture Committee, which would give the FDA the flexibility to allow hemp-derived CBD to be marketed in dietary supplements.

Then came these comments on February 26 from the FDA’s new commissioner, Dr. Stephen Hahn, on why CBD products likely aren’t going anywhere and thus should be accepted.

“People are using these products. We’re not going to be able to say you can’t use these products. It’s a fool’s game to try to even approach that,” said Hahn. “We have to be open to the fact that there might be some value in these products and certainly Americans think that’s the case. But we want to get them information to help them make the right decisions.”

This is positive news for companies in the industry, McLeish said.

It should be recognized that CBD has already been approved as a pharmaceutical drug in the form of Epidiolex, a drug created by GW Pharma to inhibit seizures.

SAFE Banking Act

As CBD legalization moves forward at the regulatory level, one significant challenge remains: banking. Congress has yet to lift banking restrictions on cannabis, meaning companies operating in the space have little access to capital, and have to rely on cash. This has limited the expansion potential of US-based cannabis firms.

However, a pending bill could loosen the purse strings and make things easier.

The Secure and Fair Enforcement (SAFE) Banking Act passed through the House of Representatives in 2019. The bill proposes to “… generally prohibit a federal banking regulator from penalizing a depository institution for providing banking services to a legitimate marijuana-related business.”

If passed by the Senate, which appears more likely now that the upper chamber is in effect controlled by the Democrats, banks would no longer be held liable for facilitating transactions for CBD/hemp businesses.

Cannabis investors are advised to follow news about the SAFE Banking Act and the STATES Act, which would amend the Controlled Substances Act to include marijuana. Passage of both could have a major impact on the ability of US cannabis companies to raise capital.

World High Life

One of the most significant growth stories in the CBD sector is Love Hemp LLC. and its parent company, World High Life, which trades under the symbols OTCQB:WRHLF and AQSE:LIFE.

World High Life’s mandate is to build a portfolio of companies that could follow a similar path as the industry’s most successful forerunner, Canopy Growth Corp. (NYSE: CGC).

Integral to this vision is Love Hemp Inc., the United Kingdom’s leading CBD supplier.

Established in 2015 by two London entrepreneurs, Love Hemp quickly gained recognition in the UK with the launch of innovative products such as Love Hemp water. The company’s product line has since expanded to a range of over 80 products including CBD oils, edibles, cosmetics and vapes, sold via its websites Love Hemp and CBDOilsUK. It also has a strong CBD wholesale presence through its LH Botanicals subsidiary.

Since its inception, sales have grown rapidly on a year-to-year basis, reaching a reported £2.6m in 2019. In 2020, the company planned to hit £6 million in total revenue, thanks to a 122% sales growth through February-September during the Covid period.

The company’s rising popularity has allowed it to secure listings in over 1,000 stores, including some of the biggest retailers in the UK, Ireland and the Netherlands.

Among the list of retailers is Boots, the UK’s leading health and beauty retailer. In December, the Love Hemp brand was launched across 200 Boots stores nationwide and online. Available products include CBD oil drops in natural, peppermint and cherry flavor, as well as CBD atomizer sprays in peppermint and orange.

The brand can also be found at Sainsbury’s, Ocado, Holland & Barrett, WH Smith and even Amazon.

Love Hemp Expands In-Store and Online with Holland & Barrett UK

Love Hemp Products now available in 880 Stores across the UK and Ireland

World High Life Plc (AQSE: LIFE) (OTCQB: WRHLF) is pleased to announce that its wholly owned subsidiary, London-based Love Hemp Limited (Love Hemp), has successfully launched a 10 SKU Love Hemp product line across 880 Holland & Barrett stores throughout the UK and Ireland, and online at www.hollandandbarrett.com.

Tony Calamita, CEO at Love Hemp says: “This is a significant relationship not only in its scale, but also because Love Hemp and Holland & Barrett have implemented a ground-breaking education and awareness program designed to inform consumers around the benefits of CBD. The opportunity to play such a leadership role in the category is directly aligned with our values. It is important to invest with partners such as H&B to increase knowledge and confidence for consumers, so they know they are buying credible products from credible retailers.”

Love Hemp’s success story culminated with a £9m acquisition by World High Life in 2019, but the business’s growth is far from over.

Building on an impressive consumer, trade and business audience of over 1.7 billion, Love Hemp is now looking to expand its brand across the rest of Europe and worldwide.

An expansion into North America is planned for Q1 2021 and Japan by the end of the year, and the company is also in discussions with authorities in South Korea and Thailand to launch its CBD products.

World High Life

OTCQB:WRHLF, AQSA:LIFE

US$0.0255, 2020.01.21

Shares Outstanding 230,119,819m

Market cap US$5.86

World High Life website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not owns shares of World High Life (OTCQB:WRHLF, AQSA:LIFE). WRHLF is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.