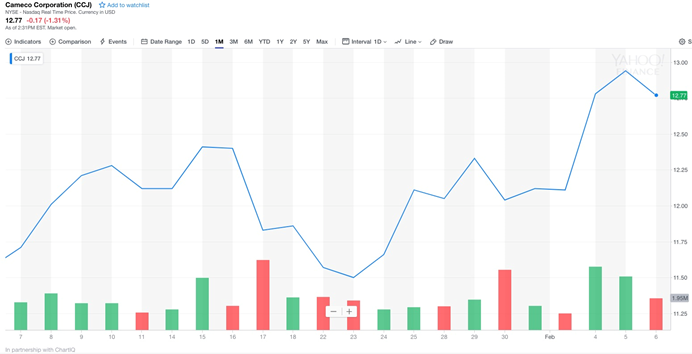

Uranium bellwether Cameco on the march

2019.02.07

On February 5 Cameco (TSX:CCO) broke through $13.00 for the first time since January 2017, when the Canadian uranium major made a brief appearance as a 13-dollar stock.

Sure, it’s almost half the $24 a share Cameco was worth in 2014, and another 50% less than the five-year high of $55 in 2007, four years prior to Fukushima, but uranium bulls should be thankful the tide appears to be turning for the downcast sector.

Other big uranium producers are seeing good action on their share prices. Paladin Energy has a 2.5-cent gain since the beginning of February, Energy Resources of Australia is up a dime, and market-mover KazAtomProm, a partially state-owned company, spiked to within 54 cents of a 52-week high, Tuesday.

Before the nuclear accident at Fukushima Daiichi, triuranium octoxide (U3O8) was trading at a heady $70 a pound. By 2017 the price of the nuclear fuel was plumbing $17 a pound, making almost all uranium mines uneconomic.

But it has since risen steadily, and was actually the mineral darling of 2018, with a gain of over 20%. As of Jan. 4, spot uranium was trading at $28.75 a pound.

So why the renewed interest in uranium?

First, the glut of uranium supply that has hung over the market is finally being cleared out. We know this due to the upward uranium price trajectory that has been trending since April 2018, when spot uranium bottomed out at $21 a pound. The price today is 37% higher.

The main way this excess supply is being mopped up is by less uranium being produced and adding to the pile. Several large uranium mines have shut down including Cameco’s McArthur River and Rabbit Lake mines in Saskatchewan.

In 2017 KazAtomProm announced a 20% production cut, to last three years, in the hope that decreased supply will lift uranium prices beyond the $20-something range per pound, which is below the cost of production.

Big mines like Ranger in Australia, and Rossing in Africa are running out of ore. As the grades become too low to be economic, these multi-million-pound producers will scale back production, or even close down, further inflating prices.

Second, there’s been a lot more buying.

Cameco has closed down mines, but is still committed to supplying uranium to its long-term contracts with utilities. With prices so low, it’s actually cheaper for the Canadian producer to buy uranium on the spot market than to mine it. Cameco will have to buy 8 to 12 million pounds of spot uranium in 2019. This represents around a quarter of spot.

On top of this, several new uranium funds and holding companies have emerged in the last year and a half. Seeing an imbalance in the market, their rationale is to buy uranium on the spot market, store it, and sell it later to utilities when the price goes up.

The third and fourth factors behind the improved picture for uranium are demand-related; they feed into the future price.

Uncovered uranium demand (utilities’ requirements for U3O8 that is not covered by contracts) is projected to increase by up to 54 million pounds by 2020, or just under a third of total demand that year. Then it keeps rising: 150 million pounds in 2025, 179 million pounds by 2030. That 179 million pounds of uncovered demand is actually 16 million pounds more U3O8 than total mined production predicted for that year.

Then there’s the continuing, and increasing, need for electrification.

Despite Germany shutting down its nuclear program after Fukushima, nuclear isn’t going away, in fact it’s getting stronger. According to nuclear consultant UxC, the global capacity for nuclear power is expected to grow by 27% between 2015 and 2030.

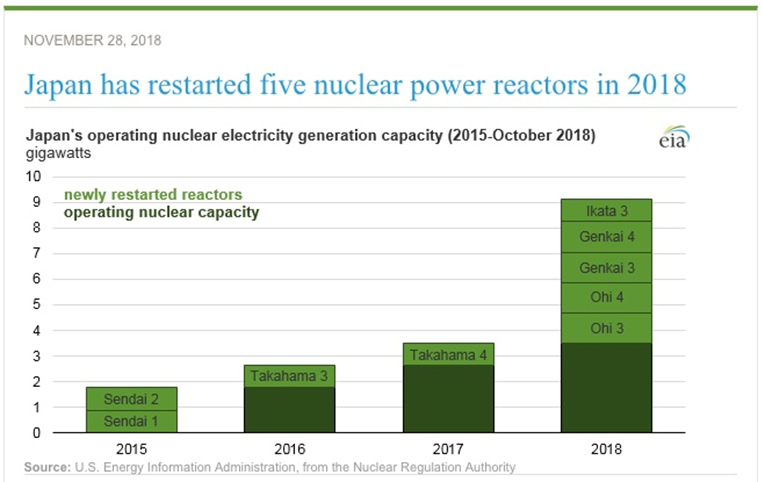

In Japan, 34 of the 54 reactors taken offline after the accident are expected to restart; nine already have, six have received regulatory approval to restart, and another 12 are being reviewed.

There are 56 new reactors being built globally. According to the World Nuclear Association, China with its appalling air pollution is the leader with 17 new reactors under construction and 184 planned or proposed. The country wants to have 58,000 megawatts available from nuclear by 2025 and is on the way to achieving its goal.

What will all this additional nuclear power plant capacity mean for uranium? UxC estimates annual uranium demand will spike by nearly 60%, from the current 190 million pounds of U3O8 to 300 million pounds by 2030.

For more read our Why the uranium price must go up

The bullish uranium environment bodes well for juniors exploring in the Athabasca Basin of Saskatchewan.

One of the best companies to have amassed a large, prospective land position is Skyharbour Resources (TSX-V:SYH).

The Vancouver-based company completed its fall drill program focusing on the Maverick Zone of its Moore property, located about 15 km east of Denison Mines’ Wheeler River project.

Drilling at the western end of the Maverick Zone, SYH pulled up a 15.2m intercept containing 0.56% U3O8 – including 3.11% U3O8 over 1.8m. The intercept – one of the broadest to date – occurred between 264.5m and 279.7m downhole, and most of the zone was below the unconformity in the basement rocks.

According to Skyharbour CEO Jordan Trimble, the high-grade intercept is proof that the basement rocks have a lot of potential to host more high-grade uranium mineralization, which was a key objective of the fall drill program.

“Conceptually it gives us a lot more confidence there’s probably a lot more to be found at depth.”

A recent $600,000 private placement means Skyharbour is fully cashed up for its next phase of exploration at Moore.

Skyhabour is also progressing its Preston uranium project in the Basin. The company’s joint venture partner Orano Canada Inc. will soon have drills turning at the project, located near NexGen Energy’s Arrow deposit, and Fission Uranium’s Triple R deposit.

The 3,600-meter, C$2.2 million winter drill program will focus on two targets, JL and FSA, previously identifed by an electromagnetic survey. The exploration program will encompass 11 to 15 drill holes, along with a ground EM survey around Canoe Lake, where Orano will investigate a conductive zone.

Under a prospect generation arrangement, SYH optioned 70% of Preston to French nuclear giant Orano (formerly Areva), which can earn up to 70% of Preston by spending $8 million over six years. The other 30% would be divided between Skyharbour and Clean Commodities.

At the same time, Skyharbour agreed with Azincourt Uranium to option 70% of another portion of Preston, with Azincourt issuing 4.5 million shares and spending $3.5 million over three years, to Skyharbour and Clean Commodities.

The two agreements in total mean that for $11.5 million in exploration and cash payments plus 4.5 million Azincourt shares, 70% of the Preston and East Preston projects will be optioned off.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Skyharbour Resources (TSX-V:SYH) is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of SYH.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.