Unwinding the financial system

By Alasdair Macleod

This article looks at the collateral side of financial transactions and some significant problems which are already emerging.

At a time when there is a veritable tsunami of dollar credit in foreign hands overhanging markets, it is obvious that continually falling bond prices will ensure bear markets in all financial asset values leading to dollar liquidation. This unwinding corrects an accumulation of foreign-owned dollars and dollar denominated assets since the Second World War both in and outside the US financial system.

Furthermore, collapsing collateral values, which are increasingly required backing for changing values in over $400 trillion nominal in interest rate swaps are a new driver for the crisis, forcing bond liquidation, driving prices down and yields higher: we are in a doom-loop.

What action can the authorities take to ensure that counterparty risk from widespread failures won’t take out inadequately capitalised regulated exchanges?

It seems that they acted some time ago by giving central security depositories (The Depository Trust and Clearing Corporation, Euroclear, and Clearstream) the right to pool securities on their registers and lend them out as collateral. Your investments, which you think you may own can be absorbed into the failing financial system without your knowledge.

This seems particularly relevant, given the appointment of JPMorgan Chase as custodian of the large gold ETF, SPDR Trust (ticker GLD). In a test case in the New York courts concerning Lehman’s failure, JPMC was given legal protection should it seize its customer’s assets.

This important erosion of property rights is poorly understood. But as the financial distortions are unwound, leading to unintended consequences such as bank failures and ultimately the collapse of the dollar-based fiat currency regime, the implication is that holders of physical gold ETFs will be left owning an empty shell at a time when they might have expected some protection from the collapse of the value of credit.

Introduction

In today’s complex markets it is difficult for the layman to understand their workings. It has always been about the expansion and limitation of bank credit, which must never be confused with money, and which from the dawn of history has been physical metal, particularly gold. But that is the medium of exchange of last resort, hoarded by individuals, and in recent centuries by central banks. And the layman’s understanding is further undermined by state propaganda which has dominated markets particularly since the suspension of the gold standard in America in 1933, which had lasted a century. Subsequent events have intensified monetary disinformation, leading to a global fiat money system based on the US dollar.

In order to give us all the illusion of price stability the Breton Woods Agreement was designed to promote the dollar as a gold substitute for all other currencies. That aspect of the illusion ended in 1971. Since then, to maintain the dollar’s credibility the US Government increasingly resorted to market manipulation. First, they tried selling gold into the market in the early seventies, which was readily bought and failed to stop the gold price from continuing to rise. The next wheeze was to create artificial demand for dollars in an attempt to support its purchasing power, measured against commodities and other currencies. This led to the expansion of derivative markets, which diverted speculative demand for commodities thereby suppressing their prices below where they would otherwise be. The expansion of the London bullion market which created paper gold, and the general adoption of the dollar not just to settle cross-border trade and commodity pricing but to replace gold in central banks’ reserves was all part of the deception.

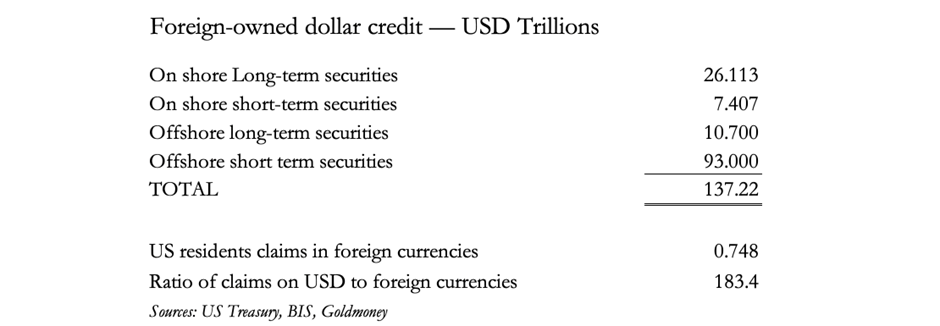

Over the fifty-two years since Bretton Woods was suspended, huge imbalances accumulated. In last week’s article I showed a table of bank and shadow bank dollar balances, onshore and offshore, which I repeat below.

The offshore element is considerably larger than that registered in the US Treasury’s TIC numbers, which in itself tells us that foreign interest in onshore dollar investments and bank balances exceeds US GDP by a fair margin on its own. The offshore element is based on the Bank for International Settlements analysis of dollar deposits and obligations outside the US financial system which we can equate with the eurodollar market. In the main, they are currency forwards and swaps where one leg is in US dollars.

Now that the financial bubble inflated by zero and negative interest rates is being lanced, these credit balances are bound to diminish. We can see why this is the case just with onshore long-term securities, comprised of bonds and equities, to which we must add the estimated $10.7 trillion of eurodollar long term bonds. That’s nearly $37 trillion in foreign-owned long-term investments overhanging US financial markets as bond yields start soaring, which is already in process. Including offshore eurodollars, it is a tsunami of dollar debt threatening to break on America’s shores.

The role of collateral in the LDI crisis

What is generally not understood by the layman is that it is inflated investments which underpin many over-the-counter derivative positions by acting as collateral. A problem arises when the value of collateral falls, triggering further calls. This attracted public attention in the UK when rising gilt yields threatened liability driven investment schemes, an example that we can use to improve our wider understanding of the role of collateral in derivative contracts, and the dangers presented by a collapse of the entire collateral system.

Liability driven investment (LDI) was being used by UK pension funds to enhance their returns. Defined benefit schemes faced with expensive final salary commitments to their beneficiaries were unable to meet these commitments from their investments when central banks reduced interest rates to the zero bound and through QE suppressed bond yields to minimal levels. The only solution for these DB schemes was to enhance their returns through leverage.

Typically, this was being achieved through a LDI scheme. It allowed a pension fund to protect itself from falling interest rates, which increases a pension fund’s future liabilities through net present value calculations. An LDI scheme provided leverage, so that the income on a gilt would be multiplied three of four times, allowing a pension fund to cover its future liabilities.

The pension fund invested in an LDI scheme has effectively entered into a leveraged interest rate swap with the LDI provider. A rising interest rate imparts a negative value to the swap, fixed income stream becomes worth less than the yield offered in the market. This requires the pension fund to put up collateral to the LDI provider. And leverage multiplies the collateral called. But pension funds tend to be fully invested, and don’t have that liquidity to hand, and were exposed to a radical increase in bond yields.

The crisis was triggered when markets became spooked by Liz Truss’s proposed budget in September 2022. Yields for the 10-year gilt rapidly rose from 3.88% to 4.5%. And for the 30-year maturity from 2.7% to 4.8%. In the latter case, the value of this gilt fell by 13% in a matter of days.

This forced pension funds to liquidate assets, including their gilts which is why the Bank of England had to step in to support the gilt market. And only when it was apparent that the authorities were stabilising gilt prices, panic among pension fund managers and LDI providers subsided.

LDI is going global

Gilt yields have now risen to even higher levels today, with the ten-year gilt yielding 4.63% and the 30-year 5.07%, so far without the LDI panic returning. Obviously, that episode alerted pension fund managers to the dangers, and they will have addressed their LDI risk accordingly. But the same cannot be said for the wider use of collateral in international markets, for which the 10-year US Treasury note is the “risk-free” yardstick. And in Europe, it is the ten-year German bund against which other euro-area bonds are compared. The chart below shows how these yields have risen recently.

LDI contracts are essentially interest rate swaps, exchanging a floating rate (in their case volatile gilt yields) for a fixed rate, usually enhanced through leverage. These characteristics are similar to those of the global interest rate swap market, which is enormous. According to the Bank for International Settlements at end-2022 it amounted to a nominal value of $405.5 trillion, of which $145.5 trillion is in dollars and $109.3 trillion equivalent in euros. With a shift in the global inflation and interest rate outlook, this is leading to mounting collateral demand from those who have taken the fixed rate leg. It is developing into a major crisis which probably requires much more than central bank intervention, such as that deployed by the Bank of England in the case of LDIs.

Furthermore, collateral values backing these derivatives and other leveraged commitments have fallen sharply, adding to enormous and escalating amounts of collateral top-ups being required. And this is occurring at a time when bank credit is tightening, which is bound to lead to higher market rates for bond yields anyway, even without collateral demand from interest rate swaps being unwound.

This is rapidly turning into a doom-loop, similar to that exposed by the UK’s LDI crisis, but involving the dollar, the euro, and all other major currencies. Additionally, US banks are probably heading towards a trillion dollars in mark to market losses on their bond positions, and as borrowing costs continue to rise the damage to their P&L accounts funding their bond holdings is increasing.

Perhaps this persuaded the Fed to go easy on interest rate policy, the FOMC having put it on pause last month. If so, it didn’t work, because US Treasury note yields rose sharply in the wake of the last FOMC statement. And then there is the commercial real estate crisis in America, to which regional banks are particularly exposed. This is a situation which is already out of control, with escalating collateral demand forcing liquidation of bonds, driving borrowing costs and bond yields inexorably higher.

It is becoming rapidly apparent to lenders that collateral values are likely to continue to fall, particularly for longer durations, and that leverage is the road to disaster. One question this raises, is that in their long-term planning have the authorities foreseen a possible collateral crisis of this sort and taken action to deal with it if it becomes reality. This question, but not the motivation is addressed in a new book by David Rogers Webb, The Great Taking.

The taking of your securities for collateral

Webb’s analysis initially centres on the dematerialisation of securities from certificate form into book entry on the Depository Trust and Clearing Corporation. It is the forerunner of Europe’s Clearstream and Euroclear. These are central securities depositories, closely allied to central clearing counterparties. Without the investing public being aware of the implications, certificated property ownership of securities has been replaced with a “security entitlement”.

The Depository Trust and Clearing Corporation also has a securities financing transaction clearing facility. From its website, we see that:

“The SFT Clearing service introduces central clearing for equity securities financing transactions, including lending, borrowing and Repo to:

- Support central clearing of institutional clients’ equity SFTs intermediated by sponsoring members.

- Support central clearing of equity SFTs between full service NSCC members.

- Maximize capital efficiency and mitigates systemic risks by introducing more membership and cleared transaction opportunities for market participants.”[i]

This confirms that pools of collateral are made available to institutions, without the knowledge of those who possess securities entitlements that there is another claim on them. They no longer have clear title to their investments.

Since the US’s Uniform Commercial Code enacting these changes was introduced, other jurisdictions such as the European Union and UK have followed suite. Besides the erosion of property rights for owners of securities, the objective appears to be to give institutions and hedge funds access to everyone’s property for collateral purposes. And where losses occur such as in a systemic failure, instead of the central securities depository taking the losses, it is those with the newly defined securities entitlements: in other words, you and me.

Undoubtedly, the framers of the Uniform Commercial Code had the protection of thinly capitalised exchanges in regulated markets in mind. We expect our transaction settlements to be guaranteed by regulated exchanges. But in a financial crisis leading to multiple counterparty failures, regulated markets cannot extend this protection. The solution has been to take this risk away from them and centralise it in central securities depositories, giving them the power to use the pools of securities under their control to ensure deliveries can continue under all circumstances. Not only does this allow collateral lending, but it transfers systemic risk from regulated exchanges to pools of securities entitlements.

It appears that the corruption of security holders’ rights doesn’t stop there, as the Safe Harbour clause in US bankruptcy law legislation can also apply. The relationship between central securities depositories, such as the Depository Trust and Clearing Corporation, and central clearing counterparties such as a systemically important bank enables this to happen.

In a test case in New York between Lehman Brothers creditors and JPMorgan Chase which acted as Lehman’s clearing agent, the creditors sought to reclaim $8.6bn from JPMorgan Chase.[ii] This was the amount which was seized by the bank as if it was collateral in the days leading to Lehman’s failure. Prior to the seizure, it was an obligation to Lehman in the form of deposits and securities without a lien. Indeed, in the 92 page ruling, there were many references to the legal status of these obligations.

It could be argued that without the safe harbour provisions in US bankruptcy law, the seizure of these assets would have been illegal. Indeed, this is the situation demonstrated under UK law, when JPMorgan was fined £33.32m by the Financial Services Authority in June 2010 for failing to ensure that client money, in other words funds which were custodial, was not properly segregated from the bank’s liabilities.

We learn two things from these different rulings. The first is that following the precedent of the US court in New York, JPMorgan has the power to ignore the distinction between assets held as collateral and assets which the bank has an obligation to discharge to a depositor. And secondly, this US bank, which happens to be the largest and the Fed’s primary conduit into commercial banking has failed to distinguish between that relationship in US law and its legal and regulatory obligations in other jurisdictions, such as the UK.

JPMorgan’s relationship with gold

At the outset, it is worth noting that regulatory bodies tend to give large banks the benefit of the doubt, only looking closely at their compliance activities when they can no longer be ignored. Consequently, large banks have been known to act as if regulations don’t exist. The example above, where it was absolutely plain that JPMorgan Chase was in breach of the regulations with respect to custodial client money in London may or may not have been an exception. We are entitled to assume that some of the smartest lawyers and compliance officers are employed by JPMorgan Chase who should have known better.

This lack of respect for the law was demonstrated in an important case in the gold market, when JPMorgan Chase’s global head of precious metals trading and board member of the London Bullion Market Association was found guilty of attempted price manipulation, commodities fraud, wire fraud and spoofing prices in gold, silver, platinum, and palladium futures. And it is not as if this was an isolated case: it had been going on for eight years involving thousands of unlawful trading sequences. And another colleague heading up the New York gold desk was also found guilty. That was in July 2019. Finally, in 2020 the bank itself pleaded guilty to unlawful trading in precious metals futures markets and was heavily fined.

Inexplicably, with this track record JPMorgan Chase Bank was recently appointed joint custodian of SPDR Gold Shares (GLD) alongside HSBC. This ETF is the largest in existence by far and its sponsor is a subsidiary of the World Gold Council. Why the WGC sanctioned the appointment of a bank whose senior dealers in precious metals have been found guilty of manipulating gold prices and jailed is a mystery. It is not as if having one custodian represents more risk than two. Furthermore, HSBC stores all GLD bullion in its London vaults, so that it is subject to English property law and securities regulation in every respect.

JPMorgan Chase is reported to be considering the transfer of GLD’s bullion to its vaults in New York. It is thought that their vault is linked underground to the Fed’s vault, with the Fed on the north side of Liberty Street and Chase Bank across the road.[iii] It is in this context that we return to David Webb’s analysis of central counterparties, ownership of securities as property being replaced with a “security entitlement”, and the free use of that security entitlement as collateral without the knowledge or agreement of the entitled. And according to the ruling of the New York court effectively extending this facility to JPMorgan Chase as a central clearing counterparty, we may be assembling a picture which will allow JPMorgan Chase to use GLD’s bullion as collateral, or perhaps to lease or swap it, or alternatively to dispose of it in return for a book entry credit.

Our suspicions will be increased when we think through the implications of the proximity of JPMorgan Chase’s vault to the Fed’s vault across the road and circumstantial evidence of a tunnel between the two. Stored in the Fed’s vault is gold for the New York Fed, earmarked for foreign central banks. And when we remember the difficulty Germany had getting the New York Fed to return a paltry 300 tonnes, doubtless our suspicions will go into overdrive.

Undoubtedly, GLD’s trustee The Bank of New York Mellon and the World Gold Council have some serious questions to answer as to why JPMorgan Chase was appointed a custodian. Here are just a few suggestions:

- Did the Trustee of the World Gold Council come under pressure or recommendation from any government organisation or monetary authority to appoint JPMorgan Chase a custodian to the SPDR Trust?

- Were the Trustee and Council not aware that JPMorgan Chase has a history of market manipulation in gold contracts, and that the bank had pleaded guilty. According to the Office of Public Affairs in the US Department of Justice: “In September 2020, JPMorgan admitted to committing wire fraud in connection with: (1) unlawful trading in the markets for precious metals futures contracts; and (2) unlawful trading in the markets for U.S. Treasury futures contracts and in the secondary (cash) market for U.S. Treasury notes and bonds. JPMorgan entered into a three-year deferred prosecution agreement through which it paid more than $920 million in a criminal monetary penalty, criminal disgorgement, and victim compensation, with parallel resolutions by the Commodity Futures Trading Commission (CFTC) and the Securities Exchange Commission announced on the same day.”[iv]

- Furthermore, that two of their senior staff were on trial when JPMorgan Chase was appointed custodian, one of which served on the board of the LBMA and ran JPMorgan’s global precious metals desk, and the other an executive director and trader on the New York precious metal desk? And that both men were subsequently jailed and fined for market manipulation in August?[v]

Almost certainly, the Trustee and the World Gold Council’s management won’t be called upon to answer these questions. But the legal position of GLD shareholders’ underlying property assets is compromised by these developments.

Furthermore, authorised participants can borrow their shares from a centralised securities depository and redeem them for physical gold. By hedging their position in futures or London’s forward markets, they are under no pressure to return the gold and close their stock loan. Given this facility, far from GLD being a secure investment in gold bullion, it may already be being used as a source of liquidity for bullion dealers.

Conclusion

There can be little doubt that access to GLD’s property would be a partial solution to urgent problems arising from over fifty years of official suppression of the gold price. As I have written before, after extensive and careful research, analyst Frank Veneroso concluded as long ago as 2002 that between 10,000 and 14,000 tonnes of central bank gold were either leased or swapped. And he further concluded that much of that gold “was adorning Asian women” so would not be returned.

We know that the Bank of England arranges these contracts for its central bank clients. We can only assume that the New York Fed similarly arranges these income generating activities on behalf of earmarked gold in its custody. Worse still is the thought that the New York Fed might have sold off earmarked gold into the markets, which would explain why it refused to let Bundesbank representatives inspect its gold, and initially proved extremely reluctant to return only 300 tonnes out of 1,536 tonnes of Germany’s gold supposedly held in the New York vault. And presumably, it was the Bundesbank’s experience which prompted the Dutch Central Bank to repatriate 122 tonnes of its gold from New York, leaving 190 tonnes behind at the New York Fed.

With the failing of the fiat currency regime, the chickens of gold leasing and price suppression are now coming home to roost. It is becoming apparent that at a minimum the stagflationary conditions of the 1970s are returning, when gold rose from the official rate of $35 per ounce to over $800. And the Fed funds rate rose from about 6% to nearly 20%. After fifty-two years of currency debasement, the starting point for a new rise in the gold price is somewhere between $1500—$2000. And arguably, the dollar is in a far worse position today than it was when President Nixon suspended the Bretton Woods Agreement.

The legal position in the US is shared with the EU and UK, whereby holders of shares in ETFs could find the property in them plundered through the agency of JPMorgan Chase and other central clearing counterparties, where, it seems, their status permits them to deploy bullion and other private property as they see fit.

The bullion banks are currently trying to close their paper shorts and to go long, benefiting from the ignorance of speculators, who believe that higher interest rates are bad for gold. That may be true in markets devoid of systemic and inflation risks, but only these fellows below would take this seriously in the developing situation.

Currently, bond yields are rising strongly, which means that collateral values are falling. It amounts to a credit contraction of up to 30% on longer dated bonds so far. And where collateral backs leveraged interest rate swap positions, calls can be catastrophic.

Fairly quickly, the gold price can be expected to reflect systemic and currency risks, which will trump any meme the three wise monkeys might come up with. Driving the dollar’s falling value measured in goods will be the funding outlook for the US Government. With interest costs likely to rise to $1.5 trillion in the fiscal year just started and the onset of economic stagnation if not outright recession, the budget deficit could easily top $3.5 trillion, perhaps eight or nine per cent of expenditure. And this is at a time of diminishing foreign appetite for US Treasuries.

This takes us back to the enormous mountain of dollar credit in foreign hands, quantified in the table at the beginning of the article. Long term investments, totalling $26.113 trillion, plus a further $10.7 trillion in Eurobonds will all fall in value as interest rates continue to rise. There can be no doubt that foreigners will sell these positions down. Their only problem is what to do with cash dollars, which already amount to over $100 trillion. Other currencies are mostly less attractive than the dollar. There is only one thing to be done, and that is to follow the Singaporeans, who have the prescience to accumulate hard real money without counterparty risk, which is physical gold.

And finally, there are geopolitical considerations. The deteriorating collateral position is surely being observed with concern in Asia and the Global South. The sudden rise in US Treasury bond yields is signalling that a global version of the UK’s liability driven investment debacle is already developing, in which case the collapse of financial market values could escalate rapidly from here.

It is against this background that Russia and Saudi Arabia are driving up energy prices, leading to rising CPI inflation and expectations of higher interest rates to come. Commercial banks will almost certainly intensify credit restrictions as well. Viewed from outside America, it all amounts to intolerable pressures on the US and Eurozone credit systems. And if Russia, perhaps followed by China decide to deploy their gold reserves in order to secure the value of their currencies, it is bound to be the coup de grace for the fiat currency system.

[i] See https://dtcclearning.com/products-and-services/equities-clearing/sft-clearing.html

[ii] See https://www.nysb.uscourts.gov/sites/default/files/opinions/198038_134_opinion.pdf

[iii] See Ronan Manly’s article at https://www.bullionstar.com/blogs/ronan-manly/keys-gold-vaults-new-york-fed-part-2-auxiliary-vault/

[iv] See https://www.justice.gov/opa/pr/former-jp-morgan-precious-metals-traders-sentenced-prison

[v] Ibid.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.