Universal hits copper on first drill hole at Poplar

- Home

- Articles

- Uncategorized

- Universal hits copper on first drill hole at Poplar

2019.09.07

The first of several drill holes planned for Universal Copper’s (TSX-V:UNV) Poplar project in British Columbia shows indications of strong mineralization.

In a September 4 news release, Universal says disseminated chalcopyrite – a copper pathfinder mineral – was noticed 160 meters deep, and continued to the end of the 511-meter Hole 19-PC-129, from which drill core samples were pulled.

Cores were sawn in half for the length of the hole and sampled in three-meter intervals. Molybdenite was found concentrated in quartz veins and quartz stockworks.

“We are very pleased to see excellent copper mineralization throughout the drill hole and eagerly await the assay results,” said Clive Massey, Universal Copper’s CEO. He added, “We continue to push toward an expansion of the historic resource and a new current mineral resource.”

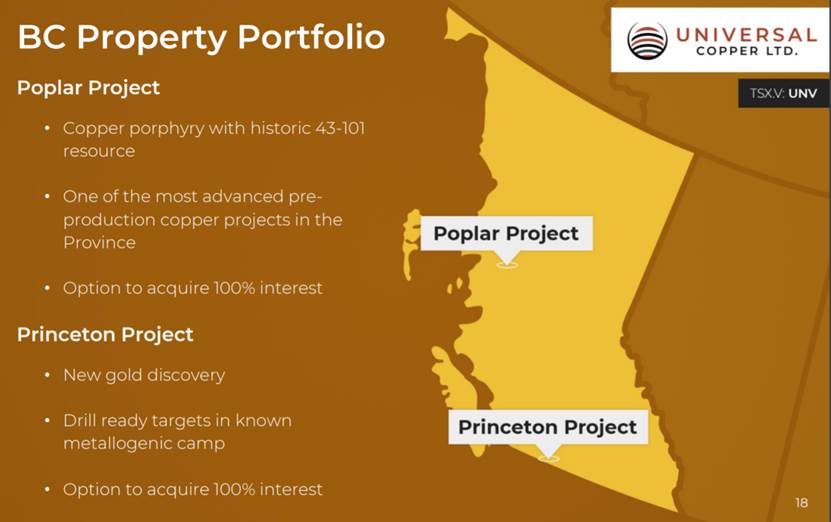

Poplar is one of two copper plays that Universal Copper is focused on – the other being the North Block of the Gachala project in Colombia, that UNV acquired from Max Resource Corp.

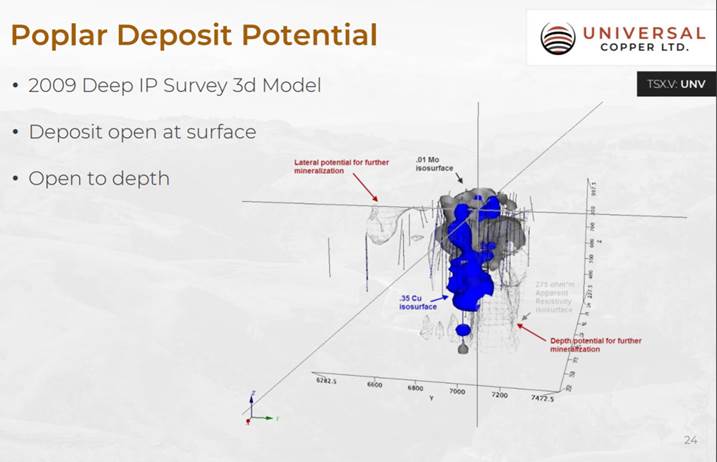

Originally discovered in 1974, Poplar has been heavily explored by a number of companies including BHP, the world’s largest mining company. Over 30,000 meters have been drilled, in close to 300 holes. A number of the holes bottomed in mineralization; the potential deposit delineated so far is open at depth and along strike.

Poplar hosts an indicated mineral resource of 131 million tonnes grading 0.31% copper (Cu), 0.009% molybdenum (Mo), 0.09 grams per tonne (g/t) gold (Au), 2.39 g/t silver (Ag); and 132 million tonnes inferred, grading 0.27% Cu, 0.005% Mo, 0.07 g/t Au and 3.75 g/t Ag. The historical resource, compiled in 2012, is based on 147 drill holes.

Universal Copper is conducting exploration of the copper-gold-silver-moly property around targets identified during previous exploration programs, and by a long-wave-infrared (LWIR) survey completed at the end of 2017.

A key takeaway from the survey was a direct correlation found between the nearby Silver Queen property, owned by New Nadina Explorations, and the Poplar deposit, particularly the identification of sericite, an alteration mineral frequently associated with hydrothermal mineralization, such as vein and porphyry deposits.

Porphyry deposits are usually low-grade but large and bulk mineable, making them attractive targets for mineral explorers. Gold, copper, silver and lead are among the metals found in porphyries.

LWIR is a new mineral exploration technique that employs satellite imagery to uncover targets that were previously unavailable to exploration companies. LWIR bands can penetrate vegetation and other ground cover, to mathematically “fingerprint” mineralized areas.

The 2019 exploration program includes prospecting, mapping, soil and rock sampling, concentrating on the western part of the property where a forest fire last year likely exposed a number of mineralized outcrops. The goal is to chase the known mineralization to depth, and to make the historical resource current.

UNV will be guided in its exploration efforts by three widely spaced holes drilled in late 2018. The drills cut mineralization consisting of disseminated pyrite/chalcopyrite, and stockwork vein to veinlet pyrite, chalcopyrite and molybdenite.

The best results were:

- a 30-meter interval of 0.554% Cu, 0.027% Mo, 0.104 g/t Au and 4.44 g/t Ag;

- a 27-meter interval averaging 0.643% Cu, 0.030% Mo, 0.146 g/t Au and 2.62 g/t Ag; and

- 0.330% Cu, 0.002 % Mo, 0.118 g/t Au and 3.46 g/t Ag over 151.10 meters.

For perspective, most copper mines in BC are under 0.4% copper, so the grades are above average.

Results from the 30m interval back up a hypothesis from an earlier induced polarization (IP) survey, that the mineralization continues to depth.

Wednesday’s announcement also appears to confirm that theory, although we must caution investors that assay results are pending.

British Columbia is known for its low-grade but big copper-gold porphyry deposits including Highland Valley, KSM, Prosperity and New Afton. The lower grades are made up for with other metals found in the deposits like gold and molybdenum, making them more economic if or when copper prices slump.

BC is Canada’s largest copper-producing province and the red metal is BC’s second-most valuable mining commodity export, behind metallurgical coal.

At the Association for Mineral Exploration BC Roundup (AMEBC) conference in January, a speaker at a panel called ‘The B.C. Copper Advantage’ pointed out the high demand for copper in a future low-carbon, electrified economy (EVs, wind turbines etc.) has BC well-positioned.

A recent report from Wood Mackenzie states that copper consumption is expected to grow 250% by 2030, due to the implementation of 20 million electric vehicle charging points. Other EV battery metals such as cobalt, nickel and lithium are anticipated to remain in high demand.

Meanwhile copper supply is projected to tighten. The combination of high demand and diminished supply will build a stable floor beneath copper prices.

According to the International Copper Study Group, world copper mine production shrunk from 1.797 million tonnes in November 2018, to 1.515Mt in February 2019, an 18.6% decrease.

As we wrote in The coming copper crunch, by 2035, without major new mines up and running to replace the ore that is being depleted from existing copper mines, we are looking at a 15-million-tonne supply deficit by 2035.

Enter quality juniors like Universal Copper, whose undeveloped red-metal deposits can help to correct the coming supply-demand imbalance.

We like that Universal has two very prospective copper projects. Its Gachala property in Colombia has geology analogous to Kamoa-Kakula in Africa, the largest undeveloped high-grade copper discovery in the world.

Its Poplar project in British Columbia has seen a lot of historical drilling and it comes with a resource – meaning Universal is able to skip that step and move straight into proving up reserves and starting a PEA. The prospect of finding a porphyry among BC’s jumbled copper-gold mineralization is very exciting.

I expect lots more news flow from UNV in the coming months.

Universal Copper Ltd

TSX-V:UNV Cdn$0.055 2019.09.06

Shares Outstanding 37,977,272m

Market cap Cdn$2.08m

UNV website

*****

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Universal Copper and UNV is an advertiser on Richards site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.