Undervalued silver poised for explosive move higher – Richard Mills

2025.02.28

Spot silver gained 27% in 2024. The white metal benefited mostly from physical buying in India and China. Silver ETFs have also been a factor.

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty.

However, much of silver’s value is derived from its industrial demand. It’s estimated around 60% of silver is utilized in industrial applications, like solar and electronics, leaving only 40% for investing.

The lustrous metal has a multitude of industrial applications. This includes solar power, the automotive industry, brazing and soldering, 5G, and printed and flexible electronics.

A report by Oxford Economics commissioned by the Silver Institute found that demand for industrial applications, jewelry production and silverware fabrication is forecast to increase by 42% between 2023 and 2033.

The Silver Institute expected demand to grow by 2% in 2024, led by an anticipated 20% gain in the solar PV market.

Silver’s application in solid-state batteries is a future usage that could mean significant new silver uptake. The batteries are seen not just as the future of electric vehicles but also as a game changer in energy solutions due to their superior safety, energy and longevity compared to traditional lithium-ion batteries, according to Citizen Watch Report.

Samsung has reportedly developed a solid-state battery that can deliver a 600-mile range on a 9-minute charge, and a lifespan up to 20 years. The battery incorporates a silver-carbon composite layer for the anode.

Each battery cell uses about 5 grams of silver and a standard 100kWh EV battery pack would potentially require 1 kg of silver. Applications aren’t confined to automotive; solid state batteries could be fitted into consumer electronics and energy storage systems.

Estimates quoted by Citizen Watch Report suggest that if only 20% of global car production adopts solid-state batteries, the annual demand for silver could reach 16,000 tonnes, compared to 25,000 tonnes of global mine production currently.

Total silver supply should decrease by 1%, meaning 2024 should see another deficit, amounting to 215.3Moz, the second-largest in more than 20 years.

In fact it’s the fourth year in a row that the silver market would be in a structural supply deficit.

As for what’s in store for silver in 2025, UBS financial markets strategist Julian Wee says that silver could enjoy a spillover effect from gold.

He suggested stronger industrial demand could propel silver higher, especially if China lowers interest rates, sparking a recovery in global manufacturing. The People’s Bank of China lowered its benchmark lending rates by 25 basis points in October.

Wee said on the supply side, mining output should remain constrained in 2025. “We thus expect prices to reach USD$36-38/oz in 2025, and advise investors to stay long the metal or use it for yield pickup opportunities,” he said via Kitco.

In fact there is evidence to suggest that silver could be on the verge of its biggest breakout in history, with projections of $50 an ounce by mid-year.

The Jerusalem Post reports that governments and central banks are taking an increasing interest in silver for both its monetary and industrial purposes. For example, some central banks are considering adding silver to their portfolios, while several countries are stockpiling silver supplies for high-tech and defense applications. Silver’s use in solar power has made it a strategic metal.

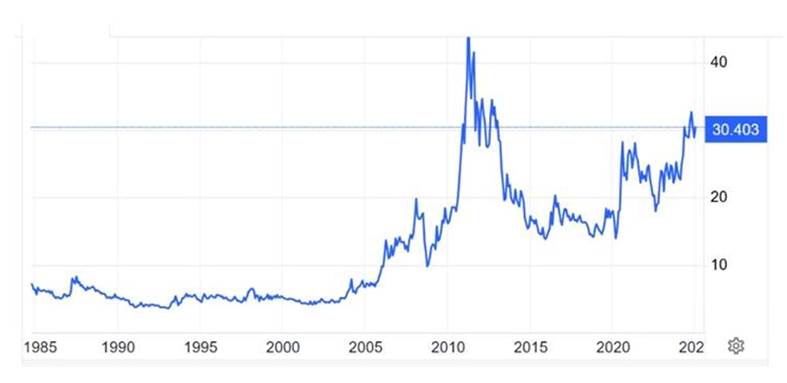

The gold-silver ratio shows how many ounces of silver equal one ounce of gold. The ratio is a good indication of whether silver is under- or over-valued. To find it, simply divide the price of gold by the price of silver.

As of this writing, the gold-silver ratio sits at 90.9. Historically, when the ratio is this high, silver tends to outperform gold in the following months. The historical average for the gold-to-silver ratio has typically ranged between 50 and 70, meaning silver is significantly undervalued relative to gold at current levels.

In an interview on CapitalCosm, precious metals analyst Peter Krauth argues that the Federal Reserve’s policy of keeping interest rates near zero for an extended period has contributed to the current inflationary pressures and that recent rate hikes may not be enough to control it.

He cited instances where silver prices tripled within a few years and mentioned silver companies that witnessed gains of 16 times and 17 times their share price within a two to three-year period.

The author of ‘The Great Silver Bull’ thinks a new bull market in silver will be driven by inflation, rising interest rates and the impact of the Trump tariffs. He sees the current economic climate as similar to the 1970s when silver prices skyrocketed amid high inflation.

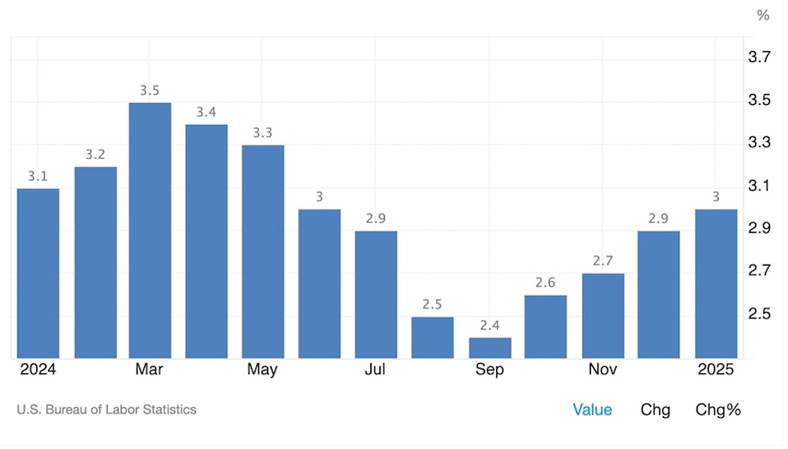

Consumer prices rose 2.6% in December from a year earlier, up from 2.4% in November and the third straight monthly increase. AP notes the Jan. 31 figures arrived two days after the Federal Reserve paused interest rate cuts in part because inflation has been stuck at about 2.5%, above their 2% target, for the past six months.

Tom Stevenson from Fidelity International believes silver is a better way to play the uncertainty happening due to the economic policies of the Trump administration than gold.

“More than half of the annual demand for silver comes from industrial uses, in myriad electronics applications — notably renewable energy, artificial intelligence (AI), and defence. Also, in the chemicals industry and in medical equipment — bacteria will not grow on silver. But, as with gold, macro drivers such as inflation and interest rates, geo-political stress, and policy shifts are an influence on the silver price,” he told Kitco News.

Stevenson noted the current gold-silver ratio is partly justified due to gold being a risk management tool, but it doesn’t recognize the growing deficit in the market for silver.

“The traditional correlation between the two metals has broken down and gold looks overvalued compared to silver, which remains well below its recent peak,” he said, suggesting that best ways to benefit from silver’s upside is either via silver ETFs or silver miners’ stocks.

In another Kitco News piece, John Weyer, director of the commercial hedge division at Walsh Trading, said that even though the Trump administration opposes renewable energy, the large infrastructure bills passed under the Biden administration will still happen — bolstering the demand for silver.

Mining magnate Frank Giustra said that unlike gold, silver’s price is not yet dictated by Eastern markets. He predicts that silver prices will follow gold’s upward trend and potentially outperform gold in an explosive bull market.

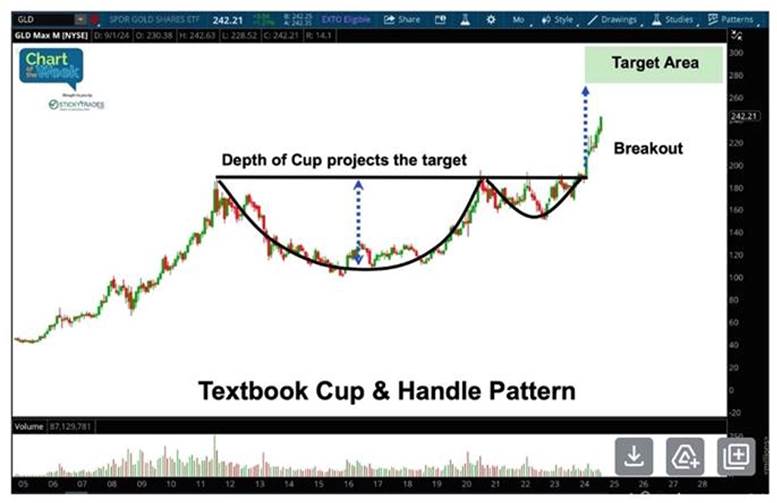

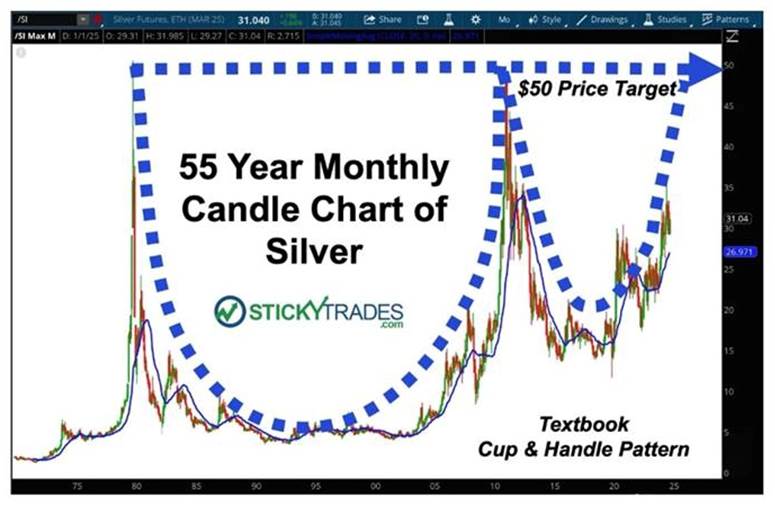

Another reason to think silver is on the verge of a breakout is that the silver price has formed a textbook cup and handle formation. A cup and handle is a technical indicator that suggests a price increase.

A 50-year-old silver price chart shows a cup and handle pattern with highs around $50 per ounce in 1980 and 2011.

A 44-year cup and handle pattern in silver has been called one of the largest ever seen.

A contributor to Zero Hedge offers a similar chart, with the cup and handle pattern spanning 55 years and the handle projecting a $50 price target.

PDAC primer

The demographics of mining investment are changing. At January’s Vancouver Resource Investment Conference (VRIC), we at AOTH noticed the attendees are getting younger and the company presentation audiences are no longer a sea of blue hair.

Mining companies are getting more comfortable with new technology like artificial intelligence, increasing the chances of making discoveries.

The annual PDAC convention in Toronto brings together 27,000 attendees from over 135 countries for its educational programming, networking events, business opportunities and fun. Since it began in 1932, the convention has grown in size, stature and influence. Today, it is the event of choice for the world’s mineral industry, hosting more than 1,100 exhibitors and 700 presenters.

PDAC 2025 runs from March 2-5 at the Metro Toronto Convention Centre. Be sure to check out AOTH advertiser Max Resource Corp. (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2), whose CEO Brett Matich is giving a presentation on its Sierra Azul copper-silver project in Colombia. Max has a $50 million earn-in agreement with major US copper miner Freeport McMoRan, and controls Max Iron Brazil Corp. The presentation will be in the Investment Hub Theatre on Monday, March 3 at 11:44 am. It falls within the Base metals 1 session theme which runs from 10:30 am to 12:30 pm.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.