Undersupplied silver to follow base metals into deficit

2021.12.10

The Silver Institute predicts that global silver demand will rise to 1.029 billion ounces this year, up 15% from 2020 and exceeding a billion ounces for the first time since 2015.

In a November report, SI says every area of silver demand is forecast to rise in 2021, including a record amount of industrial demand despite ongoing supply issues.

“The recovery in silver industrial demand from the pandemic will see this segment achieve a new high of 524 million ounces (Moz). In terms of some of the key segments, we estimate that photovoltaic demand will rise by 13% to over 110Moz, a new high and highlighting silver’s key role in the green economy,” states a press release that accompanied the Silver Institute’s Interim Silver Market Review webcast.

Demand for silver used in brazing and solder is expected to improve by 10%, aided by a recovery in housing and construction.

Silver bars and coins will continue to hold investors’ interest, with the Silver Institute predicting that physical investment in 2021 will increase by 32% to 64Moz, pushing the year-on-year total to a six-year high of 263Moz. US bar and coin demand is expected to surpass 100Moz for the first time since 2015, while in India, physical investment in silver is expected to recover from last year’s collapse, and surge three-fold.

A major source of silver investment demand, exchange traded products, are forecast to see total holdings rise by 150Moz. Year to date, silver ETP holdings increased by 83Moz, bringing the global total to 1.15Boz, within a whisker of 2020’s record-high 1.21Boz.

Silver supply

The supply picture for silver is especially interesting.

According to SI, “In 2021 mined silver production is expected to rise by 6% year-on-year to 829 Moz. This recovery is largely the result of most mines being able to operate at full production rates throughout the year following enforced stoppages in 2020 due to the pandemic.”

“Overall, the silver market is expected to record a physical deficit in 2021, albeit modestly. At 7Moz, this will mark the first deficit since 2015.”

Silver demand is only likely to strengthen, given its use in solder, solar panels, 5G, EVs, and printed and flexible electronics — not to mention steady investment demand in the form of physical silver (bars & coins) and silver-backed ETFs.

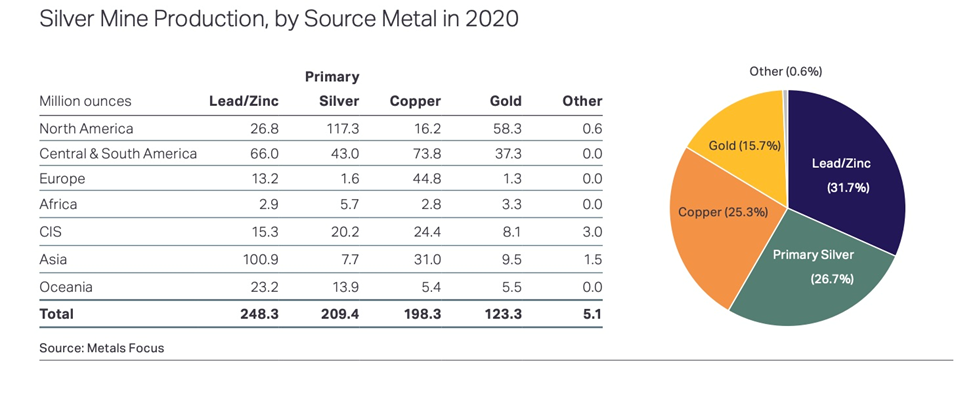

Remember, less than 30% of silver production comes from primary silver mines, with over half sourced from lead-zinc operations, and copper mines, meaning that silver’s fortunes are tied to other industrial metals.

Indeed to fully appreciate silver’s supply side, we need to understand what zinc, lead and copper’s supply side will look like because at 57% of silver supply the mining of these industrial metals has a dominating effect on how much silver is produced each year.

“For the first time in over a decade, six of the world’s most vital industrial metals are flashing a rare-synchronized warning over tight supply, as logistical turmoil and strong demand spark anxiety among buyers.

From aluminum to zinc, spot prices for base metals on the London Metal Exchange are all soaring above futures — a condition known as backwardation — for the first time since 2007. Buyers are paying a premium for access to metal against a backdrop of plunging exchange inventories, supply-chain delays, production hiccups and surging demand for industrial commodities in everything from construction to consumer electronics.” Metals from Aluminum to Zinc Are All Flashing Tight Supply Right Now, BNN Bloomberg

Copper supply challenges

S&P Global Market Intelligence predicts that due to a shortage of projects, copper supply will soon lag demand.

While the New York-based analytics firm expects mined copper production to rise to 21.87Mt and 26.14Mt in 2021 and 2025, respectively, from 21.16 Mt in 2020, that will not prevent a supply gap in the post-2025 years.

Production from existing copper mines, including concentrate and solvent extraction-electrowinning, is expected to increase at a CAGR of 1.0% in 2021-25 but fall to a 4.7% CAGR in 2026-30, driven by declining ore grades and mine closures.

These include Glencore’s 33.75%-owned Antamina (BHP 33.75%, Teck Resources 22.5%, Mitsubishi 10%), Codelco‘s Radomiro Tomic and Teck’s Highland Valley.

As a result, production from operating mines — not including assets that are starting up, project expansions or mine restarts — is projected to fall to 15.90Mt in 2030 from 20.53Mt in 2021.

Diminished supply from operating mines, combined with the projected increase in demand for copper concentrate over 2021-2030, will result in a 3.85Mt production shortfall in 2025, according to S&P Global estimates.

The refined copper market will also move into a 279,000-tonne deficit by 2025, from a 142,000-tonne surplus in 2020, S&P Global adds.

From 2026 to 2030, the copper industry will be unable to meet a growing demand for concentrate, even when including uncommitted development-stage projects that could potentially move forward and start up during this period, S&P Global says.

Dwindling copper reserves and lower ore grades at some of the world’s largest mines also mean that new deposits will just replace existing output, thus not contributing to supply growth.

CRU estimates that over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

The solution is to have more copper projects that can be developed into producing mines. S&P Global has identified 14 probable and 26 possible projects in the copper pipeline, though the firm admits it’s unlikely that all will come to fruition.

Therefore, given copper‘s increasing demand from EVs and renewable energy, plus all its other uses, more action from the mining industry is imperative to close the supply gap.

S&P Global estimates that new copper discoveries have fallen by 80% since 2010.

As of now, the global copper cupboard is quite bare.

Remember, to even have a chance at net-zero emissions, at least 19Mt of additional metal must be delivered by 2040, the equivalent of one new Escondida mine (1Mt annual production) every year.

While such a feat is difficult to achieve, finding the right investments in projects leading to copper discoveries would help to close the supply gap.

According to CRU, the copper industry needs to spend upwards of $100 billion to erase what it estimates to be a 4.7Mt deficit by 2030.

Consider too: it takes 15 to 20 years to build a new copper mine from scratch, so, any new supply is unlikely to reach the market in time to alleviate the supply deficit that is projected to come, according to S&P estimates, as early as 2025.

Other base metals including zinc and nickel are facing similar supply-side pressures, owing to explosive demand from battery-electric vehicles, solar and wind energies, and large investments in infrastructure such as President Joe Biden’s US$1 trillion infrastructure plan.

Not all metals have the projects required to meet the demand.

In a CIM Magazine article, Osisko Metals’ President & COO Jeff Hussey said, “the forecasted rise will require twice the amount of copper and zinc relative to the 2019 supply levels, and four times that of nickel and cobalt. For certain metals this is simply not probable. Zinc and nickel will be challenged going forward.”

Globally a zinc market deficit widened to 44,000 tonnes in September from a shortfall of 14,000 tonnes in August. Over the first 9 months of 2021 zinc had a deficit of 93,000 tonnes versus a surplus of 457,000 tonnes over the same period in 2020.

On top of these copper and other base metals supply challenges, there is also resource nationalism to contend with.

Chile is the world’s top copper producer. For many years Chile’s pro-mining government made the country a focus for investment, however its recent lurch to the left is casting doubts on how much of a player the former bastion of free-market policies and privatization will be.

Currently in the midst of an election campaign, front-running leftist presidential candidate Gabriel Boric this week talked up his plans for a state lithium firm, and according to Reuters, slammed the Andean country’s “historic error” of privatizing its resources. Chile has also proposed legislation that would see copper mine profits taxed at 75%.

Next door in Peru, the second-largest copper producer, the new leftist government led by Pedro Castillo is seeking to impose a 70% tax on copper mining profits, which would discourage further spending on existing and future projects.

His prime minister, Mirtha Vasquez, in November provoked the country’s mining industry, declaring that four mines including two owned by Hochschild Mining, would not be allowed extensions on operational timelines.

“We will close the mines as soon as possible,” Vasquez said, according to a government news release. “There will be no extensions, whether for exploitation, exploration or even shutdown.”

Resource nationalism of a different sort has forced the closure of one of the country’s largest copper mines. Chinese miner MMG will reportedly end production from Las Bambas by mid-December following months-long road blockades that have prevented supplies from reaching the operation.

Community protests have plagued several large Peruvian mining operations, including Las Bambas and Antamina, co-owned by Glencore and BHP.

Meanwhile in the DRC, Africa’s top copper producer, the Chinese embassy is apparently telling its nationals to leave three provinces where mining takes place, following a spate of attacks on Chinese working in the country’s mining industry.

The attack on Chinese marks a new development in conflict-ridden Africa, where Chinese companies have tried to win local support for mining through the building of schools, water systems, roads and other infrastructure. Perhaps that is not enough anymore and the locals are getting more desperate.

Copper & silver

In a previous article we noticed there is a fairly strong relationship between silver prices and copper prices. This makes sense, given that both metals are increasingly demanded in green energy applications. The closer correlation is seen below in the similar-shaped line graphs of 6-month spot silver and copper.

But it’s more than just prices. It makes sense that copper supply, along with zinc, lead and to a lesser extent, gold, should influence silver supply, since Ag is a by-product of all three.

The idea of silver getting caught up in declining copper supply was recently mentioned by successful resource investor Rick Rule. In a video chat with Wall Street Silver, Rule explains why silver supply is declining and it is likely unavoidable due to lack of investment in new copper mines and other base metals.

“It is very likely that by-product silver production particularly from copper in the next five years fades, because as a society we have underinvested in copper exploration development for 30 years. Almost no matter what we do, the next five years will see lower copper production because we don’t have the projects in the pipeline,” Rule says.

Rupiah factor

Rule, the founder and CEO of Rule Investment Media, also notes that investors usually ignore the impact of the Indian silver market on silver supply.

As “the poor man’s gold”, silver is much more affordable to the wealth-challenged and that includes the Indian peasantry for which it is extremely important not only as a store of value, but in the form of silver jewelry that is begifted at special occasions.

Sudden spikes in demand or supply are sometimes explained as manipulation, but as Rule contends, the simpler reason is often due to Indian buying, such as after a good harvest, or profit-taking when cash is needed.

“What actually happened [in 1996] is the Indian rupiah fell by 50% against the US dollar so the silver Indian people held was worth twice as much,” he told Wall Street Silver. “Then the price of silver in US dollars doubled and they had a poor harvest in India so the peasantry had a choice of selling an asset that was up 400% in local currency terms or letting their children starve, so all that silver entered the market and crushed supply.”

While things aren’t as dramatic this year, we do see indications of strong Indian silver demand currently. Times of India reported last week that silver imports in October surged to a near-seven-year high, with 146 tonnes shipped to the western state of Gujarat.

Despite the Indian rupiah falling since May against the US dollar, making the precious metal more expensive to holders of other currencies, silver in Indian rupiah right now is attractively priced, as the chart below shows.

“An estimated 9% decline in prices in early part of October did encourage jewellers to stock up for the coming festive and wedding season,” Times of India quoted the president of India Bullion and Jewellers Association, Gujarat chapter.

Conclusion

A billion ounces of silver demand this year is expected to outpace silver supply leaving a 7-million-ounce deficit — the first in six years.

Last year due to covid-related mine closures, production from primary silver mines fell 11.9%, silver output from lead-zinc mines declined 7.4% and silver from gold mines shrunk 5.7%. Silver output from copper mines actually increased 3.5% (data from the 2021 World Silver Survey).

This year could be quite different. While mines are no longer closed due to covid and therefore are expected to regain 2020’s lost output, there are other challenges ahead. As we have identified, they include a steadily increasing supply-demand gap for copper, with a 3.8Mt deficit predicted by 2025; supply shortfalls in other base metals including zinc and nickel due to a lack of new projects; and resource nationalism in Peru, the world’s second-largest copper producer and the third-biggest miner of silver, behind #1 Mexico and #2 China. Major copper miners (with silver by-products) Chile and the DRC could also see resource nationalism affect silver production.

Continued supply constraints on silver, when combined with robust industrial and investment demand, are likely to power silver higher heading into the new year and beyond.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.