Under the Spotlight: Brad Aelicks on exploration and development of Max Resource copper-silver CESAR project in Colombia

2023.05.09

Richard Mills, Publisher/ Editor, Ahead of the Herd:

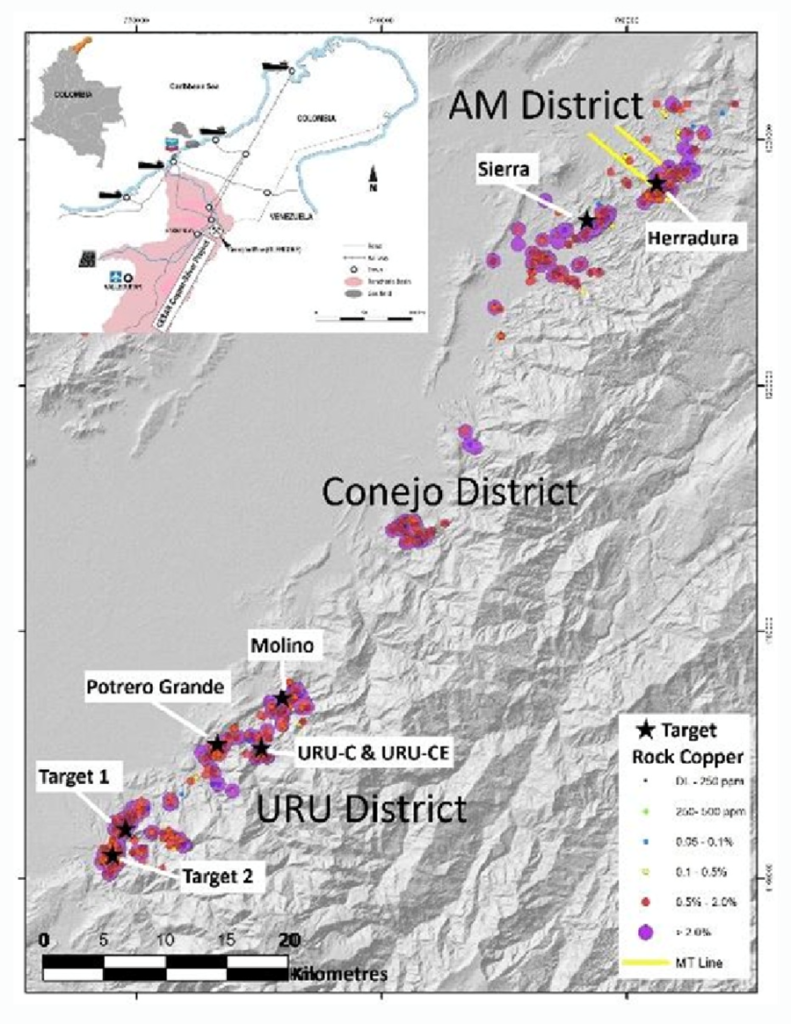

Brad, Max Resource’s copper-silver property in Colombia is absolutely massive and as we’ve discussed before that’s both a blessing and a curse. But being split into three areas: AM in the north, Conejo in the middle and URU on the southern end at least makes it easier for investors to focus on the different areas and hopefully today we can give them a better understanding of how MAX is going about using the treasury to effectively explore this regional size project.

Brad Aelicks, geologist and Pyfera Growth Capital Principal: The major areas are AM in the north, Conejo is in the central part of the basin and URU is at the southern part of the basin, but each one of these regional districts also has many sub-districts in it so as an example AM has Herradura and Sierra, Conejo is fairly confined to Conejo there’s a couple of other little subsets in there but most of the action is at Conejo Main, and then URU is a massive set of concessions and that includes everything from Cueva East to Cueva, Portrero Grande, Molino, Orozul URU South target 1, URU South target 2 and numerous other ones that we have already had a chance to visit and start to work up targets and then there’s numerous other ones that we haven’t even had a field crew back to start to work up those targets.

The exploration team now is using a whole basket of tools to advance the various prospects further. I use the word prospects because that’s exactly what they are. The whole first phase of exploration was prospecting through this enormous belt that you made reference to, the 90-kilometer long Cesar Basin that has evidence of a sedimentary copper system, which is a red bed reducing environment. These are known around the world to be very prolific when you get into one that has the maturity level that we think the Cesar Basin has had. It also has a whole host of other structural, fluid-flow areas that are represented by different formats and styles of copper-silver mineral deposition.

Where the team is at right now is they’re following up on some 6,600 samples that were taken during the prospecting days, which were used by the company to acquire the concessions. Now the task is conducting a series of follow-ups on this enormous amount of samples.

In the latest press release that the company issued, it stated that through a filtration in the database there are over 1,100 samples that were in excess of 1% copper, and that those 1,100 samples, averaged 3.5% copper and 36 grams per tonne silver. So we literally have 1,125 samples that are now being followed up so as to develop these prospects into drill targets.

Now, these aren’t randomly scattered across 90 kilometers, they form in clusters, in places where there’s a nice area of mineralization. But there are dozens of those types of areas that need to be followed up before we can advance them to a drilling stage.

RM: That was a lot great information on a broad-brush stroke scale, let’s turn to the specifics on the exploration plan.

BA: Each one of these clustered areas is being plotted on the compilation map and now each of those prospects has a plan to be worked up as a particular area. These are not just individual outcrops, there are multi-square-kilometer districts that will be worked from the exploration stage.

A team goes in and will do everything from silt sampling in each of the drainages that is representing that particular area, revisiting the existing outcrops that we know had significant mineralization, trenching those outcrops to extend to see how large the occurrence is, and mapping it in context of classifying this as either being into the sedimentary bed sequences that would fit the red bed model, or into a structural environment which may be feeders. These feeders could potentially occur either above the sedimentary sequence or below the sedimentary sequence in the underlying volcanics and volcaniclastic rocks. And then there are other areas that could also fall into potential porphyry models, because they’re seeing high barite occurrence, high-temperature alteration and so each one of these is being mapped and classified as to target type.

RM: So, silt sampling, trenching and mapping, all intensive boots on the ground stuff and at the same time, do it while they are there, I’m assuming other surveys are being conducted?

BA: Oh yeah, the company has purchased its own ground magnetometer survey equipment, so the team, in conjunction with the mapping and re-sampling of these areas also runs a precursor magnetometer survey over top of those occurrences that registers the magnetic strength and gives us some background information.

At some of the targets, including up at AM, we’ve also started to do a wider variety of surveys from a geophysical perspective and the first one that’s been completed to date is a magneto telluric or MT survey that looks at the resonance of the rocks from a resistivity perspective, it has deep penetration capabilities and you can map the contact, of the different rock units, so we can see how thick the sedimentary sequence is and we can map the underlying contact with volcanic rocks.

That helps to determine what the thickness of this sedimentary target would look like for us in a particular region. So these are the baseline surveys that we have done, and continue to do. As these targets get worked up we’ll be moving to regional geophysical and some airborne surveys that may include regional magnetics and radiometric surveys on the particular clusters that start to shape up into much more defined targets.

RM: How many target areas is Max working now or planning to work?

BA: Approximately a dozen but that work is ongoing.

RM: We said earlier that over 1,100 filtered samples averaged 3.5% copper and 36 grams per tonne silver. Can we get into that filter process, what exactly you used to define a priority area?

BA: Absolutely, the filter applied on the database is basically looking for high concentrations of silver in conjunction with high concentrations of copper.

The reason we’re applying that filter is that you can get high concentrations of copper without silver in these models, but you’re more subject in those type of samples to have supergene enrichment or enrichment from secondary mobilization of the copper mineralization because the silver does not mobilize as easily. By applying the high-grade silver filter in conjunction with the high-grade copper we expect that most of the clusters that will fall out from that data will be primary occurrences, not secondary, and so it will be a quicker route to develop the prospect.

Every part of this system that we’ve seen that is primary mineralization contains both chalcocite and various copper minerals which would include malachite and some other silica-based or micaceous copper minerals. The silver appears to be primary in most cases but the silver and the copper come together in virtually all parts of the model, so it doesn’t matter whether it’s a sedimentary sequence or whether it happens to be coming in the volcanics, if it’s primary mineralization, which means it’s part of the main mineralizing event, then we see very good ratios of silver to copper.

There are other areas that we don’t really have a good handle on yet that just appear to be secondary copper mineralization that is coming from somewhere else. It could be just leached from up the hill or it could be re-mobilize during a metamorphic event and squeezed into new areas, or it’s supergene enrichment, that is, a system that is degrading or just being eroded and the copper is being precipitated out and redeposited over top of something else that’s already there whether it was previously mineralized or not previously mineralized. So those ones we’ve decided will have a lower priority but all form parts of the whole system, whether you’re in the red bed sequences or you’re in the structurally-controlled parts of the deposit, we have seen good silver and copper ratios in all parts of the depositional model.

It doesn’t mean the areas that are only high-grade copper may not lead us to something as significant or more significant than a copper/ silver area, but those copper only areas are areas we’ve decided will be a secondary priority.

RM: Your building a ranking system based on primary occurrence.

BA: Correct, we move all initial targets into a ranking system that will start to move them up the channel towards drill targets.

And then there’ll be multiple exploration crews, the one who’s doing regional advancement work on individual sample clusters will carry on down the priority list, and the other advanced targets will move to a different crew that will start the diamond drilling and guys that are logging core and running drill programs.

RM: We received drill results from two holes in the AM where we hit multiple layers of Kupfershiefer-style mineralization.

BA: That was an area we chose to do a magnetotelluric survey over, this survey maps resistivity within various rock. What we were looking for was the thicknesses of sedimentary sequence(s) and where do we find the contact with the volcanics? Also is that contact close enough to surface that we can explore both parts of model with a drill?

From the magnetotelluric survey results our geologists interpreted multiple parallel horizons that appeared to be multiple stratigraphic sedimentary beds so we decided to test that theory.

Max has now proved there are multiple parallel mineralized beds and in fact that we can see the sedimentary sequence and the contact with the volcanic sequence that lies below the sediments. Those were very useful holes for us and it gives us a precedent, if we decide to do much broader MT surveys then we have the data to specifically be able to correlate the response to the MT survey with the mapped sequence on surface as well as the confirmed dip and extent of those rock units that we now have as drill logs.

And so it’s a very good confirmation technique that you can build your model for how effective will MT be in this particular circumstance where you have a sedimentary sequence overlying volcanics. The drill holes both intersected multiple copper mineralized beds as we had hoped.

In fact we saw some other things in there as well which included copper mineralization in fracturing that was running perpendicular to the beds, so we didn’t hit a home run on those couple of holes but we got exactly what we had hoped to achieve from a geological and technical perspective, supporting the MT survey and building the database around that.

RM: We also drilled URU-C and URU-CE?

BA: From my perspective the drilling there was on a really obvious target. We had multiple trenched samples that were right on surface of primary copper mineralization that was 16 to 19 meters wide and was running anywhere from 4-8% copper with wonderful kickers of silver. What I’m referencing now is Cueva, or URU-C, so that was the first and primary target and so we did get a huge surprise there, a structure that was interpreted to be going up the hill as a steep- standing structure now looks like it’s multiple structures that are parallel and are modestly dipping to the east.

Those intercepts were confirmed with multiple holes that had high-grade mineralization and then what led to the model is also a number of holes that didn’t intercept the mineralization where it was supposed to be and led to a re-interpretation of what is the sequence there that has led to these glorious-looking outcrops with super high-grade copper in them.

We’re starting to get a better handle on what Cueva looks like, there’s still a lot to be done there to figure it out in its entirety, and we’re expanding research in that area because there’s additional copper showings to the west of us that are right in the same vicinity and are probably part of the same system and so there’s a bunch of work going there.

RM: And 750 meters to the east we have the URU-CE or Cueva East occurrence.

BA: Yes, we put holes 9 and 10 over there into that occurrence, and although it looks different it still is a very significant finding for us, I think the average there was around 30m of 0.34-.35% copper, all oxide there was very little primary mineralizing there with the chalcocite, so the next exercise for that area will be to do the metallurgical study because it looks like a real obvious heap leach target that would be very low cost — you can get away with lower-grade material when you have a leaching environment.

So we’re quite encouraged by what was found at URU-CE, because of the width of the mineralization showing a pretty powerful part of the system over 30m continuous intercepts in both those holes, we just need to work that prospect up now to make sure that there’s economic potential through the oxide copper type model before we start to go to the next level of exploration on it.

RM: Is there anything else you want to add about the properties or the exploration results?

BA: Rick the only other thing I would say is it’s very interesting to see the amount of copper and silver that is coming from so many depositional models.

Even though we see this entire basin as one large mineralizing event, the number of different types of places where you’re seeing the copper actually precipitated out in a depositional event is very, very encouraging. We’re seeing it in the mafic volcanics, intermediate volcanics, felsic volcanics, and it can be in the structural controls within the volcanics.

We’re seeing it in breccias that are lying at or near the sedimentary sequence with the underlying volcanics, and then we have the entire upper part of the model with the red bed sequences which is more towards the Kupferschiefer model, whereas the stuff I was just talking about is more towards the Central African Copper Belt where you have these strong structural controls in the sub-basin that have acted as conduits to allow the pregnant solutions of copper and silver to be mobilized throughout the basin before they’re sort of squeezed up and into the reducing environment that would’ve originally been the sea bed which is where these red bed sedimentary occurrences are derived from.

So it’s really neat to see all of these different styles of mineralization, now we have to put the puzzle together and follow these things back to the major structural controls or low parts in the basin that had more detrital (carbonaceous) material within the sedimentary sequences to coax out additional copper and silver.

It’s a very big project, it’s a little daunting at times when you’re embedded in the middle of the exploration team, to get their feedback and really understand the magnitude of the task at hand, even just following up the number of clusters of samples that we have, but then each one of these has to be categorized as to what role did this area play in the fluid flow, and the depositional model overall, and then to use those to vector into areas that we fully expect are going to deliver us large concentrations of copper-silver in the depositional model.

RM: I remember talking to a senior VP Exploration for a major mining company, and he said that most juniors don’t do things right, they don’t understand that the majors want to see firstly scalability of a project and secondly they want drill targets, a lot of them and all properly worked up.

I’ve always kind of followed that, I look at what Max is doing here, I can see that the way we’re working it up, we’re going to have a large number of well-qualified drill targets here, that’s kind of walking right into the majors’ ballpark isn’t it?

BA: Yeah it is, in my opinion it’s the only way to approach something of this magnitude. Because there’s so many targets if you just went out and said we’re going to start drilling these things and we had 12 or 15 Cuevas, you’re going run through $20-30 million in drilling without knowing where are your best targets? When you have this size of a potential play I think the number one thing that has to be done is to get that raw level of data collected on as many of these areas as we can, so that we can comfortably prioritize where’s the drill going to start when we start drilling again?

Once we have that isolated then we can get crews ahead on the next one and the next one, making sure they’re in line and ready to drill as we move through the process of testing this giant basin. And that is what the majors do, they’re patient, they tend to do this level of work along the way.

You can’t go blow your brains out drilling every prospect because there’s so many of them, and surface prospecting is not over, there’s still an enormous area left to cover. When your well on your way to covering everything that has worked its way to surface then you have to figure out how to evaluate the sub-surface and which ones of these things have the highest likelihood of being of serious economic potential?

So that is the process, I still am extremely intrigued by what Max is doing in the Cesar Basin, it is an unfortunate market right now that is barely surviving on drill results only, I don’t think it takes away from the potential that Max has here, but there’s another step of exploration that needs to happen before we can get that big drill campaign re-ignited.

RM: Thank you Brad, as always extremely informative.

BA: Thank you Rick, it was a pleasure speaking with you.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resources (TSX.V: MAX). MAX is a paid advertiser on his site aheadoftheherd.com

Brad Aelicks owns shares of Max Resources (TSX.V: MAX).

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.