Under the Spotlight – David Hottman CEO Orestone Mining

2026.01.23

Rick Mills, Editor/ Publisher, Ahead of the Herd:

We’re going to the Salta province in Argentina, 80 kilometers northwest of the city of Salta, where mapping has outlined an oxide gold stockwork mineralized trend. Why don’t you tell us about it and getting boots back on the ground?

David Hottman, CEO, Orestone Mining:

The Francisco property was acquired by Orestone in 2025, and it hosts quite an exciting target that represents an opportunity to discover and outline an oxide open-pit gold-silver deposit.

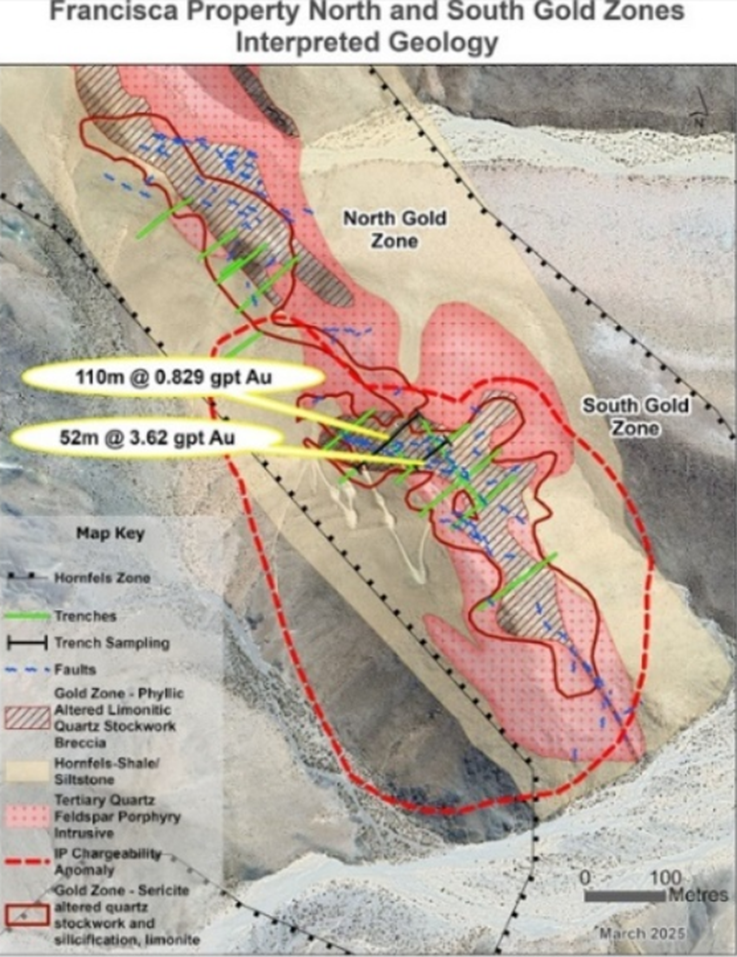

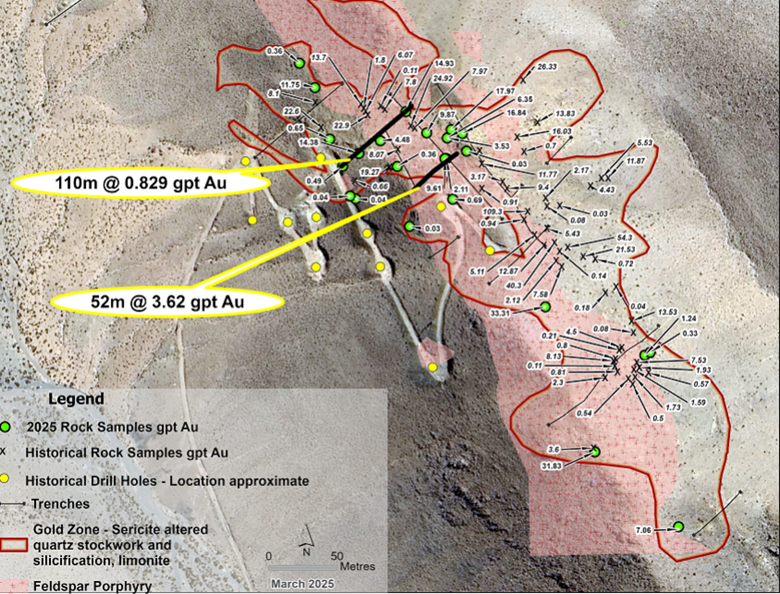

Back when it was originally discovered in the late 90s, when the gold environment was plus or minus $300 a zone was outlined that’s about 1,100 meters long, 50 to 100 meters wide, and it’s on the crest of a hill. Broken into two pieces, the southern zone is the most important to us and has the most work done on it and the better grades. The 300 samples taken in that time frame averaged about one gram per tonne.

Extending out from the zone is an area of hornfels, which is alteration through heat of the country rock, of 500 to 1,000 meters. Basically, this is indicating that there’s an intrusive around. Coincidentally, there is an IP anomaly that is 400 by 500 meters underlying this target. That in itself indicates there’s metal in the ground.

We have a target that represents a multimillion-ounce opportunity, gold-silver, open pit, and that’s the historic perspective on it.

RM: You added some ground recently.

DH: Yes, we added some ground last year, the project is now just under 10 square kilometers in size, and the South zone is only one of several targets identified to date. There may still be some ground that needs to be acquired over the course of time, but not immediately.

Orestone Initiates Exploration On Francisca Gold Project In Salta Province Argentina

The next stage for the property is to initiate exploration and start defining and de-risking this opportunity. We’ve already laid out the initial drill program, but drilling is a lot more expensive than taking samples and mapping, so we have initiated a program of detailed mapping and 600 samples prior to drilling.

The first quarter of 2026 will be the mapping and sampling, and the second quarter, we should be drilling.

The initial program is approximately 1,500 meters of RC or reverse circulation drilling. The budget in the first quarter is approximately $100,000 USD and then the drilling program will be approximately $400,000 USD.

It’s an exciting time for the company and for our shareowners. This is an opportunity to drill off an open-pit gold and silver deposit.

RM: And please explain why RC drilling.

DH: The zone is heavily oxidized, and regionally the oxidation level goes down to several hundred meters.

When you have really oxidized rock, usually the gold is on the fractures of the rock, especially in breccias or stockwork scenarios. If you use diamond drilling or core drilling, you have high-pressure water, and the water can and has in many cases rinsed or washed the gold out of the rock.

You recover the rock, you send it to the assay laboratory, but the gold has been washed out of those fractures. It’s very important to get the appropriate type of drilling for the type of deposit that you’re dealing with and to be able to have the most accurate sample possible.

RM: Does the silver present any kind of a recovery problem?

DH: It’s not necessarily a recovery problem, but many cases it’s a lack of opportunity. As an example, in the mid-90s, in Eldorado Gold, we put a mine named La Colorada into production in the Sonoran Desert in Mexico. We were mining one gram of gold and one ounce of silver. In a heap leach scenario that was about US$15 rock, and we only recovered about half of the silver.

A lot of the silver was locked up in manganese, and it can be a metallurgical issue trying to recover it.

In a typical heap leach environment, you’ll recover 25% to 50% of the silver very seldom do you recover more than that.

RM: There is a process you could use today that would help you recover more of the silver and not plug up the system.

DH: Yes, if you have a lot of silver in the deposit in a heap leach environment, the alternate recovery method would be the Merrill Crowe system. Basically, it’s a filter press. Before the solution gets forced through the filters, granular powdered zinc is introduced.

The gold and silver let go of the cyanide, grab onto the zinc. The zinc is caught in the filters and you then scrape the filters, dry it and smelt it. At La Colorada, we were pouring 89% silver and 10% gold dore’ bars.

In the 1990’s high silver values would clog up the system; in todays world of US$90 silver prices, I would love to have that problem.

RM: Interesting. What’s typical recovery in this kind of a heap leach situation?

DH: We have not done any metallurgy, but the rock is heavily oxidized. You would like to see 70-80 in an operation.

RM: Is one gram a tonne in this kind of scenario considered a normal grade or a high grade?

DH: Back when you could find a lot more surface oxide deposits similar to this opportunity in the ‘80s in Nevada, you would have been mining a gram and a half to two and a half grams per tonne Nevada, the birthplace of heap leaching. As time passes that grade has lowered dramatically, today the average open-pit gold grade is in the 0.5, 0.6 grams per tonne.

If we are successful defining a one gram per tonne oxide gold orebody with added value from silver, then yes, that would be considered high-grade.

RM: What questions, what boxes need to be checked as we move forward short term? If we check the boxes is there a rough timeline to possible production? And please compare underground versus open pit capex.

DH: Well, initially, the questions are what are the grades and what size could it be? Is it oxide? If it looks like it’s a million ounces, then inside of a couple of years you could be pouring gold-silver bars in a perfect world.

If it looks like it’s going to be multimillion ounce, then you’re going to have to drill an awful lot of holes. The drill spacing is going to be 50 to 100 meters initially which isn’t a huge amount of holes per ounce outlined; for mine planning a tighter grid may be warranted. We’re permitting 50-something drill locations, and you could have multiple holes off of each location.

Then it’s a question of money, and with a significant discovery, the floodgates will open and we should be able to drill year-round until we’ve drilled it off. It just depends on how big it is and how deep the oxidation level goes.

In terms of costs for building a heap leach operation, open-pit gold and silver is in the lowest quartile being some of the cheapest ounces to discover and development.

There’s no way to guesstimate what the capex might be, but as a comparison, to develop an underground mine of 100,000 ounces a year you’re looking at 3 to 5 times higher capital costs.

RM: Thank you, Chester Millar.

DH: Exactly. We started Eldorado Gold with Chester, the godfather of heap leaching, lots of old stories and most of them are true. I’ve spent a lot of time with Chester. He’s a good man.

RM: I did not know he was part of that team.

DH: Yes, actually Bema Gold’s first mine in Idaho was an 85-15 joint venture with Chester through Glamis Gold, Glamis had the 15% interest. It was called the Champagne mine, the mine opening was September 1989, and we announced the acquisition of the Refugio project in Chile; that wound up being 8 million ounces of gold.

Years later, when we started Eldorado, we teamed up with Chester to go to Mexico and find some heap-leach opportunities and we found the first one, La Colorada. Eldorado was pouring gold bars before we even came public. That’s the kind of driver Chester is.

RM: Fascinating, I know about Chester Miller because of Afton.

DH: Chester Millar is an avid explorer, mine developer and legend in the mining business and I am honoured to know him.

RM: Last time we talked in October, you were saying that you’ve got porphyry dikes exposed at surface, but there’s a big IP anomaly indicating potentially a larger target deeper.

With the drilling, are you planning on going deeper, or are you going to mostly stay close to surface with the RC drilling?

DH: Our intention is to drill as deep as we can with RC, as long as we believe that it’s effective. We may be drilling 150-meter holes, which is reaching the edge of effectiveness for RC. Especially at that elevation, we’ll have to get extra compressing power to get the sample up to surface.

Yes, it is our intention to drill through the oxide into the larger target below. If we end up drilling to 150 meters and we’re still in oxide, then, so sorry, it’s going to be huge anyway and we will drill deeper the next program.

RM: Have we covered everything that we want to about Orestone’s plans for the next two quarters?

DH: Yes, I believe so. I would just leave you with the fact that it’s a robust gold and silver system. It has good size to it, surface exposure with good grades.

The underlying IP anomaly makes this a big target, in the hands of an experienced management team in a gold bull market.

I would welcome you and your subscribers to visit our website to get more information and conduct due diligence.

RM: And you are going to VRIC?

DH: Yes, we’ll be having a booth at the Vancouver Resource Investment Conference, and I’ll be giving a corporate presentation on Monday, January 26th at 2:40 in the afternoon.

I would invite everybody to stop by the booth and attend the presentation.

RM: Thanks David, we appreciate your time.

DH: My pleasure, thanks Rick.

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard owns shares of Orestone Mining (TSX.V:ORS).ORS is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of ORS

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.