U.S. Economy: Cloudy With a Chance of Stagflation

By Felix Richter

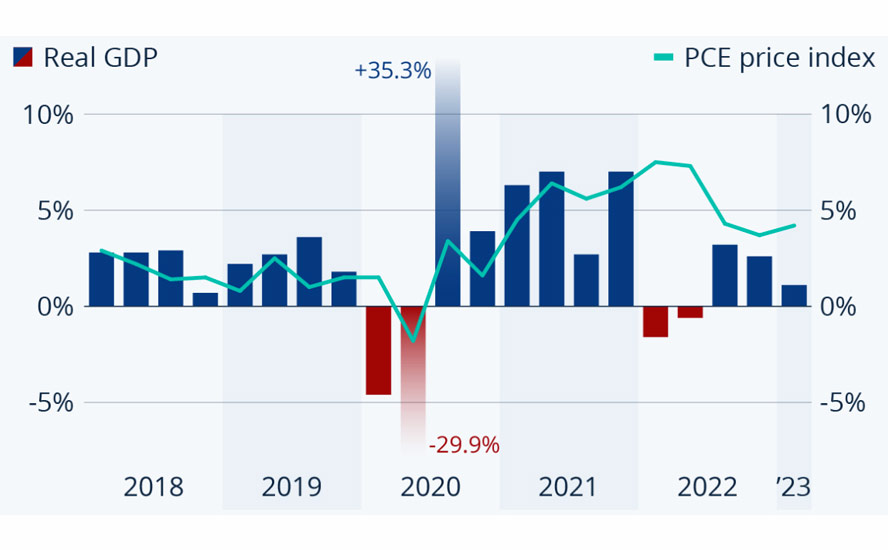

Having proven surprisingly resilient in the face of the Fed’s aggressive tightening policy over the past year, the U.S. economy started to show signs of weakness in the first three months of 2023. Annualized real GDP growth slowed to 1.1 percent in Q1 2023, the Bureau of Economic Analysis said on Thursday, down from 2.6 percent in Q4 2022 and way below analyst expectations.

While that could have been good news for those hoping for the Fed to pause rate hikes at the upcoming FOMC meeting next week, the underwhelming growth reading was accompanied by an uptick in the price index for personal consumption expenditure (PCE), the Fed’s go-to inflation gauge. The PCE price index increased at an annual rate of 4.2 percent in Q1 2023, up from 3.7 percent in the previous quarter. The core PCE index, excluding food and energy, increased 4.9 percent, up from 4.4 percent in Q4 2022.

Slowing growth is generally accepted as a necessary evil to bring down inflation. Slow growth combined with stubborn or even rising inflation is another story altogether, however, as it evokes fears of stagflation

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.