Trump tariffs and insults spark national Canadian furor – Richard Mills

2025.02.14

It’s déjà vu in Canada-US trade relations.

Over the weekend President Trump signed executive orders imposing 25% tariffs on Canadian and Mexican imports of steel and aluminum — actions similar to what started a trade spat in 2018 during Trump’s first term as US president.

According to CTV News, The orders remove the exceptions and exemptions from Trump’s 2018 tariffs on steel, which excluded Canada and other countries from the duties. Monday’s orders also increased aluminum tariffs to 25 per cent from 10 per cent, which was what he’d set them at in 2018…

The president also suggested he would also announce “reciprocal tariffs” later this week.

It’s all happening one week after Trump temporarily paused plans to slap Canada and Mexico with 25 per cent across-the-board tariffs and a lower 10 per cent levy on Canadian energy.

Trump delayed those levies until at least March 4 in response to border security commitments from both countries, saying it would allow time to reach a “final economic deal.”

The steel and aluminum tariffs also take effect on March 4.

“This will be purely inflationary,” the Toronto Star quoted Flavio Volpe, president of the Automotive Parts Manufacturers’ Association, of the tariffs Trump has threatened several times to impose. “This will make cars more expensive everywhere.”

Aluminum from Quebec is typically smelted in B.C. and Quebec, before getting shipped to the U.S. for rolling into sheets, which are then shipped to plants in Canada and the U.S. to be turned into everything from automotive parts to beer cans. Steel also crosses back and forth across the border several times, Volpe noted.

“When President Trump implemented tariffs on Canadian steel in 2018, we saw massive disruptions and harm on both sides of the border, hurting both America and Canada,” said CSPA president Catherine Cobden. “While the (targeting) of Canadian steel and aluminum is completely baseless and unwarranted, we must retaliate immediately.”

Trump readies reciprocal tariffs as trade war fears mount

“WASHINGTON, Feb 12 (Reuters) – Donald Trump’s trade advisers on Wednesday were working on plans for the reciprocal tariffs the U.S. president has vowed to impose on every country that charges duties on U.S. imports, ratcheting up fears of a widening global trade war and threatening to accelerate U.S. inflation further.”

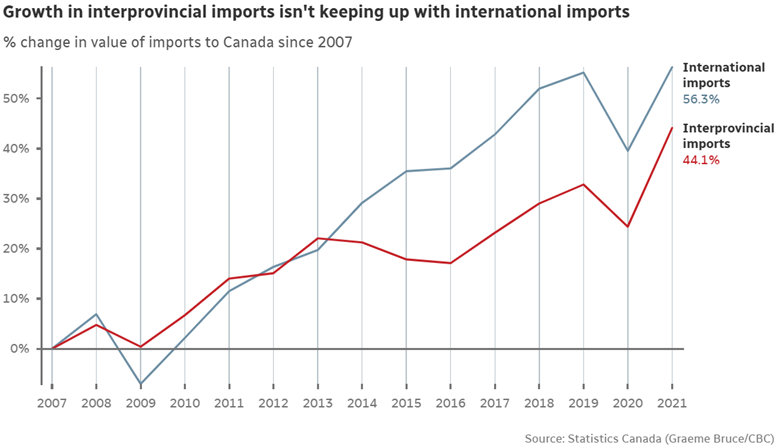

As the March 4 deadline looms, the tariffs have re-ignited the debate about removing trade barriers within Canada. The possibility of tariffs also has Canadian exporters re-thinking their operations to avoid or withstand the costly duties.

Unnecessary red tape

Canadians may not realize the extent of trade protectionism that currently exists in Canada despite improvements in recent years.

To clarify, there are no tariffs on goods that cross provincial borders. Instead, the barriers fit into three categories: inconsistent regulations, rules around transportation, and provincial protectionism.

“Just imagine that Canada’s 13 provinces and territories are each a small country. Each of which has its own government, its own ability to tax, its own spending decisions, its own regulations on road safety, health standards, educational qualifications — those types of things, if they differ between one province and another, is an interprovincial barrier.” Moshe Lander, economics professor Concordia University

The federal government’s 2024 economic statement, citing IMF data, argued the country could boost its GDP by up to 4%, or $2,900 per person, by liberalizing internal trade.

Current Minister of Transport and Internal Trade Anita Anand said last week that interprovincial trade barriers could be wiped away within a month. Her optimism, CBC News reported, was based on an emergency meeting between Prime Minister Trudeau and the premiers. She also said the threat of punishing new tariffs being imposed on Canadian imports by the Trump administration has brought a sense of urgency to the issue as never before.

Anand has previously said that removing existing inter-provincial trade barriers could lower prices by up to 15%, boost productivity by up to 7% and add up to $200 billion to the domestic economy, according to CBC News.

It’s been a long potholed road to internal trade liberalization, with efforts starting as far back as 1995. That year, the provinces, territories and the federal government agreed to remove impediments to trade, including restrictions on the sale of alcohol, vehicle weight standards, and licensing and paperwork requirements.

This agreement was replaced in 2017 by the Canadian Free Trade Agreement, which recommitted the parties to doing more to reduce red tape.

Despite these agreements, and others negotiated between provinces, much more needs to be done. According to CBC News, there remain rules, regulations and standards that inhibit the free movement of goods and services from one province to another. In fact, the latest work plan for the federal-provincial committee charged with removing barriers lists dozens of items still in negotiations or yet to be signed off.

Another CBC News article cites a report from the Montreal Economic Institute stating that in 2023 there were 245 exemptions across all provinces and territories. The MEI report notes that Quebec leads the country with 35 exceptions to the CFRA, with language requirements the main barrier. Businesses wanting to sell products in Quebec must abide by the province’s French language laws, which the Quebec government tightened in 2021.

The Globe and Mail gives the example of overzealous booze regulations:

Most Canadian wineries, breweries and distilleries can’t sell or ship directly to consumers in other parts of the country. The Supreme Court ruled that provinces have the right to control the supply of liquor, regardless of whether it impedes domestic trade. That’s led to a patchwork of rules and restrictions. Manitoba, Saskatchewan, Nova Scotia and BC each allow out-of-province consumers to purchase directly from their wineries and breweries. Last month, Alberta launched a one-year pilot project with its western neighbor to let Albertans order from more than 300 BC wineries. share the tax revenue and sealed the deal with an Okanagan rosé.

But the rest of the provinces — including Ontario and Quebec, the two largest markets — have slammed the door on interprovincial direct-to-consumer sales. If I want that same Okanagan rosé, I can’t just buy it online from the winery and have it shipped to my house in Toronto. I have to hope my local LCBO carries it, or I need to get myself to B.C., buy a bottle there, and bring it back home to drink. The other option is to see if I can find the wine in one of the independent bottle shops that Ontario allowed to open early in the pandemic.

Now a $16 bottle of B.C. wine starts to get expensive. “The LCBO adds their 72-per-cent taxes to the wholesale price from the winery, so it instantly becomes $28,” said the owner of Toronto wine shop Grape Witches. “Then the agency adds their 30-per-cent markup, so it’s closer to $37.” She needs to sell that bottle for $60 or $65, which can be a tall order for a Canadian wine intended for a low- or mid-price point.

Part of the reason for the byzantine rules around alcohol was so that smaller brands wouldn’t get squeezed out by competition from other provinces. That reasoning “may have outlived its usefulness,” CBC News quotes an economics professor at Concordia University in Montreal.

There are literally thousands of interprovincial trade barriers. Even deli sandwiches have been caught up in the regulatory web. For example, in Lloydminster, which straddles the border between Alberta and Saskatchewan, café owners couldn’t sell a sandwich on the Alberta side of the city without a separate license. A recent change removed the barrier.

Chicken sold in BC is more expensive than in other provinces because the price is set by a provincial chicken board. Fruits and vegetables are packed and labeled differently in Quebec compared to Manitoba.

A third CBC article notes a nurse trained in Ontario might need to do additional coursework to practice in Manitoba; a psychologist certified in Alberta might need more training to work in Nova Scotia; and lawyers from outside Quebec who want to practice in the province face barriers because it has its own Civil Code (and the rest of Canada follows common law).

In fairness, there has been some movement on this front: British Columbia, Alberta, Saskatchewan and Manitoba signed their own mini-agreement in 2010, removing most barriers to trade between the four western provinces, including ones that hinder labor mobility, CBC stated.

The provinces made a deal in 2018 to raise personal exemption limits on alcohol, letting individual Canadians carry six cases of beer, two cases of wine and six liters of spirits across borders.

No one is saying remove all barriers. When BC was hit by a drought in the early 2000s, Alberta farmers wishing to share their harvests with BC farmers hit a snag when it was discovered the trucks transporting hay between the provinces had to follow BC’s load safety regulations. This is, imo, common sense and needs to be kept – driving in BC is much different than driving in Alberta!

Among the more ludicrous of interprovincial trade barriers, courtesy of CBC, are:

- Toilet seats: Ontario says toilets at construction sites need to have “open-front” seats; Alberta is “toilet-seat netural.”

- Maple syrup: Not every province thinks their neighbor’s sap is up to snuff; maple syrup grading differs across the country.

- Truck driving: Certain trucks can only be driven at night in BC, but in Alberta, the same trucks are only driven by day.

Why are there so many trade barriers? A little bit of research suggests the reason is mostly political, not economic. Former Quebec Premier Philippe Couillard said when he and colleagues from BC, Ontario and Nova Scotia agreed on a framework to open up alcohol catalogues so that other provinces could showcase their products, “we’d get down to the [Crown] corporation itself, which has its own board, its own objective — and remember, has to provide money to the government every year to help them with the budget.”

Couillard also said that because provinces need revenues from Crown corporations, politicians hesitate to make changes that threaten the success of those businesses. According to CBC, Couillard said it would be politically costly for a government to suggest weakening laws meant to protect the French language.

“I don’t want to be the Quebec premier [that’s] going to add an amendment to the linguistic legislation to exempt certain businesses… Politically, it would create significant turmoil,” Couillard said.

Manitoba, PEI and Newfoundland/ Labrador are among the provinces that would benefit the most from lifting interprovincial trade barriers. The MEI report suggested that if barriers had been completely lifted in 2023, Manitoba’s GDP per capita would be $5,000 higher in 2030. The per-capita GDPs of Prince Edward Island and Newfoundland & Labrador would rise by a respective $10,000 and $9,000. That’s an extra $5K, $9K and $10K in the pockets of average Canadians in those provinces.

Loosening regulations on alcohol distilling, for example, would potentially open up markets across Canada for Manitoba producers. Farmers would benefit from fewer hurdles, as well as from changes to the trucking and transportation sector, which plays a big role in agribusiness.

Oil pipeline irony

Back to the Trump tariffs, part of Donald Trump’s justification for imposing them on Canada is border security. To him, not enough is being done to curtail the illegal shipment of the dangerous street (and pain relief) drug fentanyl from Canada to the US, as well as illegal immigrants crossing the Canada-US border into the States.

The border is hugely contentious among Republicans and the news channels that reflect the GOP’s values.

The other reason though, is the trade deficit the US is currently running with Canada. While Trump said it’s USD$250 billion, that number is wildly exaggerated.

Global News reports Trump has inaccurately equated the existing deficit as a “subsidy,” claiming the U.S. is economically propping up Canada, and has threatened to tariff those Canadian goods it sells in the name of “fairness.”

“They’ve taken advantage of us for years, and we’re not going to allow that to happen,” Trump told reporters aboard Air Force One over the [Jan. 25-26] weekend.

“Without our subsidy, Canada doesn’t exist, really. Canada is totally reliant on us. Therefore, it should be a state.”

The most recent data from the US Census Bureau shows that on goods traded, the deficit with Canada was USD$64.26 billion in 2023. The year before it was USD$78.19 billion.

The Global News article goes further in stating that, rather than being the fault of Canadian administrations, the deficit going back to 2017 has largely mirrored the rate of energy exports to the US and the price of crude oil.

It notes the US gets more than half of its crude from Canada and that many US refineries are reliant on that product, called Western Canadian Select, mined from the northern Alberta oilsands.

An analysis by TD bank shows that when oil exports are removed from the Canada-US trade equation, the US in 2023 actually had a trade surplus with Canada of more than US$30 billion.

One more point from the Global story is worth mentioning. While Trump during his first term railed against China for having a trade surplus with the United States, since being re-elected in November Trump has hardly mentioned it. Which is odd, because the US trade deficit with China is four times greater than Canada’s, in 2023 registering USD$279.4 billion.

The fact that Canada has a trade deficit with the US, and is getting into a trade war because of it, is supremely ironic. It’s ironic because we have always sold our oil to the United States through north-south pipelines that offer up Canadian crude at a major discount to the two international benchmarks, Brent crude and WTI crude.

(Historically, the spread between WCS and WTI is between $18 and $20 per barrel).

If we were to build an oil pipeline to tidewater on the Canadian West Coast from Alberta, both Alberta and north-eastern British Columbia producers would receive the higher Brent crude price.

Enbridge wanted to build that pipeline, the Northern Gateway, but it was rejected by the federal government after opposition from indigenous and environmental groups.

There are currently no oil pipelines running east from Alberta except for Enbridge Line 3, the oil in that line starts in Alberta and ends up in Superior, Wisconsin.

That could be changing, however.

Federal Industry Minister François-Philippe Champagne recently said the country needs an oil pipeline connecting Alberta oil to the country’s east coast.

“You need to look forward in the future,” Champagne told CTV Question Period in an interview Sunday. “And that may mean that we need to have transmission lines that could bring electricity East-West. That may mean you need pipelines that go East-West.”

Champagne’s comments followed a call by Alberta Premier Danielle Smith to resume talks on major pipeline projects that could connect the province’s oil and gas to tidewater, according to CTV News.

It’s hard to say whether, even in light of the Trump tariffs, an oil pipeline to the east coast would receive support. In the CTV News article, Champagne sounds uncharacteristically bullish on fossil fuels when he states, “We cannot be dependent. We have these natural resources. We need to be able to export to markets. And you know what? I think people understand better now, the nexus between energy security, economic security, and I would even say national security.”

On the other hand, Bloc Québécois Leader Yves-François Blanchet said he “fiercely opposed” any new pipeline projects in Quebec, while Quebec Premier François Legault said that while Quebec needs to diversify export markets, he was doubtful there was any “social acceptability” in the province for a pipeline project.

Trump claims the United States doesn’t need Canadian oil exports but he is wrong about that, too. According to the CD Howe Institute, the 4.4 million barrels per day of imports from Canada allow the US to export an identical amount of 4.4Mb/day of light oil, mostly from the Permian Basin, earning the country annual export revenue of USD$119 billion. 97% of Canadian oil exports go to the US.

It’s not so much the amount that matters but the type of crude oil.

The heavier Canadian crude is delivered to refineries in Minnesota, Wisconsin, Illinois, Colorado, Louisiana and Texas. These refineries have made significant investments to accept Canadian crude. As CD Howe observes, it is not possible to refine the lighter crude oil produced in the Permian Basin, Texas and New Mexico without spending heavily on reverse-engineering these facilities’ ability to accept light crude.

Knowing this, we pose the question again: Does America need Canadian oil? Well, yes. As CD Howe puts it, In simplest terms, the US buys Canadian oil at a discount and exports at full price, which currently yields a US$19 billion annual windfall.

Using Permian crude domestically instead of exporting it would eliminate the $19 billion per year benefit.

If the US rejects Canadian oil, it will have to find another source.

Venezuela and Saudi Arabia are possibilities. Both produce heavy crude like Canada’s. But approaching Venezuela after bashing Maduro while he was president before, would mean Trump having to lose face to a South American dictator. Saudi Arabia would want something in return and asking them would mean admitting that the United States is back in need of Middle Eastern oil after declaring itself energy independent.

What happens if tariffs are placed on Canadian oil imports? The president has said that 10% tariffs will be applied to the 4.4 Mb/day of crude oil starting on March 4.

CD Howe noted that Midwestern US refiners would have few alternative sources of supply, given that pipelines from tidewater on the Gulf Coast (which accept heavy crude) do not flow north-south, and there is little to no US crude production in that area.

A Feb. 11 CNBC article states that Trump’s tariffs on Canadian oil are expected to raise gasoline prices for US drivers:

How much fuel prices would rise due to the tariffs depends on how Canadian producers and U.S. refiners respond. In general, a 10% tariff passed to the consumer would increase gasoline and diesel prices by about 15 cents per gallon, Andy Lipow, president of Lipow Oil Associates, said in a Feb. 2 note.

Diversifying trade

While US refineries have few alternatives to Canadian crude oil, when it comes to other exports, Canadian businesses have more options and are exploring them.

A recent survey by KPMG found that, in response to Trump’s tariffs, 88% of Canadian businesses are considering diverting their exports to other countries without tariffs.

The survey via the Financial Post also said most Canadian business leaders are already taking drastic action to mitigate any impact from the tariffs, with 83 per cent looking to make their supply chains more resilient by either sourcing alternative materials, revisiting contracts or implementing new technologies, among other possible solutions.

Conclusion

Time is ticking away for the Canada-US trade war to begin. Trump has announced 25% duties on Canadian steel and aluminum imports, and 10% on oil and gas imports, all coming into effect on March 4.

Some say it’s all a negotiating ploy, and once he gets what he wants, Trump will drop the tariffs. But what he wants is to force Canada, by causing economic destruction, to become the 51st state. Steve Bannon, a former top aide to Trump (who recently admitted to defrauding Americans), believes tariffs are just the first step in a plan for “hemispheric control”.

Trump wrongly believes, or is lying to the American public, it’s the exporting company, and country, that will bear the brunt of the tariffs. In fact, it’s the importing company that has to eat the levy, which will be passed onto customers or consumers in the form of higher product costs. This of course leads to inflation — the very thing the US Federal Reserve has been fighting, and partially tamed, over the past year or so, the very thing Trump was elected to reduce.

Americans will be paying more for gas and just about everything will get more expensive (including food) because so many goods are transported via trains or trucks using gasoline/ diesel and oil.

$28 Trillion roll-over

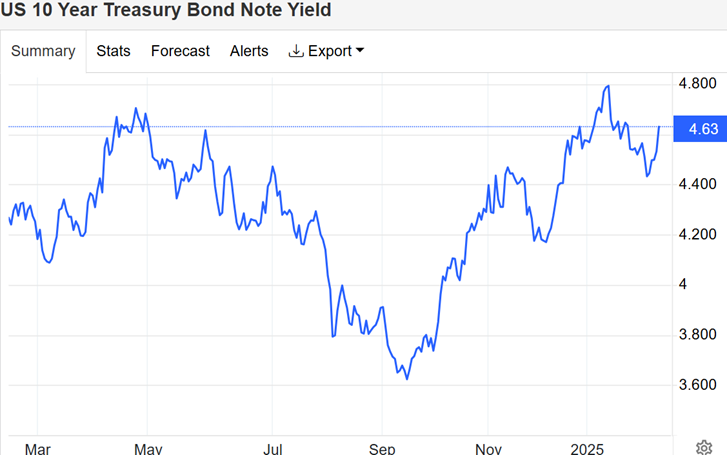

And then there’s this: According to Federal Reserve data, there will be roughly $28 trillion worth of US government bonds maturing over the next four years, i.e. now through the end of 2028.

That’s more than 75% of the government’s $36+ trillion national debt.

This is an absolutely staggering figure, averaging $7 trillion per year for the next four years.

And remember, we’re just talking about the existing debt that is set to mature. It doesn’t even include new debt that has to be issued over the next four years, which could easily be another $7-10 trillion.

This is an enormous problem for the Treasury Department, because they clearly don’t have $28 trillion to repay those bondholders.

Usually when a government bond matures, the investor simply rolls the proceeds into a new bond. This is referred to as the debt “rolling over”. The problem for the US government, besides the sheer size of the debt, is that most of the bonds that are maturing over the next four years were issued when interest rates were much lower. If they were previously issued at 3%, for example, now the government has to refinance that debt at say 5%, meaning an extra 2% in interest charges per year.

That’s almost $600 billion in additional interest EACH YEAR on top of the $1.1 trillion interest bill that they’re currently paying.

Trump’s Looming Deficit Disaster

“During his first term, Trump pursued an aggressive trade policy, imposing 10-20% tariffs on approximately $350 billion worth of Chinese imports, along with similar tariffs on steel and aluminum. But instead of shrinking, the trade deficit increased by nearly 40% from $480 billion in 2016 to $680 billion in 2020.

What is often overlooked is that the real reason the trade deficit widened under Trump was not tariffs but tax cuts. While Trump was raising import duties, he was also aggressively slashing taxes. The 2017 Tax Cuts and Jobs Act had two major effects: incentivizing investment by lowering the corporate tax rate and increasing the budget deficit, thereby reducing the national savings rate. Consequently, even before the COVID-19 pandemic caused the deficit to surge, it had already jumped from $584 billion in 2016 to $984 billion in 2019.

The key economic lesson Trump should have taken from his first term is that trade deficits aren’t determined by tariffs but by a country’s spending relative to its production.”

Trump has said he wants the Fed to lower interest rates but new Reuters polling suggests highly indebted Americans are going to wait far longer than hoped for the much wanted rate cuts. The Fed has been forced into a wait-and-see mode, their bias still for cuts not hikes. But bond yields jumped after the Fed cut its rates by 100 points in November and December. In my opinion it will not take much of an inflation rise from here to really spook the bond market, if that happens the Fed will change its bias to hikes.

Investors have already scaled back their expectations of more policy easing in 2025 to just one cut.

US consumer prices post largest increase in nearly 1-1/2 years in January

“WASHINGTON, Feb 12 (Reuters) – U.S. consumer prices increased by the most in nearly 1-1/2 years in January, with Americans facing higher costs for housing and food, reinforcing the Federal Reserve’s message that it was in no rush to resume cutting interest rates amid growing uncertainty over the economy…

The consumer price index jumped 0.5% last month, the biggest gain since August 2023, after rising 0.4% in December, the Labor Department’s Bureau of Labor Statistics (BLS) said.”

We pointed out the irony of getting into a trade war because of our cheap oil exports state-side. It’s ironic because we have always sold our oil to the United States through north-south pipelines that offer up Canadian crude at a major discount to the two international benchmarks, Brent crude and WTI crude.

There is major opposition to east-west pipelines, particularly in Quebec and BC, and building them would take years.

Even if by some miracle we could get them built sooner, we still face a myriad of obstacles to interprovincial trade. We need to knock those barriers down if Canada has any hope of diversifying trade by keeping it within Canada. The more likely course of action is for businesses to look beyond the US market.

88% of Canadian businesses are considering diverting their exports to other countries without tariffs, with 83% looking to make their supply chains more resilient by either sourcing alternative materials, revisiting contracts or implementing new technologies.

When Trump was in office 2016-20, he forced the renegotiation of NAFTA and called it the greatest trade deal ever, it was perfect, the most beautiful deal ever done. Now all of that is forgotten and Trump has again gone on the offensive, threatening Canada and Mexico (and China) with tariffs and following through. We’re already looking at a minimum 25% on aluminum and steel, and 10% on energy. What else is on the target list come March 4?

Canadians have shown resolve in boycotting American products but that can only go so far. Our auto sector and grocery sector, to name just two, are deeply integrated and some Canadian products are too expensive to substitute. The end result of countervailing tariffs on US imports will be higher prices i.e. inflation.

Trade negotiations have previously been done in good faith but Trump has extinguished that and Canadian negotiators are in a foul mood. Trump threatened Canada with 25% tariffs and we complied with what he wanted — a crackdown on drugs and illegals crossing the border.

In December the federal government announced CAD$1.3 billion in border spending and that was followed up with $200 million for a new intelligence directive on organized crime and fentanyl, the appointment of a “fentanyl czar”, and the listing of drug cartels as terrorist organizations.

Canada and Mexico handed Trump an olive branch and he responded by slapping 25% tariffs on aluminum and steel.

We Canadians can fix this and come out the other side much more unified and stronger as a sovereign nation. Canada and Mexico have long taken the convenient, far easier and lazier route of having the US as our largest trading partner. As you see in the graphic above, and have read in the article, we have plenty of room, and the need, to diversify our trading amongst the rest of the world. The opportunity is here.

According to Trump, America is the center of the universe. He believes everybody needs the US and the US doesn’t need anybody.

Canada has a multitude of options to diversity its trade and it starts by dismantling interprovincial trade barriers and looking beyond the United States to Latin America, Europe, Asia and yes, even China.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

5 Comments

Leave a Reply Cancel reply

You must be logged in to post a comment.

Unpacking the Document that Spells Out Trump’s Tariff Strategy

Josh Hendrickson is the chair of the Economics Department at the University of Mississippi. He recently brought to Twitter’s attention a 41-page document released in November by Stephen Miran, the Harvard PhD whom Trump has nominated as the new chair of the Council of Economic Advisors. The document spells out a strategy of using tariffs and deregulation to Make America Great Again.

https://www.hudsonbaycapital.com/documents/FG/hudsonbay/research/638199_A_Users_Guide_to_Restructuring_the_Global_Trading_System.pdf

One unmentioned interprovincial impediment to business that is not widely known (because it isn’t written about) is listed in this LeDevoir article. https://www-ledevoir-com.translate.goog/economie/838813/comment-entreprise-ici-fait-concretement-face-tarifs-douaniers?_x_tr_sl=fr&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=sc

The problem is each province has set up a purposeless department that reviews the product for sale in their own province, after Health Canada has approved the medication for use!

“”This is a product that has a huge impact on patients’ lives,” Edwards said. He added that “unfortunately,” interprovincial trade barriers prevent its sale across the country. He is therefore advocating for an end to these barriers to trade between provinces.

“Our product can be marketed immediately in the United States, by reaching doctors directly, while in Canada the approval process is very cumbersome. In fact, we find ourselves in front of ten buyers with ten times the paperwork. It’s even more frustrating when you know that we could very well live just on sales made in Canada, where there is a great need for our product.””

https://aheadoftheherd.com/here-are-the-interprovincial-trade-barriers-that-are-costing-canadian-consumers-more-money/

https://aheadoftheherd.com/us-tariffs-would-stack-for-canada-official-says-as-countries-condemn-trump-moves/

Have to wonder about US Energy Secretary Chris Wright saying “would love to” see Australia supplying uranium for nuclear power. Canada currently supplies 26% of US’s uranium needs. If they are going to annex Canada by economic destruction they certainly would not need OZ for uranium..

Rick