Torr Metals starts drilling Bertha target at Kolos Copper-Gold Project – Richard Mills

2025.10.22

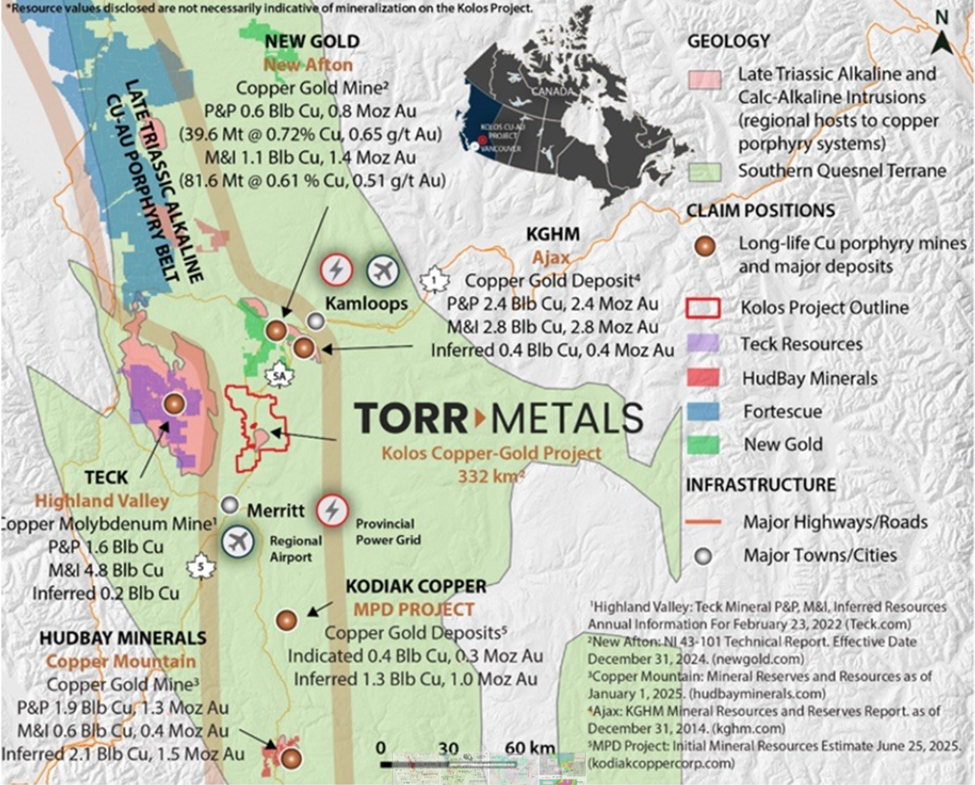

Torr Metals’ 332-square-kilometer Kolos Copper-Gold Project (including the 57 km² Bertha property optioned in March 2025 for full ownership) in BC contains Nicola Belt geology along trend and with similar attributes to alkaline and calc-alkaline copper ± gold ± molybdenum porphyry mines at Copper Mountain, Highland Valley and New Afton.

The project is adjacent to Highway 5, the Coquihalla Highway, with year-round access and operation potential via forestry service roads and substantial infrastructure provided by the city of Merritt located 23 km to the south. The project contains 16 historical copper and gold occurrences, the majority never drill-tested.

In total, Torr has identified four undrilled copper-gold porphyry targets at Kolos — Sonic, Bertha, Kirby and Lodi — with surface geochemical anomalies covering a combined 11.8 km². Bertha, Kirby, and Lodi are fully drill-permitted, while Sonic is in the permitting phase.

Torr Metals started out exploring the Latham Copper-Gold Project in the Golden Triangle of northwestern BC but pivoted to the Kolos Copper-Gold Project after CEO Malcolm Dorsey and his brother, Cameron Dorsey, both structural geologists (Cameron is an advisor to the company) staked the claims based on an exploration model they have developed over the past several years of working in the region.

Torr’s third property is the Filion Gold Project in Ontario.

The project lies within the Quesnel Terrane, a prolific porphyry belt in British Columbia that is host to major deposits and long-lived mines that within the region largely consist of Late Triassic calc-alkaline and alkaline intrusions, including Highland Valley (30 km to the northwest), New Afton (30 km to the north), and Copper Mountain (106 km to the south) deposits.

The Coquihalla Highway separates the two main lithologies encountered on the Kolos project. West of the highway and in the northeast section of the property andesitic rocks of the Late Triassic Nicola Group predominate, consisting of andesite hornblende porphyry as well as andesitic tuff, lapilli tuff, agglomerate and volcanic breccias. Within the northern portion of the property Nicola Group volcanics are intruded by a fine-grained diorite that is apparently a subvolcanic equivalent of the andesite.

A major north-trending structural corridor, the Fanta Fault, is exposed along the Coquihalla Highway and for the most part separates Nicola Group volcanic and sedimentary rocks to the west from the batholith to the east. The fault is characterized by brecciation, pyritization, carbonate and epidote alteration, local clay alteration and variable silicification.

Highly prospective mineralization consists of locally abundant pyrite that is disseminated within host volcanics as well as concentrated within north-trending fault structures that separate the underlying Late Triassic Nicola Group rocks from Late Triassic granodiorite to quartz monzonite intrusions.

Elsewhere throughout the project area, localized occurrences of malachite with rare chalcopyrite also occur within host Nicola Group volcanics, associated with increased fracturing together with carbonate alteration and quartz-carbonate veinlets. These veinlets carry malachite, pyrite ± chalcocite that together with observed alterations styles is suggestive of the upper level of a large-scale copper porphyry system with near-surface exposure.

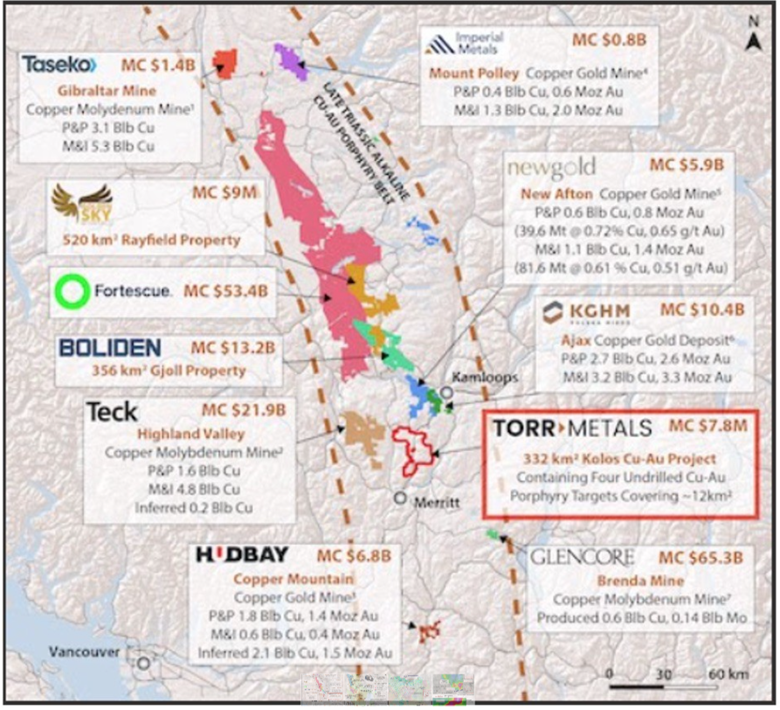

As shown on the map below, there are at least nine major or mid-tier mining companies operating within the Late Triassic-Alkaline Cu-Au Porphyry Belt, including Taseko (Gibraltar mine), Boliden (Gjoll project), Teck (Highland Valley mine), Hudbay Minerals (Copper Mountain mine), Imperial Metals (Mount Polley mine), New Gold (New Afton mine), KGHM (Ajax project), and Glencore’s shuttered Brenda mine.

In August 2024 Torr Metals made a discovery that both confirmed the exploration methodology, and introduced a fascinating analog.

Final assay results from a total of 33 rock grab samples collected during 2024 reconnaissance programs revealed additional high-grade rock grab assays within the Kirby, Rea and Clapperton zones, as well as a new copper-gold discovery in the northern portion of the project that Torr termed the Sonic Zone.

Initial rock grab samples from the Sonic Zone revealed anomalous copper and gold values in outcrop within a 1,000- by 2,000-meter footprint of strong magmatic-hydrothermal alteration that aligns with the margins of a high magnetic geophysical signature, identified as a potential source for a monzodiorite intrusion.

The discovery reinforced Torr’s exploration model and suggested the potential for another large-scale cluster of anomalies comparable in scale to the already established Kirby, Lodi, Ace and Rea targets to the south.

CEO Malcolm Dorsey for the first time referenced New Afton as a potential comparable to the Kolos Copper-Gold Project:

“The discovery of the Sonic Zone is particularly promising, as it opens up a new area of mineralization that bears geological similarities to the high-grade New Afton copper-gold porphyry deposit, located just 27 km to the north,” he said.

The following three paragraphs are from the July 8, 2025 news release:

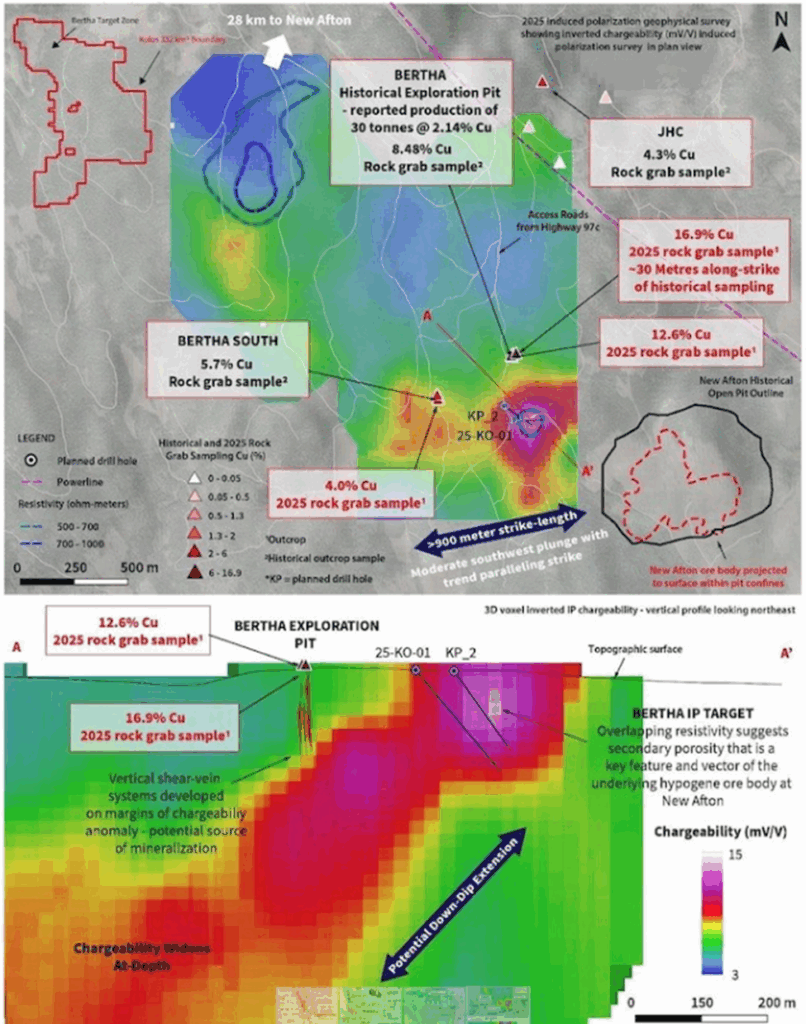

“The Bertha Zone represents a highly prospective, underexplored high-grade copper target where recent fieldwork has confirmed supergene-style copper mineralization, primarily sooty chalcocite, native copper, and malachite nodules hosted within brecciated volcanic rocks. This style and setting are geologically significant and comparable to the supergene enrichment zone at New Afton, located just 28 km to the north.”

“Supergene mineralization happens when copper-rich fluids from deeper underground move up through cracks in the rock, usually helped by rainwater or groundwater. As these fluids rise closer to surface, they interact with oxygen and other elements. This chemical reaction causes high-grade copper minerals, like chalcocite, native copper, and malachite, to form near surface.”

“At New Afton, the presence of a well-developed supergene blanket, characterized by abundant native copper and sooty chalcocite, was critical to the early economic success of the mine. This zone accounted for approximately 80% of the initial orebody, enabling low strip ratios, enhanced metal recoveries, and early cash flow. It overlies a deeper primary hypogene copper-gold porphyry system hosted within the Cherry Creek intrusion of the Iron Mask batholith, where brecciation and hydrothermal fluid pulses played a key role in both metal deposition and alteration zoning.”

I have been looking at these types of deposits in the southern Quesnel Trough for over 20 years. But no one has ever found another Afton. A well-developed supergene enrichment blanket superimposed on the hypogene mineralization is a target well worth chasing; Kolos appears to have it (although it is very early stage and needs to have more work), strengthening the potential comparison to New Afton. And let’s not forget at least three other large, already identified targets.

Bertha drilling

On Oct. 15 Torr announced it has started drilling the Bertha target. The inaugural drill program at Kolos is slated for 1,500 meters, and is designed to test the 900m by 500m moderate-to-high chargeability induced polarization (IP) anomaly.

The company also said it increased the size of its previously announced non-brokered private placement, from aggregate gross proceeds of up to $2.8 million, to aggregate gross proceeds of up to $4.57 million.

Under the Spotlight – Malcolm Dorsey, CEO, Torr Metals

The Bertha Zone hosts strong surface mineralization and near-surface discovery potential, with recent rock grab sampling from outcrop on the margins of the IP anomaly returning up to 16.9% copper (Cu) and 8.48 grams per tonne (g/t) silver (Ag). These results come from a series of parallel quartz-carbonate veins extending along a 30-meter strike length within the historical Bertha exploration pit, which reported past production of 30 tonnes averaging 2.14% Cu and 27.43 g/t Ag.

The 2025 campaign will comprise up to 1,500 meters of diamond drilling in five to seven holes designed to test the near-surface core of overlapping chargeability and resistivity anomalies at depths of 200 to 300m. The geophysical anomalies remain open at depth beyond 600m.

In conjunction with drilling, Torr will undertake a comprehensive surface geochemical program consisting of approximately 1,500 soil samples at the Sonic Zone, located east of Highway 5. This work will infill and expand upon areas previously lacking soil geochemical coverage, where recent sampling of porphyry-style alteration and mineralization yielded up to 1.1 % Cu. The program is designed to extend known soil anomalism southward from historical grids that returned values of up to 4,510 parts per million (ppm) Cu and 590 parts per billion (ppb) gold (Au), establishing the geochemical footprint and continuity of mineralization in preparation for planned drill testing of the Sonic target in 2026.

Additional prospecting and geochemical sampling will target the Bertha South occurrence, located approximately 450 meters west-southwest along strike from the Bertha pit. Recent fieldwork has identified potential extensions of copper mineralization at surface. This integrated approach aims to refine structural interpretations, extend known mineralized trends, and generate new targets for potential follow-up drilling.

“We are very pleased to commence our inaugural diamond drill program at the Bertha Zone, marking a major milestone as we begin the first-ever testing of the IP anomaly identified earlier this year,” Malcolm Dorsey, president and CEO of Torr Metals, stated in the news release. “Our Phase 1 drilling at Bertha is focused on a near-surface target that exhibits strong geological and structural similarities to the high-grade New Afton alkalic copper-gold porphyry system, located approximately 30 kilometres to the north. In parallel, we are advancing additional fieldwork at the Sonic Zone, which displays a larger geochemical footprint and similarly strong characteristics to the nearby Ajax system. Both zones represent highly compelling copper-gold targets that could be transformational for Torr. With excellent infrastructure access and a recently upsized private placement providing full funding for continued drilling into 2026, we are exceptionally well positioned to build momentum and unlock the broader potential of our 332 km² land package.”

Torr Metals

TSXV:TMET

2025.10.21 Share Price: Cdn$0.15

Shares Outstanding: 31.8m

Market Cap: Cdn$7.8m

TMET website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard does not own shares of Torr Metals (TSXV:TMET). TMET is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of TMET.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.