Top 5 reasons why battery metals will continue to boom

2022.04.09

The metals used to power our electric vehicles — lithium, graphite, nickel, cobalt, etc. — have exploded onto the scene in recent years amid the global transition to clean energy, and are now the driving forces of what analysts call the next “commodity supercycle.”

Metals like lithium and nickel have seen their prices soar to new highs recently, with automakers worldwide scrambling to get their hands on more raw materials and meet their EV targets.

Many, including AOTH, believe that the rally in battery metals isn’t likely to stop anytime soon, for various reasons listed below:

- Explosive Demand

Although the market share of electric cars remains tiny compared to the traditional ICE vehicles, that is likely to change in the coming years as major economies transition away from fossil fuels.

Fastmarkets predicts that EV sales will experience a compound annual growth rate of 40% per year through 2025, when EV penetration is expected to reach 15%. After that, EV penetration is expected to rise even further, reaching 35% by 2030. Over that period, automakers worldwide will need an unprecedented level of raw materials to build lithium-ion batteries.

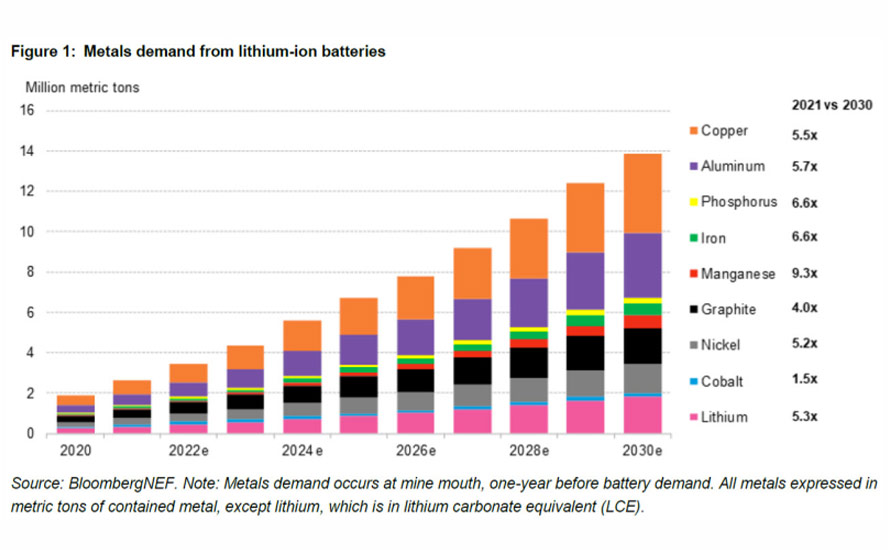

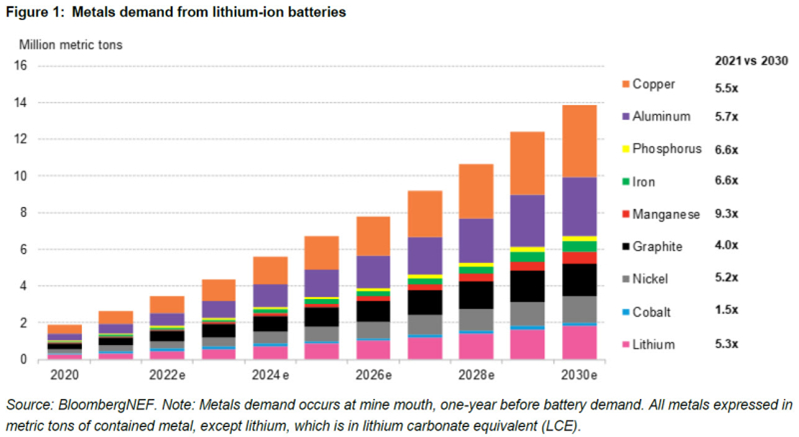

According to BloombergNEF, EV battery demand is expected to remain strong through this decade, with annual demand surpassing 2.7TWh by 2030. Total annual battery demand in 2030 is 35% higher than in last year’s outlook, largely due to higher demand from passenger EVs. That, by Bloomberg estimates, requires more than five times the amount of lithium, nickel and copper metal (see below).

By law of demand and supply, prices of these commodities will continue to surge long as demand keeps its current trajectory.

- Lagging Supply

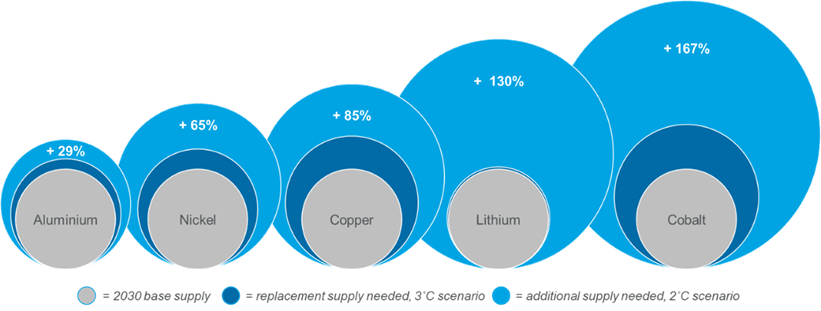

On the other side of the equation, the world’s supply of various battery metals could struggle to keep pace with the level of demand being projected.

According to price reporting agency Benchmark Mineral Intelligence, lithium demand is forecast to more than triple between 2020 and 2025, rising to a million tonnes and out-pacing supply by 200,000 tonnes.

Bank of America forecasts that 690,000 tonnes of nickel will be needed by 2025, based on its estimate of 13.6 million EVs sold that year. That represents more than the combined nickel supply of Russia and the Philippines.

Copper, too, is facing the tough task of meeting demand from the EV sector. In 20 years, BloombergNEF says copper miners need to double the amount of global copper production, just to meet the demand for a 30% penetration rate of electric vehicles.

Supply shortages are already being pegged for battery metals, which for lithium could begin as soon as this year, says S&P Global Intelligence.

- Climate Goals

A motivating factor behind the EV revolution is the global transition towards a “green economy”, and metals are the centerpiece to this transition.

According to consultancy firm Wood Mackenzie, the world needs at least $50 trillion of investment over the next two decades to achieve its climate action. This begins by increasing the EV adoption rate from 5 million vehicles today to at least 80 million by 2030.

Under WoodMac’s Accelerated Energy Transition-2 (AET-2) scenario, which is consistent with limiting the rise in global temperatures since pre-industrial times to 2°C, about 360Mt of aluminum, 90Mt of copper and 30Mt of nickel will feed the energy transition over the next 20 years.

WoodMac’s report also shows mining companies will need to spend $1.7 trillion over the next 15 years, to supply enough lithium, graphite, cobalt, copper and nickel for the shift to a low-carbon world.

Meanwhile, IEA’s Global Electric Vehicle Outlook reveals that if governments worldwide are able to ramp up their efforts to meet international energy and climate goals, the global electric vehicle fleet could reach as high as 230 million by the end of the decade, which would keep battery metals demand elevated.

- Political Tensions

Political instability has always been regarded as a major risk factor that could add pressure to the EV metals market. The supply of cobalt, lithium and nickel are all exposed to disruptions because their production and processing are concentrated and even dominated by “high-risk” jurisdictions.

A recent report by FitchSolutions found that increased risk of instability in the Democratic Republic of the Congo, which is responsible for nearly 70% of the world’s production, could add pressure to the supply chain over the next few quarters.

In a separate study, Fitch claimed that growing East-West geopolitical tensions could cast doubts over the long-term prospects of the world’s lithium supply, which is dominated by Chile, China and Australia.

The ongoing military crisis in Europe brought into light the vulnerability of the battery metals supply chain. Mounting sanctions against Russia, a major producer of nickel accounting for 7% of global output, resulted in massive supply disruptions that sent nickel prices soaring. A global “nickel crisis” ensued, leading to a historic squeeze that even forced the London Metal Exchange to suspend trading of the metal.

The events that unfolded in Europe highlights the inherent risks in the battery metals supply chain, which could keep prices high while demand continues to climb.

- Lack of Production Capacity

Another contributing factor to the relentless battery metals rally is the lack of processing and production infrastructure for the minerals.

Part of this is due to underinvestment in capacity expansion during the bear market years (i.e. lithium between 2018-2020) while demand for battery metals was still gathering steam. And when prices eventually erupted, the EV industry found itself shorthanded when it came to securing raw materials.

“This has translated into surging lithium prices,” S&P Global Platts noted earlier this year. “Although the battery industry has been investing significantly in downstream battery capacity to power the surging EV demand, lithium is still getting less funding than required — and such investment could be too late to prevent a structural deficit in the coming years.”

This poses a huge threat for automakers partaking in the global EV revolution, as battery capacity can be built much faster than mining projects, so there may not be enough battery metals to go around.

Joe Lowry, president of consulting firm Global Lithium, told S&P that “the lack of investment in lithium capacity over the past five years will extend the supply shortage”, adding more fuel to the lithium rally.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks.

Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.