Top 5 reasons to ‘think zinc’

2022.04.29

Zinc is the fourth most used metal today in terms of annual tonnage produced. Zinc’s main function is to galvanize metals. Adding a zinc coating to steel or iron protects it against rusting. A high percentage of steel that goes into buildings and automobiles is galvanized with a zinc coating, making it a highly prized metal.

Zinc is also frequently used in die-casting, is a common ingredient in coins, and has applications in construction, including pipes and roofing.

The majority of the world’s zinc deposits contain lead, meaning lead and zinc are often mined together.

Zinc has risen in importance and value thanks to its fundamental role in clean energy applications. The base metal can be used as anode material for batteries, making it a key part of energy storage systems as we move towards a world of renewables.

Below are 5 reasons to invest in zinc, and companies that specialize in exploring for the base metal and developing new zinc deposits.

Prices on a tear

Demand from China remains strong, as industrial activity ramps up in the world’s biggest metals consumer and number one electric vehicle market.

The same can be said for the rest of the world, as nations put the covid-19 pandemic behind them and invest more in their civic infrastructure. The elevated demand, paired with supply concerns over rising power costs, is reflected in the metal’s price movement: zinc prices surged more than 20% in 2021, peaking at a 14-year high last October.

Zinc is likely to stay at multi-year highs in 2022 owing to high energy costs resulting from the war in Ukraine. Year to date, spot zinc is up nearly 18%, and Fitch Solutions has raised its 2022 price target to $3,500 a tonne from $2,900/t. At this rate, zinc is on track to reaching its all-time high of $2.06/lb, in November 2006.

Depleted supply

Over the years, some very large zinc mines have been depleted and shut down. These include MMG’s Century mine, which used to supply 4% of the world’s zinc, and Glencore’s Brunswick and Perseverance mines in Canada.

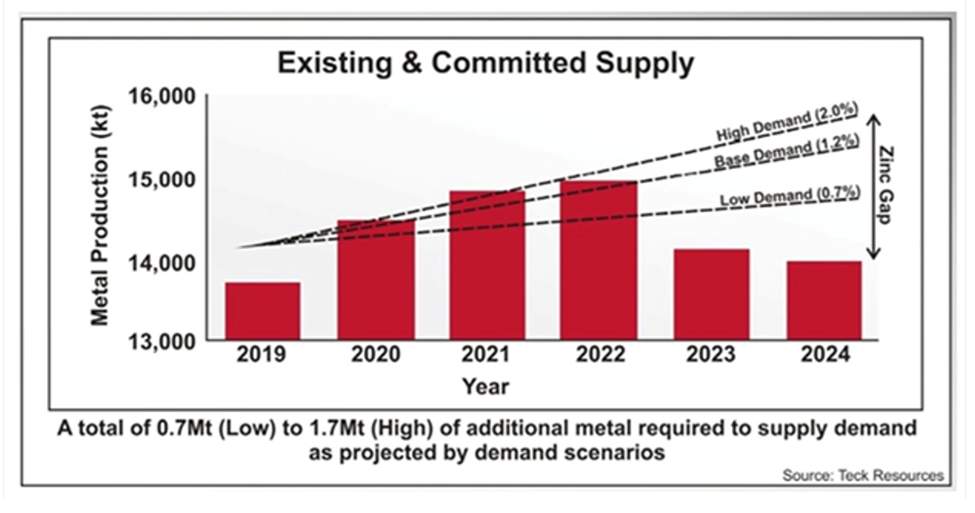

Yet there have been few discoveries or big zinc projects planned, setting the zinc market up for a supply shortage.

At the end of January premiums for physical zinc hit record highs, as the market scrambled for metal following the closure of a second zinc smelter due to high power costs. Reuters reported that Nyrstar placed its Auby smelter in France on care and maintenance, while Glencore closed its Portovesme zinc plant for the same reason.

Although Nrystar restarted Auby in March, high electricity prices hinder it from moving to full production. Global refined zinc output continues to be pressured by the energy crisis in Europe.

Given the current rate of consumption, it is projected that global zinc reserves — estimated by the US Geological Survey at 250 million tonnes — will only last another 17 years. The zinc market has reached a critical stage when more mines are needed. But even if all the development projects come online at full capacity, industry experts think that won’t be enough to outpace demand.

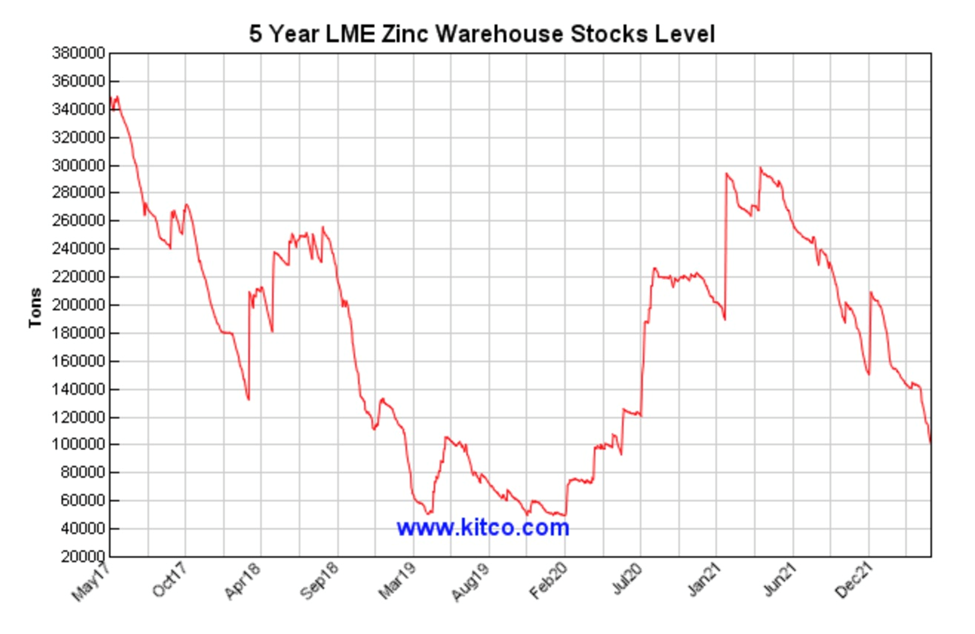

Zinc reportedly moved from a 5.3 million tonne surplus in 2020 to a million-tonne deficit in 2021, with warehoused metal in London and Shanghai recently plummeting to six days consumption. According to Shanghai Metals Market, zinc inventories in China have been drawn down due to curbs announced by the Chinese government to tackle the pandemic that has resurfaced there.

Infrastructure

Primarily used to coat and protect steel from corrosion, zinc is unquestionably a staple in a nation’s infrastructure buildout.

The International Zinc Association (IZA) explains that “galvanized steel is one of the strongest construction materials in existence and has been used for centuries in the building of bridges, buildings and other structures.”

Last fall the US Congress passed a trillion-dollar infrastructure package that includes, among other things, money for roads, bridges, power & water systems, transit, rail, electric vehicles, and upgrades to broadband, airports, ports and waterways.

Beyond the United States, there is China’s Belt and Road Initiative (BRI), consisting of a vast network of railways, pipelines, highways and ports that extends west through the former Soviet republics and south to Pakistan, India and southeast Asia. BRI requires millions more tonnes of zinc, along with other key infrastructure metals such as copper, nickel and aluminum.

At Beijing’s behest, local governments have reportedly drawn up lists of thousands of “major projects,” which they are being pressured to see through. Planned investment this year amounts to at least 14.8 trillion yuan (US$2.3 trillion), according to a Bloomberg analysis.

In Europe, post-pandemic spending incudes a “green recovery” pledge worth 550 billion euros. Among the projects that could benefit from the funds, are low-carbon steel production in Sweden (steelmaking represents about half of zinc consumption) and an EV battery factory in Poland.

The bullish case for zinc, then, is clearly bolstered by the green and blacktop infrastructure projects that haven’t even begun to be rolled out.

Galvanized steel

More immediately, Fitch Solutions says it expect steel sector consumption to boost demand for zinc in the coming months. Crude steel output is likely to grow at a similar rate to last year, 3.4%, suggesting robust growth in the production of galvanized steel, which is the main source of demand for zinc.

The strength and flexibility of zinc alloys mean they are widely used to create die casts for industrial uses — for example, in the production of car or machine parts. Zinc is also used to make brass and bronze. Zinc oxide is mainly used in the production of rubber, while zinc sulfide is employed in X-ray screens, optics and as a pigment.

Next-gen batteries

Research shows batteries built around zinc can be a cheaper, safer, and more effective alternative to the lithium-ion battery systems commonly used in electronics and electric vehicles today. This finding could even potentially alter the landscape of the global energy storage market.

According to the IZA, annual demand for zinc in batteries was 600 tonnes in 2020, but that figure is projected to leap to a massive 77,500t by 2030.

A 2022 article in Power Magazine states that lithium-ion raw materials cannot be produced in sufficient quantities to satisfy demand for EVs and renewable energy storage installations. However, it has also become increasingly that any alternative to lithium-ion would need to adopt standard manufacturing processes to allow for a rapid and low-cost scale-up.

“So far, the zinc-ion battery is the only non-lithium technology that can adopt lithium-ion’s manufacturing process to make an attractive solution for renewable energy storage, particularly for its compatibility along with other advantages,” Power Magazine states.

Just over a year ago, the IZA launched a new program, the Zinc Battery Initiative, a partnership between zinc-producing members and leading companies in the zinc battery sector.

“The advancement of zinc battery technologies, resulting in low-cost, sustainable, and safe options for key applications represents a disruptive innovation with significant impacts on these markets going forward,” said Andrew Green, executive director of the International Zinc Association, in a February 2021 news release.

The IZA describes zinc batteries as versatile, offering flexible designs with broad operating temperatures, high power discharge, and capable of long-duration storage. The association maintains that zinc has strong supply chains in all major regions, with production in North America, South America, Europe and Asia-Pacific. Zinc batteries also have an excellent safety record.

As the push to electricity the global transportation system gathers pace, and to transition to renewable energy systems requiring reliable storage, we expect zinc to be among the metals most likely to benefit. The base metal is uniquely placed for its utility in both “blacktop” infrastructure programs requiring large amounts of galvanized steel, and “green” infrastructure projects that in future may require zinc batteries en masse. Combine these attributes with strong supply-demand fundamentals, and there appears to be no stopping zinc’s upward price movement, making it a strong candidate for investment.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.