Tinka delivers more good results from drilling at Ayawilca

2021.01.25

The Covid-19 crisis has served as a catalyst for a new “commodity supercycle” mirroring that of the 2000s — this was the belief among Goldman Sachs analysts in the bank’s 2021 outlook released last November.

Historically, a “supercycle” is characterized by high commodity prices that persist over an extended time. It can be loosely defined as a “decades-long, above-trend movement in a wide range of base material prices” deriving from a structural change in demand. (Examples of such a period include the US industrialization of the late 19th Century and the post-war reconstruction of Europe around the 1950s.)

Indeed, base metals went on a remarkable run during the second half of calendar 2020 as the global economy embarked on the road to recovery. Commodities led by copper received a massive boost from rapid industrialization and urbanization in emerging nations, in particular China, the world’s largest consumer.

Another metal that became a star performer during the recent bull run was zinc, which moved in tandem with copper and touched its highest point in 2020.

Given the robust demand and supply disruptions, the zinc market is currently facing a deficit, estimated at 650,000 tonnes by ING Bank. This massive deficit is likely to remain in the new year on the infrastructure stimulus narrative, supporting this upward trend in zinc prices.

Opportunity for New Zinc Projects

According to Fitch Solutions, the high zinc prices are encouraging investments into a pipeline of new projects in 2021. While China has always been the world’s biggest producer of the metal, the firm sees mine production stagnate there over the coming years on declining ore grades and environmental concerns.

This paves the way for Peru, the second-largest zinc producer and the top producer of concentrates. While Peru’s zinc sector is dominated by the Antamina operation, Fitch sees more projects – namely Tinka’s Ayawilca – coming online shortly to capitalize on the high commodity prices.

“Ayawilca contains one of the higher-grade zinc resources anywhere in the world, and we are very excited to see zinc prices reflect the lack of significant new supply. We strongly believe that Ayawilca is perfectly positioned to take advantage of current positive market sentiment towards base metals,” Dr. Graham Carman, Tinka’s president and CEO, recently stated in a press release.

As exploration continues at its Ayawilca zinc-silver project in Peru, Tinka Resources Ltd. (TSX.V:TK) (OTCPK: TKRFF) has delivered additional results from its ongoing drill program, which is aimed to improve the project resources ahead of an updated preliminary economic assessment (PEA) later this year.

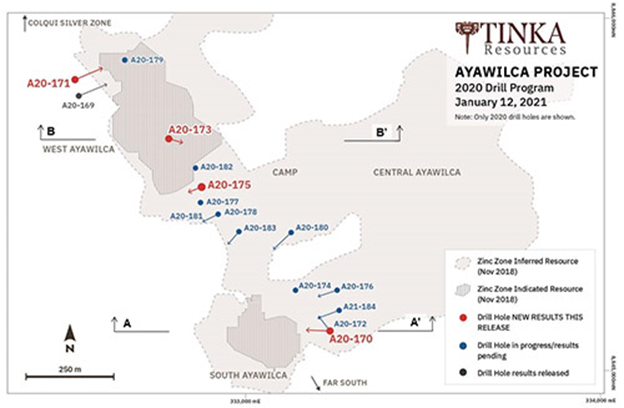

Three of the holes targeted extensions of indicated resources at the West and South Ayawilca areas, while one hole is an infill hole at West Ayawilca.

One hole at South Ayawilca (A20-170) returned 38.8 m at a grade of 9.3% zinc and 14 g/t silver from 282.6 m to 321.4 m depth, including 13.7 m at 15.9% zinc and 26 g/t silver from 282.6 m depth. This is expected to expand the indicated resources at South Ayawilca, the company says, with mineralization still open to the southeast.

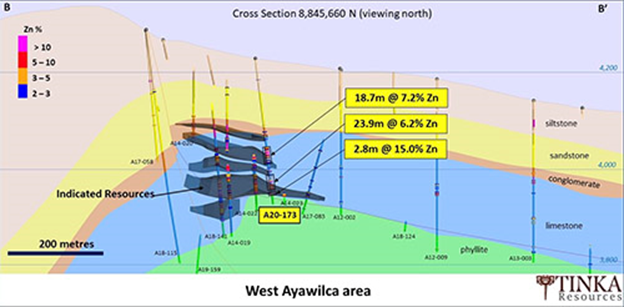

Highlight assays from West Ayawilca include 18.7 m at 7.2% zinc and 11 g/t silver from 187.3 m depth (A20-173), including an intersection of 7.3 m at 11.8% zinc and 21 g/t silver from 196 m depth. Another hole (A20-175) returned 1.2 m at 43.6% zinc, 212 g/t silver and traces of lead (at 0.5%) from 136.5 m depth. These holes have improved its geological model of the central portion of West Ayawilca, the company noted, and with good grades to boot.

Meanwhile, the infill hole at West Ayawilca (A20-171) showed 0.4 m at 19.6% zinc and 99 g/t silver from 110 m depth.

The company has now completed 6,000 m of the 7,500 m program planned at Ayawilca. Many of the completed holes targeted zinc-silver mineralization between West and South Ayawilca, an area that has not been well drill tested. Sixteen diamond drill holes have been completed so far, with results for eleven of those still pending.

Drilling will continue for the next few weeks focusing on expanding the high-grade indicated resources at South Ayawilca.

Ayawilca Project

Tinka’s flagship Ayawilca project is located about 200 km northeast of Lima in the Pasco region. The entire property consists of 16,500 hectares of contiguous claims, all along a world-class mining belt in central Peru known for producing base metals.

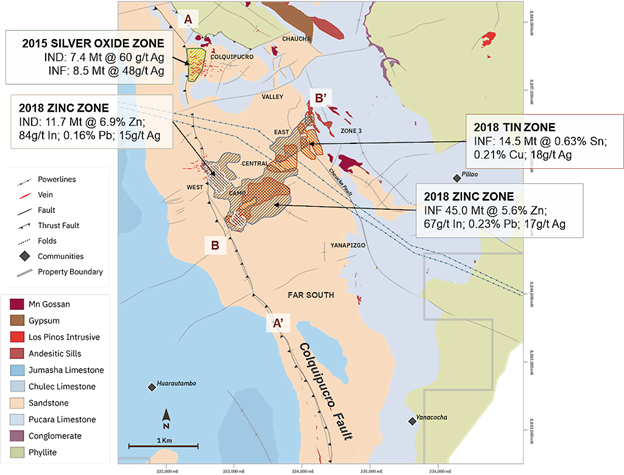

Ayawilca is a carbonate replacement deposit (CRD), an important style of economic silver-zinc-lead(-copper) mineralization found in the region (mined deposits include the Cerro de Pasco and Morococha mines – see map below).

About 100 km to the north is the giant Antamina mine (copper-zinc) jointly owned by BHP, Glencore, Teck Resources and Mitsubishi.

Since acquiring its land position at Ayawilca back in 2005, the company has identified three separate mineral deposits at the Ayawilca project: the Ayawilca zinc zone (sulphide), the Colqui silver zone (oxide) and the Ayawilca tin zone (sulphide).

Ayawilca Zinc Zone

The Ayawilca zinc zone was discovered by Tinka in 2013. Prior to the 2020 drill program, the company has already completed approximately 75,000 m of drilling at the property, which has now grown into one of the largest zinc-silver resources held by a junior miner.

According to the latest resource update (November 2018), the deposit contains an estimated 1.8 billion lb zinc and 5.8 million oz silver in the indicated category, and 5.6 billion lb zinc and 25.2 million oz silver in the inferred category as sulphides. In addition, there are 42 million lb and 230 million lb of lead resources in the indicated and inferred categories respectively.

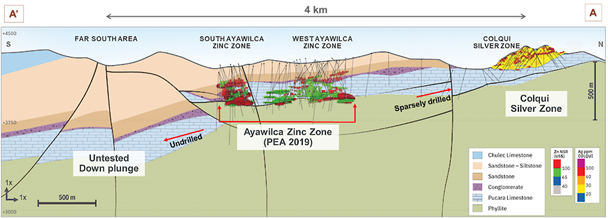

Zinc mineralization at Ayawilca occurs as massive sulphide lenses hosted in limestones of the Pucará Group (Triassic-Jurassic age), the same host rock as at the large CRD mines of Cerro de Pasco and Morococha. Pucará Group limestone occurs at depths of between 150 and 450 m from surface in the resource area at Ayawilca, beneath sandstones and siltstones of the Goyllarisguizga (“Gollyar”) Group (Lower Cretaceous age) between 120 and 200 m thick.

Goyllar sandstones outcrop extensively over the resource area and dip gently to the east. Beneath the Pucará Group limestone lies basement rocks of the Excelsior Group (Paleozoic age), in fault contact with the limestone which also dips gently to the east. An important north-northwest trending fault structure, the Colquipucro Fault, controls the location of high-grade mineralization adjacent to the fault.

At the Ayawilca West and South areas, mineralized lenses are ‘stacked’ to form almost continuously mineralized zones with a vertical thickness of 100 to 150 m. Zinc mineralization occurs as both iron-rich sphalerite (marmatite) and low iron sphalerite.

Colqui Silver Zone

The Colqui silver zone (historically known as Colquipucro, or “pot of silver” in the Quechua language) is located 1.5 km north of the Ayawilca zinc zone, with both deposits connected by the NNW-trending Colquipucro Fault (see figure below).

Silver was exploited from Colquipucro at a small scale in the early 19th Century. Tinka claimed several mining concessions when the area became available in 2006, and has since completed 8,000 m of drilling in 45 holes at the Colqui area.

The Colqui silver zone is estimated to contain 14.3 million ounces of silver resources in the indicated category and 13.2 million ounces in the inferred category. The resources remain open to the west.

Ayawilca Tin Zone

The Ayawilca tin zone forms flat-lying sulphide lenses at the contact of the limestone and phyllite, underlying the zinc zone at Central and East Ayawilca (see figure below).

The sulphide lenses consist of massive pyrrhotite with quartz, chlorite, cassiterite (a common ore mineral of tin), pyrite and chalcopyrite. Quartz stockworks within phyllite also host tin-copper mineralization beneath the lenses.

Mineral resources at this deposit are estimated at 201 million lb tin, 67 million lb copper and 8 million oz silver, all in the inferred category.

Conclusion

In short, Ayawilca is possibly the best zinc development project currently in Latin America, and in our opinion will likely lead the next line of base metals mines to emerge from there.

The fact Ayawilca has other metals like silver and tin adds an extra layer of appeal, as these types of deposits are extremely rare. Not to mention that both its tonnage and grade compare well to existing base metals mines in the region.

Right now, Tinka is focused on developing the Ayawilca asset through resource expansion drilling with a view of completing a PEA by mid-2021. The current program is fully funded, and the company has about $16 million in cash (as of December 2020) to complete the remaining work.

Should all go according to plan, Tinka will fast-track to operations by 2023, producing approximately 140,000 tonnes of zinc concentrate in its first year.

Tinka Resources Ltd.

TSX.V:TK, OTCPK:TKRFF

Cdn$0.25, 2021.01.25

Shares Outstanding 340,740,715

Market cap Cdn$81.7m

TK Website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Tinka Resources Ltd. (TSX.V:TK, OTCPK:TKRFF) TK is a paid sponsor of his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.