Tin: an upcoming ‘green’ metal

2020.12.23

The next time you crack open a can of beer, you might want to think about tin.

The silvery metal with a faint yellow hue goes into 25% of the 370 billion metal drink containers produced every year, via tin-plated steel. The other 75% of cans are made from aluminum.

This application is constantly reinforced by beer drinkers in Britain, who refer to their beverage cannisters as “tins”, and Australians, who call them “tinnies”.

But if you think tin is limited to the lowly tin can, you may be surprised to learn the metal is due for a strategic re-think. Sentiment among the small number of analysts who cover the tin market (only 310,000 tonnes are produced annually, compared to say, copper at 20Mt) is turning bullish, based on anticipated supply deficits, as demand ramps up for tin’s use in what has been dubbed the ‘Fourth Industrial Revolution’ — involving machine to machine communication, the Internet of Things and artificial intelligence.

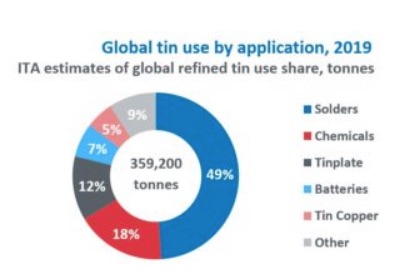

And that use is… solder. Over the past few decades, tin usage has quietly moved away from food storage to nano-soldering in electronics, such as semiconductors. According to the International Tin Association (ITA), soldering accounted for 48% of global usage in 2018, compared to tinplate packaging at just 13%.

Tin has even proved resilient against the pandemic. Semiconductor sales, seen as a proxy for the electronics good sector, are up about 6% this year compared to 2019, and that has been a boon for tin.

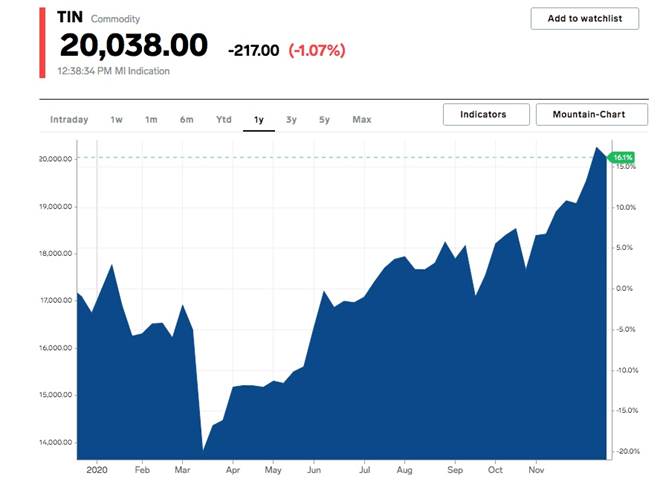

From a virus-related mid-March low of $13,791 a tonne, tin is now trading at $20,038/t, for an impressive gain of 45%.

Source: Markets Insider

As Reuters metals columnist Andy Home wrote recently, [s]oldering will also drive increased tin demand as the world tools up for the Industrial Revolution Version 4.

Tin is literally the glue that binds together the machines needed to interface with the virtual and robotic worlds.

This, along with its usage across a wide modern manufacturing spectrum, has not gone unnoticed by the US Geological Survey, which in 2018 included tin on its list of 35 critical minerals.

In addition to primary uses in solder, tin plating, tin chemicals, brass and bronze alloys, tin is also becoming important for “green” applications. Over the next decade tin is likely to be found in lithium-ion and other batteries, solar PV, thermoelectric materials, hydrogen-related uses and carbon capture.

Composition/ geology/ mining

A chemical element with the symbol Sn, tin is soft enough to be cut without much force. After solidifying, pure tin retains a polished, mirror-like appearance, but in tin alloys such as pewter, it becomes a dull grey color.

Despite being considered critical, tin is not especially rare. It is the 49th most common element in the Earth’s crust, at 2 parts per million (ppm), compared to 75 ppm for zinc, 50 ppm for copper and 14 ppm for lead.

Tin does not occur as a native element. Rather, it is most often obtained from the mineral cassiterite, which contains stannic oxide SnO2, hence the atomic symbol Sn. Other forms of tin can be mined from less abundant sulfides such as stannite, which requires a more involved smelting process. Tin is chemically similar to germanium and lead, and does not easily oxidize in air.

Cassiterite, a dark-colored mineral, often accumulates in river channels as alluvial deposits, being harder, heavier and more chemically resistant than the usually accompanying granite. About 80% of mined tin is reportedly from secondary deposits found downstream from the primary lodes. Most is produced from placer deposits, which contain as little as 0.015% tin, using economical mining methods such as dredging and open pits.

The tin is extracted by roasting the mineral casseterite with carbon in a furnace to approximately 2,500 degrees Fahrenheit. The next step involves leaching with acid or water solutions to remove impurities. Electrostatic or magnetic separation helps to remove any heavy metal impurities.

History

The earliest tin mining occurred at the beginning of the Bronze Age, around 3,000 BC. Bronze objects with tin or arsenic content first appeared in the Near East. It is thought that the low tin content, <2%, was there unintentionally, due to traces found in the copper ore, along with arsenic. The health risk of this combination was quickly realized, prompting a search for less hazardous tin ore. This created a demand for the metal and fostered trading networks between numerous Bronze Age cultures.

When copper was alloyed with tin, it produced bronze, which has a lower melting point than copper, making it easier to work with. Bronze was also harder, therefore ideal for tools and weapons. According to the Royal Society of Chemistry, the Chinese were mining tin around 700 BC, and pure tin was found at Machu Picchu, the mountain citadel of the Incas in ancient Peru.

A bronze alloy of one eighths tin and seven eights copper was used on a large scale from 3,000 BC. Pewter, an alloy of 85 to 90% tin, with the remainder usually consisting of copper, antimony and lead, was reportedly used as flatware from the Bronze Age until the 20th century.

Uses

Source: International Tin Association (ITA)

Source: International Tin Association (ITA)

Solder

Modern-day tin usage is mostly in tin-lead soft solders. Tin is an excellent metal for alloying because it melts and adheres to many base metals at temperatures considerably below their melting points. Smaller amounts of other metals, such as antimony and silver, add strength to tin-lead solders. The electronics/ electrical industries typically use solders containing 40-70% tin.

According to the International Tin Association, Thanks to the positive growth forecasts for 5G-based electronics technologies in the imminent ‘4th Industrial Revolution’ as well as new markets for interconnection in electric vehicles and other climate change-related infrastructures the longer-term outlook for solder usage remains very positive, despite recent macroeconomic shocks.

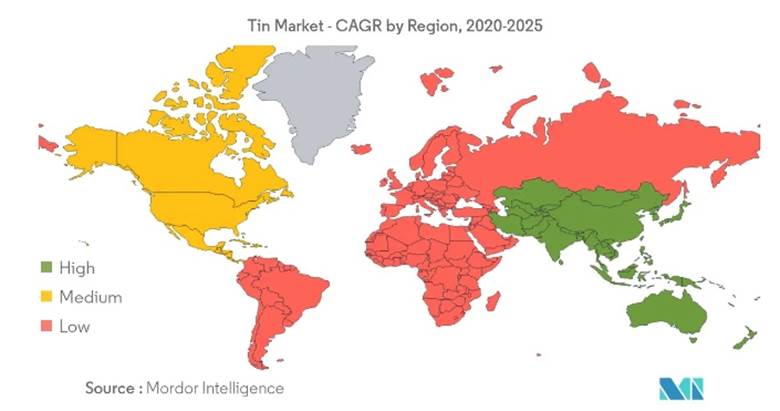

Research firm Mordor Intelligence finds that solder is the fastest-growing tin market segment, led by the Asia Pacific region.

Tin market CAGR by region, 2020-25. Source: Mordor Intelligence

Tin chemicals

Tin chemicals for PVC stabilizers, polymer catalysts and numerous other applications, is the second largest use of tin. Tin fluoride is added to some dental care products as stannous fluoride (SnF2), which has been shown to be more effective than sodium fluoride in controlling gingivitis.

Tin plating

Because tin has low toxicity, tin-plated steel is widely used for food and beverage packaging, as well as cans for chemicals, paints and dry products. Tin is also used for coating lead and zinc, and bonds readily to iron, as an anti-corrosive agent. Copper-based saucepans are often lined with a thin plating of tin; without it, the combination of acidic foods with copper can be toxic.

Alloys

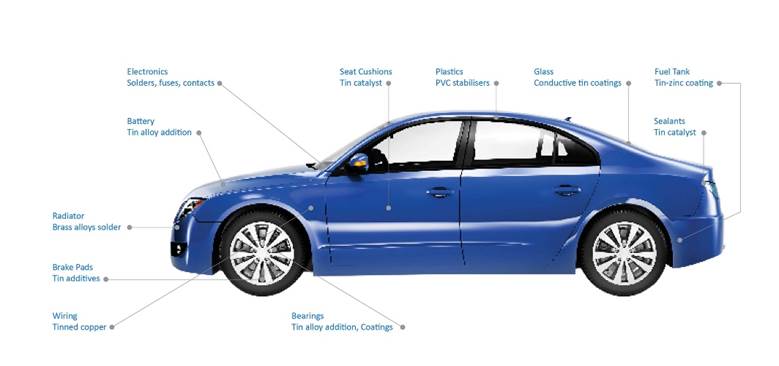

Tin combined with other elements forms a variety of useful alloys. Bronze is still widely used in applications ranging from sculpture to electrical products, and traditional pewter giftware is still highly valued. Bell metal is a copper-tin alloy containing 22% tin. The metal in single-digit percentages has sometimes been used in coinage, for example US and Canadian pennies. Alloys containing tin are also used in brake pads, roofing, and bearings, to name a few.

For an illustration of tin’s prevalence in the auto industry, see the infographic below, courtesy of the International Tin Association.

Source: International Tin Association (ITA)

Tin market

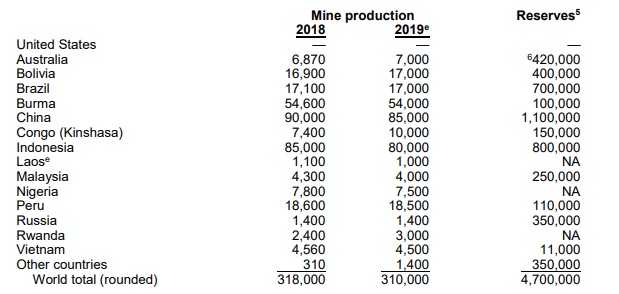

According to the USGS, China is the largest tin producer in the world, followed by Indonesia and Myanmar/ Burma. In 2019, out of a global market of 310,000 tons, China produced 85,000t, Indonesia mined 80,000t, and Burma outputted 54,000t. China and Indonesia also have the most tin reserves, at a respective 1.1 million tons and 800,000t, followed by Brazil @ 700,000t.

Source: Unites States Geological Survey (USGS)

The United States does not produce any tin of its own. Last year, the US relied on Indonesia for 25% of its refined tin imports, closely followed by Malaysia @ 24%, Peru @ 20% and Bolivia @ 18%.

But, although the States has not mined tin since 1993, nor smelted it since 1989, the country is the world’s largest secondary producer, recycling about 11,000 tons last year. Canada was the leading supplier of tin waste and scrap to the United States in 2019.

The global tin industry is highly consolidated, with the 10 major producers accounting for more than 60% of the market. Among the key players are China’s Yunnan Tin and Yunnan Chengfeng Non-ferrous Metals, PT Timah from Indonesia, Malaysia Smelting Corporation, and Minsur, out of Peru.

Source: Wikipedia

Most of the world’s tin is traded on the London Metal Exchange, from eight countries under 17 brands.

Given China’s importance to the tin market, its value to Beijing must be considered, regarding future supply and demand for the metal. According to the above-cited Reuters article, The country is expected to include a stockpiling programme for strategic commodities in its next five-year plan beginning 2021…

Given both China’s existing manufacturing base and its drive to dominate next-generation technology, tin is a likely contender for strategic metal status.

Analysts at Macquarie Bank have forecast supply deficits this year and 2021, at 4,400 and 2,900 tonnes, respectively, with shortfalls occurring every year until 2025. Roskill analysts are slightly less bullish, predicting shortages through 2023, according to Reuters.

Why the deficits? Macquarie states,“some concerns have emerged around future supply from Myanmar, with market participants telling us that Chinese buyer inquiries are now reaching Africa and the new Alphamin mine in (the Democratic Republic of Congo)”.

China has grown reliant on tin imports from mines in the former British colony, which are getting depleted. Imports of 470,000 tonnes peaked in 2016 but have been trending lower ever since. This year, adding insult to injury, for Myanmar producers, were covid-19 restrictions at the China-Myanmar border, and recently, flooding at some mines.

On the demand side, despite global solder usage expected to decline about 8% in 2020 owing to covid-19, most respondents to the ITA’s annual survey saw major opportunities in 5G. Tinplate usage was forecast by survey participants to increase 7% in 2020 due to increased consumer canned food purchasing during the pandemic, especially outside China.

Future tin applications

Notwithstanding the limited size of the tin market — around 300,000 tonnes annually — it’s easy to see tin’s versatility, through its use in a number of industry verticals. Yet tin’s scope continues to expand.

At the London Tin Seminar 2020, a presentation on the future of tin by Dr. Jeremy Pearce, head of market intelligence & communications at the ITA, found that the properties of tin are delivering a wide range of R&D project across green energy technologies, as well as new electronic materials.

First and foremost is tin’s usage in lithium-ion batteries. While battery metals like lithium, cobalt, nickel and graphite hog the limelight, tin is quietly gaining momentum as a performance-enhancing component in the battery’s anode, plus some solid-state technologies. According to ITA, several hundred papers and patents have tracked development of tin-based materials in Li-ion batteries.

Tin, its alloys and compounds are also good candidates for the next generation of batteries, beyond Li-ion, that are already in development, including sodium-ion, magnesium-ion and potassium-ion. There may also be an opportunity for tin in the booming energy storage market, for example as a catalyst in redox flow batteries, or in liquid metal technologies.

Certain materials that go into solar panels are expensive, such as gallium, a rare earth element. Tin was reportedly early in the race for cheaper, more plentiful metals to replace them. The metal is currently being explored as a heat energy storage medium on solar farms that concentrate sunlight using mirrors. The solar power sector is also benefitting from China’s increased use of solder ribbon to join solar cells.

Speaking of heat energy, tin is often part of a suite of thermo-electric materials that convert waste heat into electricity. According to ITA, tin selenide has been hailed as the world’s best thermoelectric material due to its unique crystal structure. A large number of materials are under development for different temperature ranges and environments including zinc-tin oxides or tin sulfides, as well as more sophisticated alloys such as nickel-manganese-tin.

Tin may also play a role in the future hydrogen economy. The metal has the potential to significantly reduce costs in hydrogen production, in particular as a liquid metal to strip carbon from methane, and as an oxide or sulfide photocatalyst to split water in sunlight. Apparently liquid tin was first used as an electrode in a type of fuel cell that was able to convert any type of hydrocarbon gas feed, and at the same time act as catalyst the recombinant reaction. Other developments have used tin, its alloys and compounds in various parts of the fuel cell, including tin pyrophosphate as a medium-temperature fuel cell membrane.

Finally, tin may have a role as a catalyst in carbon capture technology, while tin oxide nanotechnology could assist in water treatment. As explained by ITA, tin has a special ability to reform and join organic compounds that can be exploited, using sunlight or electrochemistry (carbon capture), and can chemically interact with and neutralize various contaminants, especially in its most active ‘stannous’ form (water treatment).

Conclusion

Tin isn’t the most exciting metal, but the fact is, tin will play an important role in developing a new economy, reliant on green energy, electric vehicles and advanced technologies like 5G, the Internet of Things and artificial intelligence.

For such a small market, tin has an impressive array of current and potential uses, putting it in the same league as silver, as a metal essential to modern electronics. Its primary use in tin-lead solder practically guarantees tin will enjoy steady demand for years, maybe even decades to come. This more than makes up for tin’s declining usage in kitchen foil (now made from aluminum), for example, and metal beverage containers, three-quarters of which are now aluminum.

This year the tin price took a hit from the pandemic, as did practically every other metal, but it has stormed back, gaining 45% since a mid-March low. Covid has actually been good for the electronics sector, which has benefited tin. When global economic growth resumes, following the roll-out of vaccines, demand for tin and other industrial metals will surely pick up. When we factor in current and future supply shortages predicted by the experts, tin looks increasingly like a metal that forward-looking resource investors should have on their radar.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.