Throwing the golden baby out with the covid bath water

2020.09.22

The dollar is the most important unit of account for international trade, the main medium of exchange for settling international transactions, and the store of value for central banks. The Federal Reserve is the lender of last resort, as in the 2008–09 financial crisis, and is the most common currency for overseas borrowing by governments and businesses.

Investors want to own dollars when the proverbial poo hits the fan, or a wrench is thrown into the machinery of the global economy – pick your metaphor they all fit the coronavirus crisis.

On Monday the US dollar index, DXY, soared as investors flocked to safety amid a global stock market rout resulting from rising covid-19 cases, especially in the UK and Europe.

The threat of new pandemic-related lockdowns is prompting concerns about the global recovery. The Dow dropped more than 500 points, Monday.

Adding to the risk aversion is the death of US Supreme Court justice Ruth Bader Ginsberg, which has thrown Congress into turmoil regarding when a new justice will be voted on; their failure to pass a $1 trillion stimulus package, and dwindling prospects of one during the campaign season; and rising economic and military tensions between the US and China.

US stock market indices are having their worst month since March, with volatility seemingly back on the rise, after bottoming out in mid-August.

Gold and silver prices normally benefit from stock market weakness, but not this week. In what looks like a repeat of March, when precious metals followed equities over a cliff, on Monday gold and silver prices plumbed six-week lows in mid-day trading. Kitco reported October gold futures down $53 at $1,900.20/oz, and December Comex silver falling $2.48 at $24.64/oz.

As of this writing, spot gold’s last bid was $1910.70/oz; spot silver’s was $24.71.

“What we’re seeing here this morning for the dollar is largely a risk-off safe haven bid,” said Erik Bregar, head of FX strategy at Exchange Bank of Canada in Toronto, adding that the trigger was in the European morning on rising fears of a new U.K. nationwide lockdown.

“It’s scary stuff that reminds you of March,” he said.

We’ve seen this movie before

That month, when the coronavirus began spreading beyond China, bonds, the Japanese yen, the Swiss franc, even gold, the world’s oldest safe haven, were no match for the dollar, as the virus caused widespread dislocation in the form of business closures, layoffs, and requests for government bailouts.

After hitting a 7-year high on March 9 of $1,674.50 per ounce, gold prices retreated, as traders sold bullion to cover losses in other asset classes, amid a three-week market meltdown.

Of course, gold prices would go on to notch record highs over $2,000 an ounce, in August, on the back of dollar weakness. Since March, the buck has been on a steady decline.

Its retreat has been directly correlated to America’s failure to control the virus. States that reopened too early saw a resurgence of infections. By May there was a pre-summer surge of 20,000 cases a day, overwhelming hospitals and causing an economic tailspin from Wall Street to Main Street. As summer comes to a close, daily case numbers have doubled to 40,000 a day, as the virus migrates from major cities to the US heartland. Eleven states and Puerto Rico are still showing a positivity rate of 10% or higher, CBS News reported Monday. Health experts warn of another wave heading into the fall and winter flu season.

According to the Centers for Disease Control (CDC), there are currently 6.8 million cases in the United States, and the death toll is almost 200,000.

All of which makes the dollar’s apparent comeback puzzling. How can the US and it’s currency still be thought of as a safe haven, with all that is going on?

Stimulus stalemate

Let’s begin with the stalemate in Congress over the passage of a second stimulus package. Lawmakers remain deadlocked over a measure to provide another round of $1,200 checks, after most recipients saw the money they received from Congress’ $2.2 trillion CARES Act dry up over the summer.

The record bill provided hundreds of billions in extra food aid, unemployment benefits, and stimulus checks for workers and their families, including expanding UI to millions of workers who under existing rules would not have qualified.

Some economists believe if aid isn’t restored, the US economy will slip back into recession (in March the economy sunk into its deepest recession since the Great Depression). Others think that further deficit-financed stimulus will come at the expense of higher debt and higher taxes; the national debt is currently at an eye-popping $26 trillion. The federal deficit in fiscal 2020 has tripled to $3.3 trillion, on pandemic-related aid.

The disagreement over how to proceed is playing out in Congress. The $3.4 trillion HEROES Act, passed by the Democrat majority in the House, would restore the $600 federal supplement to weekly unemployment benefits, which ended in July, and would provide fresh funding for small businesses and cash-strapped state/ local governments. Republicans have offered reduced aid packages, ranging from $300 billion to $1 trillion.

Notorious RBG

With the death of Supreme Court Justice Ruth Bader Ginsburg (“Notorious RBG” to liberals, a meme to the late rapper “Notorious BIG”), and the need to put together a funding bill to keep the government open by the end of September, it looks increasingly unlikely that the GOP-dominated Senate will come to a deal anytime soon.

President Trump on Saturday said he would announce a nominee imminently, even releasing a list of potential picks. Democrats argue that the winner of the Nov. 3 election should choose the nominee. Biden and others have pointed out that the Republican-led Senate in 2016 used the same rationale to block Barack Obama’s nominee following the death of Associate Justice Antonin Scalia. That’s “I’m in politics”, folks.

The more important point is what could happen if Trump, either before the election or after, should he pull off the win, nominates another conservative to the bench. (Trump appointed conservative justices Neil Gorsuch in 2017 and Brett Kavanaugh in 2018). Naming a third would stack the Supreme Court with 6 conservative-minded judges to 3, thereby decisively tilting the ideological balance of the court to the right, for decades. It would almost certainly be the most lasting, and damning, legacy of the Trump administration.

In short, this is a big deal.

In the United States the Supreme Court plays an important role in ruling on legislation sent to it by a deadlocked Congress. In the 2000 election, for example, the court ended a Florida recount and made George W. Bush President. Now, with partisanship in Washington at historical highs, parties will look to the court to resolve political disputes.

Among the highest-profile is the Affordable Care Act. A challenge to the law known as Obamacare is scheduled for Nov. 10. A decision by the highest court in the land is bound to affect the healthcare of millions of Americans, including pre-existing conditions. Other issues likely to be brought to the court, include voting rights, the future criminal justice, workplace benefits, the rights of immigrants, tax rules, and most explosively, reproductive rights.

Recent polling suggests that a majority of Americans would preserve the landmark Roe vs Wade Supreme Court decision protecting a pregnant woman’s liberty to have an abortion, but 28% would overturn the ruling.

If conservatives try to strong-arm liberals into re-considering a woman’s right to an abortion, I believe the ensuing protests will light the entire US on fire.

American nightmare

Stacking the court with conservatives will also exacerbate social divisions in America – something we already see happening with the coronavirus crisis.

CBC quotes from Adam Cohen’s book ‘Supreme Inequality’, which states that historically, the US Supreme Court has favored the wealthy and the powerful, the rare exception being the 1960s when the court was led by Justice Earl Warren.

[Cohen] said the court has recently been a major driver of American inequality — stripping away union powers, allowing corporate money into politics and undermining the integration and funding of schools in minority areas.

The economic fallout from covid-19 includes over 13 million unemployed, as of August – better than the +40 million jobless in May but still higher than pre-pandemic February – and unprecedented debt levels taken on by states and the federal government.

As usual the burden falls most heavily on the poor, who are unlikely to have jobs allowing a “work from home” option, and can ill-afford to buy stuff on Amazon in lieu of shopping at the mall. Add the plight of these individuals to the decreased purchasing power of the average consumer, due to rising food and gas prices, and more expensive imports owing to the billions worth of trade war tariffs still on many of them, and you have a declining standard of living for Joe and Jane Sixpack.

Adding to the economic pain, many US cities have experienced unrest following the police killing of a black man in Minneapolis. Some protests have escalated into violence and looting. This week the US Justice Department threatened to cut funding to New York City, Seattle and Portland, saying the three liberal cities are allowing anarchy and violence on their streets. In a joint statement, New York Mayor Bill de Blasio, Seattle Mayor Jenny Durkan and Portland Mayor Ted Wheeler accused the Trump Administration of playing politics and said withholding federal funds is illegal, CBC reported.

Will China dump Treasuries?

Back to the dollar and gold, US Treasuries are a safe haven amid the coronavirus and other geopolitical tensions. They were attractive in comparison to the trillions of negative-yielding sovereign debt sloshing around. But with yields at record lows and 0.25% to 0% interest rates expected until 2023, bonds are a poor investment. If foreign investors slow or stop buying US Treasuries, as Russia and China did in 2019, the United States is in real trouble. Without purchasers of US debt (Treasuries) the US has no way of financing its annual deficits and $26 trillion pile of debt, without printing money. Printing money on a large scale causes hyperinflation.

A worsening US economy will turn investors away from bonds and Treasuries – no more financing for US debt. The dollar will fall further and commodities will rise, including gold and silver, pushed higher by investment demand for gold-backed ETFs and physical metal.

Could that actually happen? It’s hard to say but in June of this year, China sold $9.3 billion worth of US Treasury bonds. In a 12-month period, China’s holdings – at US$1.074 trillion, China is the second highest holder of US government bonds after Japan – dropped 3.5%.

Not enough to sound the alarm of a widespread sell-off, but there are recent indications that more Chinese T-bill liquidations are coming. According to ‘Global Times’ a state-backed newspaper, Beijing continues to weigh options to insulate itself from tensions with Washington. And don’t kid yourself about that money – it comes straight home to roost in the form of inflation.

It is no secret that relations between China and the US have deteriorated. In July, the US ordered the abrupt closure of the Chinese consulate in Houston, citing the need to “protect American intellectual property and private data.”. There is no end to the trade war, despite a “Phase 1” agreement in January, in fact Trump just signed into law a bill imposing sanctions against Chinese individuals, banks and businesses that are helping Beijing’s Hong Kong crackdown. Billions worth of import duties on either side remain. A commitment from China to buy an additional $200 billion worth of US goods will probably never be honored.

Chinese telecom giant Huawei is accused of being a trojan horse letting China spy on countries that use its 5G technology. The US has convinced other countries, most recently the UK, not to use Huawei’s 5G equipment.

And of course, the coronavirus has been front and center in an ongoing propaganda battle over who is to blame for the pandemic.

We have also written extensively on the escalating tensions between the US and China in the South China Sea, where China holds historical claims despite international treaties to the contrary (ie. the UN Convention on the Law of the Sea). Ongoing maneuvers in the waters off its southern coastline demonstrate that Beijing is willing to flex its muscles in a region it sees as strategically and economically critical. China has built man-made islands and constructed port facilities, military buildings and even airstrips on them.

Secretary of State Mike Pompeo called China’s territorial claims in the South China Sea “completely unlawful” and pledged US support for countries that want to challenge Beijing.

The United States supplies weapons to Taiwan despite not having diplomatic relations with the island and its government. China sees Taiwan as a breakaway territory that must be re-united with the Chinese Mainland; its independence is not recognized by Beijing. A forced reunification would almost certainly cause a war between China and the US; the Americans would never allow Taiwan, a key tentacle of US influence in that part of the world, to be overtaken by the Chinese. Yet there are increasing calls from China to end Taiwan’s independence by the 100th anniversary of the Chinese Communist Party in July, 2021.

The anti-China feeling pervading Washington extends to US Attorney General William Barr, who recently branded Disney, Google, Microsoft, Yahoo and Apple “all too willing to collaborate” with the Chinese Communist Party; and FBI Director Chris Wray, who charged that Beijing pursues its ambitions through industrial espionage, theft, extortion, cyberattacks, and malign influence activities, CNBC reported.

For its part, China has sanctioned Senators Ted Cruz and Marco Rubio for their legislative actions linked to the detention and suppression of ethnic minorities in the Xinjiang region, and threatened to sanction US military contractor Lockheed over its defense sales to Taiwan.

While China has certainly done a lot to poke its stick in Uncle Sam’s eye, we mustn’t forget it was the Trump administration that kicked sand in the face of its Asian adversary.

Attacking the trade deficit between China and the United States became an obsession with current White House, and the sine qua non behind the trade war that Trump launched against Beijing in the spring of 2018 (the first tariffs, on imports of steel and aluminum, targeted not only China but its other trading partners, including Canada)

Arguably, these economic irritants were just the appetizer for the main course, a “Cold War II” being cooked up between the two largest economies.

An increasingly belligerent US has turned a trade war into a cold war. Diplomacy is gone, replaced by a brash “my way or the highway” mentality.

Is this what we should expect from the printer of the world’s reserve currency?

Gold will win

Given that gold prices move in the opposite direction as the US dollar, in predicting what will happen to gold, we need to examine the dollar’s short-term prospects.

Analysts at Commerzbank believe that the European Central Bank will continue to talk down the euro, because they don’t want the common currency to appreciate, as it would hurt EU exports.

“Thus a currency war has begun between the USD and the EUR that other currencies may well join,” the analysts said.

Much is riding on this Wednesday, when Fed Chair Jerome Powell and Treasury Secretary Steven Mnuchin will testify to the Senate Banking Committee on coronavirus relief.

Via Kitco, Commerzbank said that Federal Reserve Chair Jerome Powell will have his turn to talk down the U.S. dollar as he testifies before Congress this week.

“He is likely to urge members of Congress to approve a new fiscal package now that the Fed has done what it can to stimulate the economy with its new monetary policy orientation. Monetary and fiscal policy thus remain extremely expansionary, paving the way for the gold price to make further gains,” Commerzbank analysts said.

I agree.

“Lower for longer” is the US Federal Reserve’s new mantra for the economy which continues to struggle under the weight of the pandemic. While the Fed normally targets 2% inflation as a way of keeping the economy in the Goldilocks zone of “not too hot, not too cold,” the central bank recently said it will allow inflation to run hotter, (>2%) to support the labor market and the broader economy. This effectively means the Fed is less inclined to hike interest rates when unemployment falls, so long as inflation does not creep up as well.

In August the cost of US goods and services rose sharply, for the third month in a row.

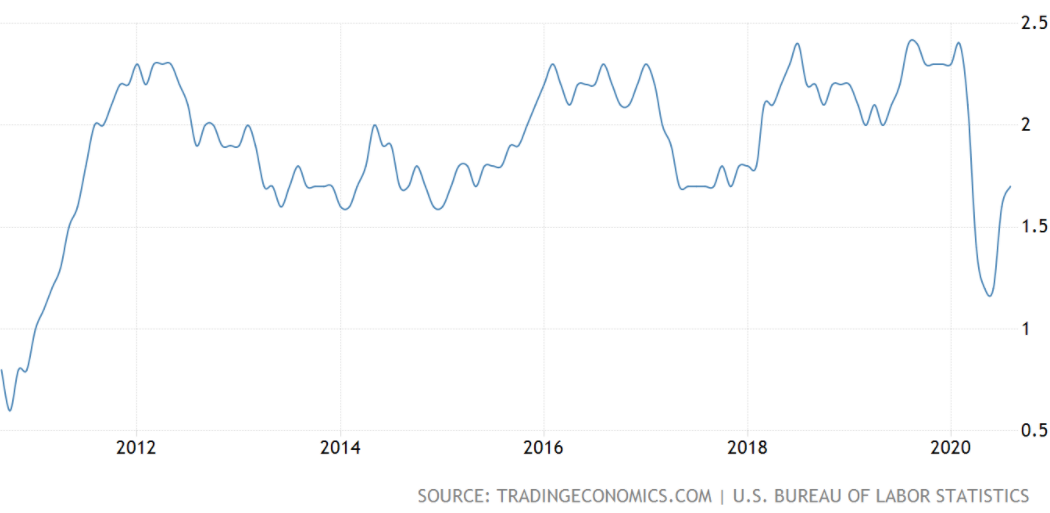

Consumer Price Index (CPI) in the United States

If inflation goes, say, above 3%, yet interest rates remain near zero, that would create bullish conditions for gold – negative real rates (interest rates minus inflation). When US Treasury bond yields turn negative, investors typically rotate their funds out of bonds, into gold.

US Core Inflation Rate

10 Year Treasury Yield

Inflation is creeping up, 10 Year Yields, the global benchmark for interest rates, are extremely low, and according to the Fed are set to remain so for medium term. Real interest rates, in the US, are negative. And going deeper into the red.

Gold and silver have been on a tear since mid-March. The factors behind the surges of both metals are worrisome covid-19 infections, geopolitical concerns especially US-China tensions over trade and the South China Sea, inflation expectations on the back of (seemingly) unlimited monetary stimulus, and low interest rates worldwide.

Bullion prices have climbed 23% year to date, as investors choose gold as a safe haven amid widespread economic uncertainty created by the pandemic. They believe gold will hold its value better than other assets such as stocks and bonds.

Silver in July gained an astonishing 35%, its best performance since 1979, as investors sought shelter from pandemic turmoil and low or negative interest rates, while industrial demand for the metal recovered in some parts of the world.

Gold is also being helped by skyrocketing US debt levels, as the federal government scrambles to spend its way out of the pandemic. In a previous article we established the strong correlation between gold prices and a country’s debt to GDP ratio.

Earlier this month the Congressional Budget Office said federal debt held by the public is projected to exceed 100% of GDP, for the first time since World War Two (in 1946, US debt to GDP was 106%, after years of financing military operations to end the war).

All of this is extremely bullish for gold prices. We might be seeing a pullback this week, as panicked investors, fearful of another virus-related market meltdown, “sell everything”. But, as we’ve shown, throwing the golden baby out with the covid laced bathwater is not, imo, a wise move. Those who do so will regret it later, after gold re-gains its footing and soars well past their exit points.

Despite temporary dollar strength, the bull market case for gold and silver remains very much intact. I for one plan to buy the dip and use it as an excuse to purchase more of my favorite gold and silver stocks.

With results season upon us and several of the companies on my front page currently drilling, it seems like a great idea.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.