2023.09.04

Scandals involving industrial metals are becoming a common occurrence, and it appears nothing has been done to stop them from happening again and again.

This week, Europe’s biggest copper producer Aurubis became the latest victim after finding out that scrap metals worth millions of dollars were missing from its inventories. Behind the missing metals is what the company believes to be a conspiracy between its suppliers and employees to manipulate logs of scrap metal at its recycling business which was scheduled to conclude by the end of September.

The company does not mine ore itself, but buys huge volumes of copper-bearing scrap, from near-new manufacturing offcuts to old cables, pipes and electronic circuit boards. It then processes thousands of tons of these materials every day to produce refined metal.

Its website states that it sources metal concentrates from “over 30 mining partners and a few traders”.

“What we currently know is that some of our recycling suppliers appear to have manipulated details about the raw materials they deliver to us, and they have been working with employees in our sampling department to hide the shortfall from us,” Angela Seidler, vice president for investor relations and corporate communications, stated via a Bloomberg phone interview.

Suppliers provide an estimation of what the materials contain, and after a visual inspection Aurubis’ labs analyze the metal content and pay the firms on that basis, Seidler explained. “Then, in the production process, we have found that the metal is missing, but it is something we have discovered over time because in the case of copper, for example, it takes four weeks for the material to be processed.”.

As a result of this scandal, Auribus said it now expects to take a profit hit in the “low three-digit-million-euro range”, and therefore won’t meet its profit forecast for the year. A company-wide investigation is already underway to look into the matter.

How Metal Thefts Happen

The latest incident raises questions not just Aurubis’s security controls, but the wider industry’s shortcomings in limiting repeated offenses of fraud and theft. The biggest issue is a widespread use of paper-based documentation within the metals trading business, which makes it an easy target for criminals.

The vulnerability to forgery has been a problem throughout the history of commodities trading, as the sector is heavily reliant on paperwork to back the shipment and storage of cargo.

As described in this Bloomberg piece: Dealing commodities is typically a high-volume, low-margin business and merchants take out loans backed by the product they’re trading to fund purchases and optimize cash flow. In metals, that collateral is often underpinned by paper records — warehouse receipts and shipping documents recording details like quantity, quality, ownership and location of the goods. These can be faked, using fictitious material, or a single cargo can be collateralized for multiple loans — often known as over-pledging.

However, as the article mentioned, even with legitimate paperwork, there are several other ways in which things can go wrong..A stretched trader might sell on the goods to which the lenders have a claim, without paying back the loan.

Sometimes, metal is simply stolen from warehouses by criminal gangs in sophisticated heists — but it’s the threat of fraud perpetrated by industry insiders that tends to cause most concern (i.e. Aurubis).

The fragility of warehousing and shipping networks remains a huge concern that remains unaddressed due to inadequate oversight, compliance and security protocols.

Rampant Trading Scandals

The Aurubis incident is just the latest episode in a series of scandals that have rocked the metals industry in recent times.

Earlier this year, global commodity trading group Trafigura was left facing $577 million in losses after discovering that shipments of nickel that it had purchased failed to contain the metal. The company also accused certain companies connected to Dubai-based trader Prateek Gupta of “misrepresentation and presentation of a variety of false documentation” to perpetrate the fraud.

Another nickel fraud followed soon after, this time involving the London Metal Exchange, the world’s oldest and biggest industrial metals market. In a statement in March, the LME said that “a number of physical nickel shipments, out of one specific facility of an LME-licensed warehouse operator, have been subject to such irregularities”.

Reports later came out revealing that the supposed nickel consignments were just bags of stones. Following the discovery, the LME asked the warehouse operator to conduct an inspection, which found nine cases of missing nickel amounting to 54 tonnes of material worth $1.3 million owned by JPMorgan.

In August, another metals trader said it had been hit by a nickel fraud separate from Trafigura’s. In the new case, US trading house Kataman Metals alleged it paid $3.3 million for nickel from a company named New Alloys Trading, only to find the shipping containers empty. New Alloys also happens to be among the companies that Trafigura claims were part of the alleged Gupta fraud.

Even before these incidents, the metals industry’s reputation had already been tainted by a string of frauds and thefts in China.

In August 2022, a group of Chinese merchants found that a local copper trader did not have almost $500 million worth of ore that was meant to be their collateral. Lenders learned that Risun, the trading company, was under financial stress, and when they went to check their collateral, they only found a third of the pledged amount.

In June 2022, several Chinese traders claimed that they were duped into providing credit of up to 500 million yuan ($74 million) against fictitious quantities of aluminum. Trafigura and commodities giant Glencore were among those that rushed to audit their exposure, and at least one creditor sued the warehouse managers seeking compensation.

As cited in Bloomberg’s story, traders in China who were running on thin profit margins faced ever tougher financing conditions as credit flows weakened. That encouraged a turn to alternative and more lightly regulated financing — such as transactions in which smaller private firms pledge goods to large state-run traders for cash.

Stories of metals fraudulence were also rife around the world. In 2020, Switzerland’s Mercuria Energy Group bought copper from a Turkish supplier but instead found containers of painted rocks. Earlier this year, two executives of a British steel-trading business were found guilty of fraud in a $500 million trade-finance scheme.

Two of the biggest cases came in 2017, when banks and brokerages were duped on cargoes of nickel stored in Singapore, and in 2014, when a sprawling multibillion-dollar fraud was uncovered in China’s Qingdao port.

Metals Theft Epidemic

Without a transformative change in the metals trading business, such as digital platforms to replace the paper-based approach, it’s likely that we’ll see more metals being subject to theft and fraud.

But even then, there’s no stopping the small-time thieves from continuing about their “business”; it’s simply impossible to eradicate crime of any shape or severity.

As Maclean’s called it in an article, there is a ”copper theft epidemic” going on where items containing the metal — air conditioners, bronze statues and wire from railway lines — are being targeted by thieves. That article was from 10 years ago, and the situation has probably gotten even worse. Also, the more precise term should be “pandemic”, because copper thefts are now a worldwide phenomenon.

Here in Canada, there has been an uptick in copper theft incidents coincident with the rise in the metal’s price on the market. In April, thieves in British Columbia stole more than 2,500 metres of copper wire along Highway 19, which the police say could result in damages of approximately C$20,000. In February, someone took off with a copper pipe from a recreation centre in Fort Saskatchewan that was part of the ice rink’s cooling system.

In Nova Scotia, the province’s power company said it experienced about 30 thefts of copper wire from its electric equipment this year, and similar things are happening in New Brunswick.

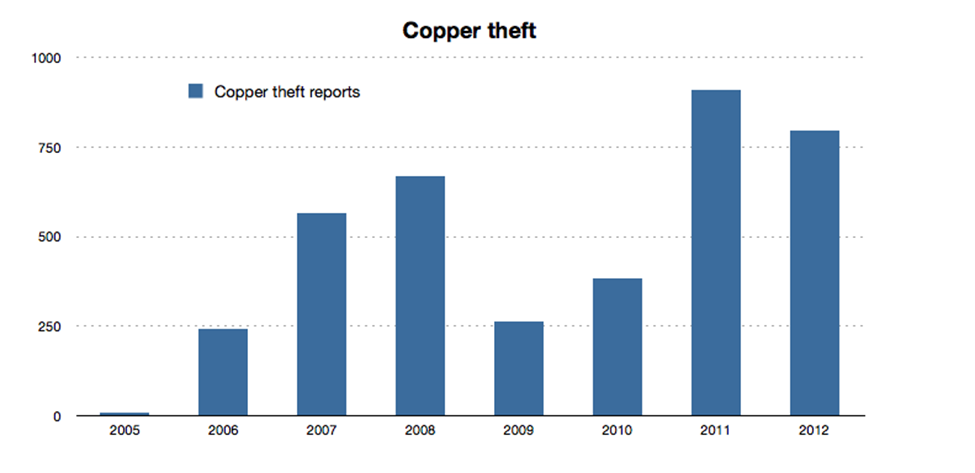

Statistics Canada says metal-related thefts in 2021 in Canada were at their highest level since 2013 — the last time copper prices were in the same range as current rates.

The United States is no different, and given its higher population that requires more infrastructure built on copper metal (i.e. houses), the incidents should be even more frequent.

A favorite among criminals are empty, foreclosed homes in the post-housing meltdown US. Unlike common burglars, they do not look for cash, jewelry or electronics: they break and enter because the average single-family home contains over 400 pounds of copper, according to the Copper Development Association, an industry-supported group.

The Federal Bureau of Investigation says copper thieves are threatening US critical infrastructure by targeting electrical substations, cellular towers, telephone landlines, railroads, water wells, construction sites, and vacant homes for lucrative profits.

“Copper thefts from these targets have increased since 2006; and they are currently disrupting the flow of electricity, telecommunications, transportation, water supply, heating, and security and emergency services, and present a risk to both public safety and national security,” the Bureau wrote on its website

In recent years, electric vehicle chargers have been the target of copper thieves in places like Nevada. The EV charging cables are cut and stripped to retrieve the valuable copper, which are then sold on the market at attractive prices.

The Motive: High Price

Attached with each crime is a motive; for someone to steal metals, the prices at which they can be sold would most definitely be a deciding factor. A surge in demand saw copper prices hit a record high $5.05 per pound in March 2022. In the same month, nickel prices spiked 250% on fears of supply disruption.

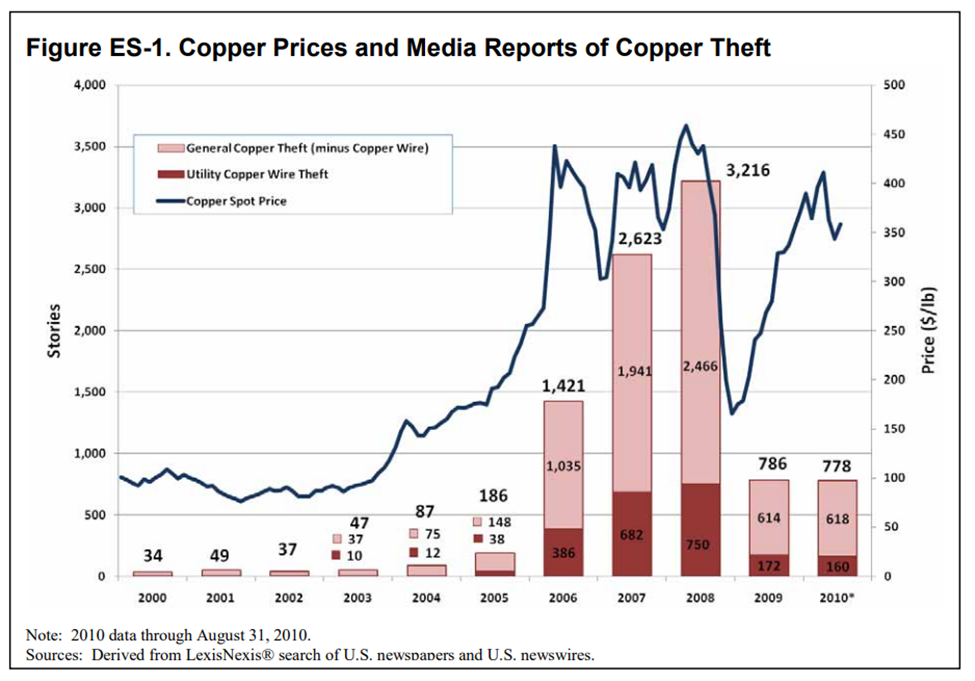

Ben Stickle, a criminal justice professor at Middle Tennessee State University in Nashville, said the rise in copper theft is “highly tied” to its significant price increase over the last few years – which, for some, outweighs the challenges and potential dangers associated with stealing the metal.

“When you have high value for something like this that could be re-sold, then you’re going to end up with more crime,” he told Global News.

Stickle, who has been investigating these incidents since 2014, said there was an increase in copper usage and purchases from China and several other buyers during a worldwide economic downturn that started in 2008. Rising demand led to an increase in copper prices, resulting in more metal theft, he added.

Stabilization of prices in 2013 led to a decrease in theft until recent economic conditions saw copper’s value increase again. Thefts increased, as well.

He also noted that the process of stealing copper is likely passed along to others from someone who has experience pulling off a successful theft.

In a separate interview with CBC News, Stickle said doesn’t expect the problem to go away any time soon, partly because demand for copper is likely to remain strong “as we move to a more electrified economy.”

The Catalyst: Energy Transition

The prevalence of scams and thefts underscores the value of industrial metals in the global transition to clean energy, which is the real catalyst driving up their prices. BloombergNEF has estimated that getting to net zero could require almost $10 trillion worth of metals between now and 2050.

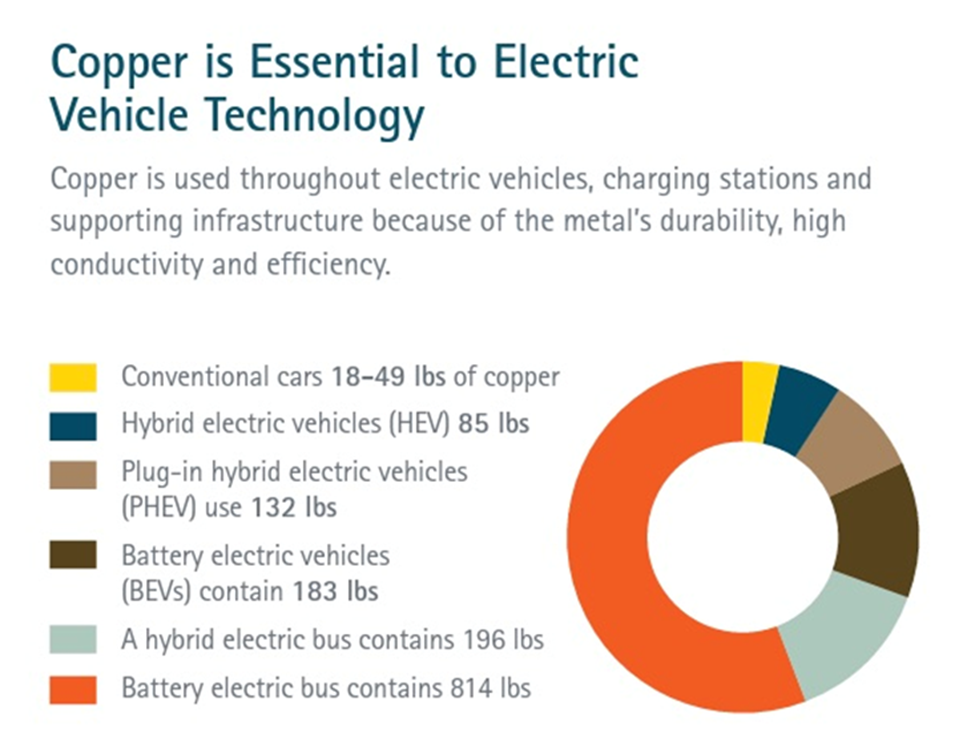

Great emphasis will be placed on copper, which for centuries has been one of the most consumed metals on the planet. Due to its excellent electrical conductivity properties, the red-colored metal plays a vital role in the construction of renewable energy sources ranging from wind, solar, hydro, and thermal, to electric vehicles.

To keep the global energy transition going, it’s estimated that millions of feet of copper wiring will be required to bolster the world’s power grids, and hundreds of thousands of tonnes more are needed to build wind and solar farms.

According to the Copper Development Association, a 3-megawatt onshore wind turbine takes up to 4.7 tons of copper, with offshore wind turbines requiring even more at approximately 8 tons per MW. The CDA estimates that wind farms use approximately 7,766 lbs of copper per megawatt, while an offshore wind installation uses 21,068 lbs per MW.

More copper tonnage is required for solar power systems, approximately 5.5 tons per megawatt, states the CDA, with the red metal used in heat exchangers, wiring and cabling. An estimated 1.9 billion lb. of copper will be needed to power 262 gigawatts of new solar installations between 2018 and 2027 in North America.

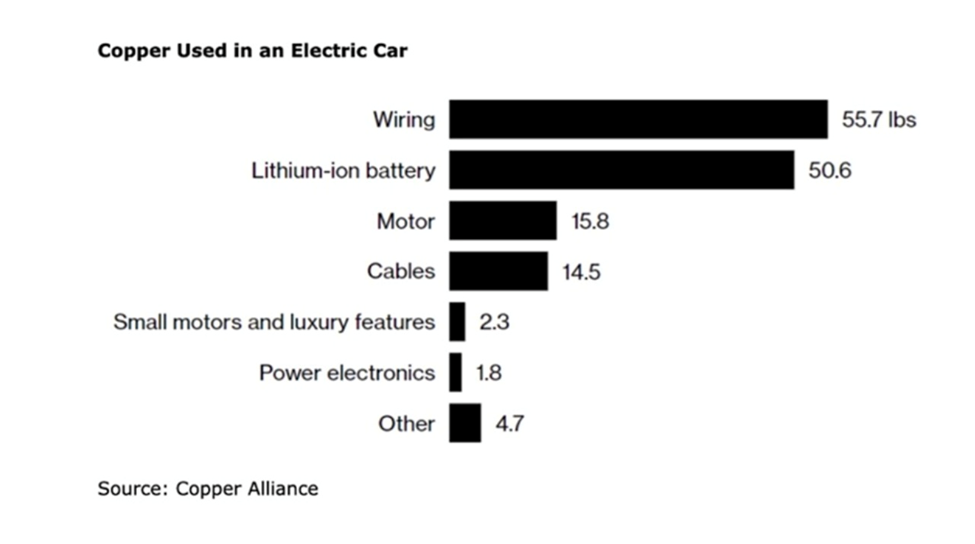

Copper is also used in energy storage made necessary by the intermittent nature of solar and wind power. A lithium-ion battery, for example, contains 440 lbs of copper per megawatt, with a flow battery needing 540 lbs/MW.

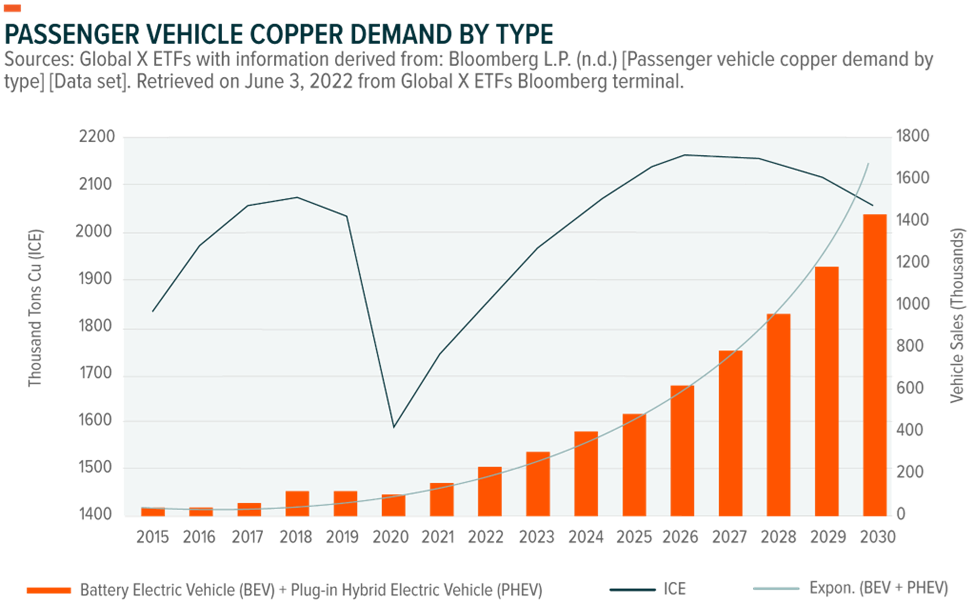

Speaking of Li-ion batteries, EVs now represent a fast-rising source of copper demand, using over twice as much of the metal as gasoline-powered cars (85 kg versus 30 kg), according to the Copper Alliance. Not to mention, more would be needed to build related EV infrastructure, namely charging stations, which can take 0.7 kg (for a 3.3 kW slow charger) or 8 kg (for a 200 kW fast charger).

Those at Goldman Sachs see the rise of electric vehicles as a “key pillar of copper’s bullish story”, recently forecasting copper demand from the sector to amount to 1 million tonnes this year, rising to 1.5 mt in 2025.

Last year, EV production accounted for about two-thirds of the increase in global copper demand, with EVs likely accounting for about 27% of additional copper consumption over the next decade, the bank predicted.

Goldman said its analysts were optimistic about EVs, anticipating “strong sales in China, driven by lower prices and a high demand for EVs that has been building up over the rest of 2023.”

For a long time, analysts at Goldman have been bullish on the metal due to its high demand, predicting earlier that “we’ll be at the lowest observable inventories that have ever been recorded at 125,000 tonnes” this year.

BloombergNEF isn’t shy about going further in its projections, stating that copper demand will jump by a significant 53% to 39 million tons by 2040, driven by various clean energy initiatives like EVs.

Analysts at S&P Global are expecting an even quicker and bigger jump, with copper demand set to double to 50 million tonnes as early as 2035.

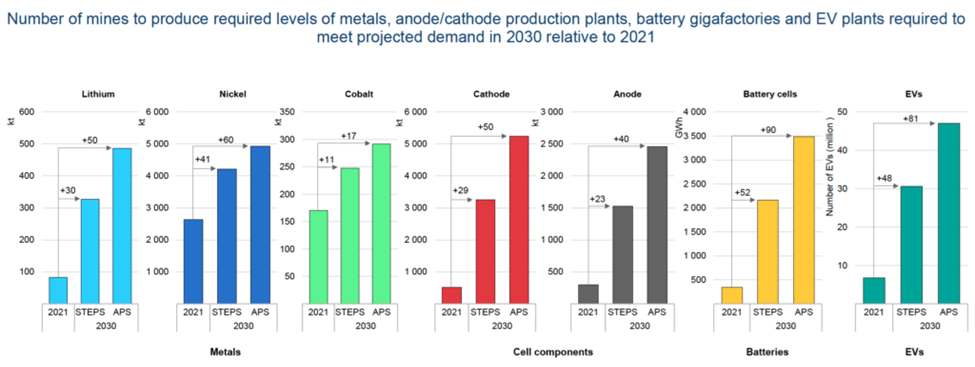

Drastic demand increases are also projected for nickel, which is being used for geothermal power, batteries for EVs and energy storage, hydrogen, hydro, wind and concentrating solar power.

In fact, of all the key metals needed, nickel is facing the largest absolute demand increase as high-nickel chemistries are the current dominant cathode for EVs and are expected to remain so, an IEA report found.

As many as 60 new nickel mines would be needed by 2030 to meet global net carbon emissions goals, the IEA estimates. BHP, the world’s biggest miner, expects global demand for nickel to grow as much as fourfold over the next 30 years as electric vehicles almost entirely replace traditional cars.

Conclusion

The bullish market outlook pretty much confirms what experts like Ben Stickle, who published his research findings in a book titled Metal Scrappers and Thieves: Scavenging for Survival and Profit, had been saying: that metals frauds and thefts are here to stay. This is because the incentives (i.e. profits) are getting increasingly bigger.

As he described to CBC reporters, criminals “may not make the ‘rational’ choice that you and I would make because we have different rationality, but it’s still a logical choice to engage in this criminal activity, and a lot of that’s driven based on price.”

At higher metal prices, Stickle explains, criminals consider the amount of money they could make by selling the stolen goods at a scrap metal yard outweighs the risk of being arrested.

On criminal activities of a higher scale, such as the scandal that rocked the LME, the industry could step up its due diligence and shift to digital documentation, yet the exchange would still be reliant on private warehousing companies, and so the risk of fraudulence and even conspiracies (i.e. Aurubis) remains.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.