The season for gold

2019.06.04

Gold was riding high Monday on bad news regarding the US economy, causing stocks to fall and Wall Street traders to pile into bullion.

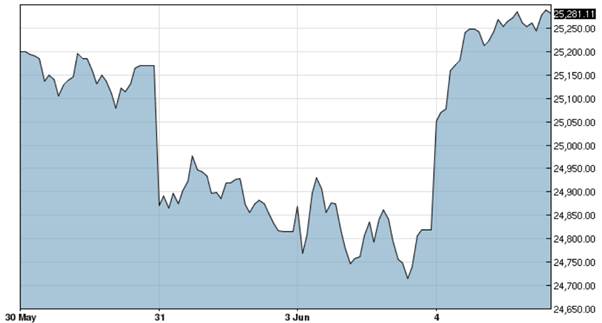

US markets were choppy on the first trading day after June 1, when the United States increased the tariff on $200 billion of Chinese imports from 10% to 25%. Shares of the so-called ‘FAANG’ stocks slumped, pulling the S&P 500 and the Dow with them, after media reports that the Department of Justice is weighing actions against Google and Apple, and the Federal Trade Commission said it wants to conduct a probe against Facebook for improper use of data.

Roller coaster Dow Jones

Contributing to the jitters was a white paper from China published over the weekend that blamed the US for escalating the trade war (ie. imposing 25% tariffs following an accusation that China backtracked on commitments agreed to earlier):

“The U.S. government accusation of Chinese backtracking is totally groundless. It is common practice for both sides to make new proposals for adjustments to the text and language in ongoing consultations,” the white paper read. “In the previous more than 10 rounds of negotiations, the U.S. administration kept changing its demands. It is reckless to accuse China of ‘backtracking’ while the talks are still under way.”

US President Trump responded that the tariffs on China are working, with Chinese firms leaving the country to avoid paying tariffs, no visible increase in inflation, and the US “taking billions.” (the IMF showed that the billions in tariffs are actually being paid by US companies, not Chinese firms as Trump has argued) He also accused China of subsidizing its industries to help them cope with the trade war.

All the uncertainty was enough to propel gold to a two-month high.

As of 14:37 New York time, the precious metal was holding at $1,324.38 – a climb of nearly $43 since May 1, when gold finished at $1,281.40.

The price was helped by a 0.1-point drop in the US dollar index. Since May 31 the index has dropped over a full point, from 98.12 to the current 97.06. Gold and the USD normally move in opposite directions.

There are plenty of other reasons to believe we are heading into a summer exploration season backstopped by some very bullish signs for gold. This article gets into the nitty-gritty of each and concludes that now is a very good time to be owning promising junior gold stocks as a wager on rising gold prices and some spectacular drill results.

Forward- looking indicators

The first reason is a set of forward-looking indicators that show the US economy has all but stopped growing from the 3.2% it managed in the first quarter: the PMI, the ISM manufacturing index, and orders for durable goods.

Orders for durable goods are down and the Purchasing Managers Index (PMI) of the countries that count are, frankly, sucking wind; Wolf Street called the US PMI figure, 50.2, “the cleanest of the dirty shirts.” Germany, Japan and China were all lower.

The finance publication notes that orders for durable goods like cars and appliances have steadily ticked down since December and have shown no growth for three months in a row. The PMIs for US services and manufacturing in May were the lowest since recessionary 2009.

After the data was released GDP forecasts for the second quarter were slashed from 2.2 to 2% in the best case scenario (Barclays Plc) to 2.25% to 1% in the worst case (JPMorgan Chase).

Pouring more kerosene on the fire was another bad report released on Monday by the Institute for Supply Management. Its manufacturing index read 52.1% in April, weaker than consensus forecasts which expected 53%. Readings above 50% are seen as a sign of economic growth.

Zero Hedge notes that the 52.1% figure was the weakest since October 2016, despite a kick of new export orders and employment. The fact that three of five ISM components – production, inventories and supplier deliveries – declined, is a worrying sign that stagflation is looming, when unemployment and inflation both rise and economic growth falls.

No trade deal

The lack of a trade deal between the US and China, of course, it’s what scaring everybody into thinking that we could be in for a long, protracted jag of protectionism.

China’s President Xi Jinping said as much when he compared the current conflict to the ‘Long March’ of 1935 and urged citizens to prepare for hardship.

For more read our How China wins trade war

Kitco quotes Scotiabank saying “A bigger move in gold” will occur when the market digests a “no trade deal scenario” whereby global growth continues to fall, inflation rates rise, equities weaken and the risk of a recession increases.

“The widening cold war accelerated with a ‘no trade deal’ now the base case, after Huawei was blacklisted, tariffs were upped and China continues to retaliating most recently with weaponizing rare earths; we are in a sustained global economic ‘us’ vs ‘them’ war (see Copper note which goes into more detail) with dire implications for both global growth (now) and inflation (later),” Scotiabank commodity strategist Nicky Shiels wrote in a macro update last week.

The US president isn’t helping matters by his erratic, careless messaging that is putting the country at odds with its so-called allies.

On Monday Trump kicked off a state visit to the United Kingdom by calling London’s mayor a “stone cold loser” after Mayor Sadiq Khan said Trump is “one of the most egregious examples of a growing global threat” to liberal democracy from the far right.

Trump ended last week by impetuously threatening Mexico with 5% tariffs on June 10, if moves are not made to stem migrants from Central America. CNN Business noted that Mexico is now the United States’ largest trading partner and that the tax on imports would affect just about every sector of the American economy including autos, electronics, oil, food products and appliances.

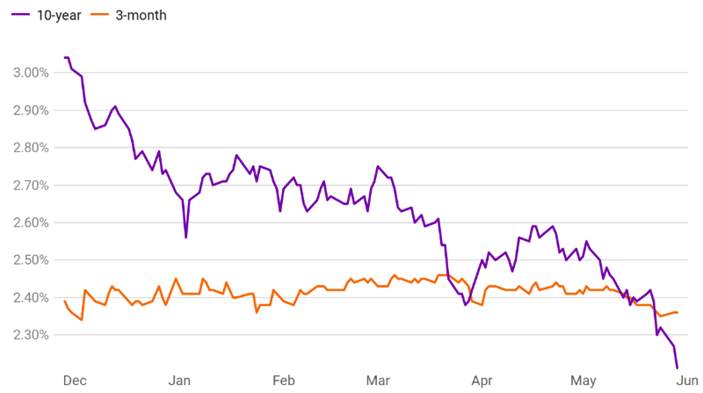

Yield curve inversion

In May the yield curve between 10-year and 3-month Treasury notes re-inverted, after dipping in March into negative territory for the first time since 2007. MarketWatch reported the yield on the 10-year note fell to 2.402%, below the 3-month note’s 2.406% yield. An inverted 10-year/ 3-month yield curve is a reliable recession-indicator.

The yield curve is the difference in returns between short-term and long-term bonds. The curve has been inverted since May 23. The yields on long-term Treasury bills are getting worse. They should be much higher than short-term notes because investors demand a higher interest rate for holding bonds long term. On Monday the yield on the 10-year note fell below 2.07% – the lowest in 20 months – while the 30-year bond also slumped, to 2.53%.

Forbes quotes an economist at Moody’s Analytics saying that the yield curve inversion spells bad news ahead for the US economy:

Generally, the yield curve inverts when investors are worried about the long-term outlook of the economy, said deRitis. Most economists say an inverted yield doesn’t cause a recession but reflects negative sentiment about growth.

Meanwhile in Canada, which takes its cues from the US economy, the yield curve on government bonds inverted the most since 2007, on worries that Trump’s threat to impose tariffs on Mexican imports could mean the demise of the new NAFTA agreement. Ten-year bond yields last Friday fell five basis points to 1.51%, and 17 points below the three-month notes, said Bloomberg.

Trade war with Europe?

The US Federal Reserve pays close attention to the yield curve as it is a measure of investors’ confidence in the economy. The Fed had planned to raise interest rates this year on the strength of a growing economy but has since backed off considering the negative outlook for global growth and concerns over the US economy.

Now, the Fed is watching bond yields to see if a further yield curve inversion will drag the dollar down, which would be good for gold prices.

A little out of left field, Morgan Stanley thinks it’s not the US-China trade dispute investors should be paying attention to but a looming trade conflict with the European Union, that could seriously dent the economy.

The Trump administration was planning on slapping a 25% tariff on European car imports on May 18 but has deferred a decision for six months. The Morgan Stanley analysts said in a report that a trade war with Europe would cause so much economic pain it would force the Fed to lower interest rates to juice growth.

As for the Fed, its board of governors is hinting that a potential rate cut is being considered as a way to bolster a flagging economy. The New York Times states:

“If the incoming data were to show a persistent shortfall in inflation below our 2 percent objective or were it to indicate that global economic and financial developments present a material downside risk to our baseline outlook,” officials would take that into account in assessing whether interest rates should continue to remain unchanged, the Fed’s vice chairman, Richard Clarida, said during a speech in New York on Thursday.

Depression analog

In fact some would say the Fed is downplaying a far greater risk to the economy, heralded by the disturbing yield curve inversion and the trade war which appears to escalate by the week.

Clive Maund states in an editorial that “what is going on now is very similar to what went down in the 1930’s with protectionism, trade wars and then depression leading to a major war…” Maund thinks a war between the US and Iran is the most likely scenario, given the neo-conservative alliance with Israel.

We agree with the first part and that Iran is certainly a powder-keg, but the drama will be contained, a more regional rather than global affair. At Ahead of the Herd we prefer to place our bets on a military confrontation with China, which certainly by the Trump administration, is seen as the enemy.

Other authors agree.

Over at Project Syndicate, economics professor Nouriel Roubini argues that China and the US are gradually moving towards war – maybe not a hot war, although the constant tensions in the South China Sea suggest otherwise – but likely a cold war, which is what historically happens when an emerging power (China) confronts an established power (the US), something called “the Thucydides Trap”.

What started as a trade war now threatens to escalate into a permanent state of mutual animosity. This is reflected in the Trump administration’s National Security Strategy, which deems China a strategic “competitor” that should be contained on all fronts.

For more on this read out Trade war will hasten bull market for rare earths

Flashpoint Taiwan

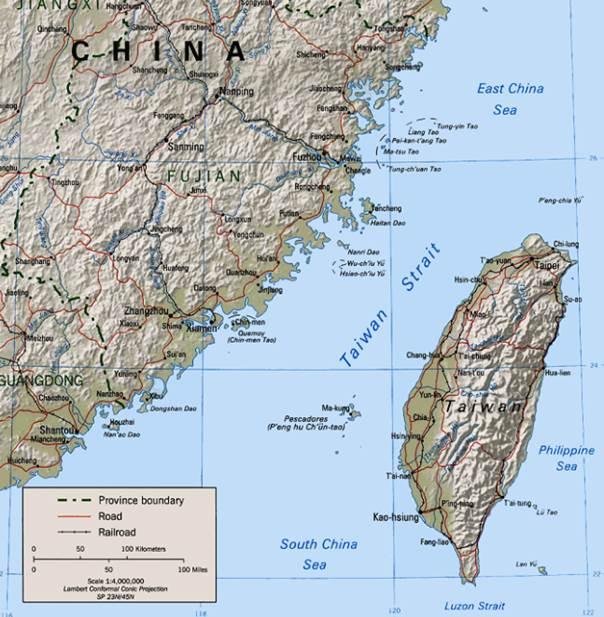

We have written extensively on the tensions between the US and China in the South China Sea, where China holds historical claims despite international treaties to the contrary (ie. the UN Convention on the Law of the Sea). Ongoing maneuvers in the South China Sea demonstrate that Beijing is willing to flex its muscles in a region it sees as strategically and economically important.

China has been dredging seabed and building islands, on which it has constructed outposts including missile batteries, despite claims of ownership by Vietnam, Malaysia, Philippines, Taiwan and Brunei.

In 2016 Steve Bannon, President Donald Trump’s former chief strategist, declared that there was no doubt, in his mind, that the US would go to war with China in the South China Sea in the next five to 10 years.

There’s also Taiwan. The United States supplies weapons to Taiwan despite not having diplomatic relations with the island and its government. China sees Taiwan as a breakaway territory that must be re-united with the Chinese mainland; its independence is not recognized by Beijing. A forced annexation of Taiwan to China would almost certainly cause a war between China and the US; the Americans would never allow Taiwan, a key tentacle of US influence, to be overtaken by the Chinese.

Yet that is exactly what Beijing appears willing to go to war over.

Shao Yuanming, a senior official of the People’s Liberation Army, reportedly said after a speech by Acting US Defense Secretary Patrick Shanahan, that China would defend its sovereignty over Taiwan should anyone ie. the US, try to keep it separate from the mainland.

“China will have to be reunified,” Shao said on Saturday. “If anybody wants to separate Taiwan from China, the Chinese military will protect the country’s sovereignty at all costs.”

The next day, Defense Minister Wei Fenghe equated President Lincoln’s efforts to prevent the secession of the union, during the Civil War, to China’s approach to Taiwan. It sees the island as integral to its territory. Bloomberg reported:

“American friends told me that Abraham Lincoln was the greatest American president because he led the country to victory in the Civil War and prevented the secession of the U.S.,” Wei said on Sunday at the Shangri-La Dialogue, a security conference in Singapore. “The U.S. is indivisible, so is China. China must be and will be reunified.”

Tensions over Taiwan have escalated in recent months, with the US regularly sailing warships through the Taiwan Strait.

Gold-backed Asian currency?

China has recently taken steps towards moving away from the US dollar as the world’s reserve currency. In May 2018 the country launched a Shanghai-based oil futures contract denominated in the national currency, the yuan or renminbi – and backed by gold.

The oil futures contract would be a way for oil producers like Saudi Arabia to circumvent the US “petrodollar” – which derives much of its value by being the currency used to buy and sell oil. Currency observers say the oil futures contract is a way for China to challenge the petrodollar and to set the stage for the yuan as the world’s dominant currency.

Later in 2018, China announced that it signed a cross-border pact with Russia to work out a new payments system – the idea being that national currencies could be used in bilateral trade, to cut out the US dollar and thereby allow Russia to bypass US sanctions and China to get around US tariffs.

The Malaysian prime minister has taken this idea a step further in suggesting a common Asian currency, presumably similar to the euro of the European Union. Last week Prime Minister Mahathir Mohamad said common currency for East Asia could be pegged to gold, and used for settling imports and exports, though not for domestic transactions.

The concept was a reaction to what Mohamad said was the manipulation of local currencies by external factors, and came on the heels of a statement by the Trump administration that included Malaysia among nine countries to watch for currency manipulation.

Peak gold

At Ahead of the Herd, among the reasons we like gold as an investment, is that gold companies are finding less of it. Last month, AngloGold Ashanti announced plans to sell its last remaining gold mine in South Africa, the Mponeng mine southwest of Johannesburg, due to ore depletion.

We are now facing “peak gold” where gold production from here-on will keep falling. The experts agree the industry is seeing a significant slowdown in the number of large deposits being discovered. It used to be that major gold miners were looking at 5-million ounce projects to buy and develop; now they’d be happy with a million ozs in the ground.

One of the most well-respected CEOs in the industry, Mark Bristow, who headed Randgold before it merged with Barrick, remarked on the tight gold supply in a recent interview with The Northern Miner. Asked to comment on how the gold industry could look in five to 10 years, Bristow had this to say:

The industry is in decline. We’ve got ourselves into a really tight spot because we haven’t invested in exploration and our future.

Now when you look at the average life of mine, it’s less than the time it takes to discover and develop a world-class asset. The supply side of our industry is very tight. The demand side … and I disagree with some of the talk presenters here today, in that gold is an inelastic industry just like everything else.

When we overdid the hedging and dumped twice as much gold into the market that we were actually producing, the gold price went to US$255 an ounce. We stopped doing it, and it started going up. The Chinese started buying gold, and it went even further.

Then all we did is we took lower and lower grades and produced more and more gold and we put a roof, a ceiling on the gold price and we’ve driven it down since then to a point now where we are staring at tightening in the market.

Conclusion

The result, as we see it, has to be continuing strength in the gold price, with major producers like AngloGold Ashanti seeing the end of gold mining in South Africa, a lack of discoveries in recent years, and as Bristow points out, the length of time needed to build a gold mine these days, being longer than the time it takes to mine it out. That’s really something, when you think about it. The lives of gold mines have become so short, it takes longer to discover one and put it into production than the time from the onset of mining to closure.

Combine these supply factors with the demand-side reasons for owning gold right now. To recap, they include the series of economic indicators showing that US growth is grinding to a halt; worsening yield curve inversion; a potential trade spat with Europe waiting in the wings, as the US-China trade war appears no closer to a resolution; and the increasing tension between China and the US over Taiwan and the South China Sea, raising the possibility of war and a flight to safe havens like gold, and you have all the makings of a powerful and prolonged bull market for gold just as we are entering the most active time of the year for junior resource companies.

With all that is going on in the world, we believe the gold price will do well over the next few months.

Richard (Rick) Mills

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.