The next shock to the global economy? Commodity prices.

2020.11.24

Often overlooked scenarios for inflation to rear its ugly head are:

- Supply constraints in the economy. When an industry, or industries, fail to deliver enough goods for their market, the result is price inflation.

- An over-reliance on imported goods can also cause price inflation.

- The prices of goods can increase if labor disruptions occur.

- When countries fail to coordinate their internal/ external emergency policies, and instead, act unilaterally.

We are seeing all of this in our current coronavirus predicament.

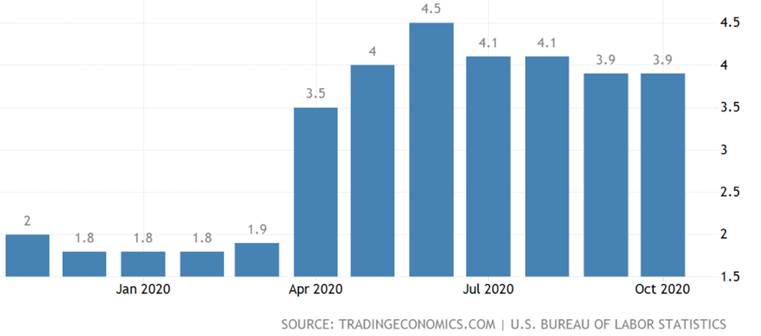

United States Consumer Price Index (CPI)

Prices for US imports

US Food Inflation

In September, the UN’s Food and Agriculture Organization (FAO) reported that global food prices rose for the third straight month in August, reaching their highest levels since February. According to CNBC,

Experts have said that while there is no pressing food shortage, farms have been roiled as the coronavirus pandemic upended supply chains and curbed movements.

“As the coronavirus crisis unfolds, disruptions in domestic food supply chains, other shocks affecting food production, and loss of incomes and remittances are creating strong tensions and food security risks in many countries,” The World Bank said [on Aug. 31].

Canadian Food Inflation

Earlier this year the Financial Times ran a column by Martin Wolf, in which he argued, even people’s propensity for restricting their spending habits, and saving for a rainy day, can raise prices. He writes,

“[T]he combination of constrained output with rapid monetary growth forecasts a jump in inflation. But it is possible that the pandemic has lowered the velocity of circulation: people may hold this money, not spend it. But one cannot be certain. I will not forget the almost universally unexpected surge in inflation in the 1970s. This could happen again.

In fact, inflation is happening again. Not only are food prices rising, so are the prices of several mined commodities, including zinc and copper, in part due to output restrictions and mine closures owing to covid-19. Upstream, a lot of manufacturing capacity has been lost, meaning higher finished good prices.

Of course, the demand is there and strengthening. Asian growth is humming and Chinese export prices have risen year over year. Bloomberg notes that, excluding oil, industrial commodity prices are higher than they were at the end of last year. US imports are also more expensive, durable goods are on a tear, and there are signs that services inflation is going up, too.

Copper

The copper market is an excellent illustration of how supply constraints can affect prices.

On the supply side, the market for copper is quite bullish. Chilean state-owned Codelco, the largest copper miner in the world, lost 4.4% of its production in July, as the coronavirus forced the company to scale back staffing, slow projects and turn off a smelter.

In Peru, the mining industry has reduced its workforce to help stop the spread of covid-19, but this has affected output and construction of new mines, including Anglo American’s $5.3 billion Quellaveco project.

The country’s copper production in August fell 2.5% to 193,852 tonnes. Full-year production is expected to drop 7.2%, due to disruptions at a number of large mines including Las Bambas, Constancia, Toromocho and Cerro Verde. Diversified Canadian miner Hudbay Minerals announced that Pampacancha, its long-planned expansion of its flagship Constancia mine, expected to open in late 2020, would be delayed by at least four months, because the company could not consult with local communities.

Covid-related mine closures, albeit temporary, are upending the copper market and bidding up prices, as investors fret over whether the industry can meet demand, especially now that China is back on its feet, recovered from the virus.

Bloomberg wrote that “The global copper market could be on the cusp of a historic supply squeeze as Chinese demand runs red hot and exchange inventories plunge to their lowest levels in more than a decade.”

Copper output from the world’s top 10 producers declined 3.7% during the second quarter, due to lockdowns in Chile, Peru and Mexico.

According to GlobalData, total output during the three-month period decreased from 2.7 million tonnes to 2.6Mt. Total annual mined copper production is around 20 million tonnes.

Another supply squeeze is likely in Zambia, where copper mines have halted $2 billion worth of planned expansions, due to a dispute over a royalty tax introduced last year.

The International Copper Study Group anticipates 2020 will be the second consecutive year of declines in world copper mine production – with the industry outputting 7,000 tonnes less than what the group predicted a year ago. Next year, ICSG expects supply growth of 4.5%, depending on how efforts go to control the coronavirus.

As we have reported, without new capital investments, Commodities Research Unit (CRU) predicts mine production will drop from the current 20 million tonnes to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

More evidence of the impending copper crunch is appearing all the time. According to S&P Market Intelligence, “Beyond 2020, we forecast that consumption will outstrip production over the period to 2024, resulting in a growing refined market deficit and increasing copper prices.” … [Analytics

provider Fitch Solutions] forecast a shortfall of 489,000 tonnes in 2024, rising to 510,000 tonnes in 2027.

Cumulative demand for copper is expected to exceed its Reserves base in most scenarios by 2050, with most copper-producing countries unable to sustain their current production that far into the future. The supply of metals co-mined with copper is also anticipated to decrease, unless extraction efficiencies from copper ore are increased substantially.

New supply is concentrated in just five mines —Escondida, Cobre Panama, Quebrada Blanca, Spence and Kamoto. These operations are vulnerable to output cuts if prices fall below $5,000 per tonne. As CME Group notes, Miners are having to search farther and dig deeper to access copper.

Supply pressures plus robust demand are having the predictable effect on copper prices. Last Friday, copper prices climbed to their highest level since 2014, with investors and traders reacting to news of a vaccine from Pfizer and BioNTech SE. The red metal’s widespread use in construction wiring & piping, and electrical transmission lines, make it a key metal for civil infrastructure renewal, hence copper’s eight months of straight gains, driven by demand from top copper consumer China, whose economy has returned to growth following a strict covid lockdown earlier this year.

Conclusion

Imagine that Pfizer’s vaccine, Moderna’s, AstraZeneca’s, or all three being proposed, start being distributed and there are no problems. Closed businesses re-open, laid-off employees are hired back, bank loans for expansions are applied for.

Global infrastructure plans will move forward, including, President Bidens multi trillion dollar electrification and 5G plans which is going to result in a soaring U.S. budget deficit, technically speaking – debt out the wazoo.

Demand for copper will certainly increase. Along with nickel, zinc, silver, graphite, cobalt etc, all the metals needed for ‘old school black top’ and ‘green, electrification’ infrastructure metals.

However, as one observer notes,

I strongly suspect that a lot of manufacturing capacity has been lost. Both domestically and internationally, transportation is at once more difficult and more expensive. The vogue for ESG [environmental, social and corporate governance] investments has probably also meant a lack of investment in stuff you dig out of the ground or drop on your foot.

Assuming that all this takes a fairly long time to get up and running, you would expect these constraints to last. The same is probably true of services. A lot of companies have already been put out of business and many more are likely to go to the wall. There has been, then, severe losses to economies’ supply potential. All of which means that the path of least resistance when demand picks up is higher prices.

Remember, often overlooked scenarios for inflation to rear its ugly head are:

- Supply constraints in the economy. When an industry, or industries, fail to deliver enough goods for their market, the result is price inflation.

- An over-reliance on imported goods can also cause price inflation.

- The prices of goods can increase if labor disruptions occur.

A vaccine means price inflation, across the board, is coming.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security.

AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.