The next copper frontier

2019.12.07

Imagine a world without copper. Or a world in which copper is so rare, therefore so expensive, that products made with are beyond the reach of the average consumer.

That includes homes, vehicles, computers, TVs, microwaves, public transportation systems (trains, airplanes) and the latest copper consumable, electric vehicles.

In EVs, copper is a major component used in the electric motor, batteries, inverters, wiring and in charging stations. An EV has nearly 10 times as much copper in its battery as a regular gas-powered car or truck.

The IEA forecasts a more than quadrupling of EV sales in the next decade, from 5.1 million in 2018 to 23 million in 2030. That year the number of electrics not counting two and three-wheelers will exceed 130 million.

Earlier this year, research quoted in Barron’s said the mining industry will need to produce 5 million tonnes of copper a month by 2030, which is about 2.5 times the amount produced this year, just to meet demand from EVs.

Supply shortage coming up fast

We have taken copper for granted, but that may soon be changing. The base metal is heading for a supply shortage by the early 2020s; in fact the copper market is already showing signs of tightening – something we at AOTH have covered extensively.

As we wrote in The coming copper crunch, over 200 copper mines currently in operation will be depleted in the next 15 years. Without new ones to replace them, we are looking at a 15-million-tonne supply deficit by 2035.

Supply is already tightening owing to events in Indonesia and South America, where most of the world’s copper is mined.

Copper concentrate exports from Indonesia’s Grasberg, the world’s second biggest copper mine, have plunged dramatically as operations shift from open pit to underground. Production is expected to fall from 1.2 million tonnes of copper concentrate last year to just 200,000t in 2019.

Major South American copper miners have also been forced to cut production.

A two-month strike in Peru at MMG’s Las Bambas mine meant a 15% drop in second-quarter output.

In Chile, Codelco’s Chuquicamata mine is expected to see a 40% fall in production over the next two years. A $5-billion expansion, moving from open-pit to underground, will take five years to reach full output of 300,000 tonnes per annum. Production will fall from an expected 459,000 tonnes in 2019 to 182,000t in 2021.

State-owned Codelco recently announced it will scale back an ambitious $40-billion plan to upgrade its mines over the next decade, after reporting a 57% drop in earnings due to heavy rains this past spring, a prolonged strike at Chuquicamata and lower metals prices. The world’s largest copper company also said it will reduce spending through 2028 by 20%, or $8 billion.

Shipments from BHP’s Escondida are expected to drop by 85% this year due to operations moving from open-pit to underground. The largest copper mine on the planet is expected to take until 2022 to re-gain full production.

Recent country-wide protests over transit prices and perceived inequality have yet to seriously impact production, but they have disrupted mining supply chains.

On top of everything, copper grades have declined about 25% in Chile over the last decade – highlighting the urgent need for grassroots exploration to arrest the trend.

Mining companies are having to go further afield and dig deeper to find copper at the grades needed to economically produce copper products for end users.

Andean Copper Belt

One of the most interesting places to look for new copper deposits is the Andean Copper Belt of northwestern South America. The belt runs from northern Chile in the south, through Ecuador and Colombia, then arcs northwest into Panama. It hosts some huge copper porphyry (and gold, molybdenum) deposits including Escondida, Chuquicamata, Las Bambas and Collahuasi.

The area’s geology is among the Earth’s most richly mineralized. The North Andean copper-gold province is a 2,500-kilometer mineralized arc that formed on the western edge of South America’s complex Proterozoic and Archaean shield, during the Lower Paleozoic era, around 300 million years ago. A complex of Cretaceous-era terranes (pieces of crust, broken from tectonic plates) was forged on the northwest margin of South America, connecting it to the southern tip of North America sometime between the Oligocene and Miocene epochs.

The largest copper-molybdenum porphyry deposits are at Cerro Verde-Santa Rosa, Cuajone, Quellaveco and Toquepala in southern Peru, and Mocha, Cerro Colorado, Spence and Lomas Bayas in northern Chile. Mainly copper porphyry deposits, with moly and gold kickers, occur in Chile at the Collahuasi, Quebrada Blanca, Chuquicamata, Escondida and El Salvador mines.

The Andean Copper Belt represents nearly half of the world’s copper production, but the parts underlying Colombia and Ecuador remain hugely under-explored.

Australia’s SolGold (TSX:SOLG) has had success in northern Ecuador, having discovered a new copper-gold-moly porphyry system at its Santa Martha target. SolGold continues to advance its Alpala deposit, located on the northern section of the Andean Copper Belt – which represents nearly half of the world’s copper production.

While there is just one producing copper mine in Colombia, in the northwestern department of Choco, the government is hoping to diversify from gold, oil and coal, into the red metal.

Recent geological studies found copper mineralization in not only Choco but Antioquia, Córdoba, Cesar, La Guajira and Nariño departments.

A 2016 peace agreement between the government and the largest Marxist rebel group has stabilized the South American country and opened it up to foreign investment. This has allowed Colombia to explore for minerals in previously inaccessible areas.

Major miner influx

Anglo American, AngloGold Ashanti, Cordoba Minerals, Max Resource (TSX-V:MRX) and privately held Minera Cobre, partially owned by First Quantum Minerals, are among the companies exploring for copper (and gold) in the Andean Copper Belt.

In September 2018 Anglo American signed a joint-venture agreement with Luminex Resources, a Canadian company exploring for precious and base metals in Ecuador. Under terms of the JV, Anglo American can earn up to a 60% stake in Luminex by spending US$57.3 million between 2018 and 2024. This includes a $50 million investment in exploring Luminex’s Pegasus volcanic massive sulfide (VMS)/skarn deposit, plus a series of $7.3 million staged cash payments. Its ownership interest increases to 70% if Anglo American funds the project to a mining decision.

This week in Colombia, China’s largest gold producer, Zijin Mining, bought out Continental Gold for almost CAD$1 billion. The Canadian company’s Buriticá gold project in northwestern Colombia has a measured and indicated gold resource of 16.02 million tonnes at a gold-equivalent 11 grams per tonne, containing 5.32 million ounces of gold and 21Moz of silver. The mine has been under construction since 2017 and is expected to open next year, producing 250,000 oz per annum for 14 years.

Zijin also has a 24% stake in Guyana Goldstrike it acquired by way of a $3.2 million investment in the company. Guyana Goldstrike put the Zijin funding towards a trenching program at a new bedrock target at its Marudi Gold Project – Toucan Ridge – hoping to add to the other two mineralized zones, Mazoa Hill (where the 2018 resource estimate was completed) and Marudi North, where 2012 drilling added additional ounces.

Not to be outdone by its Andean neighbors, Peru is also ratcheting up mineral exploration. The world’s second largest copper producer wants to promote new investment in exploring Peru’s untapped mineral riches, and bump up its representative share of global exploration expenditures from 6% to 8% by 2021.

In November 2016, Canadian diversified miner Teck Resources, valued around $11 billion, took control of the Zafranal copper-gold project in Peru’s southeastern Andes, through the purchase of AQM Copper. Japan’s Mitsubishi holds 20% of the property which has 621 million tonnes of 0.37% copper and 0.8 grams per tonne gold as of 2015, the most recent figures available. According to BNamericas, Teck has budgeted nearly $40 million for the $1.5B project his year, and plans to commission the mine in 2023.

Following is a survey of all the copper exploration currently happening in the Andean Copper Belt, by country. While every attempt has been made to be inclusive, this is not an exhaustive list.

Peru

Regulus Resources (TSXV:REG) is focused on its AntaKori copper-gold-silver project in northern Peru. A first-phase drill program in 2018 outlined a 2019 resource of 4.1 billion pounds of copper-equivalent (CuEq) and 3.9 billion pounds CuEq inferred, graded 0.74 and 0.66% CuEq, respectively. The 25,000-meter second-phase drill program has begun. In November REG received the permit allowing up to 40 drill pads for the Anta Norte portion of AntaKori, located in Cajamarca department, next to the Tantahuatay gold-silver mine owned by a joint venture of Southern Copper and Buenaventura.

Market cap $107.4M, outstanding shares (o/s) 90,994,594

Miramont Resources (CSE:MONT) is working in southern Peru, home to some gigantic copper mines including Toquepala, Cuajone, Cerro Verde and Quellaveco – the latter currently under development. Cerro Hermoso and Lukkacha are both early-stage targets. At Cerro Hermoso, an 1,862m program consisting of four drill holes completed this past summer. Three of four holes encountered polymetallic mineralization, with one hole showing eight separate intervals totaling 303.5m. The company believes it may be dealing with a deeper, possibly porphyry system, and is currently seeking a joint-venture partner.

Market cap $3.6M, o/s 54,814,795

Chakana Copper (TSX-V:PERU) is advancing its Soleda project near Aija, in Peru’s Miocene mineral belt. Chakana is focused on defining the potential of its high-grade breccia pipes, rather than the previous operator’s strategy of zeroing in on a porphyry deposit. “We think these high-grade breccia pipes can offer significant economic value because they are numerous, high-grade, vertically extensive from surface, and are relatively easy to explore,” states president and CEO David Kelly.

Market cap $14.9M, o/s 97,199,847

Camino Minerals (TSX-V:COR) recently extended by two years the environmental impact permit first granted by the Peruvian government in 2017, regarding its Los Chapitos copper-gold project in southern Peru. That year, eight holes drilled at the Atajo target cut 0.83% copper over 16.3 meters including 2.09% copper over 5.0m. “By extending our Atajo zone permit by 2 years it enables us to utilize the detailed geological mapping that is currently underway at Atajo,” said CEO John Williamson. “With a better understanding of the structure, alteration, and mineralization we will be able to more accurately test these strong zones of mineralization during future drilling.”

Market cap $4.5M, o/s 57,773,980

Hannan Metals (TSX-V:HAN) is developing a sediment-hosted copper-silver deposit in the Huallaga basin of northcentral Peru. Described as one of the best surveyed thrust and fold belts in the world for oil and gas, the style of deformation in the Sub-Andean zone is mainly related to salt tectonics rather than a compressional thrust and fold belt. This insight has opened up a new window for sediment-hosted copper deposits in Peru.

Sedimentary copper deposits are formed in ocean basins, where the seabed is composed of porous materials such as sandstone, limestone and black shale, through which copper and other minerals travel up and become trapped in the rock layers.

The process of mineral deposition is quite different from a copper porphyry deposit, which is formed when a block of molten-rock magma cools. The cooling leads to a separation of dissolved metals into distinct zones, resulting in rich deposits of copper, molybdenum, gold, tin, zinc and lead. A porphyry is defined as a large mass of mineralized igneous rock, consisting of large-grained crystals such as quartz and feldspar, that is often suitable for bulk mining.

A first mover in this part of Peru, Hannan’s initial prospecting in 2018-19 identified high-grade mineralization in outcrops and alteration in an area covering 100×50 km. Similar-styled outcrop boulders have been discovered over 100 km of strike. The best rock chip samples from two outcrops 20 km apart were 3 meters at 2.5% copper and 22 grams per tonne silver, and 2m at 5.9% Cu and 66 g/t Ag.

Market cap $4.5M, o/s 57,417,679

Panoro Minerals (TSX-V:PML) is advancing its flagship Cotabambas project in southern Peru. The Canadian copper explorer has a metals stream deal with Wheaton Precious Metals, the largest silver streaming company in the world. Under the agreement, Wheaton will pay Panoro cash payments totaling $140 million for 25% of the gold production and 100% of the silver production from Cotabambas, along with production payments over its life of mine. According to Panoro, exploration and step-out drilling from 2017-19 has identified the potential for both oxide and sulfide resource growth.

Market cap $26.3M, o/s 263,837,522

Candente Copper’s (TSX:DNT) Cañariaco Norte copper-gold-silver deposit in northern Peru has a measured and indicated resource of 752.4 million tonnes grading 0.52% copper-equivalent, containing 7.5 billion pounds of copper, 1.7 million ounces of gold and 45.2Moz of silver. A feasibility study was initiated in 2011 but put on hold in 2013 due to poor market conditions. No exploration work has been completed since then. A change in government regulations allows the company to re-start drilling under the permit approved in 2014.

Market cap $6.8M, o/s 194,000,000

Colombia

As mentioned Colombia is seeking to pivot more into copper from its traditional gold-mining base. The country currently has only one small copper mine, a 10,000 ton-per-year operation in Choco department. But Colombia is aiming much higher. Here’s Silvana Habib, president of the National Mining Association:

“We have the potential, but we are an unexplored country in terms of copper, we are located in a favorable geological environment, the Andes Mountains, we share that copper belt that neighboring countries have and are more advanced in copper,” she told Reuters news agency earlier this year.

Habib said initial estimates have Colombia hosting over a million tonnes of copper reserves. Chile currently has the most copper reserves at 170 million tonnes.

Among the copper projects she referenced are Cordoba Minerals’ San Matias property (see below), AngloGold Ashanti’s Quebradona project in Antioquia, and the Minera Cobre project in Choco, of which Canada’s First Quantum Minerals owns 10%.

Royal Road Minerals’ (TSX-V:RYR) Caramanta copper-gold porphyry project is 75 km south of Medellin. From 2010-15 Solvista Gold and in-part IAMGold, under option, conducted exploration and drill testing of four porphyry copper-gold projects within and just outside the Caramanta application. Drilling highlights included 456.7 meters at 1.01 grams per tonne gold and 0.2% copper, 323.4m @ 1.34 g/t gold and 0.2% copper, and 185.5m @ 1.22 g/t gold and 0.24% copper. Canada-based Agnico Eagle is RYR’s largest shareholder.

Market cap $50.2M, o/s 214,600,000

Cordoba Minerals (TSX-V:CDB) filed a preliminary economic assessment (PEA) for its San Matias project in September. The project hosts the Alacran near-surface copper-gold deposit as well as several known areas of porphyry copper-gold mineralization including the discovery of two outcropping copper-gold porphyries, Montiel and Costa Azul. A high-grade epithermal vein discovery featured 4,440 g/t gold, 10.25% copper, 24.70% zinc and 347 g/t silver over 0.90 meters. The open-pittable project is situated near two operating open pit mines.

Market cap $27.4M, o/s 300,019,388

Max Resource’s (TSX-V:MXR) two copper targets are Cesar and La Guajira. The company also holds exploration licenses in the Choco and North Choco areas.

Max’s head geologist, Piotr Lutynski, told AOTH that Colombia’s stratigraphy is similar to his homeland, Poland, and its Kupferschiefer sedimentary copper deposits. KGHM Polska Miedź (KGHM), the sole producer of copper in Poland, mined 30.252Mt of ore at 1.49% Cu and 48.6 g/t Ag, comprising 452,000t of Cu and 1,471t of Ag in 2018.

A crew at its Cesar copper project has been looking for surface outcrops, that Max thinks could be the tip of the iceberg of a giant sediment-hosted copper system below surface. If there’s an orebody at Cesar, underneath those outcrops, Max would be looking at a major discovery. The company has identified a 70 x 20-km copper-silver target area with up to 2% combined copper and silver. Eighteen structures identified over 9 square km indicate mineralization is open in all directions. Grades ranged from 0.3% to 4.2% copper and up to 116 g/t silver; 27 of 36 assays exceeded 1% Cu; 15 of the 43 more than 2% Cu; and 3 exceeded 3% copper.

At North Choco, rock chip samples collected over a one-meter interval returned an off-the-charts 49.8 grams per tonne gold and 4.3% copper. According to Max, the discovery could indicate the start of a new mineralized zone, considering that it is open in all directions and appears to be structurally controlled within the host rock.

Market cap $1.1M, o/s 15,918,428

Libero Copper & Gold (TSX-V:LBC) acquired the Mocoa porphyry copper-molybdenum deposit from B2Gold in 2018. The Mocoa deposit has an inferred mineral resource of 636 million tonnes grading 0.33% copper and 0.03% molybdenum, containing 4.6 billion pounds of copper and 511Mlbs molybdenum. The resource is considered to be open-pittable.

Market cap $8.8M, o/s 93,261,392

Ecuador

The mining industry has had a rocky history, no pun intended, with the government of Ecuador. In 2008 then-president Rafael Correa slapped a moratorium on mining, scaring away foreign investors. In 2013 a series of reforms were undertaken, including a reduction to the 70% windfall tax on profits, resulting in a 200% increase in foreign investment, according to BizLatin Hub. Ecuador also revised the so-called “sovereign adjustment” from projects, which virtually guaranteed the government would receive at least 50% of all project benefits.

The Ecuador government reportedly hopes to more than double the value of mining to its struggling economy by 2021. That shouldn’t be too hard – in 2014 mining’s contribution to GDP was under 1%.

Interest in exploring Ecuador has been catalyzed by the success of Lundin Mining’s Fruta del Norte project in the country’s southeast. Slated to commence in 2020, mining the largest gold deposit in Ecuador is expected to last 15 years, producing a total of 340,000 ounces.

The country has also started shipping the first copper from its one and only large-scale copper mine, which started in July. The $1.4 billion Mirador open-pit mine is owned and operated by a Chinese consortium that acquired it during Correa’s term as president. The mine has an estimated 3.1 million tonnes of copper reserves, 3.4 million ounces of gold and 27.1Moz of silver.

Another talking point is the Cascabel silver-gold-copper project in northern Ecuador being developed by SolGold. More on that below.

Aurania Resources’ (TSX-V:ARU) flagship asset is the Lost Cities – Cutucu project, found in the Jurassic Metallogenic Belt of the Andes foothills in southeastern Ecuador. The company has carried out stream-sediment reconnaissance on about 40% of the sprawling 208,000-hectare property. However earlier this year, new observations from the field led Aurania to revise its exploration model.

Its Chairman and CEO, Dr. Keith Barron, explains: “In October of last year our geologists, tasked to carrying out rather routine stream sediment collection, started to bring an extraordinary array of copper-mineralized large boulders and slabs in from the jungle. Some of these samples were covered in vivid green chrysocolla and tenorite. At first, we treated these as a curiosity and believed they were related to the supergene weathering of nearby porphyries. However the copper minerals were hosted exclusively in well-bedded siltstone, mudstone, sandstone and shale, particularly in pieces showing abundant carbonaceous plant fragments and not in porphyry.”

Tracing these boulders back to the outcrops, over a strike length of 22 km, Aurania’s geologists observed the copper mineralized setting to be similar to the “Kupferschiefer” (copper shale) being mined by KGHM in Poland and Max Resource, described above, ie. that copper leached from the sedimentary basin remains in solution because of the oxidized state of the red sandstones (“red-beds”).

Aurania also notes that data from the geophysics survey it flew over the project identified a number of magnetic centers that are interpreted as porphyries or porphyry clusters. If this interpretation is correct, the porphyries represent an additional significant source of copper potentially injected into the red-bed sequence.

Market cap $151.9M, o/s 36,600,000

SolGold’s (TSX:SOLG) historical exploration together with sediment and channel sampling was the catalyst of the discovery that is now the company’s flagship Cascabel copper-gold project in northern Ecuador. The Alpala deposit contains a measured and indicated resource of 10.9 million tonnes of copper and 23.2 million ounces of gold. A PEA was released in May.

The Australian company recently announced improvements in gold and silver recoveries that could add $8.7 billion in metal revenues over its life of mine.

SolGold has also received an added vote of confidence from BHP. In 2018 the world’s largest mining company paid SolGold $85 million for an 11.2% stake – coming close to matching Newcrest Mining’s 14.5% ownership position. In November BHP added to its stake, by agreeing to invest a further $22 million, thus putting its ownership at 14.7% and overtaking Newcrest as SOLG’s top shareholder.

Market cap $711.6M, o/s 1,846,321,033

Conclusion

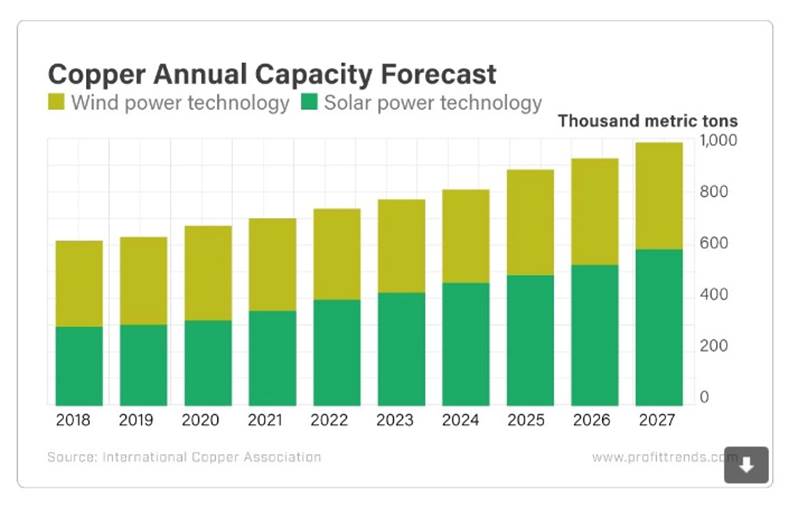

Earlier this year the International Copper Association (ICA) commissioned a study to see what the effects of a rise in renewable energy will have on copper demand. The answer? By 2027 demand will rise 56%, meaning an extra 813,000 tonnes will have to be added to current production levels. Another 5.5Mt will be needed by 2028, and that’s only for renewable energy applications like wind power, which grew 8% in the US in 2018. Onshore wind already delivers over a billion dollars in annual revenues, but the industry wants to head offshore. By 2040 global wind power could be 15x larger than it is today. Copper is the best metal for generating, transmitting and distributing energy, due to its high conductibility and low resistivity.

At the top of this article I mentioned electric vehicles demand almost 10x as much copper as their gas and diesel counterparts. Well, by 2027, it’s expected that demand from EVs will send copper demand even higher, to 1.74 million tonnes/yr.

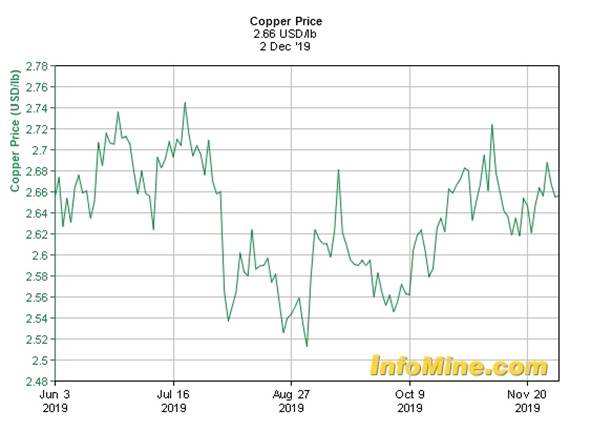

Where is all this additional copper going to come from? We are already seeing supply tighten because of mines having to interrupt operations (moving from surface to underground) and a host of other problems including weather, strikes, struggling copper prices and lower grades.

We can see this tightening reflected in copper warehouse inventories. Combined stocks of copper in LME and Shanghai exchange warehouses have plummeted 50% since mid-August, and are now sitting at about 225,000 tonnes.

If the market sees more disruptions it may have to draw these stocks down even further, resulting in an upward price correction. Less than 10 days of warehoused Cu supply doesn’t seem like much of a safety net.

There is one silver lining in the cloud, however. “Low inventories across the copper supply chain mean that any resolution to the U.S.-China trade war could trigger a snap rally in prices as consumers rush to restock,” Reuters reported market participants saying on Tuesday.

The big catalyst that would change everything for copper prices which have lagged this year mostly due to the fear of an extended trade war, would be a deal reached between China and the US. One strategist speaking to CNBC’s “Squawk Box Europe” on Tuesday said that holding any asset ahead of the agreement being finalized would pay off.

“The way to make money is easy right now, you just have to own something, because everything’s just been grinding higher. No one wants to be short going into the day before the trade deal’s announced,” said Patrick Armstrong, CIO of Plurimi Investment Managers.

I won’t hold my breath on a trade war resolution especially with Trump saying it could wait until after the 2020 election, but one thing we can do is to position ourselves in copper companies that stand to benefit from stronger copper prices. As the copper shortage becomes more acute, prices will have to head higher.

The companies we’ve presented here all offer potential entry points to copper juniors that are hunting for the red metal in the Andean Copper Belt. Peru and Colombia are already experienced mining countries so there should be the required human resources and infrastructure available, as exploration there continues to increase. Ecuador has a lot of untested ground left to uncover, thus tremendous opportunities. We’re already seeing major mining companies like BHP, Newcrest, Teck Resources, AngloGold Ashanti and Zijin Mining take stakes in South American-focused copper explorers.

This is an exciting area play that is just getting started.

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Richard owns shares of Max Resources (TSX.V:MXR). MXR is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.