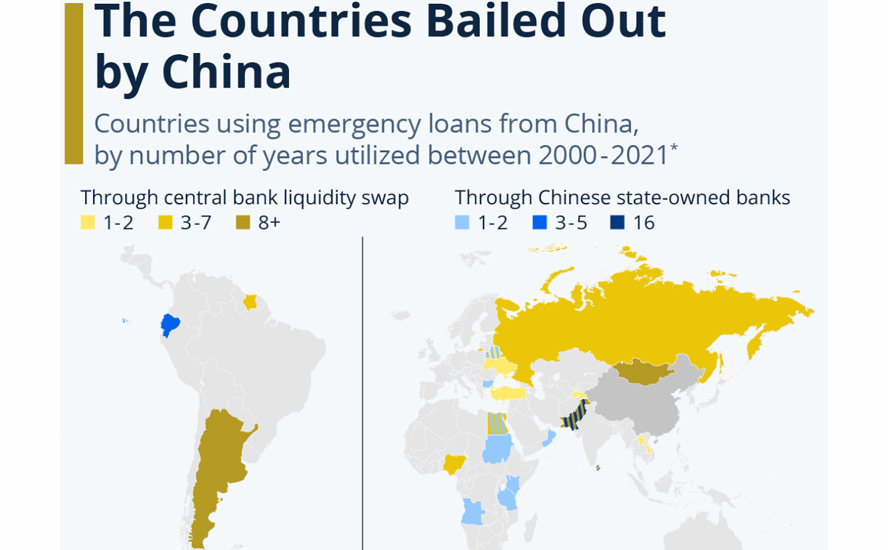

The Countries Bailed Out by China

By Katharina Buchholz

Bailout amounts provided by China remained quite low in the 2000s and early 2010s, before shooting up from 2015 onwards, climbing to a total of $100 billion for the two decades. The two most common ways in which these loans work is through a liquidity swap with the Chinese Central Bank – where most of the outstanding balances of around $40 billion were located as of 2021 – or through credit lines from Chinese state-owned banks. Three countries, Venezuela, South Sudan and Ecuador, received prepayments on goods they were to deliver to China.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Related posts

December 29, 2025

October 27, 2025

October 7, 2025

October 4, 2025

August 28, 2025

July 14, 2025

April 23, 2025

April 7, 2025