The coming cashless society and gold – Richard Mills

2022.12.23

People concerned about having their movements and finances tracked have something new to be worried about, with central banks around the world poised to roll out their own version of a Central Bank Digital Currency (CBDC), that could replace cash.

What is a Central Bank Digital Currency?

A CBDC is simply a digital form of money issued by a central authority. According to LinkedIn, The Bank of International Settlements defines CBDC as a digital payment instrument denominated in the national unit account that is a direct liability of the central bank. In other words, the central bank is responsible for the CBDC that is issued and not the private sector that we all have to come to learn and see, based on the traditional banking system.

There may be some confusion as to the difference between a Central Bank Digital Currency and a cryptocurrency, like Bitcoin. While both are digital currencies, a cryptocurrency is not legal tender, with transactions verified and records maintained by a decentralized system using cryptography, rather than a centralized authority. Instead of physical bills and change carried around in wallets, cryptocurrency is stored in digital wallets; payments exist purely as digital entries to an online database describing specific transactions.

A cryptocurrency is also described as a form of digital asset based on a network that is distributed across a large number of computers. This decentralized structure allows them to exist outside the control of governments and central authorities (Investopedia). Also, because a cryptocurrency is secured by cryptography, it is nearly impossible to counterfeit or double-spend.

Crypto backers say it’s a peer-to-peer system that enables anyone, anywhere to send and receive payments, that can either be kept in a digital wallet or redeemed as other forms of currency, like cash.

Other advantages include cheaper and faster money transfers, and decentralized systems that do not collapse at a single point of failure. The disadvantages of cryptocurrencies include their price volatility, high energy consumption during “mining”, and use in criminal activities.

As for CBDCs, adherents say one of the main benefits is it is a more inclusive system, where every citizen has a quick, safe and reliable digital retail payment instrument.

Critics point to the inherent danger of a system that could usher in the “globalist” vision of a cashless society in which all transactions are traceable by government.

Lately there have been a number of announcements concerning the introduction of Central Bank Digital Currencies.

Nigeria was the first African country to launch a CBDC pilot and in September, 2021, El Salvador became the first nation to use Bitcoin as legal tender, alongside the US dollar. The BBC said it led to widespread protests as demonstrators feared it would bring instability and inflation to the country.

The Central Bank of Nigeria reportedly announced it will begin, effective in January, restricting cash withdrawals from banks and ATMs to just $45 per day as part of a push to move the country toward a cashless economy.

In November, 2021, the Bank of England and the Treasury launched consultations on a UK central bank digital currency, that would sit alongside cash and bank deposits, not replace them.

However, earlier this month, Breitbart reported that Chancellor of the Exchequer Jeremy Hunt revealed that, as part of his reform of Britain’s financial services, the Bank of England would begin consultations on the design of a CBDC that would act as a digital version of the pound. Further, the Royal Mint has apparently been asked by the Treasury Department to make an NFT (non-fungible token). NFTs are digital assets based on blockchain technology.

Breitbart notes that, unlike Bitcoin, a CBDC would be similar to traditional fiat currency issued by a central bank, and would therefore suffer from the same inflationary issues if the central bank decided to issue more of it — like printing cash. Among other criticisms:

The Bank of England has also admitted that a digital pound could be “programmable“, meaning that the government could potentially add mechanisms to prevent people from spending their own money on things the state disapproves.

This has led to concerns that Western governments could implement a system akin to the social credit score in Communist China, which has already been used to blacklist millions of citizens from travelling, including those who dissented against the authoritarian rule of Chairman Xi Jinping…

After introducing a digital yuan pilot program in 2020, China is in the process of testing it in major cities including Beijing and Shanghai.

While governments and central bankers claim that the shift to a cashless society will help prevent crime and increase convenience for ordinary people, the real motivation behind the “war on cash” is more government control over the individual.

According to Mises.org, the Chinese government could easily track digital payments with a CBDC, and it could allow Beijing to monitor mobile app purchases more closely. Some observers wonder whether payments could be linked to China’s above-mentioned social-credit system.

If this sounds like something only totalitarian governments would do, consider: if a CBDC is implemented, the central bank will have access to all transactions, as well as being capable of freezing accounts, like the Canadian Liberal government did during the 2022 trucker convoy protests. A CBDC will also give governments the power to determine how much a person can spend, establish expiration dates for deposits, and even penalize people who saved money, writes Andre Marques in ‘Digital Currency: The Fed Moves Toward Monetary Totalitarianism’.

Like the Bank of England, China, the European Union, and the Bank of Canada, the US central bank is sowing the seeds for its CBDC. The first step was taken in August, when the Federal Reserve announced an instant payment system called FedNow, scheduled to be launched between May and June, 2023.

Marques describes FedNow as “practically identical” to Brazil’s PIX, implemented by the Central Bank of Brazil (BCB) in 2020. Sold to Brazilians as a safe, mobile-friendly insta-pay system without user fees, in fact the BCB has access to transactions made through PIX and according to Marques, It is already an invasion of the privacy of Brazilians. And FedNow is set to follow suit.

Additionally, the New York Fed has recently launched a 12-week pilot program with several commercial banks to test the feasibility of a CBDC in the US. The program will use digital tokens to represent bank deposits.

The latter is especially frightening to contemplate, from a libertarian point of view. As noted by investigative reporter Leo Hohmann on his blog, you can now be controlled by simply cutting off the supply of digital money, which really isn’t money at all in the traditional sense. It’s more like a voucher system.

This will be easily accomplished once they lock everyone’s money into a bank account and replace actual money with digital tokens. At the point in which the American middle class accepts such a system, it’s game over and we will see tyranny sweep across the globe even faster than it is now…

The banksters and corporate titans will have captured everyone into their digital beast system, which operates much like a high-tech feudal system, where you no longer truly own anything outright. You will become the equivalent of a sharecropper in the old feudal system of the Middle Ages — your obedience to whatever new rules they throw out for “sustainable living” will no longer be optional but mandatory.

The sustainability rules will start out as “suggestions” or “recommendations,” only to be later demanded and mandated, with heavy fines for disobedience. If you think you can ignore the fines, think again, as they now have direct access to your digital wallet and can simply deactivate whatever digital tokens are in that account.

Why we like gold (and silver)

Part of the reason people like investing in gold and silver is their disdain for government-issued digital currencies.

“People don’t want to disclose every single thing they do,” Todd ‘Bubba’ Horowitz recently told Kitco’s David Lin. “If you give more power and more control to two organizations, government and central banking, that only create debt and don’t create any industry, I think that you could see a much bigger demand for gold.”

The editor of BubbaTrading.com suggested the government would ban paper money and force US residents to acquire digital currencies. This would cause them to turn towards hard assets like precious metals.

Even without the CBDC trend, and the coming cashless society, at AOTH we believe there are number of reasons why now is the time to be buying gold and silver. We discuss each of them below.

Inflation hedge

Forty-year-high inflation is eroding the purchasing power of fiat currencies, not just the US dollar but the British pound, the euro, the Canadian dollar, etc., because it takes more units of currency to buy the same amount of goods as before.

Owning gold (and silver) continues to be the best defense against inflation, stagflation, and rampant currency debasement, during this period of unprecedented and irresponsible debt accumulation.

A stagflationary debt crisis looms

Still, some investors are asking: “If gold is such a great inflation hedge, why hasn’t it done better, now that inflation is running rampant?” Clearly, the interest rate hikes by the US Federal Reserve and other central bank are working against gold, which offers neither a yield nor a dividend. Investors are understandably piling into bonds, GICs and even savings accounts, which for the first time in years are offering decent interest. But once the interest rate increases stop, and the dollar falls, investor interest in gold and silver will return, with a vengeance. In fact gold and silver have already started to turn higher, in line with a marked decline in the US dollar index, in the seven weeks since the beginning of November.

The Fed pivot

As soon as the Federal Reserve realizes it can no longer keep raising interest rates without pushing the economy into recession, and it pauses the rate hikes, will mark the beginning of the next bull market for precious metals.

The Fed will arguably be forced into unwinding its tight monetary policy, becoming more dovish in the new year, as the central bank is confronted by evidence of a collapse in consumer spending, and a downward spiraling US economy.

The signs of a faltering economy are everywhere. They include continued high inflation, especially food and energy, that is not reflected in the Fed’s preferred inflation index, the core PCE; rising inflation expectations; dissipating consumer confidence; an imminent collapse in consumer spending, notwithstanding the “Black Friday” bounce; a plunging PMI and an inverted yield curve.

The 3-month/ 30-year and the 5-year/ 30-year segments of the yield curve are useful early indicators of a recession. Currently the 3mo30yr is still flattening and the 5y30y is still inverted, suggesting a recession is only a few months away. (Simon White, Bloomberg macro strategist, via Zero Hedge)

I see the Fed reducing its rate hikes to 25 basis points before the end of the first quarter 2023 and pausing by the middle of the year. A reversal could follow shortly after.

Why the Fed pivot will happen faster than people think

Central bank buying

The leading gold holders are some of the world’s most powerful nations, such as the US, Germany, Italy and France; they are keeping 60% of their foreign reserves as gold. This is a testament to the significance of gold in the central banking system.

Last month the World Gold Council said central banks bought 399 tonnes of gold in the third quarter, by far the most ever in a single quarterly period. According to the WGC, central banks globally added another 31 tons of gold to official reserves in October, putting central bank holdings at their highest level since 1974. Year to date, central banks have accumulated gold reserves at a pace unseen since 1967.

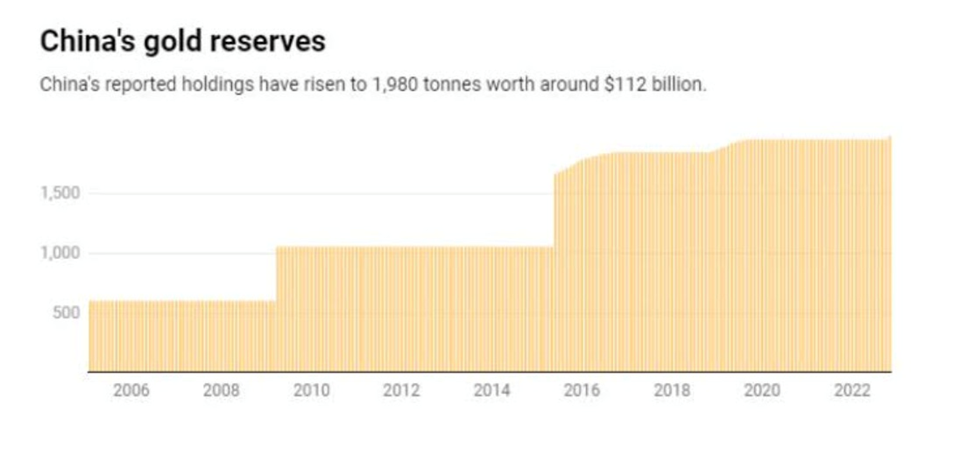

China, which is famous for not reporting its gold holdings, disclosed an increase in its reserves for the first time since September, 2019 — adding 32 tonnesworth around $1.8 billion, according to Reuters. Its stockpile now sits at 1,980 tonnes, sixth among countries with the largest official national gold reserves, including Russia, Germany and the United States, which is the biggest at 8,133.5 tonnes.

Quoth the Raven notes that central banks continue to snap up gold in what I believe to be an acknowledgement that we are on the verge of a drastic shift in for the global economy.

By that, the financial blogger means there is a “new cold war gold race” on, between the West and the BRICS nations, referring to Brazil, Russia, India, China and South Africa:

It started last year in August 2021, long before our current inflationary crisis and the war in Ukraine, when I predicted that China would try to concoct a gold-backed digital currency that would put the U.S. dollar on its heels.

As Russia’s war in Ukraine has progressed, the country has allied itself with China further and I have written and talked extensively about the threat that I think their relationship poses to the United States and the West.

(At AOTH, we identified a similar, if not exactly the same trend, in Canada and the US’s embrace of “friend-shoring”, which presumes a world divided between free-market economies and countries that align with authoritarian regimes.)

Friend-shoring threatens Western metal supplies

Quoth the Raven observes that China’s recent central bank gold purchase is simultaneous with the country dumping US Treasuries and strengthening its trade with Russia. According to the US Treasury Department, China sold $121.1 billion in US debt from the attack on Ukraine at the end of February, to the end of September.

Meanwhile, Chinese imports of gold from Russia surged in July, soaring more than eightfold on the month and roughly 50 times the year-earlier level, according to China’s customs authorities.

But it goes further than Russian-Chinese cooperation, which in all honesty, is nothing new. Quoth the Raven states, The general idea supporting my thesis of us being in the midst of a new cold war would be for China, Russia and the BRICS nations to have control over a combined total of gold that could challenge the U.S. and the West.

In fact, I don’t think it’s out of the picture that a “race” for gold could start once the picture of a new global economic era becomes clearer.

The latter has to do with the growing divide between BRIC nations, like China and Russia, and the United States. In July the BRICS nations announced their intention to create a new reserve currency that would “better serve their economic interests”, a clear affront to the supremacy of the US dollar. Then there’s China’s all-but-certain plans to try to eventually take back Taiwan, and the fact that the United States, with its $31 trillion in debt, is in possibly the most precarious economic position it has been in for decades, Quoth the Raven states.

Low supplies and inventories

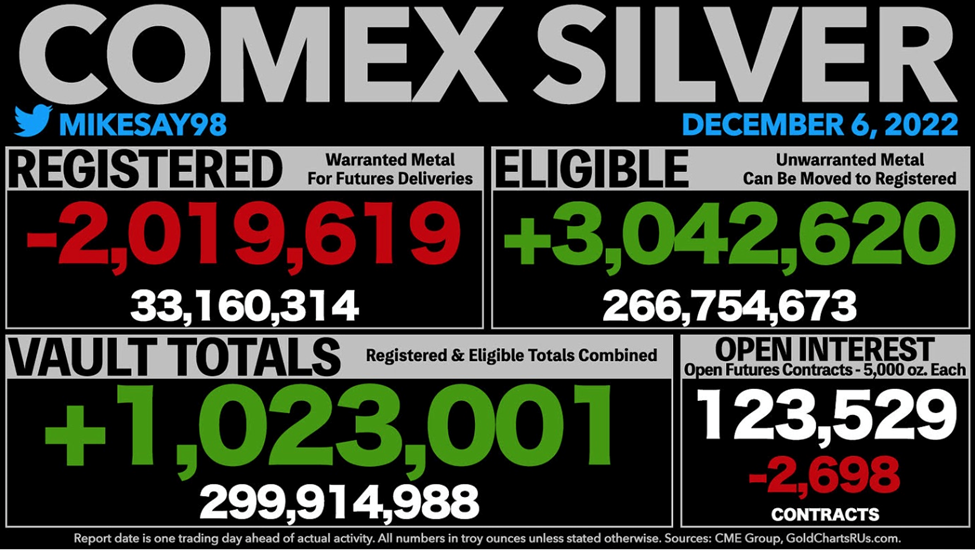

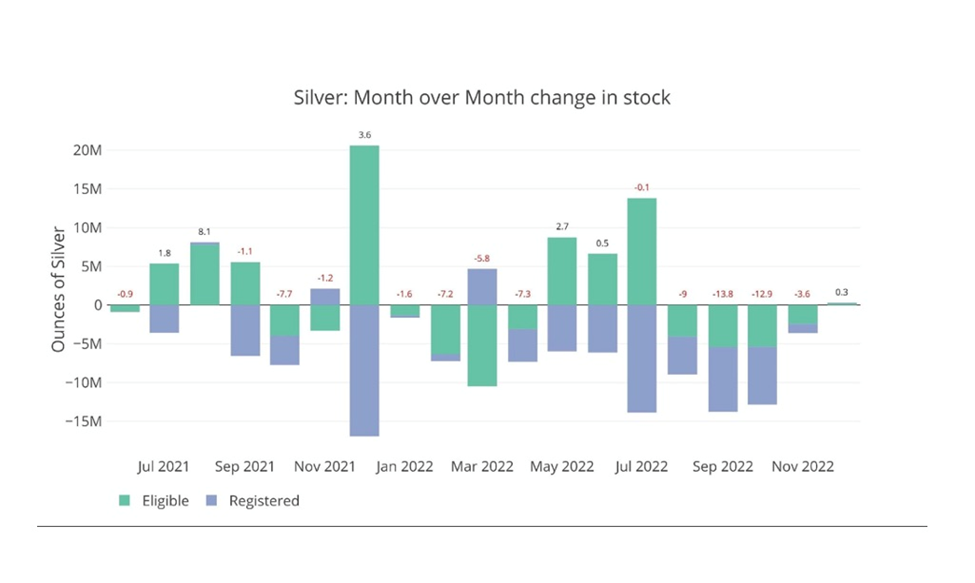

On to more practical reasons for favoring precious metals, all year there has been record demand for physical gold and silver, which is emptying out the vaults in New York and London where the metals are stored by the Comex exchange and the London Bullion Market Association.

For example registered silver in Comex vaults has fallen below 33.2 million ounces, the lowest level since 2017.

A Dec. 17 article by Schiff Gold effuses, The drainage of silver from Comex vaults since the start of the year has been nothing short of spectacular. 48.5M ounces have left [the] Registered [category] since Jan 1. That represents more than 50% of the balance of 82M ounces last Dec 31.

As an indication that inventories are even smaller than reported, Schiff Gold notes that only 77.6% of contracts for delivery have had their metal delivered, leading to the conclusion that:

Inventories are much thinner than the data shows. We have perhaps reached the bottom of metal available for delivery at current prices. This is why silver is seeing so many contracts remain unfulfilled AND why we have also seen a dip in net new contracts this late in the delivery window. There is simply no metal available so it is not being delivered.

Gold is a few months behind silver and is also a deeper market, but the same trends are starting to emerge.

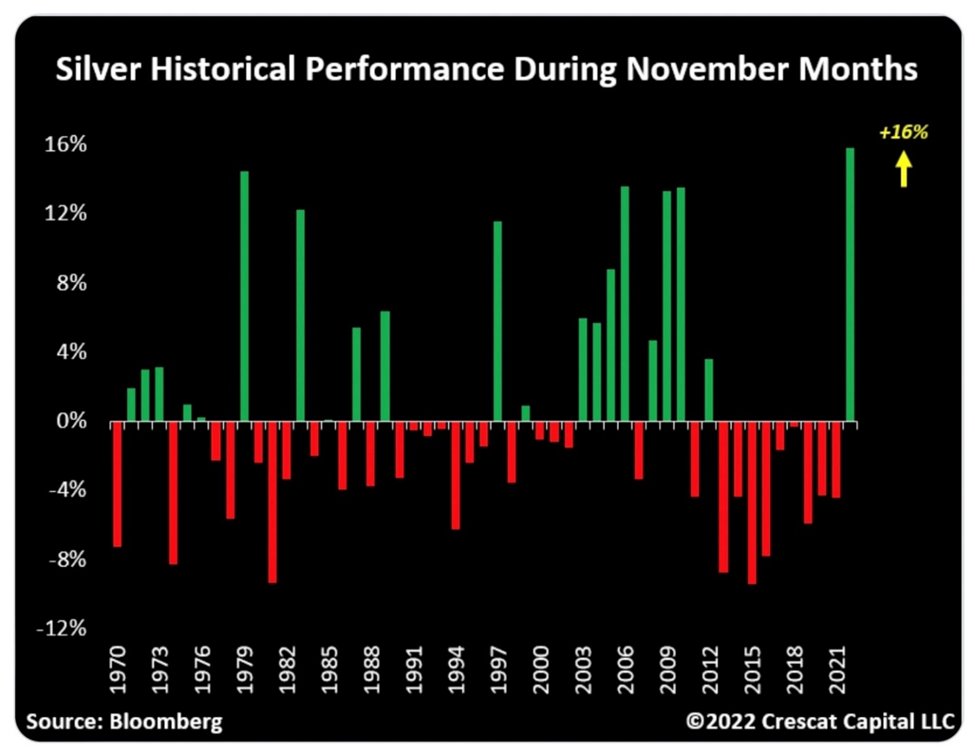

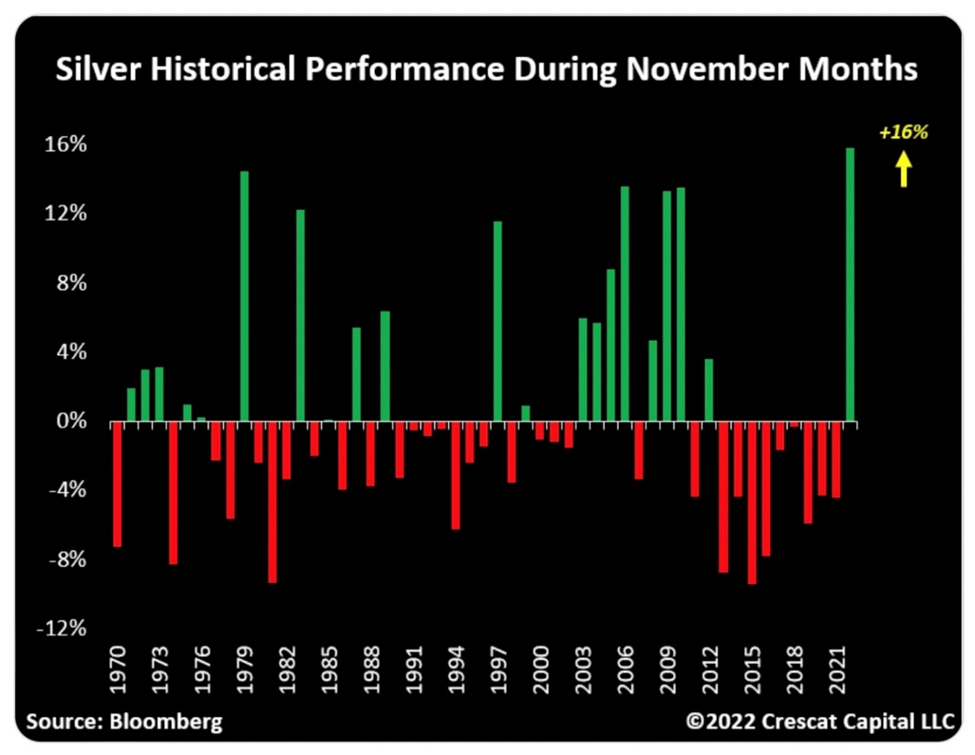

In November silver had its strongest performance in 52 years.

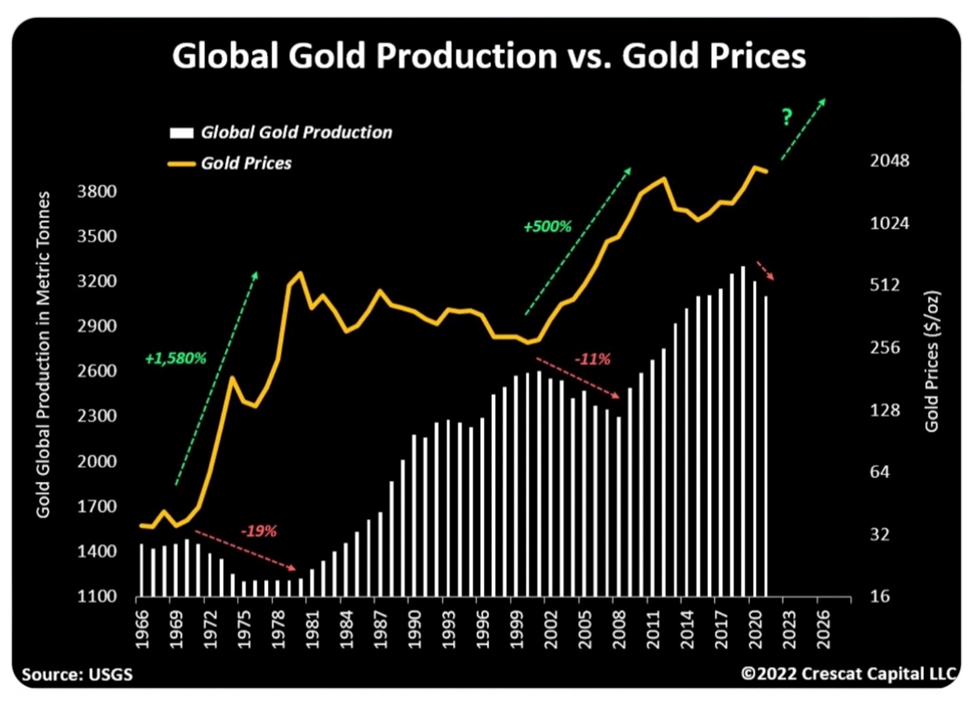

A key macro driver likely to precipitate a move higher for both gold and silver, is the multi-year decline in gold production. Notice how the chart below shows a reverse correlation between a climbing gold price and lower gold production.

Part of the issue is that mining companies which traditionally focused on precious metals, have re-directed their capital to battery metals, and other minerals (such as copper, silver) that feed into the green economy.

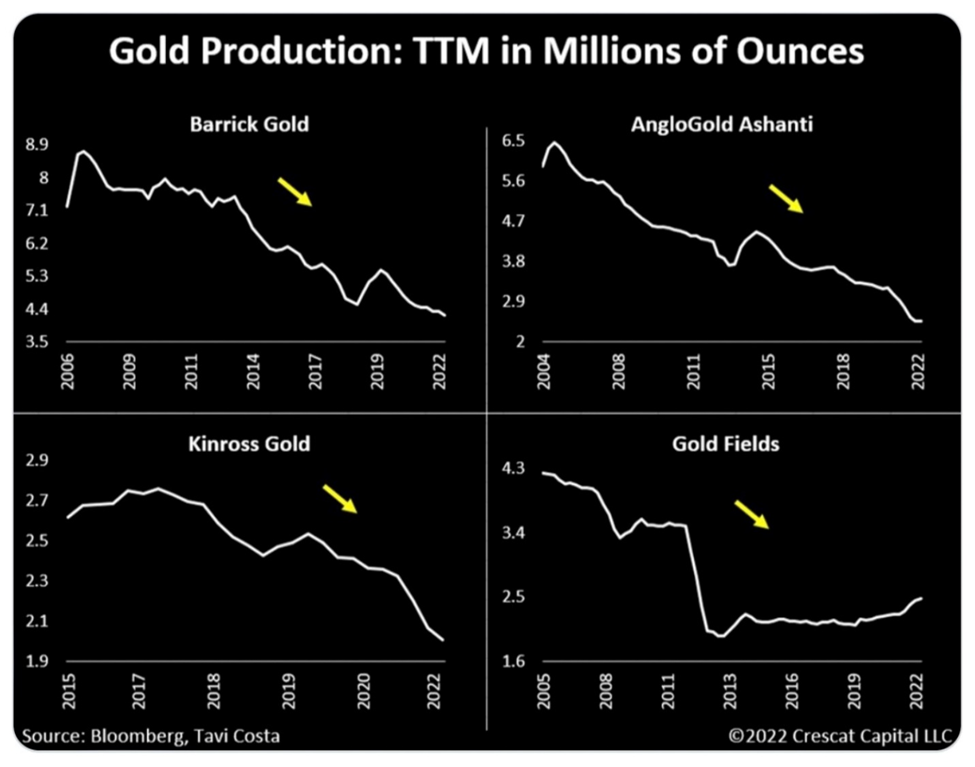

For example Newmont, the world’s largest gold miner, is producing the same amount of gold as 16 years ago, with its reserves down 24% from the peak in 2011. Other gold-focused miners have significantly shrunk production.

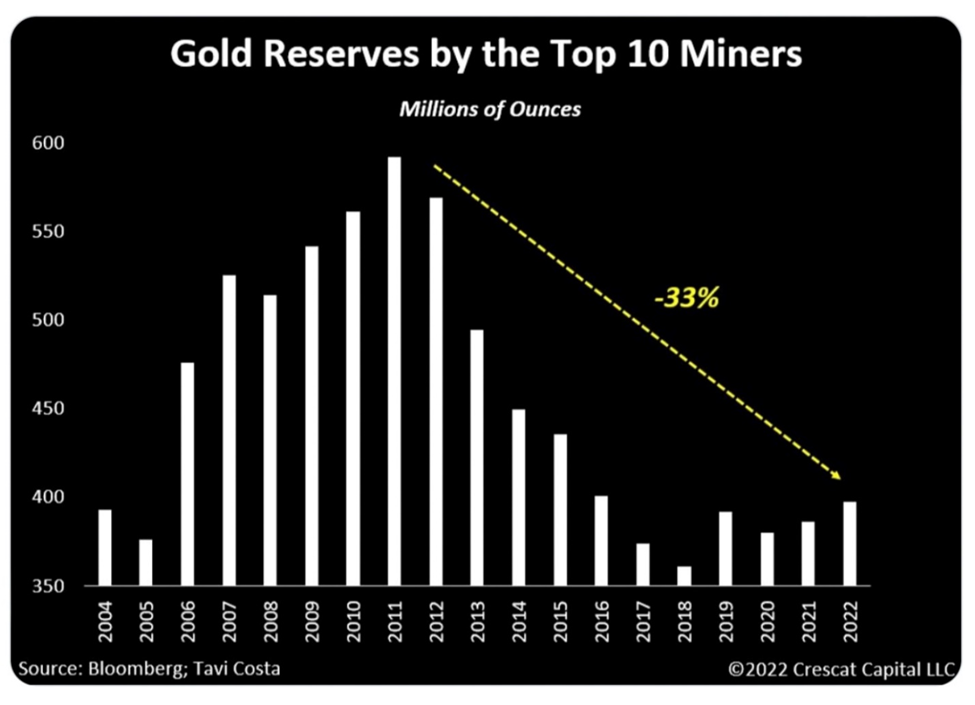

Meanwhile, there have been precious few new gold discoveries. Most of the low-hanging fruit has been picked; the remaining deposits are in remote locations, with a lack of infrastructure, often requiring unreasonably high capital expenditures. Or they are in high-risk countries with governments liable to expropriate the mine or impose other costly forms of resource nationalism. The result is the reserves of the top 10 mining companies are down 33% over the last 15 years.

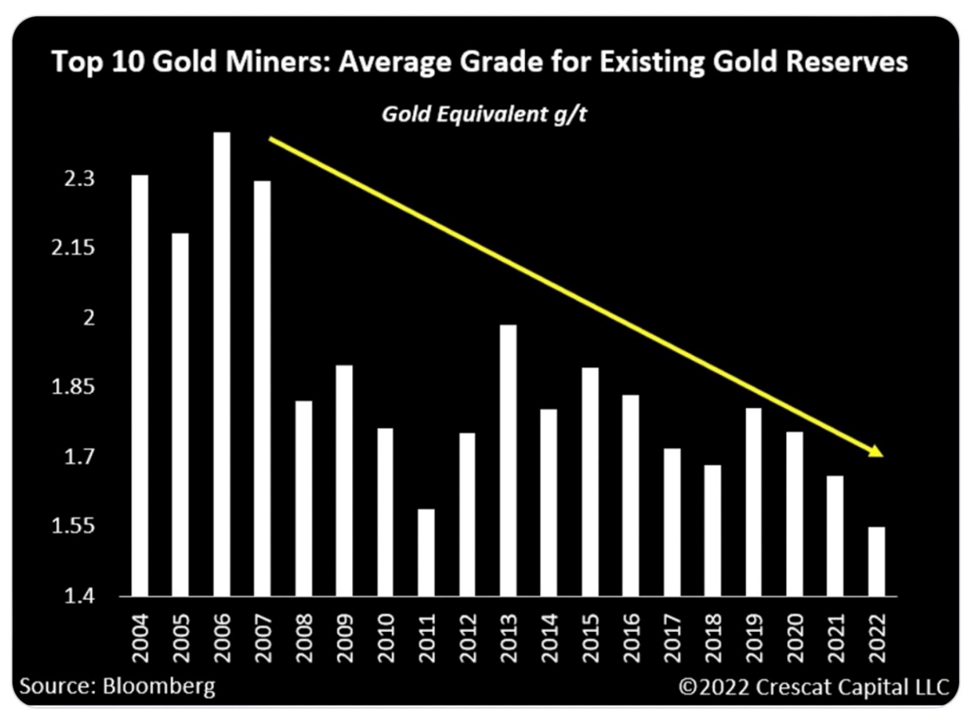

Lower grades

Not only that, the quality of the remaining reserves is deteriorating. The average grade of gold reserves for the top 10 miners has been in a secular decline. From a gold-equivalent 2.3 grams per tonne in 2004, the average grade is now about 1.5 g/t.

Conclusion

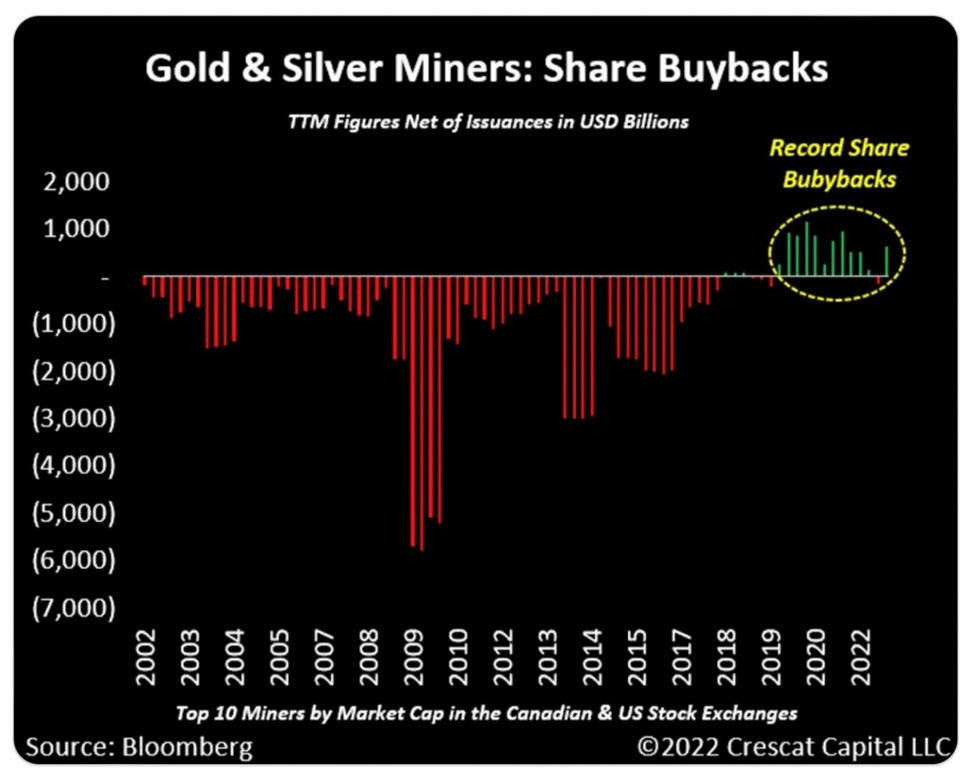

While gold is currently near 2011 highs, capital spending for gold miners is at historically low levels. Rather than spending excess cash on new mines, employees and equipment, these companies are re-investing their profits in stock buybacks. After decades of continuous equity dilution, the top 10 gold and silver miners have had three years of record share buy-backs.

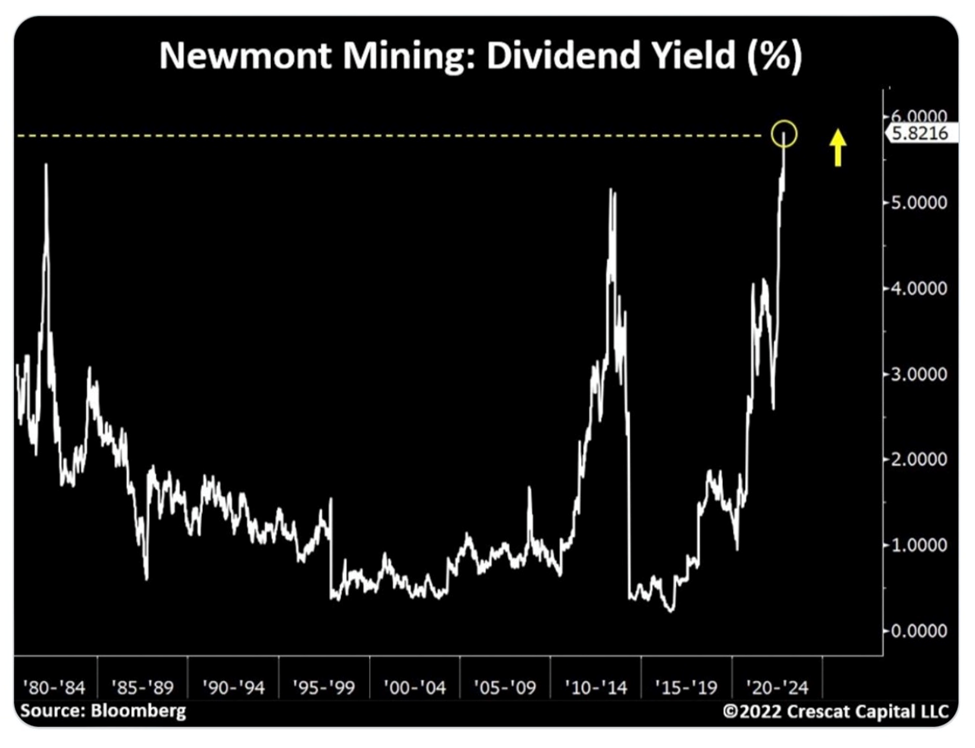

Mining companies are also hiking their dividends to maintain and attract investors. Newmont, for example, has increased its dividend in six of the last nine quarters and the stock now has the highest yield in 40 years.

The sector is at one of its most-undervalued points ever, with the P/E ratio of precious and base metal miners in the S&P 500 Metals Mining Index at its lowest since the financial crisis.

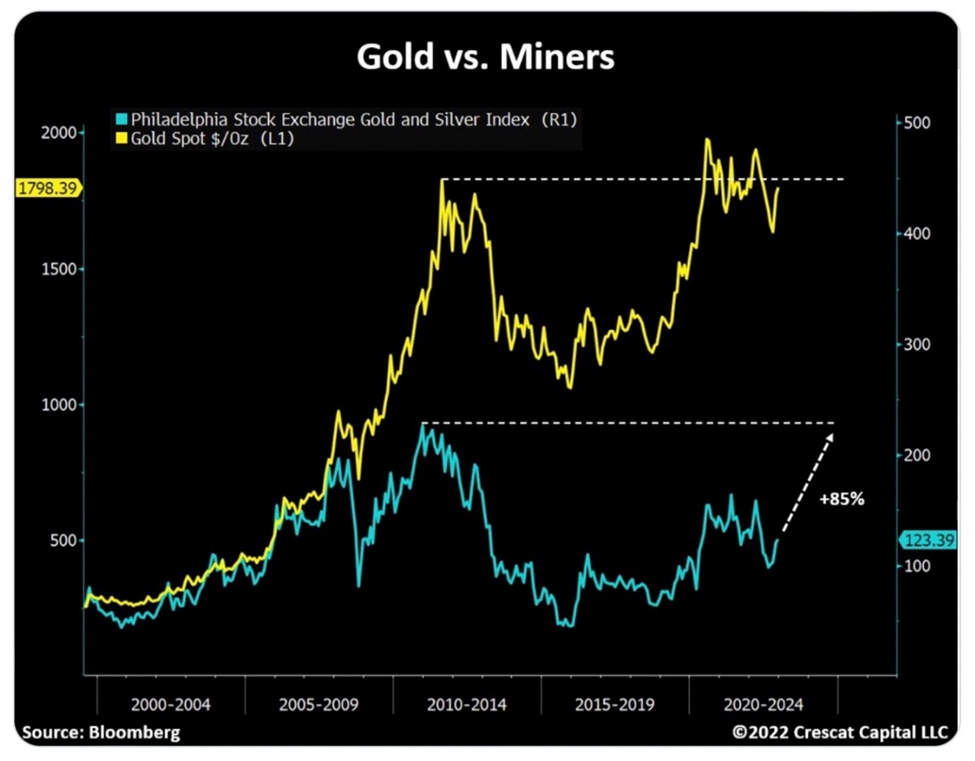

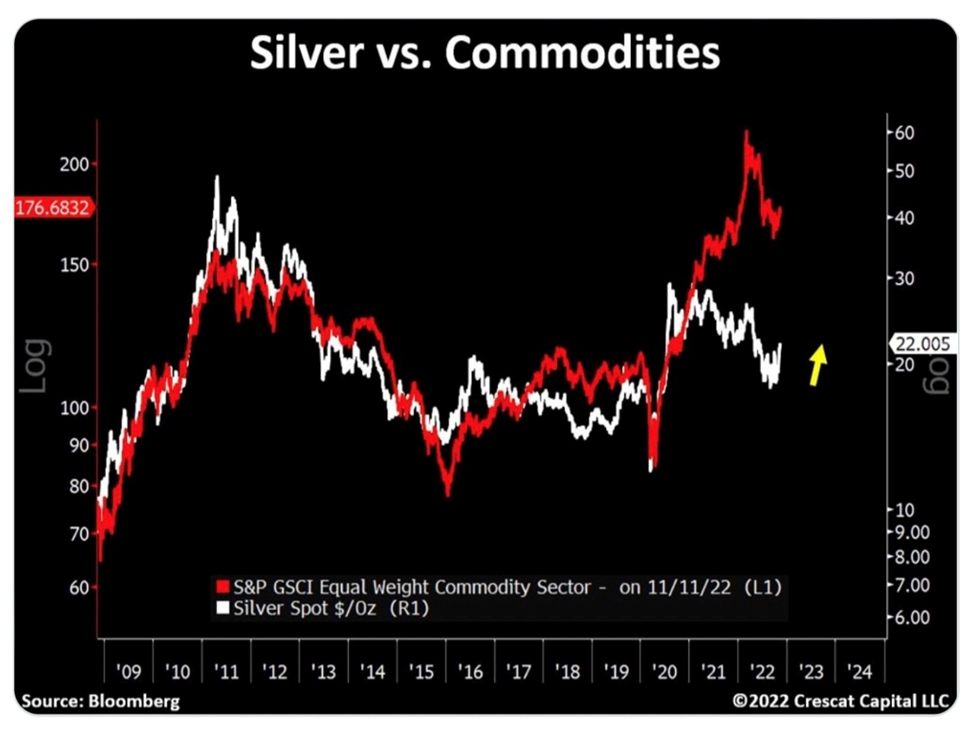

The two charts below show gold and silver are deeply undervalued, with gold miners needing to surge 85% even if the price goes nowhere, and silver way under-priced compared to commodities.

|  |

We also note that the gold sector does very well in a post-bubble contraction, like we are currently witnessing, even outperforming bullion.

Hat tip to Bob Hoye from ChartsandMarkets.com, via 321gold, who writes that, [G]old stocks underperform and then get trashed on the initial phase of the contraction. Both have happened which is setting up a lengthy bull market for the sector. Golds will not just go up but could outperform the S&P for many years. Indeed, fund managers who would not normally position golds, will have to own them.

This confirms what I’ve been saying for years that, historically, the greatest leverage to an increasing gold price is a quality junior.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.