Temporary price weakness means contrarian-play opportunity for Quebec-focused iron ore junior

October 7, 2021

Iron ore is up and down like a bride’s nightgown, as my dad used to say, with the price oscillating wildly over the past six months but ultimately being cut in half from a record $233 per tonne in May to $117.85 on Thursday.

The price is encountering resistance from China which has moved to clean up its heavily polluting industrial sector in time for the Beijing Winter Olympics next year. Coal-fired steel mills cause a significant portion of the country’s carbon emissions so Beijing has imposed steel production cuts in an effort to slow its construction-intensive economy.

Power shortages have also dampened iron ore demand. Many Chinese steel mills have had to cut output due to a dearth of metallurgical coal. Strong demand from manufacturers and industry have pushed coal prices to record highs and triggered widespread curbs on usage.

Provinces including Inner Mongolia and Guangdong, as well as local governments and industrial zones along China’s east coast, have all ordered consumption caps and power cuts.

Like most policies in China, the new energy targets emanate from the Chinese Communist Party. In 2020 President-for-life Xi Jinping promised the country would cut its carbon dioxide emissions per unit of GDP, or carbon intensity, by more than 65% from 2005 levels by 2030.

We must always remember China is a command economy meaning that whatever Beijing commands, shalt be done. This includes turning the screws on China’s industrial sector which may be a polluter but has also been a significant driver of economic growth over the years. Seems foolhardy for Beijing to kill the goose that has laid so many golden eggs.

Olympic Blue

Nonetheless, China is reportedly aiming for ‘Olympic Blue’ with plans to extend steel curbs into March of next year. The city of Tanshan is a major steelmaking hub about 150 km from the Bird’s Nest Stadium that will host the opening ceremonies. When Beijing held the Summer Olympics in 2008, authorities shut down a swath of factories near the capital. The operation dubbed ‘Olympic Blue’ allowed Beijing residents and Games visitors to enjoy blue skies for a month, before the factories restarted and the smog returned.

This is just another version of the same thing, only this time, the Communist Party has doubled down with promises to do its part to cut global emissions. According to researcher Mysteel, Tanshan will extend existing steel curbs to March 2022 to meet a targeted 40% drop in air pollution during the Games. For the city’s steel mills, that means keeping in place production curbs ordered this year — a reduction of 12.4 million tons compared to 144 million tons of production in 2020. For the surrounding province of Hubei, the steel cuts mean a 21.7 million-ton decrease.

Beijing can and will do what it likes to reduce air pollution. The fact remains, China will continue to demand a high volume of mineral commodities needed for construction projects. China spends three times more on infrastructure than the US, claiming a million bridges including most of the world’s highest. Of the world’s 100 tallest skyscrapers, 49 are in China.

The Wall Street Journal reported that in 2014, China used more cement in the previous three years than the US did during the entire 20th century. The country also produces more than half the world’s steel, last year 14 times more than the US, according to the World Steel Association. China’s 23,000 miles of high-speed rail could link New York and Los Angeles more than eight times and Beijing plans to add 30% more track by 2025.

Of course we can’t forget President Xi’s Belt and Road Initiative. 2,600 infrastructure projects costing $3.7 trillion are linked to BRI, as of mid-2020. Think about how much metal that will entail.

Tempest in a Chinese teapot

Recently the iron ore sector (and other metal markets) was thrown a curve ball in the form of the Evergrande crisis in China. As one of the country’s largest real estate developers, investors not only in Asia but worldwide have been fretting about “Asian contagion” should the company not receive a bailout from the Chinese government and become insolvent.

A meltdown in the Chinese property market could have widespread repercussions, potentially impacting the demand for construction commodities including copper, iron ore and steel.

It’s estimated around 1.5 million people could lose the deposits on their homes if Evergrande goes under. The companies that Evergrande does business with, like construction and design firms, could potentially go bust if their deposits aren’t repaid. The effect on the country’s financial system could also be far-reaching; Evergrande owes money to around 171 domestic banks and 121 other financial firms.

Despite all the “Chicken Little” headlines, I personally don’t believe Evergrande is another Lehman Brothers. A deal will be done to stabilize Evergrande’s debt and restructure bonds and loans by selling most of its assets; some investors will be repaid with real estate.

Another way to save Evergrande is for a corporate white knight to step forward. This week it has been reported that Hopson Development Holdings, a Hong Kong-listed real estate firm controlled by the billionaire Chu family, has agreed to buy a controlling stake in Evergrande’s property services business. Al Jazeera names three other Chinese billionaires who are offering to shore up Evergrande’s finances.

Rebar & cement booming

The health of the Chinese steel industry is good reason to think the markets are over-reacting to Evergrande. Take a look at rebar.

The Washington Post notes that, for all the government’s promises of steel output curbs, usage as of July this year was running nearly 10% higher.

The price of the reinforcement bar used on construction sites is at almost the same elevated level it was two months ago, before its key ingredient — iron ore — starting falling and drifted below $100 a tonne for the first time in over a year.

That suggests that end-use demand is still pretty much where it was before this panic started, which should deliver mill owners handsome profits, WaPo adds, concluding that, we’ve not yet seen the reckoning with its steel addiction that China, and the world, ultimately needs. Until that happens, don’t assume this market is dead.

The World Steel Association forecasts global steel demand to grow 5.8% this year to exceed pre-pandemic levels, followed by another 2.7% increase the year after. The association expects China’s steel consumption, about half of the global total, will keep growing from record levels.

Beyond China, the cement market is another sign that major infrastructure projects will be rolled out this year and over the short to medium term.

Despite covid-related construction slowdowns in 2020, global cement production was consistent with 2019 output. The biggest cement consumers last year were Vietnam, Indonesia, India and China.

According to IndexBox, between 2020 and 2030, the global cement market is set to expand at an average annual rate of 1.8% CAGR, reaching 5B tonnes by 2030.

Infrastructure full speed ahead

Future needs for cement, steel, stainless steel, iron ore and a host of other industrial metals such as copper and zinc, are being driven by big infrastructure programs planned in some of the world’s biggest economies as governments find ways to return to growth following the disastrous 2020 pandemic year.

In the United States, President Biden’s $1.2 trillion infrastructure package, passed by the Senate but not yet by the House of Representatives, includes transitioning the US transportation system to battery-powered vehicles and supporting renewable wind and solar energies over carbon-based sources like coal and natural gas.

The legislation includes rebuilding traditional infrastructure like highways, bridges and rail lines, and investing in technologies to reduce greenhouse gases. The latter includes installing thousands of EV charging stations, providing incentives to encourage Americans to buy more electric vehicles, and constructing new electric power lines that provide renewable energy and expand electricity storage.

The Biden administration is aiming for carbon-free power generation by 2035 and net-zero emissions by 2050.

The bill proposes nearly $550 billion in new spending over five years, setting aside $110 billion for “blacktop” infrastructure such as roads & bridges; $55 billion to replace lead pipes and ensure access to clean drinking water; $66B for upgrading passenger and freight rail; $65 billion for broadband; and $73 billion for clean energy.

An even larger $3.5 trillion spending package is also under consideration by the House. It includes:

- $198 billion in direct payments to utilities for hitting clean energy goals, providing consumers with rebates to make homes more energy-efficient, and financing for domestic manufacturing of clean energy and auto supply chain technologies;

- $67 billion to fund climate-friendly technologies and impose fees on emitters of methane, to reduce carbon emissions;

- $37B to electrify the federal vehicle fleet.

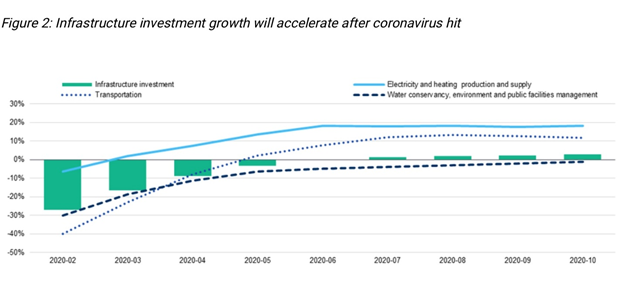

The Chinese government also sees infrastructure investment playing a key role in the country’s recovery plans.

A December 2020 report by Moody’s Investors Service that Beijing has historically relied on such investment to reverse economic downturns including the RMB4 trillion fiscal stimulus package that followed the 2008-09 financial crisis. The government is thus seeking to boost household income and strengthen the social safety net as part of its efforts to boost consumption, upgrade manufacturing industries and develop advanced technologies, the report states:

Investment will focus on developing “new infrastructure” – such as informational networks, urbanization and major transportation and water conservancy projects – while traditional infrastructure projects will continue to drive infrastructure spending, given their very large scale, capital intensity, and ambitious development targets.

Nearly all of China’s 31 provinces, municipalities and autonomous regions have announced key infrastructure investment plans for the next 5-7 years, covering 24,515 projects at RMB43 trillion, of which around 25% will be spent on transportation projects.

All of this has to be good for construction, in particular the steel, rebar and iron ore markets. A recent report by Australia’s department of industry, science, energy and resources forecasts the iron ore price will reach $150 per tonne by the end of this year, due to supply constraints in the second half including congestion at Chinese ports and slowed deliveries.

The report also notes that high iron ore prices earlier in the year resulted in a second-quarter iron ore exploration boon. A total of $151 million in exploration was spent in Q2, which is 52% more than was spent in the second quarter of last year.

This bodes well for iron ore explorers hoping to catch a bid when the iron ore price climbs, as expected, during the fourth quarter.

Manning Ventures Inc.

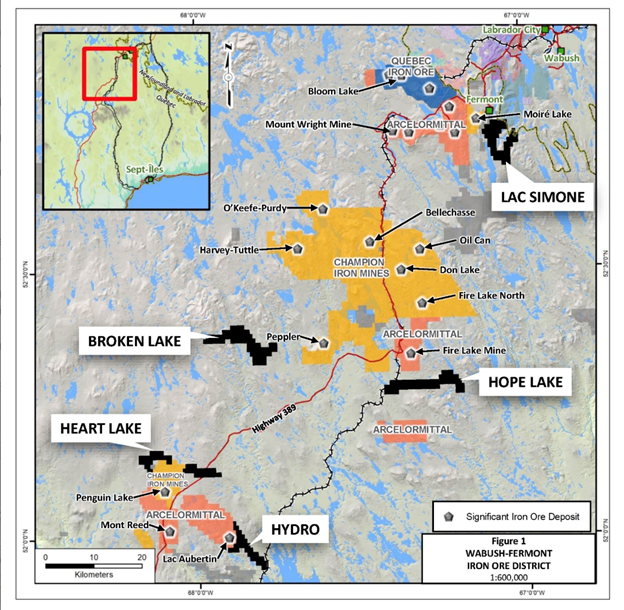

Manning Ventures Inc. (CSE:MANN, Frankfurt:1H5) in September announced it has finalized drill targets at three of its 100%-owned projects located in the Wabush-Fermont iron ore district of Quebec.

Thus far, Manning has assembled five iron ore projects with past exploration history, carrying high development upside. With three recent acquisitions, Manning now has a landholding of over 16,000 hectares covering 311 claims in Wabush-Fermont.

As previously reported in June, the Phase 1 ground mapping and sampling program has successfully confirmed the analytical results of iron formation at the Lac Simone, Hope Lake and Broken Lake properties. A total of 14 outcrop samples returned results of greater than 30% Fe (iron content).

Permitting is currently underway, with drilling expected to take place later this year.

The drill program will test the thickness of iron formation, where positive surface sampling results have been obtained, and magnetic surveys have indications of thicker iron accumulations.

The company expects to complete five to eight drill holes on the highest-priority target areas.

“There’s no doubt these projects are extremely viable, you just go back and look at the historical work and the grades we pulled on the sampling results, those are good numbers. I think 15% is the base case of working mines in the area and we’re getting a dozen of our samples greater than 30% so these are good signs. The horizons are established we just need to go in and poke holes so this is more of a test program to get our feet wet but certainly the beginning of a series of drill programs across all of those projects,” Manning CEO Alex Klenman told me over the phone this week, in an exclusive interview with AOTH.

Mineral exploration is all about location and Manning is no exception to this tried and true maxim. Consulting the above map, it’s immediately clear that Manning surrounds the main exploration player in the camp, Champion Iron Mines.

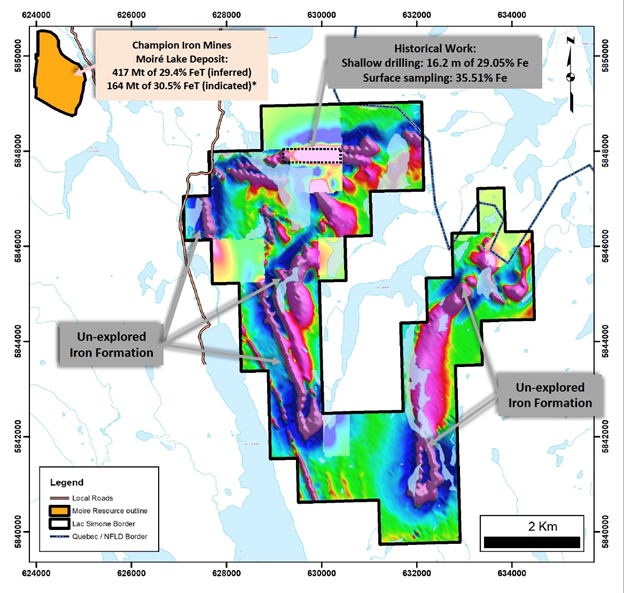

To the north of MANN’s Lac Simone project, Champion’s Moire Lake deposit has a resource estimate of 164 million tonnes grading 30.5% Fe in the indicated category and 417.1 million tonnes grading 29.4% Fe inferred. At Lac Simone, the magnetic signature, along with the regional mapping and historical work, indicates several iron formation horizons are present.

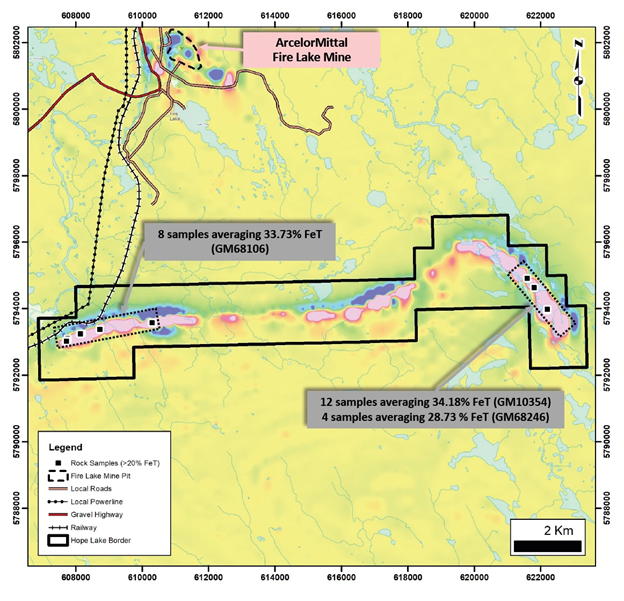

East of Champion and south of Arcelormittal’s Fire Lake mine, in operation since 2006, Manning’s Hope Lake project was previously explored by Jubilee Iron and Champion Iron Mines. Between 1959 and 1962, Jubilee completed ground and airborne magnetic and geological surveys at the northernmost magnetic anomaly, plus two diamond drill holes. Twelve samples were collected at the east end of the property, with average results of 34.18% Fe. Later testing on surface samples returned concentrate grades of 68.4% and 68.1% Fe.

In 2011, Champion collected 8 samples from the eastern part of the current property, returning an average grade of 28.7% Fe. It followed up with 8 more samples in 2013 from the western part of the property, which had average results of 33.7% Fe.

Both sampling programs indicated that the Hope Lake property, similar to Lac Simone, hosts high-grade quartz-hematite +/- magnetite iron formation.

Broken Lake is just west of Champion Iron’s Peppler deposit. The recently acquired property features an ~18 km-long trend of iron formation that has been historically drill-tested. A well-mineralized interval exceeding 84m was reported on this 4,500-ha property, although no assays were documented.

A 6 km-long belt of highly magnetic rocks in the area, not yet drill-tested, has been mapped as a magnetite-rich iron formation and currently represents a prime exploration target.

According to Manning, the project contains magnetic signatures and geological mapping that suggest structural thickening and possibly overturned sequences of rocks that have the potential to create favorable iron formation horizons.

Heart Lake is a 2,855-ha property featuring approximately 10 km of linear-style iron formation. Recent drilling intersected 26.7% Fe over 25.6m and ended in high-grade iron formation. The claims are along strike with Champion Iron’s ground, where iron formation on the same trend, approximately 6 km away, contains a drill hole with two separate iron formations of 31.2% Fe over 50.8m and 30.8% Fe over 42.2m.

Hydro, a 2,122-ha property, features approximately 12 km of linear-style iron formation. Several historical rock samples, among three separate zones, have been collected along the trend and average approximately 32.5% Fe. The trend does not have any historical drilling.

Conclusion

Sentiment is an important driver of investor interest in mining properties, although playing the long game and using a “top-down bottom-up” strategy has worked well for me over the years.

The sentiment in the iron ore market was strong earlier this year, helping to bid the shares of iron ore producers and explorers alike higher and that includes Manning Ventures which hit an all-time high of $0.57/sh on Feb. 8, 2021.

With sentiment weakening due to the lower iron ore price, the prices of these companies have also dipped, however, we at AOTH do not think that iron ore is done and, imo, this is the ideal time to pick up a junior like Manning on the cheap.

Consider: all of Manning’s projects are situated within a few kilometers of producing iron ore mines and deposits in a historical mining camp that has become one of the pre-eminent iron ore districts in the world.

The iron ore price was trading over $200 a tonne earlier this year and it is forecast to hit $150 again before the year is out. Infrastructure projects requiring copious metal content are in the planning stages in the US, Europe and China. Right now China is forcing steel mills to cut production but this, like the Evergrande tempest in a Chinese teapot, is a temporary phenomenon. Once the Winter Olympics in Beijing are done in early 2022 and all the athletes and dignitaries have gone home, will those output cuts continue? My money is on steel production and iron ore demand to rise higher to meet the needs of all of the infrastructure projects coming on stream.

Once that happens, sentiment will return to the market floating all boats including Manning’s. The last comment goes to CEO Alex Klenman who expressed that, while it is early days for Manning, the future looks bright for the small-cap as it goes to work in Quebec.

“We’re very confident in the projects and what we’re going to get out of them. It’s a long-term play for us and we’re just scratching the surface,” he says, adding:

“All the indications are the environment is right for large deposits. You can’t speak too much without drilling it and getting a better idea but in terms of lithologies and geologically speaking we have the right nest for the bird to land in and lay some big eggs, that’s what gets me excited.”

Manning Ventures Inc.

CSE:MANN, Frankfurt:1H5

Cdn$0.15, 2021.10.05

Shares Outstanding 42.6m

Market cap Cdn$6.3m

MANN website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Manning Ventures Inc. (CSE:MANN). MANN is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.