Techniques for Investing in the Metals Sector and Area Plays

Brad Aelicks

July 2020

It seems like an eternity since we have had a gold market with enough oomph to create an area play. Fortunately, today we find ourselves at the front end of a massive precious metals bull market that is going to create multiple ways for investors to reap rewards through their resource investments and speculations.

I was fortunate enough to have a long and productive career as a geologist, financier and manager of public companies, and I’ve operated through the numerous boom cycles and deep troughs of the metals sector. From experience I’ve learned there is a big difference in investing strategies depending on where we are in a cycle.

In this article I’m going to share some thoughts on what I look for in the heart of a mining cycle to give my portfolio a turbo boost. We also need to distinguish between investing in commodities, and speculating, and when both can be productive within each cycle.

Finally, once we understand the current environment and how to work within it, my friends at Aheadoftheherd.com and I are going to lay out some of the hottest mining districts and discoveries in the junior resource sector and describe the evolution of these discoveries into area plays that tend to lift the share prices of all the regional explorers surrounding a new discovery.

Let’s get started

In the first stage of a cycle, precious metals must break out of a long downturn and consolidation process. The leverage at this point is in the precious metals themselves and the senior producers. This can be quite rewarding as the cash flow leverage that producers have to a rising commodity price are pure multiples on margin and earnings. This part of a cycle can also be very frustrating – there are often false starts to a bull market. Also, only the biggest and best companies get any attention from the institutions; the retail market is largely absent.

Still, the gains, if you’re in the right big-name miner, can deliver a quick 50% to a double even in the largest of blue-chip companies. This part of the cycle is definitely investing (as opposed to speculation) as participants generally have small exposure to the sector (since it’s been in a long down-turn or consolidation) and need to be prepared to hold positions through the breakout of commodities.

I have grown comfortable completely ignoring this first part of a mining/ commodities cycle, likely because I was suckered in too many times by false starts and always seemed to end up having a handful of tax losses at year-end rather than the banner gains that the pundits promised.

However, this is the most important part of the cycle because it clears the way for all the glorious fanfare of what comes next. Before we get there, let’s take a quick look at a few factors that prove we are well underway with this cycle and the impacts of its momentum.

The reason this stage is so critical is that the industry almost personifies the term “cyclical”. In investment terms, it means there are times to be in and times to be out. When it’s time to be out the institutional money around the world holds virtually zero, yes that is nothing, nada, no exposure to the metals and mining sector. Sure, there are always a few specialist funds keeping a pulse on the sector, but the amount of capital is tiny.

However, once metal prices start to move, and these specialist funds start posting 50% gains to 100% gains, then the big money starts to take notice and these massive global funds dip a toe in the water. The sector is so small that even just one toe creates a huge ripple effect, driving commodity prices higher, ratcheting up the leverage of the producers and stimulating even more money flow.

The knock-on effects are numerous – not only are the companies making huge money from cash flow, they are also able to raise big dollars for mergers and acquisitions (M&A). These large companies almost never do any exploring themselves, preferring simply to buy junior explorers that have made discoveries during the last part of a waning cycle.

Now we’ve got institutional funds flowing into a tiny sector, and major mining companies with big acquisition budgets hunting the next successful junior to replace their dwindling reserves, all setting the stage for a huge run in the juniors. Add on the fact that the metals and mining sector is leading all investment categories, and profits just keep rolling into the next leveraged play.

That’s the second leg of the cycle and it’s just getting started. The junior producers and development projects that the market knew could never raise that $500 million of production capital were mired in a crappy market at the bottom of the cycle, sitting stagnant, churning along struggling trying to make it to the next milestone. Bang, the finance doors are literally blown off the hinges as the institutional money floods in. Virtually every single financing gets upsized and companies are turning away money. Assets are rerated from not interested and no bid, to, “I’ll take as much as you will give me” – share prices are tripling and quadrupling in two weeks.

In fairness these triples are coming off of a no-bid environment, basically prices are just getting back to par. But hey, for Ahead of the Herd (AOTH) investors this is a period when remarkably easy money is made if you can identify existing assets that are likely to be rerated in a new bull market.

We delivered one to aheadoftheherd.com readers 3 weeks ago – Freegold Ventures (TSX-V:FVL).

The company had 6.5 million ounces of gold in an historic resource that people had forgotten about until they released a new discovery hole; the stock rocketed from $0.20 to $1.45. It wasn’t just because they drilled a new hole, it was because the asset they already had was being rerated in this new market cycle. Freegold isn’t done yet, in fact at AOTH we think they are just getting started tagging on a new discovery to an (until now) under-appreciated asset.

There are loads more companies like this still raising their first meaningful capital in years that will find themselves back in the spotlight as boots hit the ground and the drills start turning. And when assay results start to roll in, the market will have to blend the value of these new results with assets that were far underpriced in the previous market and 1 + 1 = 5. (ie., a significant rerating will occur)

At Ahead of the Herd we are working hard to find these companies to share with you. We are looking around the world at juniors that are raising capital to ramp up the pace of exploration and project development. We plan to have our due diligence (DD) done before results start pouring in, so we’re ready to act on big news.

To do this requires geological expertise. Unlike the average retail investor or non-expert stock jockeys who are just pumping the latest exploration story in exchange for cash or shares, at AOTH we have the geological talent on board to do the deep research required to separate the wheat from the chaff, so to speak.

The same level of expertise that large, deep-pocketed institutional investors, either have on staff, or pay to do the DD, on projects thought to be highly prospective.

What are the exploration plays we think are going to move, based on our analysis and their drill results? Anyone can make a 2 or 3-timer in a bull market that raises all boats put another if the breeze is stiff enough even turkeys can fly, but it is a rare talent who can cast a well-trained eye over a company’s drill assays, surface samples, or geophysical surveys, to understand the rocks they’re in, and the characteristics of the mineralization – Does it continue? Does the deposit “hang together? Is it scalable? Is it economic at today’s prices? And most importantly, does it have “legs”, to borrow a term from journalism, to become a long-term play? ie., the potiential of being developed into an asset that major mining companies will be interested in acquiring?

The point at which these questions can be anwered in the affirmative, is usually when the big institutional money comes rushing into a stock, driving its trading volume and stock price to new heights.

Using geological expertise to identify these projects and companies, the ones with staying power, can be highly rewarding. They are your 5, 10, +20-timers we all dream about.

Area Play

At AOTH we believe the next great category of opportunity lies in what are known as area plays. These develop after one company makes a big discovery. Usually this is followed by a rush of companies acquiring claim packages and ramping up exploration on their projects nearby. One of the most overused slogans in the industry is “the best place to find a mine is in view of an old mine.”

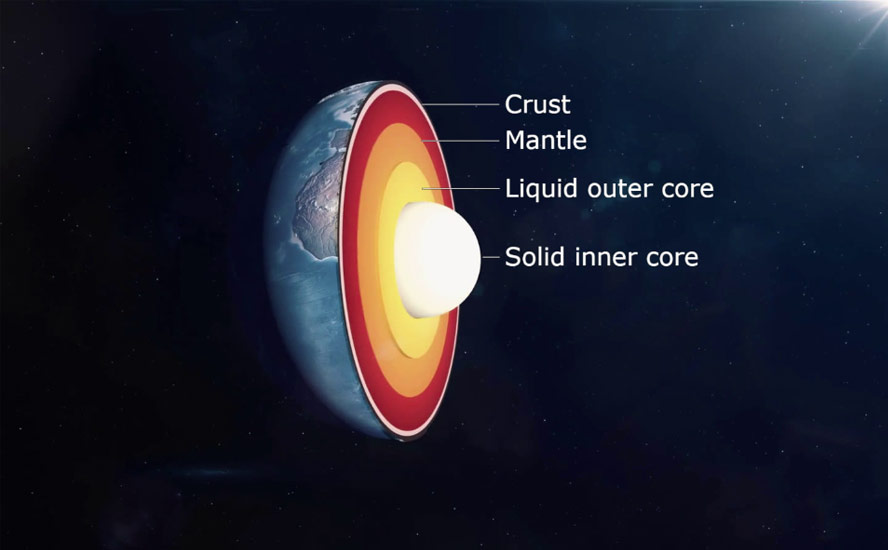

It’s over-used because it’s true. Big mineral deposits form in deep-seated crustal structures and in geological features that tend to form in clusters. So, when a new discovery is made in a mining camp, the odds significantly improve on neighboring ground where similar mineral deposition has occurred. Putting money into these companies is pure speculation but can be very rewarding.

The area play that develops around these new discoveries is a remarkable phenomenon. Sometimes dozens of companies that are holding ground on trend of the discovery, or even just by being located in the same mining camp, suddenly have access to vital funding for their exploration programs.

As the work programs ramp up the stocks all start to rise, often doubling and tripling in anticipation of results.

Some noteworthy area plays are Hemlo in 1982, Eskay Creek in 1990, Lac de Gras in 1992, Voisey’s Bay in 1995 and the White Gold Rush in 2010.

(Rick – I alerted my readers to the developing gold rush in Canada’s Yukon Territory and said, in my opinion buying Underworld, Atac and Kaminak over the winter of 2010 and holding till fall drill results should work out very well. Kinross bought out Underworld Resources (TSX-V:UW) in March 2010 (the transaction valued the fully-diluted share capital of Underworld at C$139.2 million). ATAC Resources Ltd. (TSX-V:ATC) went from a dollar a share to over $8. Kaminak Gold (TSX-V:KAM) entered into a buyout agreement with Goldcorp (TSX-G) for $520 million in May, 2016.)

Conclusion

The more money is spent in these camps, the better the odds that someone will find the next big hit. But how do you improve the odds, how do you pick the ones with the true shot at geological success?

The most important details for success in this next step are geological. Although many companies’ share prices may appreciate in an area play, the ones with the chance of making a new discovery of their own, will have grabbed ground that is on the same structure as a winner, like a mineralized fault or contact zone, be in the same geological host rocks, or have the same alteration pattern, or associated pathfinder minerals.

AOTH is starting coverage on 3 developing area plays where we see these common characteristics:

- A big discovery has been made.

- Players in the district have raised enough capital to participate in building the potential for new discoveries in the mining camp.

- Work programs are starting to be announced, allowing us to assess who’s working on what.

Subscribe to our free coverage at aheadoftheherd.com to follow these plays and their participants, as they attract hundreds of millions of exploration dollars and seek billion-dollar takeovers for their shareholders.

Brad Aelicks

subscribe to my free newsletter

Ahead of the Herd YouTube

Ahead of the Herd Facebook

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills/Brad Aelicks website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills/Brad Aelicks document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills/Brad Aelicks has based this document on information obtained from sources they believe to be reliable but which has not been independently verified. AOTH/Richard Mills/Brad Aelicks makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills/Brad Aelicks only and are subject to change without notice. AOTH/Richard Mills/Brad Aelicks assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills/Brad Aelicks assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills/Brad Aelicks Report.

AOTH/Richard Mills/Brad Aelicks is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills/Brad Aelicks articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills/Brad Aelicks be liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills/Brad Aelicks articles. Information in AOTH/Richard Mills/Brad Aelicks articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills/Brad Aelicks are not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Richard Mills/Brad Aelicks own shares of Freegold Ventures.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.