Stream sampling at North Choco points to potential gold porphyry

2019.09.07

Stream samples taken from Max Resource’s (TSX-V: MXR) North Choco property in Colombia have delivered results that point in the direction of any junior resource company’s holy grail – finding a gigantic gold or copper/ gold porphyry deposit.

Porphyry deposits are usually low-grade but large and bulk mineable, making them attractive targets for mineral explorers. Gold, copper, silver and lead are among the metals found in porphyries.

A two-month sampling program on stream sediments at North Choco, located about 80 km southwest of Medellin, highlighted gold values over 0.8 grams per tonne, and a new exploration target, the “Discovery Zone”.

“The source of gold could be indicative of the presence of potentially economic porphyry-style gold mineralization,” Max states in a September 5 news release, adding that North Choco is virgin territory for exploration, having been inaccessible for over a decade. Until now.

North Choco update

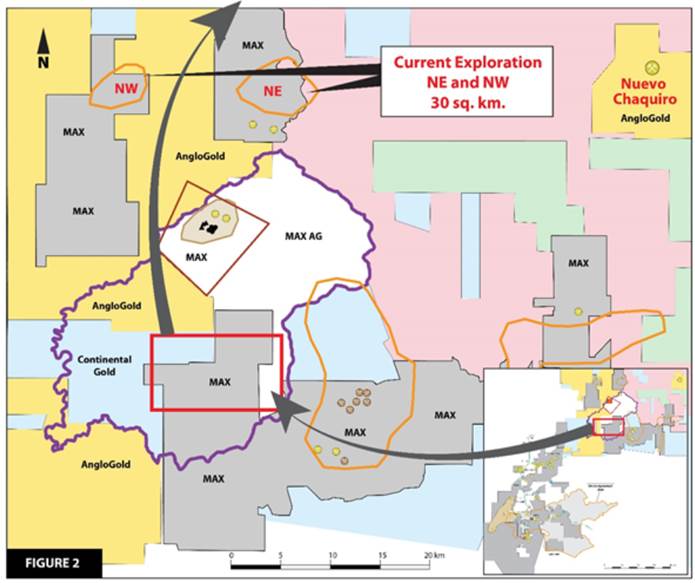

Acquired earlier this year through a binding letter of intent with the former lease holders, North Choco is within a richly mineralized area that has seen a tonne of historical exploration. Some 14 historic gold mines and four historic gold anomalies altogether cover 80 square kilometers.

The 1,250-square-kilometer land holding, including the exclusive right to explore and mine a 500-sq. km area, is contiguous to properties held by AngloGold Ashanti and Continental Gold. Forty-seven kilometers to the northeast, AngloGold’s Nuevo Chaquiro porphyry copper discovery has an inferred resource containing 3.95 million tonnes of copper (@0.65% Cu) and 6.13 million ounces of gold (@0.32 g/t); it is one of five known porphyry centers concentrated within a 15 sq. km area.

AngloGold’s initial reconnaissance work at North Choco, in 2005, identified pyrite, chalcopyrite, galena, sphalerite and arsenopyrite, in a matrix of quartz and calcite from historic gold mines and copper porphyry prospects. However, there was no follow-up because of access restrictions.

From recent stream sampling, the new Discovery Zone was found to extend 3 kilometers by 1 kilometer, and it is open-ended, meaning no end points to the mineralization were found.

Sediments from neighboring creeks yielded between 0.143 and 0.834 grams per tonne gold. An anomaly 12 km northeast of the Discovery Zone returned 0.658 g/t gold. Both areas confirmed the presence of granodiorite intrusives found on government maps. Granodiorite is an igneous rock that looks similar to granite, but has more of the gold pathfinder mineral feldspar.

Importantly, stream sediment sampling done by Max at the Discovery Zone is the same method used by AngloGold Ashanti to compile the above-mentioned inferred resource at its Nuevo Chaquiro deposit. The Discovery Zone occurs in a similar geological environment as Nuevo Chaquiro, located only 40 km away.

Results of a Long Wave Infrared (LWIR) survey, run earlier this year over the Discovery Zone, are currently being analyzed for the presence of granodiorite intrusives, to see whether the zone could be expanded.

LWIR is a relatively new mineral exploration technique that employs satellite imagery to uncover targets that were previously unavailable to exploration companies. LWIR bands can penetrate vegetation and other ground cover, to mathematically “fingerprint” mineralized areas.

Thirty kilometers north of the Discovery Zone, the first phase of exploration is underway in the vicinity of two gold anomalies Max recently added to North Choco. The anomalies are part of a 300-km expansion northward, through additional staking. One of the 5 km long by 4 km wide anomalies features a rock sample of 15 g/t gold, while the other anomaly, 6 x 5 km, highlights a 12 g/t sample.

Porphyry close-ology

Based on historic exploration and initial field reconnaissance, management at Max Resource thinks there is strong potential for finding a copper-gold porphyry – defined as a large mass of mineralized igneous rock, that is often suitable for bulk mining – within the sprawling, 1,250-km expanse of North Choco.

Their first clue is the high-grade gold and copper chip samples. The second clue is the results of stream sediment samples that appear to echo those done at AngloAmerican’s Nuevo Chaquiro project. The same exploration method, stream sampling, done in a similar geology, was used to put together a sizeable resource estimate from the porphyry-style deposit.

Its important to note that the Carmanta porphyryr cluster (CPC) is located 10 kilometers east of the North Choco property. CPC was discovered in 2010 as a result of sampling in streams and creeks with rock samples yielding >0.3 g/t gold. CPC occurs over a strike length of 3 km orientation approximately N10E. Significant drill intercepts include 1.01 g/t gold and 0.21% copper over a drill core length of 456.7m from 3.9m. However, there was no follow-up because of access restrictions.

Verification has also come from consultants Max is working with including geologists that are consultants to Continental Gold presently developing it’s 100%-owned Buriticá project with Newmont Mining and Lundin Gold, which is finishing construction on its Fruta del Norte project and aiming for production in the fourth quarter.

The underground gold and silver mine will be Ecuador’s largest, and is expected to produce 4.6 million ounces of gold over 15 years.

Sol Gold has also been active in the same vicinity as North Choco. The connection between Sol and Max is the Andean Copper Belt, which runs from Chile in the south, through Ecuador, up to Colombia and then turns northwest into Panama. The Andean Copper Belt hosts some huge copper-gold porphyry deposits including Escondida, the world’s largest copper mine that Sol Gold says has the same-age rocks as Cascabel, its flagship project in northern Ecuador.

Bordering Colombia to the south, Cascabel contains the Alpala deposit with a measured and indicated resource of 10.9 million tonnes of copper and 23.2 million ounces of gold.

Mining in Colombia – Clawing its way back

Colombia has a large footprint on the global natural resources industry. From a mining investments perspective Colombian gold projects appear to be the centre of attention of mining investments. Before Brazil and Peru took over, Colombia was the largest gold producer in South America and has produced close to 100 million ounces of gold.

While the structure of the fiscal regime resembles that of many other countries in South America, the recent tax reforms by the Colombian government secure a competitive edge.

In December 2018, the new elected government introduced a new bill, known as the financing law. It proposes a gradual reduction in taxes on businesses from the current 35% to 30% by 2022, as well as a new sales tax refund of 19 percent for capital goods such as machinery. The financing law also repeals the 4% surcharge imposed on corporate income, making the total tax rate 33% for 2019, as opposed to 37%. These tax reforms bode well for mining companies, both to those in production and those in rapid development phase with heavy investments leading to production.

Recall my statement near the top, that North Choco is virgin territory for exploration, having been inaccessible for over a decade. Well, the reason for that, is previous exploration companies did not have the agreements with indigenous peoples, who have title to their lands in Colombia for lease, that Max currently has.

Max is a first mover progressing its 2,807 sq. km of the Choco Precious Metals District – where the company has been exploring for conglomerate gold. (MXR in the news release hints of working with a partner who will concentrate on developing the conglomerates, leaving Max free to hunt for porphyries in North Choco and to develop the shear zone at El Tambita, discussed in detail below)

The agreements with the pro-mining indigenous groups in Choco are the first since 1990.

Choco Gold-Platinum Project update

Meanwhile at the Choco Gold-Platinum Project, located 120 km southwest of Medellin, Max is gearing up for an October exploration program to follow up the 2013 discovery of a 9.8-meter shear zone that returned a whopping 63 grams per tonne gold, on average. A select grab sample delivered an off-the-charts 220 g/t.

A shear zone is a type of fault, often tabular in shape, known to contain ore deposits.

The company notes that the shear zone, within an area known as El Tambita, and the Gaviota mine, are upstream along Rio Tamana, where historic placer gold production of 605,110 ounces was recorded between 1906 and 1990.

“El Tambita is one largely untested high-grade gold target, historic exploration data suggests strong potential for the discovery of additional gold zones,” Max CEO Brett Matich said in July, adding that the company sent crews to follow up outlying anomalies, hoping to find the source of Rio Tamana’a alluvial gold.

Conclusion

If you want to bag an elephant-size mineral deposit you have to go to potential elephant country. Max has thousands of square kilometers of some of the most mineral-rich ground on the planet to explore. It’s the possibility of another Nuevo Chaquiro discovered by AngloGold Ashanti in 2005 located forty-three kilometres to the north east.

Max isn’t there yet, but it’s early days. We are encouraged by the company’s two-prong strategy of working North Choco and the shear zone at the Choco Gold-Platinum Project – both which, in my opinion, have huge potential. Stream and chip samples at North Choco are evidence pointing in the right direction, of a potential copper-gold monster lurking beneath the Colombian jungle, awaiting discovery.

Max Resource Corp

TSX-V:MXR Cdn$0.085 2019.09.06

Shares Outstanding 77,960,564m

Market cap Cdn$6.6m

MXR website

*****

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Max Resources and MXR is an advertiser on Richards site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.