Storm Exploration: BIF gold in Ontario – Richard Mills

2024.06.05

In November, the Musselwhite mine in northern Ontario poured its 8,000th gold dore bar — a significant production milestone for the fly in/ fly out operation, which in 2022 celebrated 25 years.

The underground mine became part of Newmont Mining’s holdings when Newmont bought Goldcorp in 2019.

The Musselwhite deposit is classified as a banded iron formation (BIF).

Gold in banded iron formations make excellent exploration targets because of their scalability. Like VMS deposits, they are often found in clusters, something that is attractive to major gold companies looking for new deposits that can be developed into mines with longevity.

Musselwhite is one of the largest gold mines in Canada with 1.85 million ounces in reserves. About 265,000 ounces a year is mined.

Another BIF is the Detour Lake mine, located within the Abitibi gold belt running through Ontario and Quebec. Operated by Placer Dome 1983-1999, the mine now owned by Agnico Eagle produces, on average, 659,000 ounces a year and is expected to run until 2036.

There are likely other gold-bearing banded iron formations in remote northern Ontario. One company that already has one in its portfolio, and is looking to develop it further, is Storm Exploration (TSXV:STRM).

Storm Exploration (TSXV:STRM)

Storm came to my attention for the exploration agreement it recently signed with the Eabametoong First Nation regarding Miminiska, Keezhik and Attwood, which sit on their traditional territory.

It is unusual for a mining company to prioritize First Nations consultation over other activities, and I think this speaks to the progressive mindset of CEO Bruce Counts and his management team. These days, nothing happens on a mineral exploration property sitting on First Nations land without the nation’s consent.

“The execution of an Exploration Agreement between Storm and the Eabametoong First Nation is a major milestone. I would like to thank Chief and Council for their dedicated time and effort in realizing this agreement and ensuring it is beneficial for both parties,” Counts stated in the May 23 news release. “Storm firmly believes that the participation of local first nations is critical to the success of a project, and I am excited to be working with the EFN on advancing the highly prospective Fort Hope properties.”

“Getting this Exploration Agreement in place is an important step for Eabametoong First Nation,” said Chief Solomon Atlookan. “For far too long, other exploration companies have sought to obtain permits from Ontario before working collaboratively with us or other First Nations. The significant thing about this new agreement is that it recognizes the role of our community in permitting, monitoring, and regulating any activities on the land before and beyond any Crown permits. Mr. Counts has been very respectful in working with EFN and this approach should be a model for others to follow. EFN expects all resource companies to come and work with us on common interests, but also to respect where certain activities cannot occur. This agreement outlines a pathway for an ongoing relationship and we look forward to working with Storm to protect and steward the land while exploring this beautiful area that we have been entrusted with.”

Counts is a veteran geologist with over 30 years experience, including +20 years as a director and senior officer of publicly trading mineral exploration companies. He was involved in the discovery of several kimberlite fields including Lac de Gras, host to the Ekati diamond mine in Canada’s Northwest Territories.

Director Joanne Price has more than 20 years experience as an exploration geologist and project manager. Rounding out the team is Michael Sweatman, CFO Dwight Walker, and Lon Shaver, currently the President of Silvercorp Metals. Rob Carpenter and John Williams are technical advisors.

Storm Exploration has 52.1 million shares outstanding, with management/advisors and institutions holding a combined 39% of the shares. Retail owns just 29%. The company has a current market capitalization of about $2.6 million.

Properties

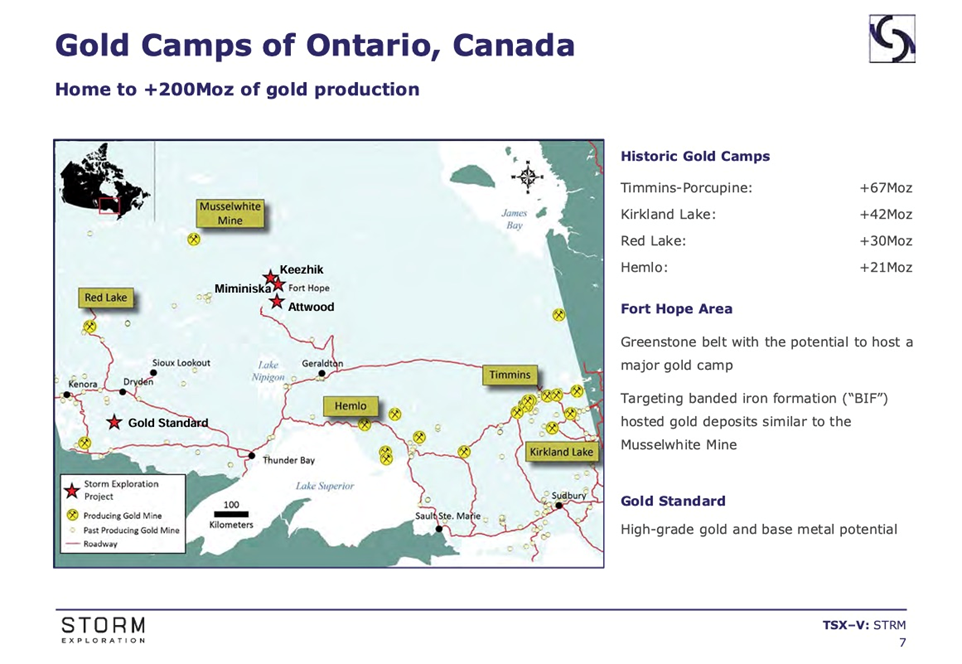

Storm’s four properties are all are in the vicinity of historic Ontario gold camps, which combined have produced over 200 million ounces. See the slide below for production details and locations. The Fort Hope area is a greenstone belt with the potential to host a major gold camp.

Miminiska

High-grade gold has been confirmed by drilling at a number of locations on the Miminiska property. Historical assays include 5.75g/t Au over 20.84m and 13.95 g/t Au over 5.32m, with mineralization hosted in banded iron formation and associated shear zones.

Miminiska is about 12 km east to west and currently has two main targets: Frond and Miminiska. Outcrops on the shores of Lakes Frond and Miminiska were discovered in the 1940s, but so far only minor drilling has been done.

Storm Exploration optioned the property from Landore Resources in 2021.

Gold Standard

Gold Standard is an early-stage exploration project. The property is approximately 65 km north of Fort Frances and within the traditional territory of the Naicatchewenin and Nigigoonsiminikaaning first nations.

Assay results from grab samples collected at one of the shafts in 2022 by Storm Exploration included 166 g/t Au, 88.6 g/t Au and 83.4 g/t Au.

Storm has signed exploration agreements with the Naicatchewenin and the Nigigoonsiminikaaning, putting the company in a position to drill a large VMS target identified in 2023.

Keezhik

The 12,482-hectare Keezhik project is located along the same regional shear structure that hosts Newmont’s +6Moz Musselwhite mine. Multiple high-grade gold occurrences have been identified on the property with historical assays up to 47.7 g/t Au over 0.6m and 25.8 g/t Au over 1.3m returned from drill core.

Attwood

Attwood is a greenfields project covering geology that is prospective for precious and base metal deposits. The property includes 23,262 ha of mineral claims staked by Storm Exploration and has no royalties.

Infrastructure

While there are currently no roads providing direct access to the properties, there is an all-weather forestry road that runs within 5 km of Attwood Lake. The company sees that location as a staging point for equipment, to be flown to the properties by helicopter.

Moreover, the Eabametoong First Nation is looking at the feasibility of extending the Ogoki forestry road to their community, which would greatly improve the value proposition of mining in their traditional territory.

Banded iron formations

Banded iron formations account for around 60% of global iron reserves, and can be found in Australia, Brazil, Canada, the United States India, Russia, Ukraine and South Africa.

The gold in banded iron is associated with greenstone belts believed to be ancient volcanic arcs, or in adjacent underwater troughs. Greenstone belts often contain gold, silver, copper, zinc and lead ores.

The gold is usually found in cross-cutting quartz veins/ veinlets, or as fine disseminations associated with pyrite, pyrrhotite and arsenopyrite.

The host strata has generally been folded and deformed. In terms of mineralogy, gold-bearing BIFs may include native gold, pyrite, arsenopyrite, magnetite, pyrrhotite, chalcopyrite, sphalerite, galena, stibnite, and rarely, gold tellurides.

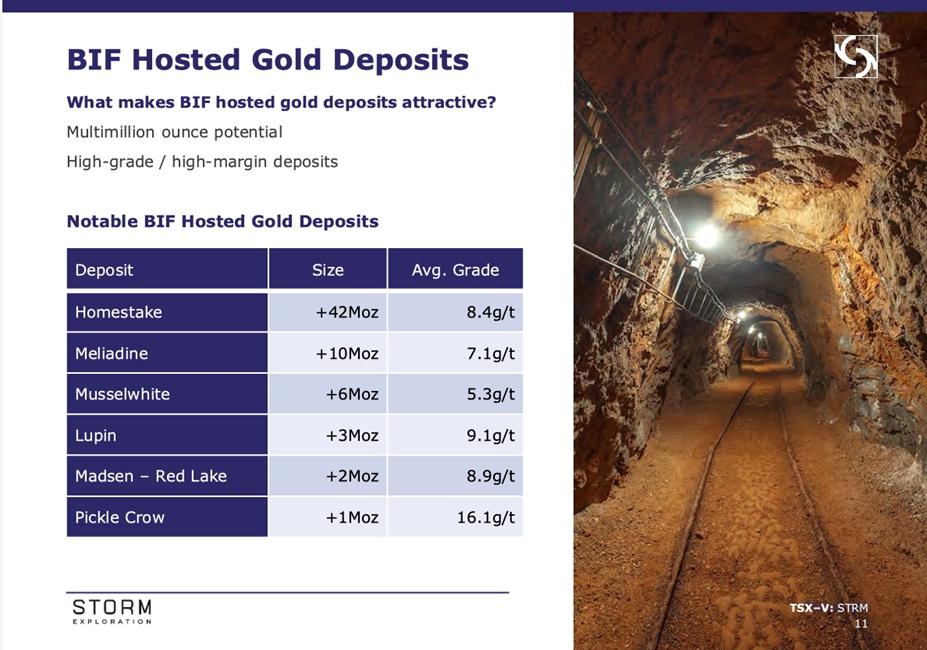

Perhaps the best example of a gold-bearing banded iron deposit is the shuttered Homestake Mine in South Dakota. The +40-million ounce deposit was the largest and deepest gold mine in North America before it closed in 2002.

The gold ore was contained almost exclusively within the Homestake Formation, a 20 to 30-meter layer of iron carbonate and iron silicate that had been deformed, resulting in upper greenschist facies of siderite-phyllite, and lower amphibolite facies of grunerite schists.

The Homestake Formation is within the Black Hills dome of western South Dakota, believed by geologists to have been created when two plates subducted under North America, forming the Rocky Mountains.

Canadian BIF mines include Detour Lake, Madsen-Red Lake, Pickle Crow, Musselwhite and Dona Lake in Ontario, and the Meadowbank and Meliadine mines in Nunavut.

Talking with AOTH this week, Storm’s CEO Bruce Counts said the Miminiska project bears all the hallmarks of a banded iron formation. The closest analog is Musselwhite, located ~115 km to the northwest. The deposit also has a similar geometry to the Lupin BIF mine, which produced 3.4Moz at 9.1 g/t Au before closure in 2005.

When Storm examined about 3,000 meters of drill core, they noticed a good correlation between arsenopyrite and gold, which as mentioned, is another characteristic of a BIF.

Drilling

Storm plans to raise money for a drill program at Miminiska.

“The focus of our initial drill program is to demonstrate that we can not only expand the mineralization that’s already been discovered, but we can extend it as well by drilling in new places down the limbs and into the nose of the fold of this banded iron formation,” Counts said, adding: “It’s a really important place to look for higher concentrations and greater thicknesses of gold mineralization.”

Ideally, between 2,000 and 2,500 meters would be drilled from six to 10 drill pads. It should be noted that the claims at Miminiska are patented claims, meaning that no drill permits are required. Normal drilling guidelines must still be followed and Storm needs the support of local first nations, which it has already has.

Drilling can be done almost year-round, with the exception of about 10 weeks from the middle of November until the end of January due to adverse weather conditions.

Conclusion

Banded iron formations are an important source of gold. They make excellent exploration targets because of their size/ scalability. Like VMS deposits, they are often found in clusters, something that is attractive to major gold companies looking for new deposits that can be developed into mines with longevity.

The Homestake deposit was the largest and deepest gold mine in North America before it closed in 2002. The banded iron formation mine produced 43 million ounces in 124 years of production, worth over a billion dollars.

BIFs are well known in Canada’s north — Agnico Eagle’s Meliadine and the past-producing Lupin mine are examples — but they are less prevalent in Ontario, despite the presence of Musselwhite, Madsen-Red Lake, Detour Lake, and Pickle Crow, all BIF deposits.

Storm Exploration aims to change that perception by developing the Miminiska banded iron formation hopefully to the point where a larger company takes the project on and advances it to production.

“People will start to pay attention more as they understand these projects and I know that they’re coming to light more and more particularly in the gold market,” Counts said.

Storm Exploration Inc.

TSXV:STRM

Cdn$0.05 2024.05.31

Shared Outstanding 41.6m

Market cap Cdn$2.6m

STRM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Storm Exploration Inc. (TSX.V:STRM). STRM is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of STRM

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.