South American sedimentary copper belt has a silver buckle

2020.05.30

One of the most interesting places to look for new copper deposits is the Andean Copper Belt of northwestern South America. The belt runs from Colombia in the north, through Ecuador and Peru, to northern Chile in the south. Not only does the region host immense copper, gold and molybdenum porphyry deposits, recently it has emerged as an exciting area play for companies that have just started tickling the surface of hugely prospective sedimentary copper-silver basins in Peru, Ecuador and Colombia.

The area’s geology is among the earth’s most richly mineralized. The North Andean copper-gold province is a 2,500-kilometer mineralized arc that formed on the western edge of South America’s complex Proterozoic and Archaean shield, during the Lower Paleozoic era, around 300 million years ago. A complex of Cretaceous-era terranes (pieces of crust, broken from tectonic plates) was forged on the northwest margin of South America, connecting it to the southern tip of North America sometime between the Oligocene and Miocene epochs.

Among the largest copper porphyry deposits are Chuquicamata (690 million tonnes grading 2.58% Cu), Escondida and El Salvador in Chile, Toquepala in Peru, Lavender Pit, Arizona and Malanjkhand, India, which has 145 million tonnes at 1.35% Cu.

The world’s biggest sedimentary copper deposits are only found in three basins: the Paleoproterozoic Kodaro-Udokan Basin of Siberia, the Neoproterozoic Katangan Basin of south-central Africa, and the Permian Zechstein Basin of northern Europe.

However, this may be changing. Over the past year or so, an intriguing theory has come to light: that within the Andean Copper Belt, are a series of large-scale sedimentary copper deposits, formed in areas known to contain other minerals, including oil, gas, coal, and salt.

Initial exploration of sedimentary basins in Colombia, Ecuador and Peru have revealed a startling realization – that surface outcroppings might be just the tip of giant icebergs of sediment-hosted copper-silver deposits lurking underneath. Samples derived from boots-on-the ground prospecting suggest these areas are analogous to “Kupferschiefer”-type copper-silver mineralization found in Germany and Poland.

Proving this theory could mean billions of pounds of copper and hundreds of millions of ounces of silver lay hidden beneath the diverse geography of northwestern South America.

How sedimentary copper forms

Sedimentary copper deposits are formed in ocean basins, where the seabed is composed of porous materials such as sandstone, limestone and black shale, through which copper and other minerals travel up and become trapped in the rock layers.

The process of mineral deposition is different from a copper porphyry deposit, which is formed when a block of molten-rock magma cools. The cooling leads to a separation of dissolved metals into distinct zones, resulting in rich deposits of copper, molybdenum, gold, tin, zinc and lead.

Copper porphyries can be visualized as a bag of flour with millions of grains of rice, where the grains are tiny pieces of copper and other minerals, spread throughout a large area, whereas sedimentary copper deposits are like a stack of books. Sedimentaries may also be tabular in form, though frequently folded and faulted.

Sedimentary exhalative deposits formed when hydrothermal fluids contacted a body of water, and precipitated ore. The large deposits in the Zambian copper belt are an example of SedEx-style mineralization.

Red-bed deposits, so named due to oxidation resulting from exposure to the atmosphere, are divided into volcanic and sedimentary.

Kupferschiefer deposits

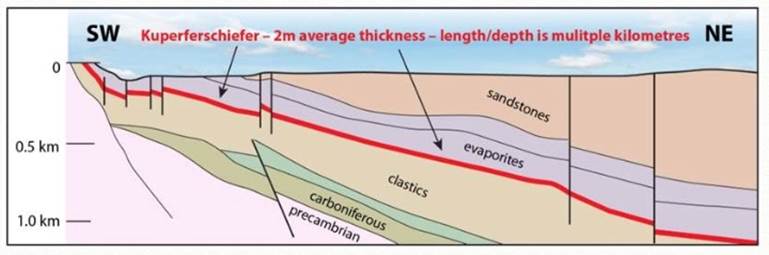

The KGHM wholly owned (world’s #8 copper and #2 silver producer) Kupferschiefer (which means “copper shale” in German) deposits are similar to red-beds but larger, even regionally extensive. They typically form in a marine setting, after land is gradually submerged in a shallow sea, then overlain by sedimentary rocks – which formed from the gradual deposition of the carcasses of dead sea creatures, onto the ocean floor.

The Kupferschiefer copper belt that underlies Germany and Poland is among only three “supergiant” sediment-hosted copper deposits in the world. It is also within an elite 1% of deposits that contain over 60 million tonnes of copper.

Orebodies can range in thickness from 0.3 m with an average mining thickness of 2 metres, contained largely within the black shale of the Kupferschiefer sensu stricto, up to more than 50 m, where sublevel stoping, backfilling, and pillar mining reflect the pervasive mineralization, states a research paper.

According to the Polish Geological Institute, Poland holds the largest economic copper resources in Europe, about 36 million tonnes, and the most anticipated economic silver resources on the continent, about 3.4 billion troy ounces.

Other metals recovered from copper ores at Poland’s Kupferschiefer deposits include gold, platinum, palladium and rhenium.

Despite being a small country, about the size of New Mexico, Poland produced 54.6 million ounces of silver in 2019, up 18% from 2018, mainly as a product of copper mining.

The richest silver deposits are located in the Lower and Upper Silesia regions, where the first shallow mines pre-date the Roman Empire, going back as far as 1136 AD.

The US Geological Survey says the massive volume of metal in Poland’s Kupferschiefer deposits is due to continuous mineralization that extends down dip and laterally for kilometers.

“Main ore minerals are Cu-S minerals (chalcocite, digenite, covellite, djurleite and anilite. Silver occurs in the form of its own minerals (native silver, electrum, stromeyerite, naumannite, mckinstryite, jalpaite, chlorotritite, eugenite and silver amalgams) but the most important silver carriers are base-metal sulfides – bornite (up to about 15% wt % Ag) and then chalcocite (up to 1.13 wt %),

Although the ore mineral zonation pattern is observed as being complex on a mine scale it is clearly defined on a regional scale. In areas with the highest copper concentrations, chalcocite, digenite and covellite predominate over the other sulfides whereas in areas further from the Rote Fäule area bornite, chalcopyrite, galena and sphalerite successively prevail. Farther away from oxidized areas, high- and low-grade mineralization is represented by a bornite-chalcopyrite assemblage with minor digenite, chalcocite, galena, sphalerite and pyrite.” The Kupferschiefer Deposits and Prospects in SW Poland: Past, Present and Future

Identified resources within the giant Lubin-Sieroszowice deposit, are 1.6 billion tonnes of ore containing 30.3 million tonnes of copper and 2.7 billion ounces of silver, at average grades of 1.63% Cu and 57 g/t Ag. Reserves are 23.7 million tonnes copper and 1.4 billion ounces silver.

The strongest copper sulfide mineralization occurs in the black clay shales, including chalcocite, bornite, covelline and chalcopyrite, accompanied by minerals associated with silver, native silver, lead, zinc, cobalt and nickel.

A classic Kupferschiefer consists of three main layers – sandstone, bituminous shale and limestone overlain by evaporates often containing oil and gas. Copper-containing fluids migrate up through the sandstone and get trapped by the carbon-rich copper shale. This is where most of the mineralization is concentrated, although it can also be found in the sandstone, limestone, or a combination of all three layers.

Max Resource Corp in Colombia, Aurania Resources in Ecuador, and Hannan Metals in Peru, all claim to have encountered Kupferschiefer-type mineralization at their respective projects. We discuss each of these companies in turn.

Aurania Resources (TSX-V:ARU)

Market cap $122.2M, o/s 40,486,673

Aurania Resources’ (TSX-V:ARU) flagship asset is the Lost Cities – Cutucu project, found in the Jurassic Metallogenic Belt of the Andes foothills in southeastern Ecuador. The company has carried out stream-sediment reconnaissance on parts of the sprawling 2,400-square-kilometer property, which includes 400 sq km across the border in Peru. Previously searching for gold, new observations from the field might of led Aurania to revise its exploration model.

Its Chairman and CEO, Dr. Keith Barron, explains: “In October of [2018] our geologists, tasked to carrying out rather routine stream sediment collection, started to bring an extraordinary array of copper-mineralized large boulders and slabs in from the jungle. Some of these samples were covered in vivid green chrysocolla and tenorite. At first, we treated these as a curiosity and believed they were related to the supergene weathering of nearby porphyries. However the copper minerals were hosted exclusively in well-bedded siltstone, mudstone, sandstone and shale, particularly in pieces showing abundant carbonaceous plant fragments and not in porphyry.”

Tracing these boulders back to the outcrops, over a strike length of 22 km, Aurania’s geologists observed the copper mineralized setting to be similar to the Kupferschiefer being mined by KGHM in Poland, and in Zambia and the DRC ie. that copper leached from the sedimentary basin remains in solution because of the oxidized state of the red sandstones (“red-beds”). Key to the mineralizing sequence is the presence of saline (salt):

Saline fluids from salt layers or domes within these sedimentary basins increase the solubility of copper, which forms stable, soluble copper-chloride complexes. Numerous salt domes are associated with the Jurassic red-beds in southeastern Ecuador. Salt is currently produced from two small artisanal operations on the Project.

When these basins are reactivated, the saline, copper-bearing fluids flow along the layering of the rock sequence to the faults, which constitute barriers to the fluids, and the fluids tend to rise along these permeability barriers. Where the fluids come into contact with reduced sedimentary layers, such as carbon-bearing black shale or limestone, the copper precipitates.

So far Aurania has identified copper-silver mineralization in boulders and in outcrops at surface. The sedimentary-hosted copper-silver mineralization is regional in nature, stratigraphically confined to key horizons of carbon-bearing sediments that have been verified in outcrop to extend for a minimum of 22 km (open along strike) across the Project area.

These areas have yet to be drilled.

Aurania also notes that data from the geophysical survey it flew over the project identified a number of magnetic centers that are interpreted as porphyries or porphyry clusters. If this interpretation is correct, the porphyries represent an additional significant source of copper potentially injected into the red-bed sequence.

In March, 2019, Aurania’s management team learned that a competitor, Hannan Metals operating about 300 kilometers south in Peru, had discovered copper-silver sediment-hosted mineralization of a similar style and grade to what ARU had found in the Cutuco Cordillera in Ecuador. (In fact, Hannan’s San Martin project lies within the same geological formation as that mapped in Ecuador, albeit with a different name in Peru.)

Recognizing the possibility of extending its Lost Cities -Cutucu project southward into northern Peru, the company, in January 2020 registered a subsidiary in Peru (Vicus) and applied for 419 mineral concessions covering 413,200 hectares in the northern part of the country.

“Believing that salt is geochemically a significant piece of the puzzle and potentially the reason for the extent and distribution of the copper and silver, it was considered too compelling to ignore the Peruvian opportunity, and we filed for open ground covering the prospective sedimentary horizons in proximity to salt deposits previously discovered during oil exploration. We believe that the areas may also have some copper porphyry potential if they prove to be an analogous geological setting to our ground across the border in Ecuador,” Barron said.

According to Aurania, the concession applications are divided into 20 blocks, located where the sedimentary layers that are prospective for copper-silver are at or near surface. The concession areas in Peru have been extensively covered with seismic, magnetic and gravimetric geophysical surveys undertaken by oil and mineral exploration companies, as well as by the Peruvian government.

Among the commentaries on Aurania Resources is one by Bob Moriarty, publisher of the website 321gold. Moriarty says “They may have discovered the first Kupferschiefer copper/silver deposit found or at least recognized in the Western Hemisphere. These sediment-hosted systems tend to be very big in lateral extent and rich.”

In the column, run by Streetwise Reports, Moriarty comments on a high-grade sample from the Ecuador project that assayed at 6.37% copper and 48.04 g/t silver, noting the material has a gross metal value of US$367.40 per tonne (Rick – current pricing).

Hannan Metals (TSX-V:HAN)

Market cap $23.1M, o/s 74,664,211

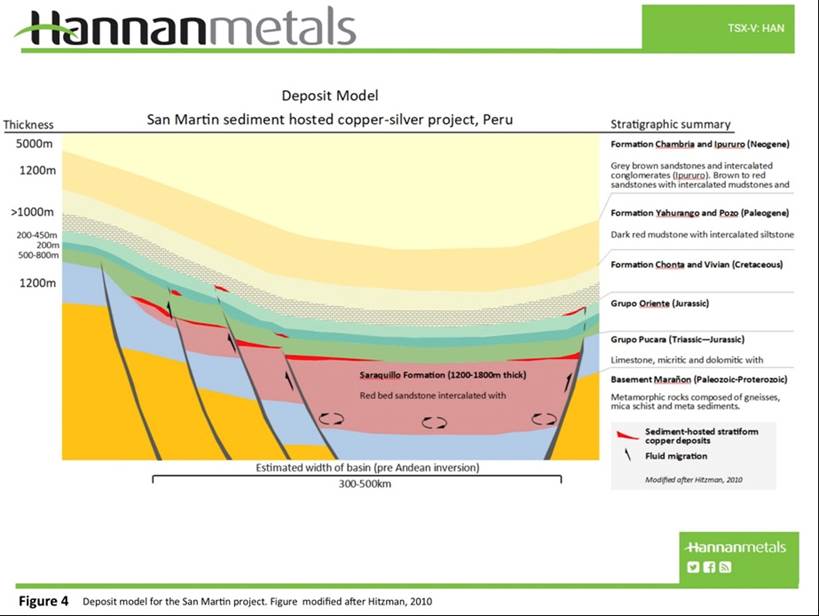

Hannan Metals (TSX-V:HAN) is developing a sediment-hosted copper-silver deposit in the Huallaga basin of north-central Peru. Described as one of the best surveyed thrust and fold belts in the world for oil and gas, the style of deformation in the Sub-Andean zone is mainly related to salt tectonics rather than a compressional thrust and fold belt. This insight has opened up a new window for sediment-hosted copper deposits in Peru.

A first mover in this part of Peru, Hannan’s initial prospecting in 2018-19 identified high-grade mineralization in outcrops and alteration in an area covering 100 x 50 km. Similar-styled outcrop boulders have been discovered over 100 km of combined strike. The best rock-chip samples from two outcrops 20 km apart were 3 meters at 2.5% copper and 22 grams per tonne silver, and 2m at 5.9% Cu and 66 g/t Ag (US$352.65t gross metal value per tonne). Drills have yet to be sunk into these areas.

Recognizing the exceptional potential for a new frontier basin-sized copper-silver deposit, in January 2019 Hannan submitted mineral claim applications covering 14,800 hectares to secure an unexplored district covering 15 km strike of copper-silver occurrences. In February 2020 Hannan upped its land tenure by 27%; holding 656 square kilometers covering multiple trends within 110 km of combined strike. On May 28th 2020 Hannan was granted more tenure.

According to the company, the San Martin project shares similarities with sedimentary copper-silver deposits including the Kupferschiefer deposit in Eastern Europe and deposits of the African Copper Belt situated in sub-Saharan Africa, two of the largest copper districts on earth:

Copper and silver mineralization is hosted by the 150 million-year-old Saraquillo Formation, which was deposited in an intra-continental basin during the Jurassic-Early Cretaceous period. The Saraquillo Formation is 1.2-1.8 kilometres thick and extends for over 1000 kilometres of strike. The Saraquillo is associated with salt domes which suggest widespread evaporitic strata, with several small artisanal salt mines present in the area…

Mineralization is associated with the contact of fine-grained reduced carbonaceous sandstones with highly oxidized red beds of the Saraquillo Formation.

Mineralization consists of disseminated chalcocite, covellite, bornite and digenite with minor fine pyrite. Chalcocite is the dominant copper sulphide and it is always found together with carbonaceous material.

Initial grab sampling outlined four high-grade copper and silver areas over 15 km of strike, within at least two structural corridors, highlighting the potential for discovery of a strike extensive near-surface, sediment-hosted copper deposit. Nineteen mineralized boulders range from 0.1% to 8.3% copper and 0.2 g/t silver to 109 g/t silver. The average grade is 2.8% copper and 27.2 g/t silver (US$164.88 gross metal value per tonne).

“The eastern margin of the Peruvian Cordillera has seen very little previous exploration, and to collect undocumented high-grade copper-silver samples over a 15 kilometres strike is a rare and exciting experience,” says Michael Hudson, Hannan Metals’ chairman and CEO.

“The project has the hallmarks of forming a significant new sediment-hosted copper-silver district, with high grab grades of up to 8.3% copper and 109 g/t silver (US$505.37 gross metal value per tonne), from an intra-continental salt bearing sandstone sequence.”

Hannan has attracted the attention of billionaire resource investor Rick Rule of Sprott Asset Management, and 321gold.com publisher Bob Moriarty mentioned earlier in reference to Aurania Resources.

Rick Rule through Sprott Global Resource Investments Ltd. (Hannan news release 45-106F1 February 18, 2020) took down a significant chunk of a recent $0.15/sh with a full warrant exercisable at $0.30 financing that raised $2.2 million, and Bob Moriarty mentioned Hannan in a February 2020 article in Energy and Gold Ltd:

They just raised money at 15 cents a share and they expect to stake a lot of ground and they will be drilling sometime in the next six months. Could they go from 15 million to 75 million? Very easily.

Also of significance is Hannan’s appointment in January 2020 of Quinton Hennigh, a PhD in geology, to its geological advisory team. Hennigh is CEO of Novo Resources (TSX-V:NVO), which is developing a conglomerate gold play in Western Australia.

Hannan commenced a social program, baseline and geological field program in January 2020. Initial samples from this program are being analysed and will be released as they become available.

The Company commenced a remote sensing study over the San Martin project. This will aid in geological understanding of the large area and help define areas for further groundwork. (MD&A April 28, 2020)

Max Resource Corp. (TSX-V:MXR)

Market cap $2.85M, o/s 35,714,906

Max Resource Corp. (TSX-V:MXR) continues to make good headway at its CESAR Copper + Silver Project in Colombia.

Since November, Max’s geological teams and prospectors have been identifying copper and silver targets in the 100 km x 20 km target area at CESAR, using rock chip sampling to identify structures, continuity of thickness, and strike length, to determine potential size prior to drilling.

Max’s head geologist, Piotr Lutynski, told AOTH that Colombia’s stratigraphy is similar to his homeland, Poland, and its Kupferschiefer sedimentary copper deposits.

“The copper and silver are very classical elements likely to be in sedimentary deposits like Colombia,” said Lutynski, noting he has worked in similar mineralization in Peru. “It’s the same stratigraphy with the sandstone below the limestone on top and the Kupferschiefer equivalent in the middle.”

Crews have been looking for surface outcrops, that Max thinks could be the tip of the iceberg of a giant sediment-hosted copper system below surface.

Two greenfield discoveries earlier this year, AM North and AM South, appear to support this conclusion.

AM South features a stratabound copper-silver horizon, with mineralized structures totaling over 5 km of strike length. Sampling from 0.1 to 25-meter intervals returned highlight values of 5.4% copper and 63 g/t silver (US$324.26 gross metal value per tonne).

On trend forty kilometers north, the AM North zone contains two mineralized areas from which rock chip samples were taken.

The AMN-1 zone returned values of 10.4% copper and 88 g/t silver (US$605.36 gross metal value per tonne) over a 1-meter interval, along 1,800m of strike.

AMN-2 returned 24.8% copper + 230 g/t silver (US$1455.13 gross metal value per tonne) over a 4m x 1m rock chip panel discovery.

Max recently reported bulk sample assay and QEMSCAN values of 9.4 % Copper + 79 g/t silver (US$546.84 gross metal value per tonne) obtained in the vicinity AMN-2 and 3.5 % Copper + 29 g/t silver (US$203.37 gross metal value per tonne) from the vicinity of AMN-1. The AM North horizon is currently approximately 1.8-km long and is open along-strike as well as down and up-dip.

“These bulk sample results from the newly discovered AM North horizon supports the Kupferschiefer model target grades of 1.6% copper + 57g/t silver (US$118.07 gross metal value per tonne). The next steps include significantly extending the CESAR 7-km accumulated horizon and expanding the footprint towards the Kupferschiefer type target,” Max CEO, Brett Matich, commented.

In a Feb. 27 news release, Max notes AM North and AM South are both hosted in well-bedded sandstone-siltstone. They appear to be large sub-horizontal sheets, that partly outcrop at surface.

“Ongoing exploration continues to build confidence in CESAR as a significant discovery of regional scale,” said Max’s CEO, Brett Matich. “The Company is working towards a 3D model to assess the potential size of the CESAR copper-silver project.”

The significant stratabound copper mineralization found at CESAR is similar to the mineralization found in Ecuador and Peru in Jurasssic-age rocks. The project lies along a historic 120-km copper-silver belt within a major oil and gas and coal-mining sedimentary basin.

According to Wikipedia, the Cesar-Ranchería Basin is bounded by the Sierra Nevada de Santa Marta and the Serranía del Perijá mountain ranges. Two rivers flowing through the basin, the Cesar and Ranchería, bear its name.

The Cesar-Ranchería Basin hosts Cerrejón, the tenth biggest coal mine worldwide and the largest in Latin America, where low-ash, low-sulfur bituminous coal is mined from the Paleocene Cerrejón Formation.

The basin is also estimated to hold the second-largest reserves of coal bed methane in Colombia, or 25% of the country’s total resources.

Earlier this month, Vancouver-based Max announced it has entered into a collaboration agreement with “one of the world’s leading copper producers”:

MAX RESOURCE CORP. (TSXV: MXR) (OTC PINK: MXROF) (FSE: M1D2) is pleased to report it has entered a collaboration agreement with one of the world’s leading copper producers (“Major“) and has brought in Fathom Geophysics (“Fathom“) to carry out a technical study of the Company’s wholly-owned CESAR copper-silver project, located in northeast Colombia, approximately 420 km north of Bogota.

The aim of Fathom’s study is to map stratigraphic (rock layers) features that can help to pinpoint stratabound copper-silver mineral horizons at CESAR.

“Participation of a Major in this geophysical study marks a significant milestone for our Company and provides validation of the CESAR copper-silver project. It combines the expertise of a world-leading copper miner with Fathom’s expertise in characterizing copper-silver deposits and their surrounds,” Matich said.

The collaboration with the major and the study being carried out by Fathom complements a research program initiated with the University of Science and Technology (“AGH”) of Krakow, Poland.

The CESAR project and its potential for hosting a Kupfershiefer-type of deposit analogous to a large group of copper-silver deposits in Poland/ Germany of the same name, has grabbed the attention of one of the most important research centers in the world for the study of these sedimentary-hosted stratiform copper deposits which are also large repositories of silver.

In an April 21, 2020 press release, Max said it sent surface rock samples extracted from CESAR’s stratabound copper+silver mineralization horizons to AGH. Researchers at the university, which has worked extensively with Polish state miner KGHM Polska Miedź S.A., will conduct mineralogical and geochemical studies on the samples; also, a Masters-level student is planning on writing a thesis paper on the results.

Initial results from petrographic analysis of two samples from AM South were released by Max this week.

They confirm the presence of native copper, chalcolite, and malachite hosted in siltstone and sandstone. Covellite, a rare copper sulfide mineral, was also detected, having not been found previously. That could be significant, because copper sulfides are more profitable to mine as a result of their higher copper content. The copper is also more easily separated from other minerals, compared to copper oxides.

According to Max, It is anticipated the near surface copper oxides will transition to the richer copper minerals chalcocite (80% copper by weight) and covellite at depth.

“The petrographic study elucidated the relationships of the various copper minerals further reinforcing the similarity to Kupferschiefer mineralogy and to the stratigraphic control on mineralization,” Max CEO Brett Matich stated.

Value proposition

The three companies discussed here, Max Resource, Aurania Resources and Hannan Metals, have one thing in common: each of their properties appear to host “Kupferschiefer”-type mineralization analogous to the large group of sediment-hosted copper-silver deposits underlying Poland and Germany.

Aurania (TSX-V:ARN) has staked a large land position. Comprising 2,400 square kilometers, its Lost Cities-Cutucu project now straddles Ecuador and Peru. If the company can show there are structures below surface that point to a mineralized system, it could be onto something. So far, no drilling has been done.

Hannan Metals’ San Martin project in Peru also covers a large area – 600 square kilometers. Like Aurania, Hannan observes the Saraquillo Formation is associated with salt domes.

Max Resource is following the Kupferschiefer model of mineralization at its CESAR project in northeastern Colombia. “It’s the same stratigraphy with the sandstone below the limestone on top and the Kupferschiefer equivalent in the middle,” says Max’s head geologist, Piotr Lutynski.

There is no doubt there will be plenty of prospective news from all three (Aurania, Hannan and Max), with potentially major discoveries. I believe all three companies have an excellent chance to give its shareholders a big win.

Conclusion

The second most significant event in the life of a junior resource company (the first is a buy-out or production) comes when its efforts at developing a project are recognized by a major mining company.

For Max Resource Corp. that moment came after just 7 months into an exploration program on its CESAR copper+silver project. On May 13, Vancouver-based Max announced it has entered into a collaboration agreement with “one of the world’s leading copper producers”.

The first phase of the partnership with the yet-to-be-named company involves a technical study by Fathom Geophysics.

The aim of the study is to map stratigraphic (rock layers) features that can help to pinpoint stratabound copper-silver mineral horizons at CESAR.

The project has also grabbed the attention of one of the most important research centers in the world for the study of these sedimentary-hosted stratiform copper deposits which are also large repositories of silver.

Researchers with the University of Science and Technology (“AGH”) of Krakow, Poland are conducting mineralogical and geochemical studies on CESAR samples; Notably, AGH has a long history of cooperation with KGHM, the largest copper producer in Europe and the world’s second largest silver producer

Initial results from petrographic analysis of two samples confirm the presence of native copper, chalcolite, and malachite hosted in siltstone and sandstone. Covellite, a rare copper sulfide mineral, was also detected for the first time, indicating the potential for copper sulfide mineralization. Copper sulfides are more profitable to mine as a result of their higher copper content. Max believes the copper oxides near surface transition to the richer copper minerals at depth.

Max’s CESAR project appears to offer good value for investors looking to take a position in an early-stage copper-silver play. Rock chip samples taken thus far have returned high-grade copper and silver assays. The fact that the AM North and AM South targets appear to be large sub-horizontal sheets, that partly outcrop at surface, adds credibility to the Kupferschiefer analogy. In Poland’s Kupferschiefer deposits, continuous mineralization extends down dip and laterally for kilometers. Could the mineralization at CESAR do the same? If so Max could be looking at a district-scale, even a regionally extensive copper-silver mineralized system.

Of course it’s early stage. The targets will have to be drilled, although not as extensively as a copper porphyry.

Max has already interested a major copper company. They are currently conducting an important geophysical survey that will go a long way towards confirming what the panel samples are saying and establishing a presence in the Cesar district. The next moves are to significantly expand the footprint of the CESAR deposit, determine the continuity of the copper-silver mineralization, finance a drill program and to reveal the true potential of CESAR as the next Kuperschiefer style district.

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Max Resources (TSX.V:MXR), MXR is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.