Solar could devour most of the world’s silver reserves by 2050 – Richard Mills

2023.03.09

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty.

After Russia’s invasion of Ukraine, the flight to safety subsequently sent silver prices past the $26/oz mark, which was last seen in August, 2021.

This silver rally proved to be a flash in the pan, however. An aggressive interest rate hike campaign by the US Federal Reserve, along with a high US dollar, has kept the safe-haven metal in check.

Still, there are reasons to believe that longer term, silver will rebound.

Solar

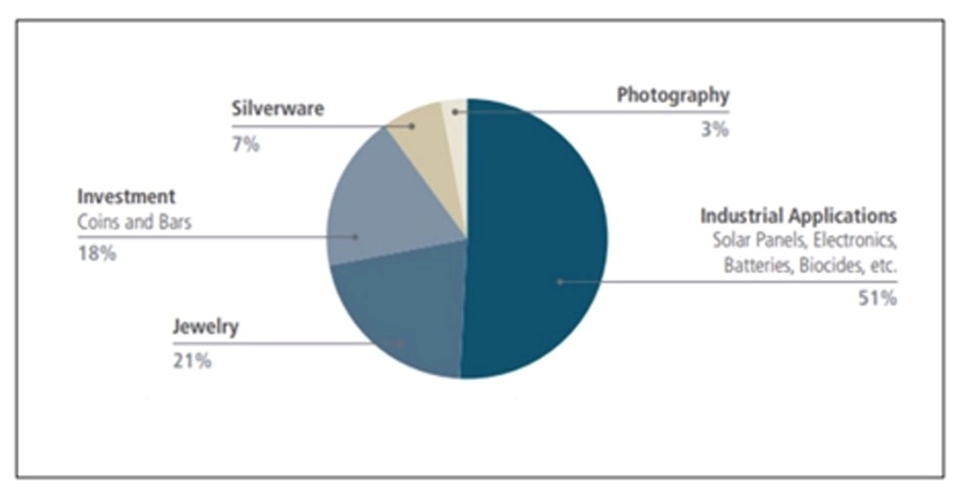

Much of silver’s value is derived from its industrial demand and supply fundamentals. It’s estimated around 60% of silver is utilized in industrial applications, like solar panels and electronics, leaving only 40% for investing.

More and more silver is being demanded for use in solar photovoltaic (PV) cells, as countries adopt renewable energy sources.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. A 2020 Saxo Bank report said, “Potential substitute metals cannot match silver in terms of energy output per solar panel.”

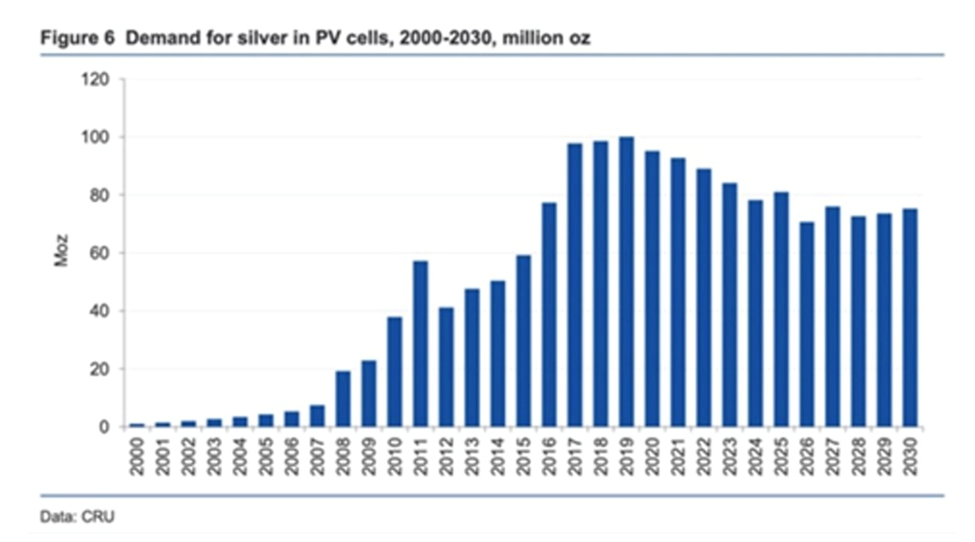

Using silver as conductive ink, photovoltaic cells transform sunlight into electricity. Silver paste within the solar cells ensures the electrons move into storage or towards consumption, depending on the need. It is estimated about 100 million ounces of silver are consumed per year for this purpose alone.

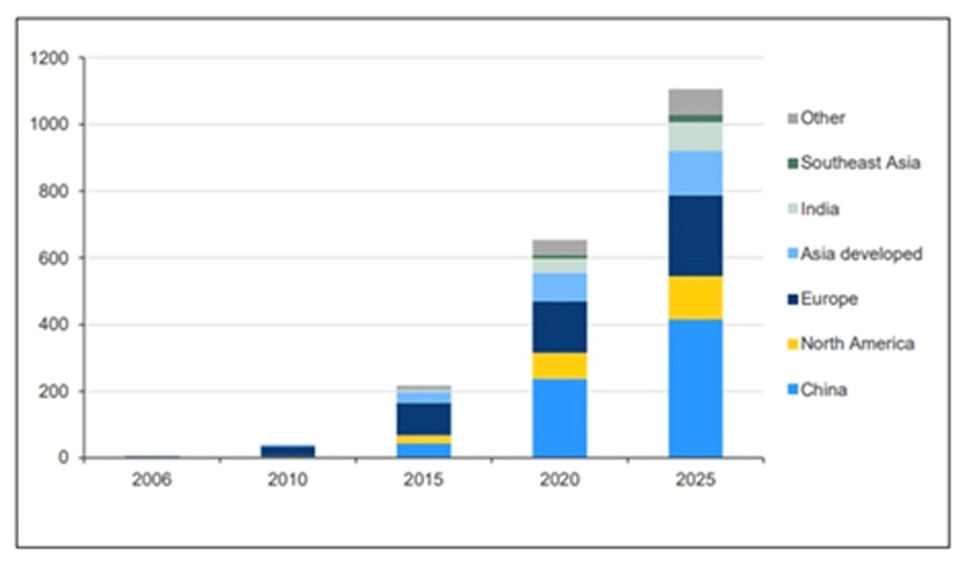

This figure is expected to rise in the coming years, with continued growth of electricity demand and renewable energy aspirations all pointing to rising solar power penetration.

Source: The Silver Institute & CRU Consulting

One projection has annual silver consumption by the solar industry growing 85% to about 185 million ounces within a decade, according to a report by BMO Capital Markets. Solar Power Europe expects global solar power installations will more than double in three years to reach 2.3 terawatts by 2025, up from 1 terawatt in 2022.

The US solar industry will likely be one of the leading drivers of silver demand. Installations grew 43% year over year in 2020, reaching a record 19.2 gigawatts of new capacity. By 2030, solar installations are expected to quadruple from current levels, according to a report from the Solar Energy Industries Association and Wood Mackenzie.

US imports of solar panels are finally picking up, Reuters said, after months of gridlock stemming from the Biden administration’s implementation of a law banning silica-based products made with forced labor. Most solar panels in the US come from China.

While each solar panel only uses a small amount of silver, with the demand for solar growing every year, it adds up. A new Australian study projects solar panels could use most of the world’s silver reserves (550,000 tonnes according to the US Geological Survey) by 2050.

A research paper by the University of New South Wales found solar manufacturers would likely require over 20% of the current supply by 2027, and between 85 and 98% of it by 2050.

Data from the Silver Institute showed silver offtake for photovoltaics hit a record 113.7 million ounces in 2021, more than double 2013’s 50.5Moz. 2022’s figures aren’t yet available, but analysts estimate solar panel production last year used about 127Moz.

The paper also noted that more efficient ‘N-type” technologies being developed, require more silver than current ‘PERC’ cells that make up over 80% of the market.

Another boost to silver demand may come from the “One Sun, One World, On-Grid” initiative, launched in the fall of 2021 by Australia, France, India, the US and the UK. The initiative plans to connect solar energy grids across borders.

Soldering

Adding silver to the process of soldering or brazing helps produce smooth, leak-tight and corrosion-resistant joints when combining metal parts. In addition, silver-brazing alloys are used widely in everything from air conditioning and refrigeration to electric power distribution. (The Silver Institute)

In 2021, brazing and soldering alloys used 47.7Moz of silver, representing 9.3% of the total industrial demand for silver that year. By 2030, the demand for this use is forecast to reach 58.8Moz, a 23% over 2021, according to a Silver Institute report titled ‘Silver in Brazing and Solder Alloy Materials’.

According to Specialty Metals, Whenever two different metals are joined together by brazing, welding, or soldering, silver almost always has a part to play. (Even in arc welding when the iron is welded to iron, silver can be found in the coatings that cover welding rods.) When silver is soldered to silver to make jewelry or decorative items, silver solder is used, along with fluxes that contain still more silver.

Silver is also used more and more today in devices where copper pipes are joined together to carry water or air. Not long ago, lead-based solders were used more extensively in these applications. Now that the toxic properties of lead are widely known, a shift to silver has taken place.

An alloy of silver and tin is often used due to its high mechanical strength, thermal fatigue properties, and wettability. Tin-silver alloys contain 3-5% silver and they are used in applications requiring high temperatures and reliability. SnAg alloys are also among the few alloys commonly utilized in the solar industry.

Market

The numbers have yet to be tabulated for 2022, however the latest (December) edition of The Silver Institute’s ‘Silver News’, states that silver demand was projected to reach a record 1.21 billion ounces, a 16% increase from 2021 demand. New highs were predicted for physical investment, industrial demand, jewelry and silverware.

Industrial demand was on track to grow to 539 million ounces, driven mainly by vehicle electrification, the rollout of 5G, and governmental commitments to solar power.

While institutional demand for silver has faced headwinds, due to rising interest rates leading to a decrease in silver ETF holdings, this has been countered by a surge in physical investment, which was on pace to jump by 18% in 2022 to 329Moz.

According to the Silver Institute, “Support has come from investor fears of high inflation, the Russia-Ukraine war, recessionary concerns, mistrust in government, and buying on price dips. The rise was boosted further by a (near-doubling) of Indian demand, a recovery from a slump last year, with investors often taking advantage of lower rupee prices.”

Silver jewelry and silverware were set to surge by 29% and 72%, respectively.

In contrast to robust demand across most categories, silver mine production last year was only forecast to rise by 1%.

After shifting to a deficit in 2021 for the first time in six years, the silver market was expected to post a second, and record shortfall in 2022.

The projected 194-million-ounce deficit compares to 48Moz in 2021 and would be a multi-decade high.

As for 2023, the Silver Institute expects global demand for silver to dip slightly to 1.15 billion ounces, but that would still be the second-highest year ever for worldwide silver consumption. Four factors that continue to drive silver demand, are industrial fabrication (electronics, solar panels, the automotive industry, brazing & soldering), jewelry, silver coins and bars, and silverware.

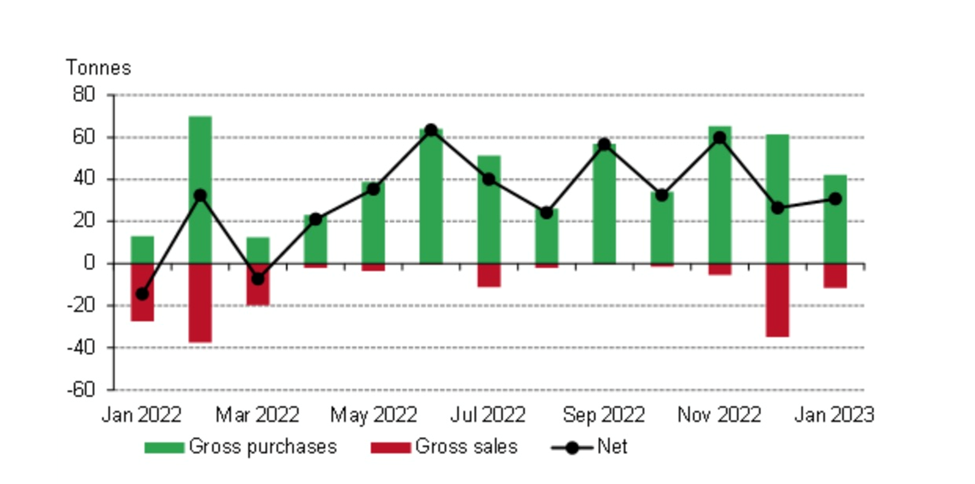

The Indian market is particularly strong for silver. Silver consumption there was forecast to surge by around 80% in 2022, Bloomberg said, as warehouse inventories were drawn down after two years of covid.

While little silver was bought in 2020 and 2021, because of hits to supply chains and demand, 2022 sales look back on track:

Local purchases may surpass 8,000 tons in 2022 from about 4,500 tons [in 2021], said Chirag Sheth, principal consultant at Metals Focus Ltd. That’s up from an April [2022] estimate of 5,900 tons.

Indian investors traditionally prefer to hold physical silver, however the introduction of new investment options, including exchange-traded products (ETPs) and “digital silver”, are expected to give them more opportunities to invest in the precious metal.

With digital silver, an investor can buy silver online at a relatively low price point. The metal is then stored in a vault by the seller. The customer can either sell it back on the same platform or take physical delivery in the form of coins or bullion.

Panelists at the LBMA gold conference in Lisbon, in October, agreed that physical demand for gold and silver remains exceptionally strong, particularly in Asia and the Middle East.

Gold

Investors often turn to precious metals during periods of economic or political turmoil, and especially when inflation is high. That’s because, unlike fiat currencies, gold and silver do not lose value to currency debasement; they are considered hedges against inflation.

Like with commodities and the dollar moving together, rather than inversely, gold and silver’s movement appears to be knocking historical trends.

The link between commodities and inflation

For the sake of simplicity, let’s stick with gold.

There are two factors at play. The first, and easiest to explain, is why gold isn’t doing better during this period of high inflation. The economy is inflating at the same time as central bank banks are raising interest rates. Gold’s price appreciation is therefore limited by higher rates and bond yields. Why invest in gold, with offers neither interest nor a dividend, when you can get a decent return on a government bond, or just by stuffing a bunch of cash into a savings account that nowadays pays around 3%?

The second factor is a big more complicated. Why is gold trading at $1,850, when the US dollar index is at 104? Central bank buying is one reason why gold has held its own over the past few months.

Central bank gold demand has reportedly seen a continuation from 2022’s record year of purchases, with CBs adding 31 tonnes to global gold reserves in January, the World Council said last week.

The largest buyer was the Central Bank of Turkey, followed by the People’s Bank of China and Kazakhstan’s national bank.

January’s central bank gold haul was 16% higher than December. The WGC sees the trend continuing throughout this year.

“We see little reason to doubt that central banks will remain positive towards gold and continue to be net purchasers in 2023,” the report said. “The healthy January data we have so far gives us little reason, at this time at least, to deviate from this outlook.”

Last year, central banks purchased 1,136 tonnes — the most on record and a more than 150% increase from 2021. (Kitco News, March 2, 2023)

Gold would undoubtedly be higher if investors were treating it as a monetary metal — one to go to as a safe haven. Again we find perplexity in the fact that, with all that is going on in the world — four hot spots in 2023 are the war in Ukraine, Iran protests, US-China trade relations, and North Korea — there appears to be little safe-haven demand for gold.

Instead, investors are piling into the tried and true haven, US Treasuries. As mentioned, government bond yields are up, the result of higher interest rates, and that is attracting a lot of foreign bondholders. According to the US Treasury Department, foreign residents increased their holdings of US Treasury bills by $44.1 billion in December.

That leaves only one other explanation for gold and silver strong performance amid a higher dollar, and that is the “float all boats” theory. I believe the general surge in commodity prices is also lifting up gold, like a rising tide, even though gold isn’t directly connected to electrification & decarbonization government funding, or infrastructure investments.

If we do end up with a recession, or if one of four global hotspots (Ukraine, Iran, North Korea, US-China trade relations) heats up, look for gold to gain further on strengthened safe-haven demand.

US consumers are getting crushed by high-interest debt and inflation

Conclusion

As our headline reads, the Silver Institute has projected solar panels could use most of the world’s silver reserves (550,000 tonnes according to the US Geological Survey) by 2050.

An earlier Silver Institute report said electric vehicles contain up to twice as much silver as gas-powered vehicles. Charging points and charging stations are also expected to demand a lot more silver.

Between robust demand for silver from the automotive, solar, industrial fabrication, jewelry and silverware sectors, and another year of tight mined supply (in an earlier article we proved peak silver), we are looking at a third straight year of deficits in the silver market.

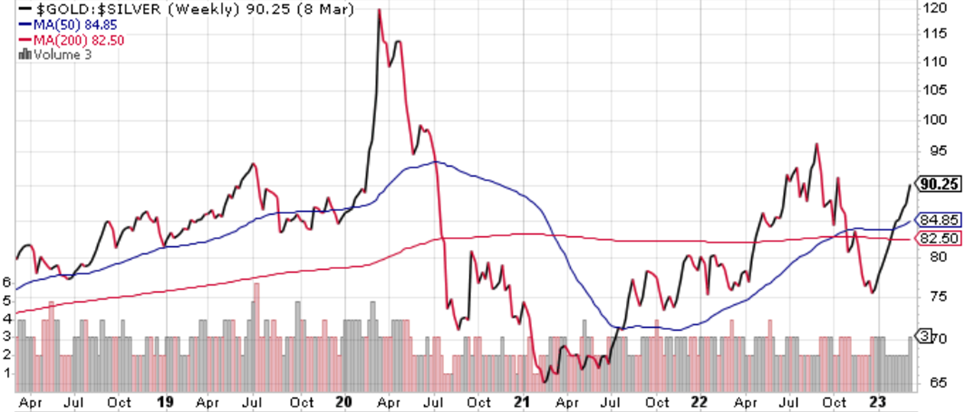

At a gold-silver ratio of 90, silver is currently extremely undervalued compared to gold. Historically, when the spread gets this wide, silver doesn’t just outperform gold, it goes on a massive run in a short period of time.

The gold-silver ratio above 80 is AOTH’s most reliable buy indictor for silver.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.