Skewed priorities: As people go hungry and freeze, spending by governments on military and debt interest soars – Richard Mills

2022.11.15

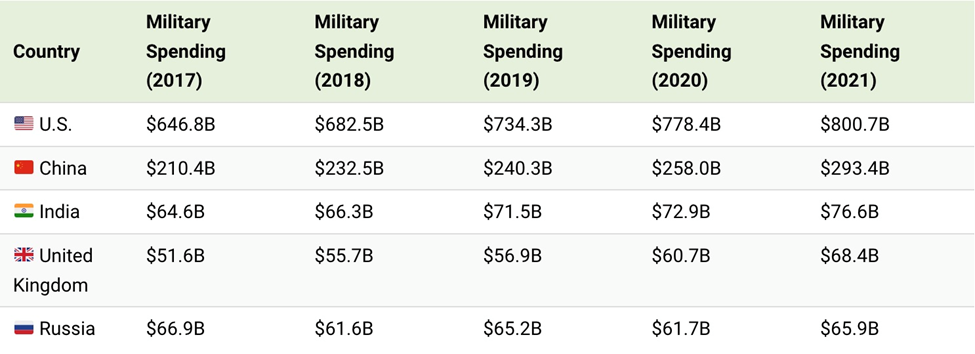

In 2021 the world’s militaries spent USD$2.1 trillion, marking the seventh straight year of increased global military spending.

The United States, unsurprisingly, was the top spender by far, forking out $801 billion, or just over a third of the total. US military spending last year increased 22% or $22.3 billion, compared to 2020, and the country’s total for 2021 was more than every other country in the top 10 combined, parsed by Visual Capitalist into the top 5, below.

In 2020, global debt hit $226 trillion, marking the largest one-year debt surge since World War II. As the world was clobbered by a once-in-a century pandemic and deep recession, global debt rose by 28% to 256% of GDP, according to the IMF’s Global Debt Database.

The rising debt trend couldn’t come at a worse time, as central banks worldwide raise interest rates to fight persistent and rising inflation. Forced to pay higher interest, many countries are finding their debt loads spiraling out of control.

Updated figures cited by the Financial Times show global debt has tripled since 2000 and doubled since 2006, reaching 352% of global GDP in the first quarter of 2022.

High food prices triggered by the war in Ukraine and numerous droughts have driven millions into extreme poverty and malnutrition. According to a World Food Program report, the number of people experiencing acute food insecurity is likely to climb to 222 million in 53 countries and territories.

Furthermore, an IMF paper says $5-$7 billion in further spending is needed to assist vulnerable households in 48 countries most affected by higher food and fertilizer import prices. An additional $50 billion is required to end acute food insecurity.

In Europe, historically high natural gas prices due to Russia’s severe NG export cutbacks, have forced shutdowns at energy-intensive businesses including steel and chemicals. Governments are reportedly issuing more debt to shield households and businesses from pain, and there are growing projections the energy crisis will spiral into a recession.

According to the New York Times, Underground storage sites around the continent have been fully stocked with emergency gas supplies. Nuclear power plants slated for closure in Germany will stay open. From France to Sweden, thermostats are being lowered to just 19 degrees Celsius, or 66 degrees Fahrenheit. Slovakia is even urging people to limit showers to two minutes.

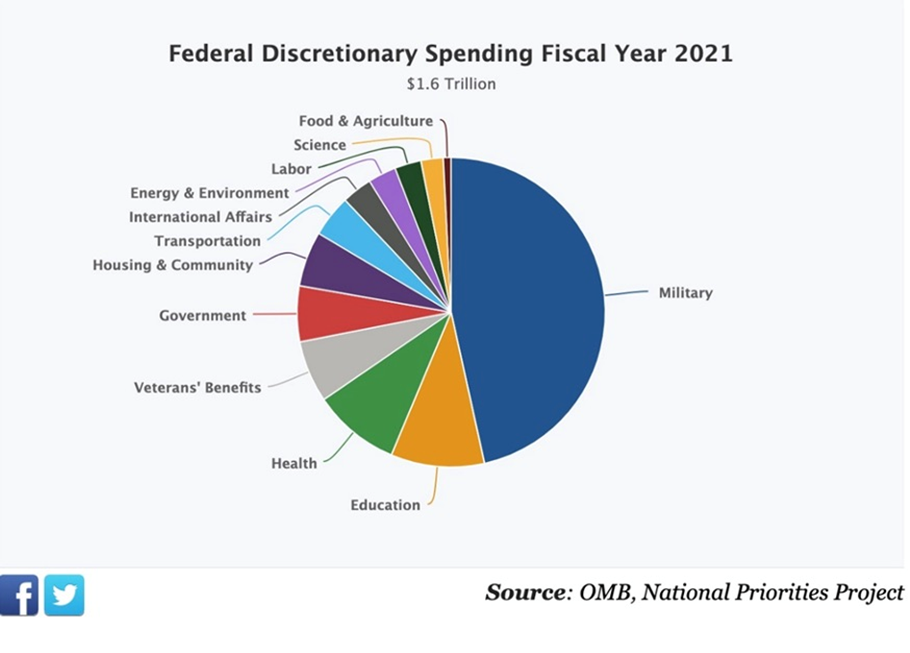

Sharply higher military spending. Record global debt levels. A food crisis and an energy crisis putting millions at risk of going hungry and potentially freezing to death. What do these four things have in common? The answer is that governments around the world are prioritizing expenditures on their militaries amid an ever-more-dangerous and polarized world. This, while drowning in debt, making necessary ever-higher interest payments, made worse by current central bank tightening, to fight global inflation, means less money is available for arguably the most important budget items: health, education, seniors & veterans, and the poor, to ensure they have electricity to keep them warm and food in their bellies.

AOTH breaks down this alarming trend and the accompanying statistics.

Drowning in debt

In July, the World Economic Forum published an article stating that total EMDE [emerging markets and developing economie] debt is at a record-high 207% of GDP. EMDE government debt, at 64% of GDP, is at its highest level in three decades, and about one-half of it is denominated in foreign currency… About 60% of the poorest countries are already in, or at high risk of, debt distress.

Developing-world economies that borrowed heavily in dollars when interest rates were low, are now facing a huge surge in refinancing costs.

The Fed, the debt, China and gold

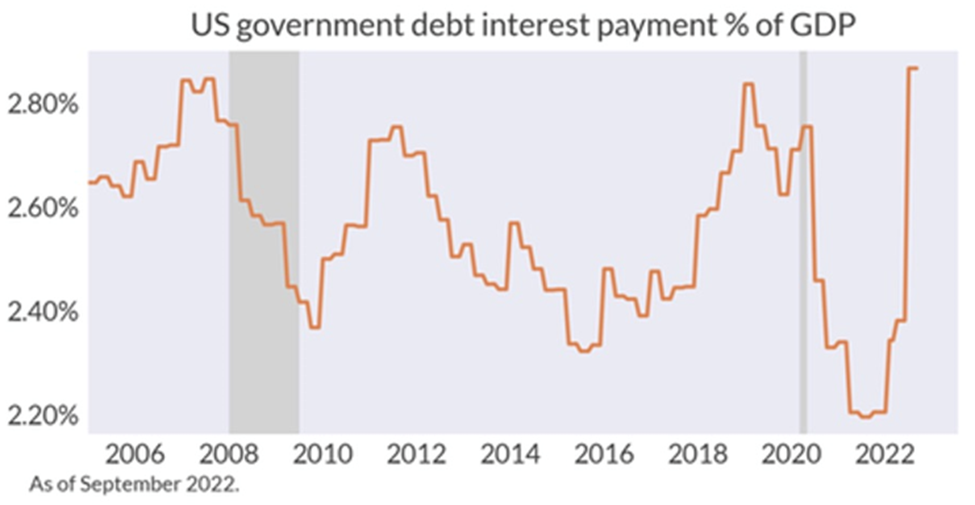

During 2021, before interest rates began rising, the US government paid $392 billion in interest on $21.7 trillion of average debt outstanding, @ an average interest rate of 1.8%. If the Fed raises the Federal Funds Rate to 4.6% (it’s already at 4%, following this week’s rate hike), interest costs would hit $1.028 trillion — more than 2021’s entire military budget of $801 billion!

The national debt has grown substantially under the watch of Presidents Obama, Trump and Biden. Foreign wars in Afghanistan and Iraq have been money pits, and domestic crises required huge government stimulus packages and bailouts, such as the 2007-09 financial crisis and the covid-19 pandemic in 2020-22.

Each interest rate rise means the federal government must spend more on interest. That increase is reflected in the annual budget deficit, which keeps getting added to the national debt, now sitting at a shocking $31.2 trillion.

The debt situation is no better in Canada. The Trudeau Liberals haven’t produced a balanced budget since they took power in 2015. Canadians may remember Justin Trudeau campaigning on a fiscal plan that would see “a modest short-term deficit” of less than $10 billion in each of the first three years and then a balanced budget by 2019-20. Well, that notion has long been forgotten by the Liberals, who were re-elected in 2021. The Liberals’ fall economic statement forecasts a small surplus of $4.5 billion in 2027-28 — the first since they formed government in 2015. Seven years of consecutive deficits put Canada’s federal debt at CAD$1.192 trillion.

Military spending gone amok

CNN states that US defense spending stood at $767 billion in fiscal 2022.

But this number is misleading. It grossly underestimates how much public money is actually plowed into the US military, through different departments. Allow me to explain.

The Air Force is allocated $52.4 billion, including $12 billion for 85 F-35 Joint Strike Fighters, the Navy will spend $34.6 billion and the Army receives $12.3 billion.

Other parts of the base defense budget are nuclear modernization ($27.7B), missile defense ($20.4B) and long-range fires ($6.6B).

The DOD will also spend $20.6 billion on space-based systems and $10.4 billion on cyberspace activities.

Now let’s look at what the $767 billion doesn’t include. The DOD budget does not count black ops, interest on the defense portion of the debt, and ongoing military obligations to veterans.

Other military expenses, such as military training, military aid and special operations, are put under other departments or are accounted for separately.

The DOD budget also doesn’t include the cost of overseas wars. That money is allocated to Overseas Contingency Operations. Since 2001, the OCO budget has spent $2 trillion on the War on Terror, none of which showed up under Department of Defense expenditures.

The budget for nuclear weapons is split between the Defense Department and the Department of Energy. According to the Congressional Budget Office (CBO), the DOD and the DOE have submitted plans for nuclear forces covering the period 2021-30. The $634 billion total averages out to just over $60 billion per year.

US nuclear forces consist of submarine-based ballistic missiles (SSBNs), land-based intercontinental ballistic missiles (ICBMs), long-range bomber aircraft, shorter-range tactical aircraft carrying bombs, and the nuclear warheads that those delivery systems carry.

This year almost two-thirds of the nuclear budget is within the DOD, with the largest costs being ballistic missile submarines and intercontinental ballistic missiles. The remaining third, paid for by the DOE, is primarily for nuclear laboratories and supporting facilities.

Because military spending includes Homeland Security, State and Veterans Affairs, and other defense-related departments, these costs combined come to $752.9B. If we add the bill for nuclear forces, @ $60B, and the US contribution to NATO, $811B, total expenditures for the US military amount to $2.39 trillion!

Remember, these figures were assembled prior to Russia’s invasion of Ukraine. Since that act of unprovoked aggression, the United States government has pumped more money into supporting the Ukrainian military than it sent in 2020 to Afghanistan, Israel and Egypt combined — three of the largest recipients of US military aid in history.

According to The Intercept, while the total amount of military assistance committed to Ukraine this year, as of Aug. 24, is $12.9 billion, the true figure is closer to $40 billion.

This includes a $675 million package of US military equipment, and a $3 billion tranche of security assistance for Ukraine whose capabilities, according to the Department of Defense, include:

- Six additional National Advanced Surface-to-Air Missile Systems (NASAMS) with additional munitions for NASAMS;

- Up to 245,000 rounds of 155mm artillery ammunition;

- Up to 65,000 rounds of 120mm mortar ammunition;

- Up to 24 counter-artillery radars;

- Puma Unmanned Aerial Systems (UAS) and support equipment for Scan Eagle UAS systems;

- VAMPIRE Counter-Unmanned Aerial Systems;

- Laser-guided rocket systems;

- Funding for training, maintenance, and sustainment.

US President Biden has also asked Congress to authorize an additional $13.7 billion, including money for equipment and intelligence.

How about the world’s second and third-biggest military spenders?

China began building up its military in the mid-1990s, with the goal of keeping its enemies at bay in the waters off the Chinese coast. Long seen to be inferior to the powerful US Navy, including the Japan-based 7th Fleet, the People’s Liberation Army is now the largest navy in the world, its submarines capable of launching nuclear missiles.

Shipyards in China recently launched the navy’s first two Type 075 amphibious assault ships, which will play a role similar to that of the US Marine Corps, giving them the ability, with supporting weapons, to fight in distant conflicts. The 40,000-tonne ships are like a small aircraft carrier with accommodation for up to 900 troops, heavy equipment and landing craft. First renditions will carry up to 30 helicopters, with later versions expected to accommodate fighter jets like the US F-35B.

A third Type 075 embarked on its maiden voyage and the navy could eventually have seven or more of these ships, according to China’s official military press.

China is also expanding its marine forces, estimated at between 25,000 and 30,000 troops, compared to just 10,000 in 2017. The PLA has two aircraft carriers and a third that was launched in Shanghai in July.

On land, the PLA’s ground force has traditionally been China’s foundation for asserting regional power. Its 915,000 active soldiers are nearly double America’s 486,000, according to the Pentagon China Military Power Report, cited by Al Jazeera. The army has been stocking its arsenal with high-tech weapons including the DF-41 intercontinental ballistic missile, which experts say could hit any corner of the globe, and the DF-17 hypersonic missile.

China’s air force is now the largest in the Asia-Pacific region and the third biggest in the world, with more than 2,500 aircraft and roughly 2,000 combat aircraft, according to an annual report by the US’s Office of Secretary of Defense published last year.

Most notably, the air force now possesses a fleet of stealth fighter jets, including the J-20, China’s most advanced warplane. It was independently developed and designed to compete with the US-made F-22.

China is also one of the world’s leading exporters of unmanned aerial vehicles (drones), especially to the Middle East. Its customers include the UAE and Saudi Arabia.

India, meanwhile, is shoring up its military with a 10% increase in expenditures. According to Defense News, this year’s defense budget is $54.2 billion, including $7.4 billion for new weapons purchases, $6.3 billion for the Navy and $4.2 billion for the Army.

Among the top line items:

- The Indian Air Force will spend most of its budget honoring existing commitments for French Rafael fighters, Russian S-400 air defense systems, Apache and Chinook helicopters, and Israeli medium-range surface-to-air missile systems.

- The Navy will use its funds to pay for one aircraft carrier, destroyers, stealth frigates and multirole helicopters.

- The Army will use its funds to pay for T-90 and Arjun MK1A battle tanks, BMP-2/2K infantry combat vehicles, Dhanush artillery guns, Akash air defense missiles, Konkurs-M and Milan-2T anti-tank guided missiles, and multiple types of ammunition.

The UK now spends a little over 2% of GDP annually on defense.

Will the Ukraine war force the UK government to re-order its priorities so that more is spent on the defence of Europe? As The Conversation notes, Britain is already the second largest spender in NATO ($73B) in 2021) after the United States ($811 billion). In fact the constitutional monarchy is one of only a handful of countries to have consistently met the NATO pledge, that each member spend 2% of GDP.

In September, UK Defense Secretary Ben Wallace told the Sunday Telegraph that defense spending would effectively double by 2029 to reach £100 billion ($107 billion) compared to just £48 billion ($51 billion) today.

For obvious reasons, accurate figures on Russia’s military expenditures are hard to come by, but a source familiar with finance ministry calculations told Reuters in September that the country is planning to spend 34 trillion roubles, or USD$600 billion on national defense, security and law enforcement between 2022 and 2025. Spread out over three years, that works out to about $200B a year.

From this total, 18.5 trillion roubles will be spent on national defense over the next three years, of which 4.7T will be spent this year, Reuters said. Moscow had planned to spend 3.5T roubles on defense this year out of a total 10.9T between 2022 and 2024 .

According to the Jamestown Foundation, Russian defense spending in 2022 may well reach as much as 5.5 trillion roubles ($90.9 billion) by the end of the year (Budget.gov.ru, May 2022).

It’s worth noting, that Russia’s 2021 military spending of $65.9B, was only 8% of the $801B spent by the United States on its military.

Tallying it up

Revisiting the number in the first paragraph, we have $2.1 trillion in global military spending in 2021 — a figure that is highly misleading, and under-estimated, because it doesn’t include the many items from other departments that should be accounted for in “actual” US military spending. By our calculations, that number is $2.39 trillion in 2022.

If we add on the more conservative figure of $12.9B (versus $40B) for America’s Ukraine war expenditures, bumping US military spending up to $2.5T, the real total for global military expenditures is 2.5T + $1.29T ($2.1T minus $801B) = $3.79T.

Now for how much governments are spending on interest payments on their national debts. The five largest economies in the world are, in order, the United States, China, Japan, Germany and the UK.

We know that last year, the United States paid $392 billion in interest on $21.7 trillion of average debt outstanding, @ an average interest rate of 1.8%. Obviously, with four straight interest rate increases in 2022, pushing the federal funds rate to 4.0%, interest payments this year will be substantially higher.

CNN reports that During fiscal 2022 alone, the federal government made $475 billion in net interest payments, up from $352 billion the prior year, according to the US Treasury Department. For context, that’s more than the government spent on veterans’ benefits and transportation – combined. And it’s nearly as much as the $677 billion spent on education.

According to Howard Wang of Conroy Investments, via Zero Hedge, If the current ~4.5% average yield curve rate propagates to all $31 trillion worth of debt, we are looking at $1.4 trillion per year just in interest payments. This would be 29% of the 2022 FY total Federal tax receipt.

According to Statista, total public expenditure on debt interest payments in China in 2021 amounted to around 1.05 trillion yuan, or USD$747 billion. These amounts have been climbing steadily over the past five years, with the amount in 2016, 499.1 billion yuan, roughly half of 2021’s 1.05 trillion.

Japan has the world’s highest debt to GDP ratio in the world, at 257%, more than other highly indebted nations including Sudan, Greece, Italy and Singapore. It has been the largest among G7 countries since 1998.

In its annual estimates over a five-year period, Japan’s Ministry of Finance projects debt servicing costs, worth 24.3 trillion yen for the next fiscal year ($165 billion), would hit 28.8 trillion yen in fiscal 2025, assuming interest rates of 1.3%. Japan is an anomaly among developed countries in keeping interest rates ultra-low right now. In September the Bank of Japan kept rates unchanged at -0.1%. According to Reuters, Japan’s monetary easing has effectively served to bankroll public debt roughly twice the size of Japan’s $5 trillion economy.

The economic engine of the European Union, Germany, isn’t immune to higher debt servicing payments, which according to Finance Minister Christian Lidner, could reach 30 billion euros next year due to rising interest rates and growing debt levels. The country only spent €4 billion on interest in 2021, or $3.9 billion. Tasmin News Agency confirmed that Germany’s interest payments on its public debt will increase from €16 billion ($15.9B) to almost €30 billion next year, due to the government issuing bonds linked to the inflation rate, which currently sits at 10.4%.

Soaring inflation is also making the interest payments on the United Kingdom’s national debt unsustainable. According to the Office for National Statistics, the government’s gross debt at the end of the second quarter of 2022 was £2.4 trillion, or $2.7 trillion. In June, debt interest payments hit £19.4 billion, the highest since monthly records began in 1997, putting the budget deficit on course to reach £100 billion this year, almost double its pre-pandemic level, according to The Guardian. The Office for Budget Responsibility said in 2022-23, the UK’s debt interest payments will be £83 billion, or $94.4B)

When interest payments on the debt are totaled for the five largest economies, we get the following:

United States $1.4 trillion

China $747 billion

Japan $165 billion

Germany $15.9 billion

UK $94.4 billion

Total: $2,422,300,000,000 or $2.422 trillion

Remember, this is only the debt interest payments for the five biggest economies. There are 195 countries in the world today, most of which carry substantial amounts of public debt they are paying interest on.

Also remember, global military expenditures are roughly $3.8 trillion, so when spending on militaries and interest payments are tallied up, it comes to $6.2 trillion.

Conclusion

Now let’s go back to what I said earlier about people going hungry and without adequate electricity for heating.

An IMF paper says $5-$7 billion in further spending is needed to assist vulnerable households in 48 countries most affected by the higher food and fertilizer import prices. An additional $50 billion is required to end acute food insecurity. For round figures, let’s call it $60 billion.

$60 billion is only 2.5% of the $2.4 trillion the five largest economies spend on debt interest payments.

$60 billion is only 1.5% of the $3.8 trillion being spent on militaries.

In other words, putting aside enough money to help vulnerable people affected by high food and fertilizer prices, and put an end to food insecurity, is a pittance compared to what governments are shelling out for military expenditures and interest on national debts.

It clearly shows how skewed our priorities have become.

“Every gun that is made, every warship launched, every rocket fired signifies, in the final sense, a theft from those who hunger and are not fed.” – President Dwight D. Eisenhower

More guns than butter: US military spending to exceed annual deficits

According to World Vision, more than 45 million people in 43 countries across the globe are at risk of starvation, with 584,000 already living in famine-like conditions (IPC5*), and the remaining 44+ million at grave risk of falling into famine (IPC4) unless they receive immediate life and livelihoods-saving assistance.

The group names five countries/ regions at risk of starvation due to the Ukraine conflict, that spiked the price of wheat to its highest level since 2008, and has hurt countries dependent on Russia and Ukraine for food imports. They are Venezuela, Northern Ethiopia, South Sudan, Syria and Afghanistan.

Closer to home, CBS News reports more Americans are using food banks for the first time, as high food inflation makes their weekly shop more expensive:

Food pantries across the U.S. say they’re struggling to meet demand as the rising cost of groceries is forcing more Americans to opt for donated meals.

A recent survey from Feeding America, a nonprofit network of 200 food banks, found that 155 food pantries reported a jump in families coming to their door.

High inflation has also driven a record number of Canadians to use food banks. A new study by Food Banks Canada, cited by The Financial Post, found there were nearly 1.5 million visits to food banks in March 2022, up 15% from 2021 and 35% from 2020 — which was the year many Canadians lost their jobs due to covid-19 and had to rely on government assistance to meet their daily/ monthly expenses.

Those programs have since been retired by the federal government.

On the other side of the Atlantic, Europe’s energy crisis threatens not only to make people uncomfortable as the weather turns wintry, but kill. Britain alone reportedly suffers more than 28,000 excess winter deaths a year, and 200,000 such deaths occur in Europe, with mortality increasing by 1.5% with ever 1 degree Celsius drop in temperature.

A bitterly cold winter and a sharp decline of constant heating could potentially trigger a six-figure increase in excess deaths continent-wide. In particular, areas with a high urban population (less able to provide wood as a backup heating source) or especially high dependence on Russian heating oil — such as France, Britain, or Germany — will be at much higher risk. (The Hill)

I’m no bleeding heart, but the amount we are spending to literally kill and maim soldiers and civilians, destroy housing/ create hundreds of thousands of homeless refugees, while shackled to higher and higher amounts of government debt/ soaring interest payments, as politicians spend, print and borrow money they don’t have, is deeply disturbing.

And as long as inflation continues to run hot, I don’t see any way out of this predicament. The US government for example is finding there are less buyers willing to hoover up Treasuries, meaning it may soon have to print money (again) to buy its own debt. This only adds to inflation and keeps pressure on the Fed to continue raising interest rates, which brings hardship to consumers/ businesses and results in higher interest payments, leaving less room in the budget for other, more important expenses, like health, housing, education, veterans’ benefits, etc.

When people have to choose between eating and keeping warm, as governments stroke checks to arms manufacturers and banks, there’s clearly something wrong with our system.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.