Silver’s Extreme Parabola

Adam Hamilton, CPA

Silver’s vertical moonshot has accelerated into a dangerous extreme parabola. This popular speculative mania fueling frenzied fear-of-missing-out buying will end badly, like all before it. Epic herd greed has catapulted silver far too high too fast to be sustainable, portending a brutal symmetrical plummeting soon. Traders need to be ready for that inevitable reckoning, either not chasing silver or tightening stop losses on it.

Warning of impending bubble bursts is fraught with peril for analysts. Parabolic ascents generate huge enthusiasm among traders, and thus can run way longer and higher than they ought to. Legendary English economist John Maynard Keynes is credited with warning “Markets can remain irrational longer than you can remain solvent.” So calling extreme topping events requires much humility, which is painfully earned.

I’ve long been a silver enthusiast, and have traded silver miners’ stocks professionally for over a quarter-century now with plenty of success. Way back in November 2001 in our monthly subscription newsletter, I first formally recommended physical silver bullion as a long-term investment. Then it was trading at just $4.20 per ounce! I’ve continuously maintained that investment recommendation ever since, always holding silver.

Silver is truly a great investment, everyone should have some decent allocation. Silver is way cheaper than gold making it easier to build positions in, and has much-greater upside potential. I’ve even gifted my kids silver bullion over the years for birthdays and Christmases, in addition to normal fun presents. I hoped owning a financial asset in their own possession would grow their interest in markets and investing.

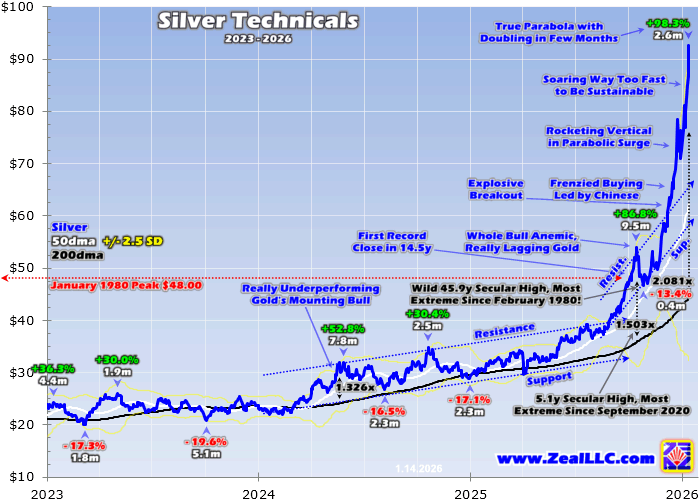

But no matter how awesome silver is, it has just skyrocketed to dangerous extremes. Just under a month ago, I wrote an essay on silver’s then near-parabola. Based on historical studies of these rare events, I define parabolas as doublings within two-to-three months following massive bull runs. This week silver indeed hit that ominous threshold, soaring an astounding 98.3% in just 2.6 months since late October!

Silver’s daily gains in these last few weeks have been crazy, including massive up days of 9.2%, 5.6%, 5.5%, 6.3%, 6.4%, and 6.9%! In the 31 trading days since December dawned, silver has surged or soared to new all-time-record highs on fully 16 of them! And silver’s overboughtness is far-beyond-extreme, unlike anything seen in most investors’ lifetimes. That prompted me to write this essay, which I will be attacked for.

The sheer violence of silver’s parabolic moonshot is glaringly-obvious technically, a massive discontinuity on any secular chart. All other price action pales in comparison to these last six weeks’. Here silver is rendered in blue, and its key 50-day and 200-day moving averages in white and black respectively. This kind of extreme chart is nightmare fuel for seasoned contrarians, the worst-possible time to chase and buy.

This unsustainable silver bubble is actually quite new. Since silver’s “market capitalization” is way lower than gold’s, the white metal tends to way outperform the yellow one historically. A month ago in my last silver essay, I found estimates of the values of known aboveground silver and gold globally. Silver’s was running about $3.7t in mid-December, less than 1/8th gold’s size! Smaller assets have proportionally-less inertia.

So a big part of silver’s historical allure has been its amplification of gold bulls, about doubling their gains. Yet as recently as mid-October, silver remained woefully shy of that precedent. At gold’s initial peak then, it’s epic monster bull had powered 139.1% higher since early October 2023! That was gold’s biggest bull in dollar terms since 1971, which means ever! Before that year the US dollar had been legally pegged to gold.

Yet over that same 24.5-month span where gold achieved 93 record closes, silver only hit 7 all in October 2025. Its total bull run paralleling gold’s mighty one was only 157.6%, for pathetic 1.1x upside leverage! So silver continued to really lag gold just 3.0 months ago. Silver’s bull was otherwise healthy then, showing no indications it would soon shoot parabolic. Yet silver still surged to really-overbought levels as gold peaked.

For short-term market directionality, absolute price levels don’t matter much at all. Vastly more important is how fast prices got there. That can be measured with various indicators revealing overboughtness and oversoldness. One of the best and my favorite simply divides prices by their 200-day moving averages. These 200dmas are fantastic baselines, moving slowly enough to reveal extremes yet still gradually evolving.

In mid-October when silver initially crested at $53.94, it had stretched 50.3% above its 200dma. Stated as a ratio, that Relative Silver or rSilver metric was running 1.503x. That proved a 5.1-year secular high, the most overbought silver had been since early September 2020! So like gold, silver definitely needed a breather. Periodic drawdowns are healthy and essential in bulls, rebalancing stretched technicals and sentiment.

Indeed from there silver corrected fairly-hard, plunging 13.4% to $46.70 in just seven trading days! That mirrored a sharp gold pullback of 7.4% in that span, for normal 1.8x downside leverage. History argued gold’s drawdown should’ve grown much larger, but it was short-circuited by frenzied Chinese buying. And because of the record government shutdown then, that was obscured by crucial gold-futures data going dark.

As gold bounced out of that largest selloff of its epic monster bull still at just 9.5%, silver recovered with it. That was righteous for six weeks or so into late November, with gold still down 4.3% from mid-October’s peak while silver managed a better 1.4% loss. But then during the Black Friday half-day session right after Thanksgiving, something changed. Silver rocketed 5.5% higher that day on a mere 1.3% gold surge!

Long writing both weekly and monthly subscription newsletters, every single day I stay deeply immersed in the markets. Studying them is my lifelong passion, so I love this aspect of my work. That includes taking one-to-two pages of notes including intraday-chart screenshots as every US trading day wraps up. Those observations underly all our newsletters and essays. Nothing on Black Friday explained silver’s surge.

But a couple weeks later as silver started blasting higher again in mid-December, it became apparent frenzied Chinese demand was the main driver. Striving to grow wealth is far-deeper-ingrained in Chinese culture than even America’s. So Chinese people are generally much more attuned to markets. Thus when some asset surges dramatically, popular speculative manias take root quicker. And silver’s timing was perfect.

Chinese culture has venerated gold for centuries, unlike in the West where most investors largely ignore it. So when gold soared nearly a third in just a couple months deep into new-record territory into mid-October, Chinese investors felt they were missing out. Per-capita incomes in China are less than 1/6th of Americans’, making gold even harder to afford for Chinese investors despite fractional-ounce bullion offerings.

China’s ruling Communist government also imposes strict capital controls, so Chinese investors don’t have many options for parking capital out of that economic system. But gold and silver investment remain legal, and precious metals have intrinsic value independent of countries’ economies and currencies. With silver accelerating in late November, Chinese traders took notice then started chasing in earnest in early December.

Despite gold only climbing 0.5% on December 9th, silver blasted up 4.5% besting $60 per ounce for the first time ever! Chinese investors worried they had missed the boat on gold’s record-shattering bull run pounced on way-more-affordable silver’s. Their subsequent increasingly-frenetic buying during the five weeks since largely fueled silver’s popular speculative mania, though Western investors chased Chinese gains.

Those flames of herd greed were further fanned on December 22nd, the Monday opening the holiday-shortened Christmas week when many if not most Western traders check out. That was a quiet news day with no catalysts according to my notes that afternoon, but gold still soared 2.4% to $4,442. That proved its first new record close since mid-October’s $4,350 peak nine weeks earlier! That supercharged silver greed.

That Christmas week alone with Chinese fear-of-missing-out chasing dominating precious metals, gold surged a major 4.4%. Yet silver was ground-zero for that manic rush, soaring a stupendous 16.9% for epic 3.9x upside! That stretched silver way up to 1.878x its baseline 200dma, the most overbought it had been since early March 1980 a whopping 45.8 years earlier! I thought about writing this essay then, but held off.

Why? Despite silver skyrocketing to extremes, then it was still “only” up 68.0% in 2.0 months. Though that was dangerous, silver’s gains remained well short of that parabola definition of a doubling in two-to-three months. While certainly excessive and irrational, Keynes’ wisdom about that persisting longer than you’d think and necessary humility in warning of toppings also gave me pause. Silver could shoot higher yet.

And indeed it did in January, soaring another 30.5% month-to-date already as of midweek! That rate of ascent is absurd, roughly a 60%-per-month or 720%-per-year pace! There’s zero chance silver can sustain such extreme gains for long, dramatically upping the odds for a symmetrical plummeting slaying this popular speculative mania. And silver’s resulting overboughtness levels at its latest $92.62 record are crazy.

On Wednesday which was the data cutoff for this essay penned Thursday, silver closed 108.1% above its baseline 200-day moving average! That was jaw-dropping to me, I couldn’t recall ever seeing anything so extreme. A fund-manager consulting client called and asked me to build him a spreadsheet showing how that silver overboughtness stacked up since 1971. The verdict was terrifying and incredibly bearish for silver.

That eye-popping 2.081x rSilver read proved the most extreme witnessed since all the way back in mid-February 1980 fully 45.9 years earlier! Since 1971, that level of silver overboughtness was the 39th highest day ever or top-0.28%. Yet the real kicker is fully 36 of the 38 even-more-extreme rSilver heights all clustered between the end of December 1979 to mid-February 1980! That proved the worst time ever to buy silver.

As I was just a little kid nearly a half-century ago, I don’t remember it directly. But I’ve studied the data in depth and have read plenty of great accounts from old-timers trading then. In just two months and one month into peaking at $48.00 in mid-January 1980, silver skyrocketed 196.1% and 103.8%! While certainly way more extreme than this recent 98.3% in 2.6 months, that was the last time silver was so overbought.

What happened next was soul-crushingly brutal. By late March 1980 just 2.2 months later, silver had crashed an astonishing 76.9% to just $11.10 per ounce! Silver exited that fateful popular-speculative-mania year fully 44.1% lower than it entered! Even worse, in nominal terms not adjusted for inflation silver didn’t best January 1980’s parabolic peak at $48.00 until late April 2011 a staggering 31.3 years later!

And even then it enjoyed only one single slight $48+ close, then fell back under January 1980’s bubble topping until early October 2025 another 14.5 years after that. So effectively in nominal terms that original peak held for 45.7 years! That’s an entire investing lifetime, no one can afford to wait that long to break even after foolishly buying into a popular speculative mania. Parabolic moonshots are exceedingly-dangerous.

That being said, thankfully today’s silver extreme is nowhere near as epic as January 1980’s. While silver skyrocketed to 3.388x its 200dma then, this week it was relatively much-more-restrained at 2.081x. In the two months leading into January 1980’s peak, silver again tripled up 196.1%. In that same span today, silver is only up 74.3%. And in inflation-adjusted terms, $93 silver now remains far under 1980’s bubble topping.

Using the US Consumer Price Index which is intentionally designed to chronically understate inflation, in today’s dollars silver’s real peak way back then was $199.93 per ounce! So while this silver parabola is the most extreme since January 1980’s, it is thankfully nowhere near as extreme as that insanity. Still this latest silver moonshot is very dangerous guaranteeing a serious reckoning, a brutal symmetrical plummeting.

Merely to return to late October’s correction low of $46.70 just 2.6 months ago, silver would have to fall 49.6%! It anything like that happens within weeks, it would be a crash. But if it is slower over months, it would be a severe bear market. Parabolic ascents generate so much herd greed that they soon attract in all available buyers on fear-of-missing-out chasing. That leaves only sellers, soon resulting in plummeting prices.

A savage reckoning is coming, a massive-and-fast drawdown looming. So what to do? For the love of all things good and holy, surely don’t join the greed-blinded herd in chasing silver’s extreme parabola! Don’t add any silver-related positions way up here, including mining stocks. If you have any short-term trades in this realm, add or ratchet-up tight trailing stop losses to preserve more of your gains when this reverses hard.

Despite it looking prudent, I don’t plan to liquidate any of my physical-silver-bullion investments way up here. They are long-term, and silver should continue powering higher on balance with gold in coming years after this parabola reckoning. But if you have any easily-tradable paper-silver positions like silver-ETF shares or silver futures, either tighten stops or sell those down. Silver’s initial plunge will be lightning-fast.

I’ve also been pondering adding silver-downside bets such as SLV put options, but haven’t pulled the trigger yet. With silver’s explosive volatility in these past six weeks, options premiums have soared. And again as Keynes warned, markets can stay irrational longer than we can stay solvent. In options timing is all-important, since they soon decay to zero as their expirations near. Betting against parabolas is also risky.

But the inevitable collapse of this one will spawn good buying opportunities in silver and its miners’ stocks. The current extreme greed permeating silver globally will reverse into universal fear as the reckoning runs its course. That will hammer everything silver-related sharply lower, likely in a matter of months on the outside. Save all the silver capital deployments you are tempted to do now until after this bubble bursts!

The bottom line is silver has skyrocketed into a dangerous extreme parabola. Silver just soared to its most-overbought levels witnessed since just after early 1980’s notorious bubble. In just a couple months after that one, silver hemorrhaged over 3/4ths of its value. And silver couldn’t decisively break out above that original parabolic peak until nearly 46 years later. Vertical moonshots are super-risky, nothing to be trifled with.

Though extreme, thankfully today’s silver parabola remains far less so than January 1980’s. Silver hasn’t soared anywhere near as much, it is way-less overbought, and it remains far under that earlier inflation-adjusted peak. So the inevitable coming reckoning and aftermath ought to be milder, but still severe. Traders should avoid chasing silver’s popular-speculative-mania gains, and gird for an imminent big-and-fast selloff.

Adam Hamilton, CPA

January 16, 2026

Copyright 2000 – 2026 Zeal LLC (www.ZealLLC.com)

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.