Silver47’s Red Mountain exudes scale and expansion potential – Richard Mills

2025.02.21

AOTH Research Report: Under the Spotlight – Silver47

Silver47 Exploration Corp (TSXV:AGA) is focused on developing high-potential silver projects to meet the increasing demand for silver driven by strong industrial demand, persistent structural supply deficits and increased investment interest in the face of increasing economic uncertainty, plus a compelling mix of critical minerals including silver, copper, zinc, lead, antimony and tin.

Among its trio of projects — Red Mountain, Adams and Michelle – Red Mountain is the flagship property.

Red Mountain

Located 100 kilometers south of Fairbanks, Alaska, Red Mountain is situated on Alaskan state-managed lands, free from Bureau of Land Management (BLM) or indigenous claims, covering approximately 620 square kilometers of highly prospective stratigraphy with highways, railway, and power within 30-80 km.

Silver47 owns 942 mineral claims and one mining lease, providing extensive exploration opportunities over a 60-km trend in a mining-friendly region near infrastructure.

The company says there are over 5,000 permitted drill sites on multiple untested geochemical and geophysical anomalies, which should indicate to potential investors a high potential for new discoveries.

The area is host to several world-class deposits and mines, including Fort Knox due west, and Pogo Northern Star to the south.

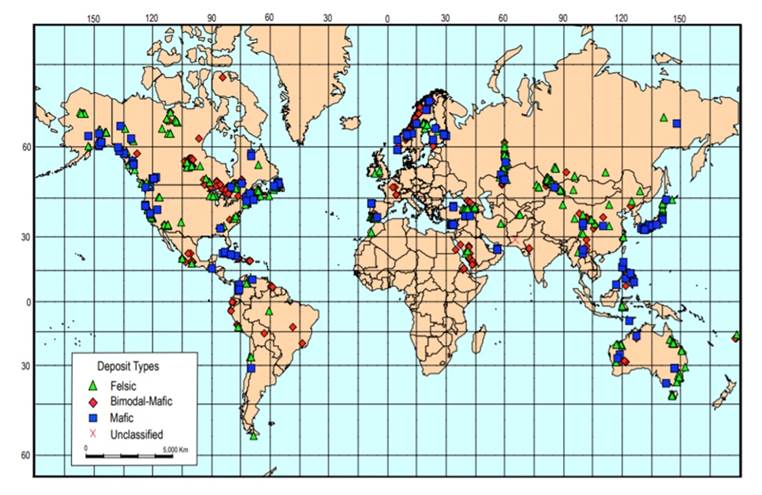

In particular, Silver47’s Red Mountain Project is nestled among several multi-million-ounce volcanogenic massive sulfide (VMS) and sedimentary exhalative (SEDEX) deposits, all located within the North American Cordillera, the mountain chain running along the Pacific coast of the Americas.

As seen on the map below, this includes Teck Resources’ Red Dog mine in Alaska, Barrick Gold’s former Eskay Creek mine in northwestern British Columbia now being developed by Skeena Resources, Windy Craggy, Macmillan Pass, Myra Falls, Sullivan, Trixie and Jerome.

VMS and SEDEX

SEDEX and VMS deposits are some of the largest and richest in the world.

Volcanogenic massive sulfides are created by volcanic-associated hydrothermal events in submarine environments. They are predominantly stratiform accumulations of sulfide minerals that precipitate from hydrothermal fluids on or below the seafloor. These deposits are one of the richest sources of zinc, copper, and lead, with gold and silver as byproducts.

VMS deposits are the primary source for many of the materials used to mold the modern world. These include zinc, lead, and copper.

Copper, for instance, is projected to reach a total demand of 40Mt in 20 years, which is twice the current mine supply of about 20Mt, according to BloombergNEF.

Therefore, the mining industry needs to invest heavily in new discoveries to fulfill the widening supply gap, and the type of mineral deposits that have been significant producers are the best bets.

VMS deposits have proven to be a major source of the world’s zinc and copper, accounting for 22% and 6%, respectively, of global production. They are also important producers of silver, gold, and lead, representing 8.7%, 2.2%, and 9.7% respectively.

To date, more than 900 VMS deposits have been discovered across the globe, with average production of roughly 17Mt grading 1.7% copper, 3.1% zinc, and 0.7% lead. These include a few giant mineral deposits (greater than 30Mt) and several copper-rich and zinc-rich deposits of median tonnage (~2Mt).

Volcanogenic massive sulfides, as the name suggests, are associated with ancient underwater volcanic activity dating back to more than 3 billion years, and still continuing to this day.

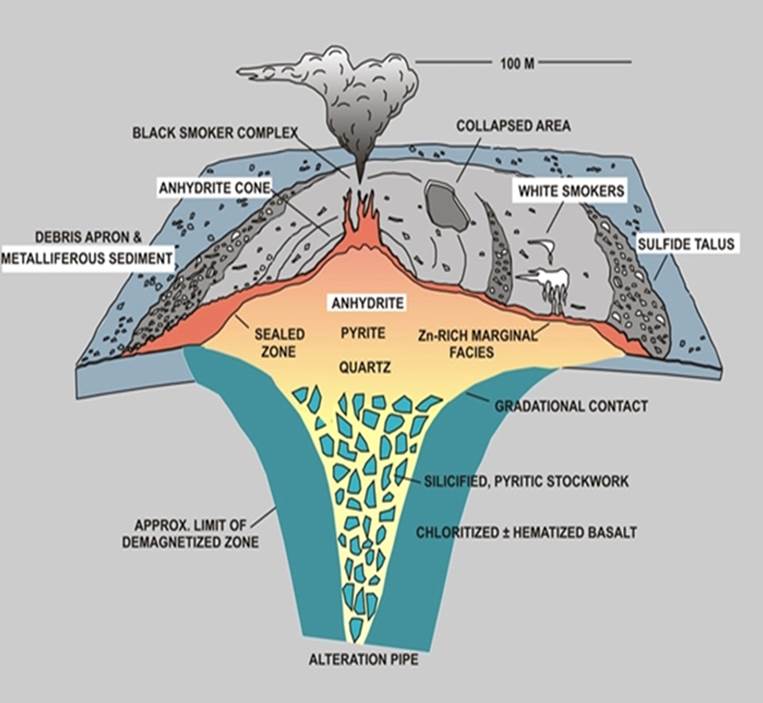

VMS deposits are usually formed during periods of rifting, when the earth’s crust is stretched thin due to the pushing and pulling of tectonic plates as they move towards and away from each other. As the crust warms, the ground softens, allowing hot magma to move up towards the ocean floor.

The magma either pushes through the earth’s surface, thus forming a volcano, or causes cracks that draw in seawater. The water is superheated and imbued with minerals, then expelled to the surface through black and white smokers. These plumes of minerals flowing from cracks in the ocean floor eventually settle back to the ocean the further they move away from the heat source.

The continual activity of the smokers and the deposition of minerals on the seafloor eventually form mineralized beds – the black and white smokers of today will become the VMS deposits of tomorrow. Through plate movements, ancient mineral-rich beds are transposed onto land that was once underwater.

VMS deposits exhibit distinctive characteristics that set them apart from other mineral formations. Typically, they feature a massive sulfide cap formed directly on the seafloor, with underlying stringer zones rich in copper-bearing minerals. These deposits often display vertical metal zoning, with copper concentrations near the vent transitioning to zinc and lead-rich zones in more distal areas. (Discovery Alert)

Belle of the ball

At Ahead of the Herd we believe there are many reasons a junior that comes upon a VMS deposit will be the belle of the ball as far as attracting investors, company suitors looking for a partner, a property, or an acquisition.

Due to the usual clusters of deposits, or ore lenses, in close proximity to the initial discovery, and the polymetallic nature of the ore, VMS deposits have immense potential for scaleable high grade, long-term production.

Typically, several deposits feed a central mill so VMS mine production can be scaled up to produce high metal volumes for many years. Also, the byproduct credits generated from production of different metals can help miners enhance their cash profile – one or two of the metals considered a byproduct might cover a portion, or all mining costs.

And, because of their polymetallic content, they continue to be one of the most desirable types of deposit because of the security offered against fluctuating prices of different metals.

You have rich base-metal content and often precious metals to boot. Usually when gold and silver prices are up, the economy isn’t doing so well and base metals prices are down. The reverse happens during economic booms. VMS mines are winners through all the ups and downs of economic cycles.

All of these reasons are why VMS deposits have long been recognized, by both majors and juniors, as potential “elephant” country.

Some of the largest VMS deposits in Canada include the Flin Flon mine (62Mt), the Kidd Creek mine (+100Mt) and the Bathurst No. 12 mine (+100Mt).

Sedimentary exhalative (SEDEX) deposits are geologically close cousins to VMS deposits, with the main difference being their host rocks. VMS deposits are dominantly copper-rich and associated with volcanic activity. SEDEX deposits are dominantly lead and zinc-rich and rely mainly on the heat caused by the depth and burial in deep sedimentary basins to drive the hydrothermal system. (911metallurgist)

Both deposit types share fundamental similarities in their formation processes, involving metal-rich fluids depositing minerals under specific temperature and pressure conditions.

SEDEX deposits generally occur in larger sizes and with more consistent grades compared to VMS deposits. They can range from 1 million to 100 million tonnes, with average metal grades between 10 and 12%, making them highly attractive exploration targets despite their relative scarcity. (Discovery Alert)

More than half of the world’s zinc and lead has come from SEDEX deposits like Mt. Isa in Australia, Red Dog in Alaska and the former Sullivan Mine in Canada.

SEDEX deposits are one of several types of sediment-hosted lead-zinc deposits. The “exhalative” part of the name comes from the fact that these deposits form when metal-rich hydrothermal fluids are exhaled from the seafloor into the ocean. Rich accumulations of lead, zinc and silver are found in the ore minerals sphalerite (zinc sulfide) and galena (lead sufide).

SEDEX deposits form deep under the ocean where vents in the sea floor allow hydrothermal fluids to mix with seawater. These hot, saline fluids have percolated through several kilometers of sediments and crystalline rocks, picking up precious metals along the way. Faults help propel the fluid upwards and out of the seafloor.

As the metal-rich hydrothermal fluids enter the cold sea water, they precipitate material onto the sea floor at and near the vents. Metal-rich minerals are deposited between layers of fine-grained mud, sand and silt.

No SEDEX deposits are older than 2.5 billion years and none are younger than 250 million years.

Airborne EM and mag survey along with ground magnetics can be useful prospecting tools. (Geology for Investors)

Polymetallic mines

Only around 30% of annual silver supply comes from primary silver mines. Over two-thirds is sourced from polymetallic ore deposits, including lead/zinc operations, copper mines and gold mines.

In 2020, only 27% of silver production came from primary silver mines. The rest was a byproduct of other metals.

“Native silver” found in the Earth’s crust on its own, is relatively rare. More commonly, it is mined alongside gold, or as a by-product of zinc-lead ore.

Exploration

The Red Mountain project area has a rich history of mineral exploration, with the first sulfide outcrop discovered in 1975. Ongoing exploration efforts continue to reveal the potential for further resource expansion, particularly in the Dry Creek and West Tundra Flats zones.

Repeating prospective geology hosts sulfide mineralization within multiple untested geochemical and geophysical anomalies.

Total drilling to date is 39,400 meters, Dry Creek and West Tundra Flats combined. Better core recovery from 2024 drilling resulted in improved grades. Drilling highlights from the Dry Creek Zone include:

- DC18-79: 6.0m @ 409 g/t Ag, 5.38 g/t Au, 1.21% Cu, 23.3% Zn+Pb (2,155 g/t AgEq)

- DC18-77: 5.0m @ 1,213 g/t Ag, 1.87 g/t Au, 0.4% Cu, 6.0% Zn+Pb (1,719 g/t AgEq)

And from West Tundra Flats:

- Multiple high-grade drill intercepts, including 7.3m @ 334.8 g/t Ag, 0.54 g/t Au, 0.07% Cu, 5.42% Pb+Zn (619 g/t AgEq)

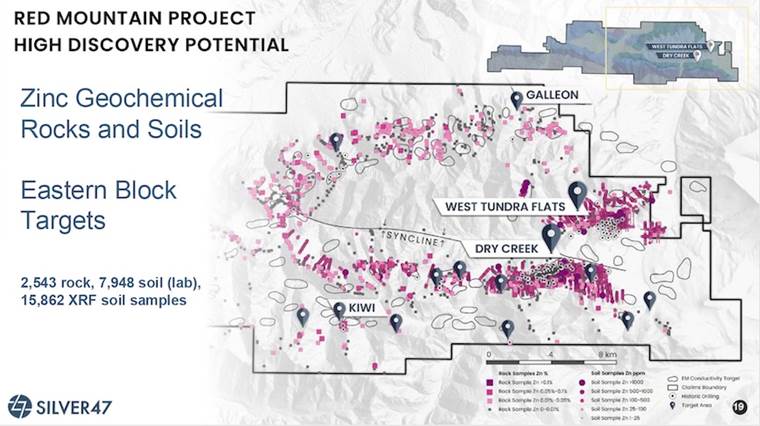

Further exploration and drilling targets are divided along a 60-km trend between Western SEDEX and Eastern VMS. The latter includes Kiwi and Galleon (1,265 g/t Ag), while the former includes Sheep Creek, Horseshoe and Keevy Peak.

Resource estimate

On Jan. 12, 2024, Silver47 came out with a mineral resource estimate for Red Mountain. The combined open-pit/ underground inferred resource amounts to 15.6 million tonnes at 335.7 g/t silver-equivalent (AgEq), containing 168.6Moz AgEq.

Expansion potential

Both Dry Creek and West Tundra Flats are open for expansion and it is “conceptually” estimated that $10M in drilling may add 8-12 million tonnes of underground material, in your author’s view a better than fair trade off between further dilution and in-situ increased shareholder value.

The high discovery potential is illustrated by the three maps below showing silver, copper and zinc showings in rocks and soils, gleaned from geochemical surveys. A total of 2,543 rock, 7,948 soil (lab) and 15,862 XRF soil samples were taken.

Galleon is a high-grade silver target, with silver samples up to 1,265 g/t Ag, 2.1 g/t Au and 5% Pb+Zn. Historical work includes mapping, trenching and prospecting, with drilling planned for this year. A 3.9-km IP geophysical survey identified two anomalies dipping south and striking east-west, consistent with local geology.

Another 2025 drill target is Horseshoe. The 2020 Keevy Trend SEDEX discovery contains semi-massive sulfides and 50-200m of mineralized stratigraphy, based on 2024 rock/ soil geochemistry.

The third priority target is Sheep Creek, also a SEDEX discovery. The strata-bound Ag-Zn-Sn massive sulfide occurrence features rock grabs up to 306 g/t Ag, XRF soils up to 60 g/t Ag, and up to 1.2% Sn (tin) over 2m reported from 1977 drilling. Silver47 is planning to map the area and to conduct dense soil XRF (X-ray fluorescence) to locate the extent of the mineralized horizons, thus aiding drill targeting.

Critical Metals

China has recently announced the halt of shipments of five critical metals to the United States. These elements include antimony, gallium, germanium, tungsten and indium. VMS deposits often carry critical metals in trace amounts. Prices, since the halt of exports, have soared making previously uneconomic amounts potentially economic.

“The identification of gallium and antimony, among other critical minerals, within the resource zones has the potential to add significant value to our Red Mountain project. While we are focused on growing the silver-gold and base metals resource at Red Mountain, further assessment of these critical minerals, which are used in a myriad of high-tech applications, is planned to better understand the potential contribution that they may have on the project.” Gary Thompson, CEO

Conclusion

The bullish market conditions for silver combined with its plethora of uses that are pushing demand past supply and creating market deficits for the fifth year in a row, have shaped the ideal environment for silver explorers like Silver47 Exploration.

Red Mountain has, so far, nearly 40,000m of drilling on the two main deposits, Dry Creek and West Tundra Flats. A 2024 combined open-pit/ underground inferred resource amounts to 15.6 million tonnes at 335.7 g/t silver-equivalent (AgEq), containing 168.6Moz AgEq.

Both deposits are open and there is plenty of room for expansion.

There are over 5,000 permitted drill sites with multiple untested geochemical and geophysical anomalies, indicating a high potential for new discoveries.

New high-grade silver targets include Galleon, Horseshoe and Sheep Creek.

High antimony and gallium assay values consistently occur within previously reported intervals of high-grade silver-zinc-gold-lead-copper massive sulfides and are distributed throughout the resources. Niobium and vanadium highs occur primarily in the western portion of Dry Creek.

Silver47 is tightly held at 50 million shares outstanding and had $740,000 in the treasury as of Oct. 31, 2024. About 40% of the shares are held by management, Eric Sprott and Crescat Capital. Four financings were held between 2021 and 2024, with the latest capital raise of $5 million done at 80 cents.

Key members of the five-member management team include CEO Gary Thompson, chairman and CEO of Brixton Metals, and VP Exploration Alex Wallis, who has over 15 years of exploration experience, including as the former project manager with APEX Geoscience, and the former country manager (Guyana) of U3O8 Corp.

Silver47’s 2025 drill program should provide plenty of news flow for investors including catalysts for share price appreciation.

Silver47 Exploration Corp.

TSXV:AGA

Cdn$0.50 2025.02.19

Shares Outstanding 50m

Market cap Cdn$25.0m

AGA website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard does not own shares of Silver47 Exploration Corp. (TSXV:AGA). AGA is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of AGA

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

1 Comment

Leave a Reply Cancel reply

You must be logged in to post a comment.

#Juniorresourcecompany #silver #copper #criticalmetals $AGA