Silver47: A silver exploration powerhouse – Richard Mills

2025.09.12

Silver is often mined as a by-product of gold, copper and lead-zinc.

In fact, there are few pure-play silver mines; only three mines in the United States are majority silver; they are Greens Creek in Alaska, the Lucky Friday mine in Idaho, and the Rochester mine in Nevada.

Silver47 Exploration Corp’s (TSXV:AGA) flagship Red Mountain is not a pure silver project, but it has 168 million ounces of silver-equivalent in a Jan. 12, 2024, resource estimate.

The combined open-pit/ underground inferred resource amounts to 15.6 million tonnes at 335.7 g/t silver-equivalent (AgEq), containing 168.6Moz AgEq. The other metals are zinc, lead, copper and gold.

But AGA also gained a handful of highly prospective new properties through a recent merger.

Silver47and Summa Silver (TSXV:SSVR) in May announced an agreement to merge their respective companies by way of a court-approved plan of arrangement.

Silver47 and Summa Silver merge into high-grade US silver explorer

According to the news release, the combined company will become a premier high-grade silver focused explorer and developer with a portfolio of silver-rich projects in the United States (Alaska, Nevada and New Mexico).

Collectively, mineral resources amount to approximately 10Moz silver-equivalent (AgEq) at 333 g/t AgEq of indicated mineral resources and 236Moz AgEq at 334 g/t AgEq inferred mineral resources, with substantial upside and a shared vision for significant additional silver discovery and consolidation.

The merger was completed on Aug. 1.

Silver is breaking out, up around 42% year to date, surpassing even gold. In January 2025, the Silver Institute forecasted another deficit in the silver market, with annual demand at 1.20 billion ounces and supply at 1.05 billion ounces. The 150-million-ounce shortfall would be the fifth consecutive year that silver demand outstrips supply.

Washington last month categorized silver as critical to US national security, meaning that any new silver mines in the United States will be highly valued.

(Among its update draft list of 54 critical minerals, the US Geological Survey added silver, copper, potash, silicon, rhenium and lead.)

The bullish factors for silver include the ongoing supply deficits, as silver miners fail to keep up with demand from the solar power sector and electric vehicles, specifically. Solid-state batteries and new applications like AI data center chips, advanced electrical relays, smart grid infrastructure upgrades, and every US manufacturing facility, will pile on more demand for silver. Mine supply has shrunk 7% since 2016.

The investment case for silver is also strong, and getting stronger, as market participants price in a 25-basis-points cut in September, and possibly a 50-bp reduction, despite the threat of inflation posed by the Trump tariffs, as imported goods get more expensive. In the first half of 2025, silver ETFs saw significant inflows, reaching 95Moz.

Trump is actively trying to manipulate the Federal Reserve’s Board of Governors, to replace current Fed Chair Jerome Powell with personnel more on board with interest rate cuts. A rate cut in September would certainly be a tailwind for precious metals.

The favorable market conditions for silver have shaped the ideal environment for silver explorers like Silver47 Exploration, which has 138 million shares outstanding. About 37% of the shares are held by management, Eric Sprott and Crescat Capital.

Red Mountain

Located 100 kilometers south of Fairbanks, Alaska, Red Mountain is situated on Alaskan state-managed lands, free from Bureau of Land Management (BLM) or indigenous claims, covering approximately 620 square kilometers of highly prospective stratigraphy with highways, railway, and power within 30-80 km.

Silver47 owns 942 mineral claims and one mining lease, providing extensive exploration opportunities over a 60-km trend in a mining-friendly region near infrastructure.

The area is host to several world-class deposits and mines, including Fort Knox due west, and Pogo Northern Star to the south.

Silver47’s Red Mountain project is nestled among several multi-million-ounce volcanogenic massive sulfide (VMS) and sedimentary exhalative (SEDEX) deposits, all located within the North American Cordillera, the mountain chain running along the Pacific coast of the Americas.

this includes Teck Resources’ Red Dog mine in Alaska, Barrick Gold’s former Eskay Creek mine in northwestern British Columbia now being developed by Skeena Resources, Windy Craggy, Macmillan Pass, Myra Falls, Sullivan, Trixie and Jerome.

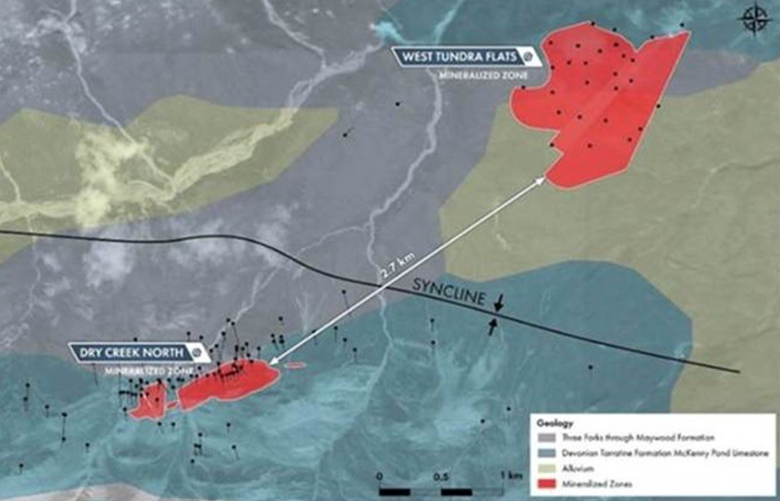

Red Mountain has, so far, nearly 40,000m of drilling on the two main deposits, Dry Creek and West Tundra Flats.

Both deposits are open and there is plenty of room for expansion. High-priority targets across the Dry Creek Syncline area include Hunter, Galleon and Glacier Creek. The project area is a potential VMS district.

VMS deposits are some of the largest and richest in the world.

Volcanogenic massive sulfides are created by volcanic-associated hydrothermal events in submarine environments. They are predominantly stratiform accumulations of sulfide minerals that precipitate from hydrothermal fluids on or below the seafloor. These deposits are one of the richest sources of zinc, copper, and lead, with gold and silver as byproducts.

Due to the usual clusters of deposits, or ore lenses, in close proximity to the initial discovery, and the polymetallic nature of the ore, VMS deposits have immense potential for scalable high grade, long-term production.

Some of the largest VMS deposits in Canada include the Flin Flon mine (62Mt), the Kidd Creek mine (+100Mt) and the Bathurst No. 12 mine (+100Mt).

On June 18, 2025, AGA commenced its fully funded drill program at the Red Mountain VMS project; 4,000 meters is planned to boost Silver47’s high-grade silver and critical minerals.

The program focuses on expanding the inferred 168.6 million silver-equivalent-ounce resource (336 g/t AgEq) at Dry Creek and West Tundra Flats, where previous drilling by Silver47 and prior operators indicates significant expansion potential.

West Tundra Flats and Dry Creek are about 2.7 kilometers apart, so the question Silver47 wants to answer is do they connect?

Summa Silver’s oversubscribed $6.9 million subscription receipt financing closed on June 17. Silver47 previously raised $9.8 million, so with the upsized private placement of $6.9M, AGA had $15.8M in the treasury.

On Aug. 25 Silver 47 announced a brokered private placement led by Research Capital Corp. on behalf of a syndicate of agents including Eventus Capital Corp and Haywood Securities. Up to 20 million units would be sold at $0.70 per unit for aggregate gross proceeds of up to $14M. The next day the financing was upsized to $20,000,400.

To date, nine holes have been completed at the Dry Creek and West Tundra Flats deposits, where zones of massive, semi-massive and disseminated sulfides have been intersected in both step-out and infill holes. Assays are pending.

Silver47 on Aug. 13 unveiled multiple exploration targets with strong discovery potential across the Red Mountain Project. Undrilled silver-rich and polymetallic occurrences are dispersed across a 55-kilometer, highly prospective east-west corridor the company is calling the Bonnifield District. (see map below)

Building on the inferred resource estimate totaling 168.6 million silver-equivalent ounces, the drill targets leverage past work. A database of historic geochemical and geophysical data, including 2,543 rock samples, 7,948 soil samples and 15,862 XRF soil samples has revealed a series of new targets outside the current resource zones that the company is developing for drilling in 2026.

Ongoing compilation highlights at least 35 mineralized prospects, many of which are undrilled or represent preliminary drilled discoveries open to expansion.

Multiple zones of high-grade surface mineralization marked by samples collected by a previous operator representing significant polymetallic upside are highlighted by grades of:

- 1,295 g/t silver at the Galleon target

- 3.8 g/t gold at the Horseshoe target

- 16.2% copper at the Kiwi target

- 32% zinc at the Anderson Mountain target

- 20% lead at the Jack Frost target

- 4,850 g/t antimony at the Bib target

- 149 g/t gallium northeast of the West Tundra Flats deposit

- 98 g/t indium at the Jack Frost target

- 0.13% tin at the Sheep Creek target

Red Mountain hosts five critical minerals scarce in the US, including silver, zinc, copper, tin, antimony and gallium, which will be evaluated during this drill program to support domestic supply chain security.

“Our Red Mountain Project in Alaska is emerging as a premier silver and critical metals asset in the U.S.,” said Silver47’s CEO Galen McNamara.

“By leveraging extensive historic data, we’ve identified dozens of high-potential targets along broadly mineralized trends. The prospectivity of these targets was first identified by past operators, and I agree; the data suggest the likely presence of additional undiscovered and potentially giant VMS deposits on the project. I am unaware of any other domestic mineral projects with similar polymetallic discovery potential. In addition, ongoing drilling at Dry Creek and West Tundra Flats continues to intersect promising sulfide zones, with assays pending, positioning Red Mountain to deliver significant value and strengthen domestic critical mineral supply chains in the future.”

Priority VMS exploration targets at the Red Mountain project are dispersed across the highly prospective Bonnifield District. The targets vary from zinc-rich to copper-rich and many have associated high-grade silver and local gold mineralization.

Four main target trends are defined and include: Dry Creek Syncline, Keevy Trend, Last Chance Corridor and Wood River Trend.

Many of the targets across the Dry Creek Syncline area were known historically, however, numerous high-priority targets across the Keevy and Last Chance areas were more recently identified through regional stream sediment, ridge-spur soil and rock geochemical surveys and project-wide electromagnetic geophysical surveys completed by a past project operator. Of the 30 known targets as well as other un-explored EM targets, only 11 targets have been drill-tested, five of those with less than three holes each.

Mogollon

AGA’s most interesting new project, Mogollon, gleaned from the Summa Silver merger, is in New Mexico.

The project is a continuation of the big vein systems found in Mexico and is thought to be one of the biggest epithermal vein systems in the western United States.

Mogollon has shown good results to date, for example 31 meters at 448 grams per tonne silver-equivalent, and 23.2m @ 433 g/t AgEq.

For an illustration, look at the red-colored silver veins criss-crossing almost the entire project in the map above.

Mogollon has an inferred resource of 32 million oz of silver-equivalent; it grades 367 AgEq grams per tonne. The grade is good, metallurgical recoveries are 97% for silver, 98% for gold, and it’s interesting in that all of that work has been done on only 2.4 kilometers of these vein structures. There’s still 77 kilometers of vein structures of silver and gold that have not been drilled.

The idea would be Silver47 to explore Mogollon in the winter, allowing for meaningful growth to the 32Moz resource. Of course, you have the whole vein field that hasn’t even been tested yet.

Hughes

Silver47’s second new project is in Nevada; it’s in the historic Walker Lane District and it’s very close to Tonopah, the queen of the Silver District.

BlackRock Silver has 100 million silver-equivalent oz on the west side of the district and Silver47 has the east side of the district: they have a resource on the Hughes, an inferred resource at 33 million ounces of silver-equivalent and then there’s another 10 million ounces in the indicated category.

Kennedy

The third new project is Kennedy; it was new to Summa and not much work has been done. But AGA knows there’s 22 km of gold and silver veins.

On Sept. 4 Silver47 presented assay results from a rock sampling program at Kennedy highlighting an expansive high-grade gold and silver system.

Highlights included:

- 21.9 g/t Au, 2,336 g/t Ag, 8.56% Cu (Borlasca Vein)

- 6.2 g/t Au, 3,037 g/t Ag (Fourth of July Vein)

- 40.4 g/t Au, 232 g/t Ag (Gold Note Vein)

- 39.4 g/t Au, 370 g/t Ag (Cricket Vein)

- 12.7 g/t Au, 305 g/t Ag (Accident Vein)

- 15.9 g/t Au, 323 g/t Ag (Coyote Vein)

- 19.5 g/t Au, 273 g/t Ag (Danneburg Vein)

- 30.4 g/t Au, 148 g/t Ag (Imperial Vein)

- 3.1 g/t Au, 583 g/t Ag (Trail/Senator Vein)

- 44.5 g/t Au (Hidden Treasure Vein)

The company notes it has staked substantial additional land around the mineralized vein system covering all prospective open ground around the Kennedy district. Sampling across a 3 km x 2 km area reveals widespread gold and silver mineralization. Plus, the 22 km of near-surface veins that are largely untouched by modern exploration.

This fall, a program including geological mapping, rock chip sampling, ground geophysics, and soil geochemical surveys is planned to pinpoint high-priority drill targets.

Peak silver

Like gold, we can study the supply-demand picture for silver to get a sense of whether we’ve reached peak mine supply.

At AOTH we differentiate between the total silver supply, which lumps in recycled silver with mined silver, versus mine supply on its own.

According to the 2024 World Silver Survey, in 2023 global mine fell by 1% year on year to 830.5 million ounces. Output was significantly affected by the four-month suspension of operations at Newmont’s Peñasquito in Mexico following strike action. This was compounded by a drop in production from Argentina due to the processing of lower ore grades at some mines and the closure of Pan American Silver’s Manantial Espejo mine.

Silver recycling rose for a fourth consecutive year, up 1% in 2023 to a 10-year high of 178.6Moz.

Combined, therefore, we have total silver supply reaching 1,010.7Moz (or 1.010 billion ounces) in 2023.

How about demand? According to the World Silver Survey, after a record 2022, global silver demand fell by 7% last year to 1,195Moz, still 9% up on the next-highest total.

2023 demand of 1.195 billion ounces outstripped supply of 1.010 billion ounces by 185Moz. But remember, recycling is included in the total supply. When we take recycling out, 178.6Moz, we get an even greater deficit of 363.6Moz.

This is significant, because it’s saying mined silver supply last year of 1.010 billion ounces was unable to meet total demand, industrial plus investment, of 1.195 billion ounces. It fell short by 185Moz, and that was including recycling.

This is our definition of peak mined silver. Will the silver mining industry be able to produce, or discover, enough silver that it’s able to meet demand without having to recycle? If the numbers reflect that, peak mined silver would be debunked.

Silver’s time

The Fed is arguably bumbling into a similar policy mistake that they made in the 1970s, that of cutting rates too soon after an initial inflation spike in July.

Will the Fed cause an inflation mountain by lowering rates too soon? — Richard Mills

US producer prices increased by the most in three years in July amid a surge in the costs of goods and services,

Companies are starting to pass on higher input costs to their customers after months of “eating them”. The higher costs are weighing on corporate earnings, putting shareholder pressure on firms to maintain profit margins and “pass through” the tariffs.

The Producer Price Index (PPI) in July rose 0.9% from June, the largest advance since consumer inflation peaked in June 2022, said a report by the Bureau of Labor Statistics (BLS). It climbed 3.3% from a year ago.

The Personal Consumption Expenditures (PCE) price index was +2.6% in July, and the core PCE (goods and services minus food and fuel, and the Fed’s preferred measure of inflation) was +2.9%, up from 2.8% in June and the highest since February.

Economist Torsten Slok warned about this at the Jackson Hole Symposium in August, where he said the Fed see structural distortions from tariffs and immigration policy.

(Tariffs are inflationary because they force importers to pay an extra “tax” on imports, that are eventually passed onto consumers. Immigration restrictions are inflationary because they pull workers out of the economy. The removal of workers is pushing up wages in industries like agriculture, construction and hospitality.)

If those forces keep inflation sticky and Powell cuts rates, as he’s under pressure from the White House to do, Slok wrote that he could be vulnerable to a 1970s-style “stop-go” policy mistake — the backdrop for the second inflation mountain.

In such a scenario, reminiscent of the ‘70s, if the Fed loosens policy prematurely, inflation could spike, leading to the painful corrective measures seen under Powell’s predecessor Paul Volcker, who hiked rates aggressively and weathered severe, double-dip recessions. — Fortune

Trump is highly motivated to get the Fed to cut interest rates so that he doesn’t have to finance the national debt at higher rates when US Treasury bonds roll over. It looks like Trump will get his wish.

He nominated Stephen Miran, chair of the Council of Economic Advisors, to replace Adriana Kugler on the Federal Reserve Board of Governors. Fed Governor Christopher Waller, viewed as more dovish, could be Trump’s pick to lead the central bank, reinforcing expectations of easier policy. Trump could either fire Powell or wait until his term ends next May before appointing a successor more to his liking.

Gold’s real secular move has yet to even begin – Richard Mills

Interest rate cuts are a tailwind for precious metals. Gold is up over a third year to date, hitting $3,500 an ounce for the first time last week. Silver had done even better, rising 42%.

The dollar, meanwhile, suffered its worst first-half performance in 50 years. A low dollar is generally good news for gold/silver and gold/silver stocks.

Barron’s pointed out that gold is getting a tailwind from buying by central banks, and said that gold’s recent rally, and the signals it echoes, shouldn’t be dismissed as merely an inflation warning. It is a signal that the US is at risk of losing its role at the center of the financial system as doubts rise about the dollar’s long-term value.

Peter Schiff compares the beleaguered dollar to the Roman denarius which used to represent a fair day’s wage for soldiers and laborers. Eventually the denarius, like the dollar, became debased, and within a few generations, it could hardly buy basic staples like bread. For centuries there was a monetary vacuum — other coins tried to replace the denarius but none ever could. The dollar is approaching a similar vacuum. With no trustworthy alternative to take its place as the global reserve currency, central banks are buying gold.

Influential investor and financial commentator Ray Dalio recently warned that the US dollar and other reserve currencies are waning in appeal due to high government debt burdens. The US government’s debt-service payments now equal about a trillion dollars a year in interest, with about $9 trillion needed to refinance the debt which will mature this year.

A top economist says the US is at the ‘Edge of the cliff’ and in a full-blown labor recession that risks spilling into the rest of the economy.

Moody’s economist Mark Zandi has been closely watching what he describes as a “labor recession” unfold, with revisions for June showing a contracting workforce for the first time since 2020. Last Friday’s report did nothing to dissuade him of the notion, and now the Moody’s economist told Business Insider he’s looking ahead for signs that the job-market downturn could spill into the broader economy.

Could history repeat itself and lead to stagflation? The signs are worrying.

In 1979, then US Federal Reserve Chair Paul Volcker faced a serious challenge: how to quell inflation which had been wracking the economy for most of the decade.

Not only was inflation going through the roof, but economic growth had stalled, and unemployment was high, rising from 5.1% in January 1974 to 9% in May 1975. In this low-growth, hyperinflationary environment we had “stagflation”.

Volcker is widely credited with curbing inflation, but in doing so, he is also criticized for causing the 1980-82 recession. He did it by aggressively raising the federal funds rate. From an average 11.2% in 1979, Volcker and his board of governors through a series of rate hikes increased the FFR to 20% in June 1981. This led to a rise in the prime rate to 21.5%, which was the tipping point for the recession to follow.

If the Fed carries through with an interest rate cut in September, and potentially two more cuts before the end of the year, amid rising inflation, a second inflation mountain similar to the one that grew between 1978 and 1982 could easily form between 2026 and 2028.

If the employment situation worsens and inflation keeps climbing, look for economic growth to sputter as the US enters stagflation.

According to economist and Project Syndicate author Stephen Roach,

The supply-chain disruptions during the pandemic look almost quaint compared to the fundamental reordering of global trade currently underway. This fracturing, when coupled with US President Donald Trump’s attacks on central-bank independence and preference for a weaker dollar, threatens a prolonged period of stagflation. — Stagflation for the Ages

How has gold done during stagflation? As it turns out, quite well.

In fact, gold outperforms other asset classes during times of economic stagnation and higher prices. Of the four business cycle phases since 1973, stagflation is the most supportive of gold, and the worst for stocks, whose investors get squeezed by rising costs and falling revenues. Gold returned 32.2% during stagflation compared to 9.6% for US Treasury bonds and -11.6% for equities.

The resumption of the Fed’s cutting cycle means that gold and silver should outperform even a hot equity market, states Sameer Samana, head of Global Equities and Real Assets at Wells Fargo Investment Institute.

“It’s becoming harder and harder to make a bear case for really anything other than bonds, given this pivot by the Fed,” Sameer said via Kitco.

Goldmoney’s Alasdair Macleod said during the first week of September that “There’s growing appreciation that the gold and silver bull has returned,” noting the Sept. 2-5 price action was a turning point.

Among the background factors driving bullish silver and gold chart action were plans for a non-dollar currency area; a developing G7 bond crisis; and technical analysis pointing to higher gold and silver prices.

He notes the prospect of the gold-silver ratio declining from its current 88 to 50, pushed down by the falling dollar. “With gold at $4,000 and a ratio of 50, that makes silver $80. This is not a forecast, only an illustration of silver’s potential,” Macleod writes.

Precious metals analyst Hubert Moolman posted a Silver/ US Dollar chart dating from 1983. He says that based on the fractal in the chart (a fractal is a pattern of five consecutive price bars that signals a potential trend reversal or continuation), “it is expected that we are now likely in a sustained silver rally similar to 2010-2011, for example.” Silver hit an all-time high of $49.51 in April 2011.

Further, Moolman showed in a previous article that significant silver peaks occurred within 8.5 years after the Dow/gold ratio peak, with the Great Depression silver peak occurring the soonest (6 to 7 years after).

“Given that silver actually rallied on a sustained basis for at least 2 years before each of these peaks, we are likely to see silver rally for most of the coming 20 months,” he wrote.

FX Empire wrote that Silver climbed within striking distance of $42 an ounce on Monday, posting its strongest rally since 2011 as a deteriorating U.S labour market reinforced expectations of a September Fed rate cut.

If the Fed makes a “jumbo rate cut” of 50-bp, it “could send precious metal prices into the stratosphere,” FX Empire predicts.

The publication says momentum points to higher highs beyond the 42% gain silver has already made this year:

- Flows into physical Silver and ETFs continue to accelerate. “Every indicator we track is flashing green” says GSC Commodity Intelligence. “Institutional positioning, ETF inflows and physical demand are all converging to create what we believe is the most powerful setup for Silver in more than a decade.”

- Labour market weakness has cemented the case for monetary easing, while persistent inflation ensures real yields remain negative. At the same time, geopolitical uncertainty – from tariff disputes to renewed trade tensions amplifies safe-haven demand. “The asymmetry of risk-reward is staggering” adds GSC Commodity Intelligence. “A single well-timed position in Silver could quickly deliver what used to take months – if not years – to achieve.”

- If policymakers opt for a 50 basis-point cut, such a decision would be the textbook trigger for a new Supercycle – a sustained multi-year uptrend in Commodities last seen during the post-2008 Global Financial Crisis.

- Beyond monetary policy, Silver’s fundamentals are screaming higher. The market is on course to register its fifth consecutive annual supply deficit with mine output unable to keep pace with industrial demand. Consumption is exploding across growth sectors. Solar panels and renewable technologies continue to absorb increasing volumes of Silver thanks to its unmatched conductivity. The expansion of electric vehicles and electrification infrastructure is also fuelling demand, while AI data centres and semi-conductors are adding an entirely new dimension of structural consumption.

“Structural deficits are colliding with an unprecedented demand boom,” explains GSC Commodity Intelligence. “This is the kind of perfect storm that doesn’t come around often. Breakouts above the $40–$42 resistance zone unlock a direct path to $50 an ounce – and once that level gives way, the market will move faster than most traders can imagine.”

Surging lease rates are another indication of a tightening silver market.

Silver lease rates are the interest rates that borrowers pay to lease or borrow physical silver. Elevated lease rates often indicate a tightening physical market, where it’s more difficult or expensive to obtain physical silver.

Bloomberg wrote on Sept. 8 that traders fear possible tariffs on silver could squeeze already tight supplies in London, where inventories have dwindled as investors pile into gold and silver ETFs.

That scarcity is already filtering through to the market. Silver futures on Comex are trading at an elevated premium of about 70 cents above London’s benchmark spot price, and the cost of borrowing silver in the UK capital on a short-term basis has spiked above 5% for the fifth time this year — well above historical levels of near-zero…

“If you look at US ETF holdings, they’ve absolutely exploded. So there’s been ongoing demand,” said David Wilson, senior commodities strategist at BNP Paribas SA.

Conclusion

With almost 250 million silver-equivalent ounces (Silver47 + Summa Silver), Silver47 is 25% of the way to their 1 billion silver-equivalent (AgEq) target. This is what scalability — growing in the silver space — looks like.

I’ve always said the best leverage to a rising commodity price is a quality junior with experienced management, an excellent property located close to infrastructure and a workforce in a mining-friendly jurisdiction, and a resource estimate with room for expansion.

Silver47’s southern properties invite a comparison to the extensive vein system in Mexico that drove Vizsla Silver’s valuation from 12 cents a share in 2019 to $5.23 today, an all-time gain of 3,386%! As noted by Crux Investor,

Since acquiring the project in late 2019, Vizsla has completed nearly 400,000 meters of drilling across more than 1,000 drill holes, establishing one of the most comprehensive datasets in the Mexican silver sector. This extensive drilling program has focused on converting inferred resources to higher-confidence categories essential for mine planning.

Remember, Mogollon has 77 kilometers of silver and gold vein structures that have not been drilled. Kennedy has 22 km of gold and silver veins.

Red Mountain is a burgeoning VMS district.

While Dry Creek and West Tundra Flats are the current focus, Silver47 has dozens more drill targets slated for testing next year. There are at least 35 mineralized prospects, many of which are undrilled or represent preliminary drilled discoveries open to expansion.

Noting the company has 10-12Moz of high-grade zinc-silver resources at Red Mountain, Quinton Hennigh, a highly respected geologist well known to retail investors, says if they can find a few more tens of millions of ounces, which is entirely possible, Silver47 could be looking at a resource base supportive of a large mine — possibly even analogous to Hecla’s Greens Creek.

The only problem with Red Mountain is it’s in Alaska, meaning it’s expensive to work year-round. Hence the rationale for the Summa-Silver47 combination.

But with its new southern properties Silver47 can explore year-round as opposed to a relatively brief window in the summer between break-up in the spring and the onset of winter.

This gives the company the all-important news flow that is the life blood of any junior; news will literally be coming out year-round from its southern and northern projects.

Silver47 Exploration Corp

TSXV:AGA

Cdn$0.83 2025.09.11

Shares Outstanding 139.6m

Market Cap Cdn$115.8m

AGA website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard owns shares of Silver47 Exploration Corp (TSXV:AGA). AGA is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of AGA.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.