Silver to hit $30 on expected 8-year-high demand

2021.04.29

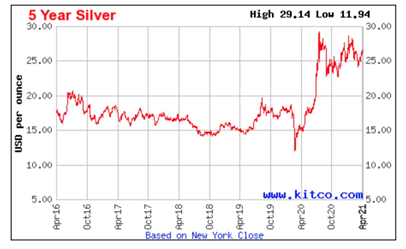

Silver jumped to $28.32 an ounce in August 2020, its best performance in seven years, and though the price retreated last fall, it finished the year up an impressive 46%, more than doubling gold’s 22% gain.

In late January silver kicked higher after a Reddit WallStreetBets subpost triggered a call to buy. A flurry of purchases saw silver blow past $28 and touch $31 briefly, before falling back. Since March, the white metal has been trading in a fairly tight range between $25 and $27.

However, the silver outlook is extremely positive due to a combination of strong monetary and industrial demand drivers.

According to the Silver Institute, global demand for silver will rise to 1.025 billion ounces in 2021, the highest in eight years, led by investments in industrial and investment-grade physical silver, ie., bars and coins.

“The outlook for the silver price in 2021 remains exceptionally encouraging, with the annual average price projected to rise by 46 percent to … $30,” it said in a statement.

“Given silver’s smaller market and the increased price volatility this can generate, we expect silver to comfortably outperform gold this year.”

Investment demand

Like gold, silver functions as a safe haven in times of economic uncertainty. And its lower price, currently 1/68th the cost of gold, makes it the “poor man’s alternative” flight to safety.

This explains silver’s excellent performance last year, as investors piled into precious metals due to the panic in the financial markets caused by the onset of the coronavirus.

While gold took about a year and a half to move from around $1,300 to a record $2,034, silver made tracks in just six months — shooting from $13 in March to $28 in September.

The Silver Institute believes the impetus for investors wanting to stockpile silver will continue, predicting that purchases of bars and coins will reach a six-year high this year of 257 million ounces.

Silver ETFs are also a hot investment vehicle. Last year global holdings in exchange traded products (ETPs) climbed by 334Moz to a total of 1.04 billion ounces. Since then they have continued to attract funds, with ETP holdings growing to a record 1.18Boz through Feb. 3.

One of the more interesting trends in the physical silver market is the premiums being demanded for coins and bars. A rush to silver means investors could pay up to 50% more than the market price, or even higher on minted silver coins.

Over the past year, premiums on physical silver have reportedly tripled from normal levels, with shortages at bullion dealers and delays common.

Going forward, investment demand is expected to gain traction on an anticipated rise in inflation. Like gold, silver is a good way of preserving wealth when currencies like the US dollar are being devalued through excessive money-printing.

The blistering speed of economic recovery in the US — economists are predicting annual GDP growth of 6.5%, versus a 2020 contraction of 3.5% — is stoking fears of inflation.

The consumer price index (CPI) jumped 0.6% in March, led by higher oil prices, and the 12-month rate of inflation rose to 2.6% in March from 1.7% in February, as the bar graph below shows.

The massive fiscal stimulus, which includes the trillions already spent on covid-19 relief and more to come with President Biden’s proposed $2.3 trillion infrastructure bill, and this week’s $1.8 trillion earmarked for education and health care, dwarfs anything even considered in the 1970s — when the United States suffered the last major bout of inflation.

Moreover, there is a palpable excitement that Americans will finally be able to discard the shackles of covid and spend the money they saved last year and the wages they’re starting to earn again. So demand is likely to soar.

More evidence of the coming inflation has come to light. Food inflation is the best predictor of future inflation, and so far this year, the prices of corn and soybeans are up double digits.

3 stages of inflation

A recent piece by Phoenix Capital Research explains how inflation comes in stages. The first price increases occur in raw materials such as copper and gasoline. When manufacturers have to pay more for their inputs, they pass the costs on to their customers. This is stage two inflation, reflected in the inflation of everyday good and services. According to Phoenix, we are already in this stage, evidenced by the fact that the prices of toilet paper, baby products, furniture, and even a can of Coca Cola, are all heading higher.

Things can get quite ugly when inflation, like a growing cancer, spreads throughout the entire economy. Phoenix explains what typically happens next:

At that point the only thing that will stop it is if the Fed begins to tighten monetary policy (raise rates, taper QE, etc.).

Bad news here too… the Fed has explicitly stated it has no interest in raising rates or tapering QE for another TWO YEARS.

Which means… inflation is going to rage and rage.

And the damage done will be measured in trillions of dollars.

Industrial demand

Silver’s hundreds of industrial applications make it very responsive to the condition of the global economy. As the US vaccine rollout continues and more sectors of the economy open up, the increased demand for manufactured goods including solar power cells and electronics is bound to be a boon for silver. Even more so considering that re-openings and innoculations are happening in most developed economies.

More and more silver is being demanded for use in solar photovoltaic (PV) cells, as countries move towards adopting renewable energy sources. Around 20 grams of silver are required to build a solar panel. The Silver Institute (SI) predicts 100 gigawattas of new solar facilities will be constructed per year between 2018 and 2022, which would more than double the world’s 2017 capacity of 398GW.

The PV sector has recovered well from a slow first half of 2020, and the momentum is expected to carry through 2021. SI forecasts 105Moz will be demanded this year, canceling out the losses in 2020.

5G technology is set to become another big new driver of silver demand.

Among the 5G components requiring silver, are semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of things (IoT)-enabled devices.

The Silver Institute expects silver demanded by 5G to more than double, from its current ~7.5 million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030, which would represent a 206% increase from current levels.

The growing penetration of 5G technology in consumer electronics is expected to power a 7% increase above 2020 levels to 300Moz, which is more than double the silver offtake needed by the solar power industry.

A third major industrial demand driver for silver is the automotive industry.

A recent Silver Institute report says battery electric vehicles contain up to twice as much silver as ICE-powered vehicles, with autonomous vehicles requiring even more due to their complexity. Charging points and charging stations are also expected to demand a lot more silver.

According to SI, silver’s use in the automotive market will see a strong rebound in 2021, to just over 60Moz.

All of the above taken into account, industrial demand for silver is projected to notch a four-year high of 510Moz this year, a 9% rise over 2020 levels.

Silver supply

Silver is vulnerable to supply disruptions, more so than gold, because there are relatively few pure-play silver mines.

Only around 30% of annual supply comes from primary silver mines. Over two-thirds is sourced from polymetallic ore deposits, including lead/zinc operations and copper mines.

Despite covid-related mine disruptions in top silver producers Mexico and Peru, last year the silver market actually witnessed its largest surplus on record — 976.2Moz of supply minus 896.1Moz of total demand, equals 80.1Moz.

It wasn’t so much that a lot more silver was mined; more the fact that industrial demand was hurt so badly.

“When you had wide-spread lockdowns, this really hit the consumer electronics side, and that is one of the reasons why we saw a decline in silver’s industrial demand,” said Phil Newman, managing director of Metals Focus, in an interview with Kitco News.

A couple more fun facts about silver supply:

- Although industrial demand suffered in 2020, investment demand took off, with global holdings in silver-backed ETFs climbing above a billion ounces for the first time since they were introduced in 2006. Strong demand for silver bars and coins pushed physical investment to a four-year high.

- Looking at total silver supply last year, there was plenty to go around; except it was in the wrong form for investors. Industrial customers buy industrial-grade silver, of which there was a significant surplus. The supply crunch was in bars and coins, as mints and bullion dealers struggled to keep up with high demand for physical silver.

Going forward, the Silver Institute expects both demand and supply to pick up in 2021. While silver demand is projected to hit 1.036 billion ounces, it won’t quite be enough to overwhelm supply of 1.056Boz, leaving a small surplus of 20Moz. (for context, consider that global mined silver totaled 881,850,000 oz in 2020, meaning this year’s expected 20Moz surplus is a mere 2.2% of last year’s production)

Mine production should rise to 866Moz this year as virus-related restrictions recede, the most since 2016.

Price outlook

As mentioned, the Silver Institute believes silver could reach $30 per ounce this year, on the back of strong physical demand for bar and coins, a continued appetite for silver-backed ETFs, and a rebound in industrial demand that is projected to hit 510Moz, a 9% rise over 2020 and a four-year high.

Of course, there is no shortage of prognostications for the white metal.

Seeking Alpha contributor Andrew Hecht, a former bullion trader, believes silver has a lot more going for it in 2021 than in 1995, when silver cost just $5 an ounce. He cites three reasons to support this thesis: inflation will become rampant; demand for silver in solar panels will be higher than forecast; and a sudden demand for silver-derivative products could cause a shortage of the metal.

Hecht observes that silver’s trading ranges over the past year have been narrowing, a sign of price consolidation after a volatile 2020.

On the technical side, Hecht notes another bullish signal: open interest, which is the total number of open long and short positions in the silver futures market, has increased in line with rising silver prices.

Rising open interest when a futures price is moving higher is typically a technical validation of an emerging bullish trend, he writes.

Jeff Clark, senior analyst with Goldsilver.com, points out five realities about silver investors should know about, and tells us what to expect from them in the days ahead.

Silver, says Clark, has numerous corrections in bull markets; always outperforms gold; spikes suddenly and violently; is gearing up for the next spike; and will some day buy a house with a modest number of ounces.

On the first point, Clark asks us to consider: over the past 16 months there have been 16 corrections — one a month — yet over this period silver has gained 69%. Compare this to the 1979-80 silver mania, when there were 13 corrections of 6.5% or greater, and a total gain of 480%! “Corrections are normal. In bull markets they are buying opportunities,” he advises.

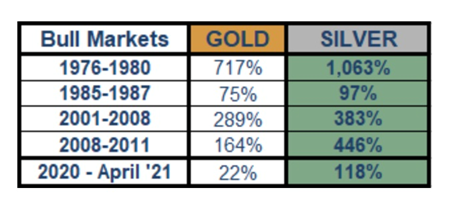

Another advantage of volatility is that silver historically outperforms gold in bull markets. We saw that last year, when silver’s 46% gain more than doubled gold’s 22% increase. The table below is illustrative.

And while volatility makes the average investor’s stomach churn, Clark urges calm. “History shows that the silver price can ignite and spike like a rocket,” he writes, although these spikes are typically short-lived. An investor has to be smart, and sometimes lucky, to capture gains and limit losses during these runs. More obviously, an investor needs to be invested before a price spike; timing it can be tricky. Those who are successful, will be rewarded. “On average, when silver spikes, the price rises 150% over a 7-month period,” says Clark, adding that the average time between spikes is 3 years and 6 months. He believes another spike in the silver price is coming, and that the current bull market is just getting started.

Conclusion

Putting everything together, in my opinion, there is really only one simple conclusion: now is a great time to invest in silver.

The resurgence of industrial demand, coupled with continued investor interest in physical silver and silver-backed ETFs, are two of the main factors likely to power the metal higher — if the Silver Institute is correct, silver is going to $30, and perhaps much higher.

Upward price movement is also likely to result from an inflation scenario which as we have shown, is already beginning to seep into the economy.

A higher silver price is great news not only for investors but for junior silver explorers which historically offer the greatest leverage to a rising commodity price.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.