Silver North’s Veronica property yields high-grade silver-lead-zinc mineralization – Richard Mills

2025.12.12

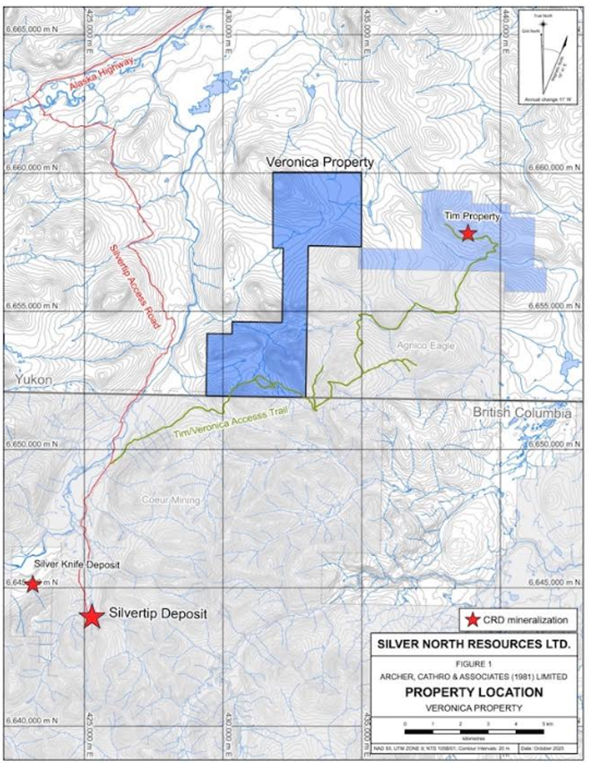

Silver North Resources (TSXV:SNAG, OTCQB:TARSF) has released the final results of the 2025 field exploration program at Veronica — one of three properties comprising the GDR Project in the southern Yukon Territory (Figure 1).

The Veronica claims are adjacent to the Tim property (under separate option to Coeur Mining), in the Silvertip area of the southern Yukon. Regional exploration is targeting high-grade silver-lead-zinc mineralization, similar to that found at the Silvertip mine, approximately 12 km to the southwest of Veronica.

According to Silver North, the GDR Project claims cover geology prospective for carbonate replacement deposits similar to that being explored at Tim and at Coeur’s nearby Silvertip mine project.

Figure 1: Location map

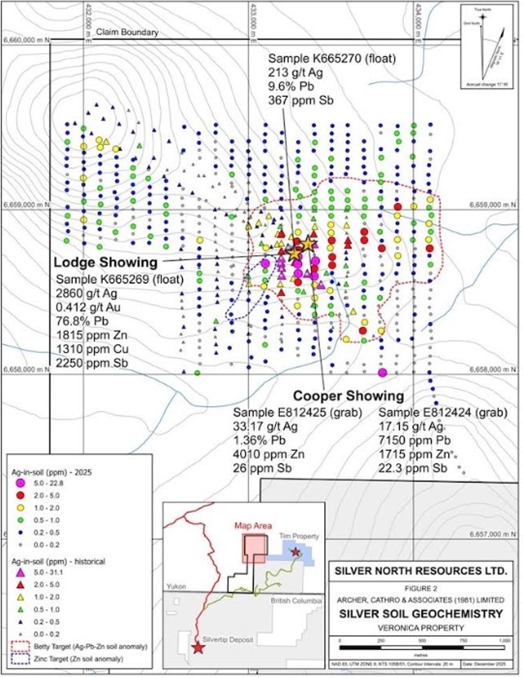

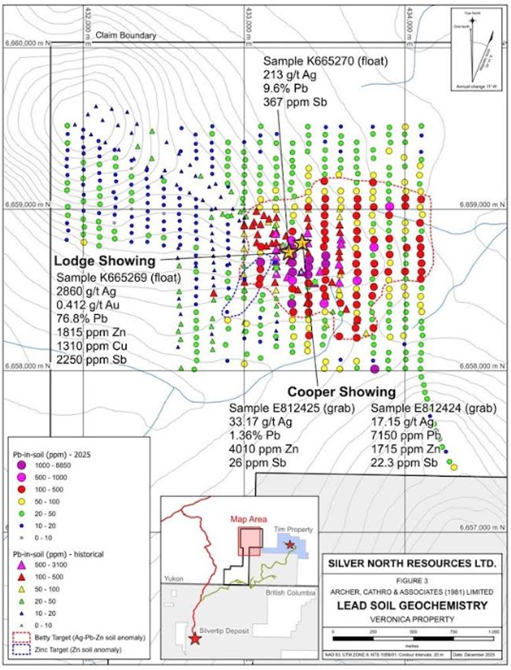

Lead assay results from two silver-bearing samples of massive galena in cobble-size float (2,860 and 213 g/t silver — see Oct. 28 news release) at the Lodge Showing, which initially exceeded upper detection limits of the sampling procedure, have returned 76.8% lead and 9.6% lead, respectively.

At the Cooper Showing, lead analysis from one silver-bearing sample from outcrop (33.17 g/t silver) returned 1.36% lead.

“Lead mineralization in the form of the mineral galena is an important component of CRD (Carbonate Replacement Deposit)-style mineralization in the Silvertip District,” said Jason Weber, Silver North’s president and CEO, in the Dec. 11 news release. “While only float, they do show the potential for high-grade silver and lead mineralization at the Betty Target, which is a great start as we begin to make exploration plans for Veronica in 2026.”

The high-grade lead results at the Lodge Showing come from float collected within the 1 km by 1 km Betty Target, which is defined as a coincident silver (1 ppm to 31.1 ppm), lead (50 ppm to 8,850 ppm) and zinc (200 ppm to 3,830 ppm) anomaly that remains open to the east and potentially to the south (see Oct. 28 news release).

Massive galena-bearing samples from float include a 15-cm-wide massive sulfide cobble which returned 2,860 g/t Ag, 0.412 g/t Au, 76.8% Pb, 0.13% Cu, 0.18% Zn and 2,250 ppm Sb, (Sample K665269 — Figures 2 and 3) and a cobble-sized sample uncovered in a hand trench in the same area that returned 213 g/t Ag, 9.6% Pb and 367 ppm Sb (Sample K665270 — Figures 2 and 3).

Emerging CRD district

The Veronica property is one of three properties in the GDR Project. Veronica consists of 100 mineral claims located 80 km west of Watson Lake, Yukon and 11 km northeast of Coeur Mining’s Silvertip deposit.

Veronica is just west of and adjacent to Silver North’s Tim property (under option to Coeur) and was acquired based on the emergence of the Silvertip area as a new Carbonate Replacement Deposit (CRD) silver district. The property is accessible by road via a spur off of the Silvertip Mine access road, which connects to the Alaska Highway.

The Veronica claims cover an area of anomalous silver-lead-zinc in soil geochemistry and geology prospective for hosting CRD style mineralization similar to that hosting the silver resources at the nearby Silvertip mine.

Recent work by Coeur and Silver North in this region suggests that both Silvertip and Veronica (and Silver North’s Tim Property adjacent to Veronica’s east side) are part of an emerging CRD district in southern Yukon and northern British Columbia.

In 2025, Silver North completed an eight-day prospecting, mapping, soil geochemical sampling and hand trenching program at Veronica. A total of 453 soil samples and 26 rock samples were collected, while two hand trenches and eight additional hand excavated pits were completed. This work investigated an open-ended 450m by 450m silver-lead-zinc soil geochemical anomaly that had been identified by the property vendors.

The 2025 program successfully expanded upon this anomaly (now termed the Betty Anomaly), bringing it to over 1 km by 1 km in size and open to the east, and possibly to the south. The Betty Anomaly is defined by coincident silver (1 ppm to 31.1 ppm), lead (50 ppm to 8,850 ppm) and zinc (200 ppm to 3,830 ppm) values in soils.

Importantly, field crews were able to identify the first-ever silver bearing mineralization on the property, in both float and outcrop within the anomaly. Float cobbles were found on surface including a 15-cm wide massive sulfide cobble which returned 2,860 g/t Ag, 0.412 g/t Au, >1% Pb, 0.13 % Cu, 0.22 % Sb, 0.18% Zn, and a cobble uncovered in a hand trench in the same area (213 g/t Ag, >1% Pb, 367 ppm Sb (collectively, the Lodge Showing).

Approximately 100m to the northeast of the Lodge Showing, an outcropping brecciated and silicified fault zone was discovered, the Cooper Showing, hosting disseminated and blebby galena. One grab sample from this location returned 17.15 g/t Ag, 0.72 % Pb, 0.17 % Zn, 22.3 ppm Sb. Geological mapping indicates the potential preservation of the prospective stratigraphy known for hosting high-grade silver-lead-zinc mineralization at Silvertip

Silver market

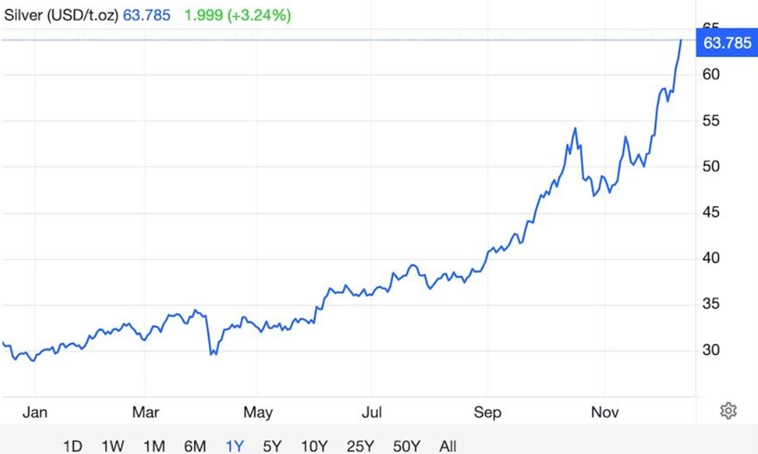

Silver has had a phenomenal 2025, gaining 115% year to date, nearly doubling gold’s 66% historic run.

According to Trading Economics, Silver [on Thursday] climbed above $61 per ounce, extending a record rally as markets digested the Fed’s 25 basis point cut [on Wednesday], and parsed Chair Powell’s remarks which markets read as relatively dovish even as committee guidance remained cautious. The cut itself was largely priced in, but Powell’s comments and a softer dollar lowered the opportunity cost of holding metal. At the same time the physical market has tightened materially which amplifies the policy impulse. ETF inflows and spot buying have surged this year and funds added large tonnes last week, while official and retail demand in Asia and India remains robust, leaving available metal scarce. Lease rates and borrowing costs for physical silver have risen as a result, reflecting genuine delivery stress rather than a pure positioning trade. Structural industrial demand from solar, EVs and data infrastructure is also rising, and independent supply signals point to a persistent deficit.

Meanwhile, silver’s combination of monetary and industrial demand, combined with tight supply conditions, is driving the metal to fresh heights. Spot silver broke past $60 on Dec. 9 for the first time ever.

A slowing world economy has weighed on the precious metal’s industrial demand, but strong investment demand has more than made up for the drop, states the Silver Institute.

In its outlook, the institute re-iterated that the silver market will see its fifth annual deficit this year of 95 million ounces. Inflows into silver-backed ETFs have increased by 187Moz so far this year, said Philip Newman, managing director at Metals Focus, the British research firm behind the annual Silver Survey.

“This reflects investor concerns over stagflation, the Federal Reserve’s independence, government debt sustainability, the US dollar’s role as a safe haven, and geopolitical risks. Silver’s exceptional price performance and its favorable supply-demand backdrop have further reinforced investor confidence,” Newman said in his note.

Gold, silver and copper are reaching new highs together for the first time in 45 years. Research by AOTH has indicated that for all three metals, mined supply can no longer meet demand without recycling.

MarketWatch notes that growing industrial demand is becoming an increasingly important factor driving silver and copper prices.

Meanwhile, strong central bank buying of gold has helped boost prices for the yellow metal. All of these fundamental drivers remain firmly in place at the start of December, said Nick Cawley, contributing analyst for Solomon Global.

“A combination of persistent inflation concerns, U.S. interest-rate cuts, fears surrounding dollar devaluation and substantial central-bank gold purchases continue to underpin prices,” he told MarketWatch by email. “These conditions show no signs of changing and should propel all three metals higher in the coming months.”

A recent study found the US has the second longest timeline from discovery to mining, and it’s up to 20 years in Canada. You’d think that with copper, gold and silver prices all hitting record highs, mining companies would be itching to take advantage of prices and build new mines.

Sadly, this hasn’t been the case. A recent post by Tavi Costa, a strategist at Crescat Capital, says that despite high metals prices, aggregate capex — total capital expenditures on mines — is at one of its lowest levels in history; 90% lower than previous highs.

But this is actually good news. As Costa writes, it means this bull market has a lot more room to run and we are nowhere near a top.

Conclusion

It’s a great time to be exploring for silver, with by-products gold, lead and zinc, in the Yukon’s historic Keno Hill Silver District, right next door to Keno Hill, an active silver mine being run by Hecla Mining, the largest silver miner in the United States and Canada.

That’s Silver North’s flagship Haldane property. In November assay results were received for the first three holes of the summer drill program at Haldane. The program started in mid-August and is now complete. It saw eight holes drilled totaling 1,759.5 meters.

Highlighted results included 3.2 meters averaging 2,014 g/t silver, 1.72 g/t gold, 4.73% lead and 1.1% zinc within a larger 13.15-meter intersection of 818 g/t silver, 1.39 g/t gold, 2.54% lead and 0.98% zinc from 249.9 meters down hole.

Another sub-interval starting at 256.1m averaged 1,112 g/t silver, 4.61 g/t gold, 7.11% lead and 1.51% zinc over 1.25m.

On Dec. 10 SNAG said it has extended the Main Fault mineralization an additional 50 meters along strike. Results were also received for two of the four remaining holes at the Main Fault target.

The highlighted intersection was 231 g/t silver, 0.24 g/t gold, 0.54% lead and 0.39% zinc over 14.40m from 170.60m to 185.00m in hole HLD25-35, including 1.25m averaging 1,261 g/t silver, 0.74 g/t gold, 0.35% lead and 0.41% zinc.

With five holes of eight reported, the Main Fault has been extended to a total of 100 meters on strike and 150m down dip in drilling and 300m down dip from surface.

At Tim, Silver North has an option agreement with Coeur Mining, which can earn 80% ownership in the project by spending $3.5 million on exploration over five years, making $575,000 cash payments and completing a feasibility study within eight years.

Coeur’s Silvertip silver-lead-zinc project, situated 19 kilometers south in BC, is also a CRD deposit; in fact, it is one of the highest-grade silver-lead-zinc operations in the world.

Coeur funded a 2,250-meter drill program at Tim, designed to test the potential for CRD-style mineralization along almost 2 km of strike length.

The 2024 program successfully confirmed the presence of a Carbonate Replacement Deposit (CRD) style system at Tim, evidenced by diagnostic features noted at Silvertip and elsewhere in the world, including fugitive calcite veining that fluoresces in UV light (displaying the classic “barbeque” pink and orange fluorescence), re-crystallization of the host limestones, disseminated pyrite-sphalerite and galena sulfide and derived oxide mineralization, and massive pyrrhotite with scheelite mineralization (an important tungsten-bearing mineral).

“We are grateful to have Coeur executing and funding exploration and we believe it is a significant advantage to Silver North’s shareholders to have their team executing and funding exploration on the property,” said SNAG CEO Jason Weber in the May 26 news.

Between Haldane, its Tim CRD Project on the BC-Yukon border, and its GDR option in the Silvertip District, Silver North offers strong discovery/ development potential.

With such great neighbors in Hecla Mining and Coeur Mining, there is also the distinct possibility of Silver North being taken over.

Silver North Resources

TSXV:SNAG, OTCQB:TARSF

Cdn$0.38 2025.12.11

Shares Outstanding 61.2m

Market Cap Cdn$24.2m

SNAG website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard owns shares of Silver North Resource (TSX.V:SNAG). SNAG is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of SNAG

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.